Signature Bank Crushes Earnings

Fundamentals

STORY

Signature Bank (SBNY) is rated the single top pick in the banking sector by CML Pro's institutional research. The detailed analysis and conclusion are included below, but first, we have some housekeeping to tend to:

SBNY just crushed earnings, and reminded us that it very well may be the best bank in the world.

EARNINGS RESULTS

SBNY reported revenue of $277.7 million in the quarter beating Wall Street estimates of $268.5 million.

The bank reported earnings per share of $2.01, beating analyst expectations of $1.93.

For the full year, SBNY reported a profit of $373.1 million or $7.27 EPS on revenue of $1.01 billion.

CEO Joseph J. DePaolo said:

"2015 was another record year in which Signature Bank demonstrated its ability to deliver exemplary results. Once again, we set records across all of our key metrics, including deposits, loans and earnings, reporting our eighth consecutive year of record earnings. And, for the first time, the Bank earned more than $100 million in one quarter."

Source: Crossing Wall Street

Source: Crossing Wall Street

STOCK PRICE

SBNY stock is down on the news and it's likely because the bank announced a public offering of 2.2 million shares of common stock at $136 per share ending January 27, 2016 (Source: Signature Bank).

There will be gyrations in the stock market, and SBNY isn't immune from that volatility, but the bottom line is, this bank is growing like a small cap technology company and it is in every way a stellar institution. Here's why CML Pro has SBNY ranked as the number one bank in 2016.

HOW TO MEASURE A BANK

There are six critical measures to examine. For purposes of this analysis, we are looking at the North American banks over $4 billion in market cap.

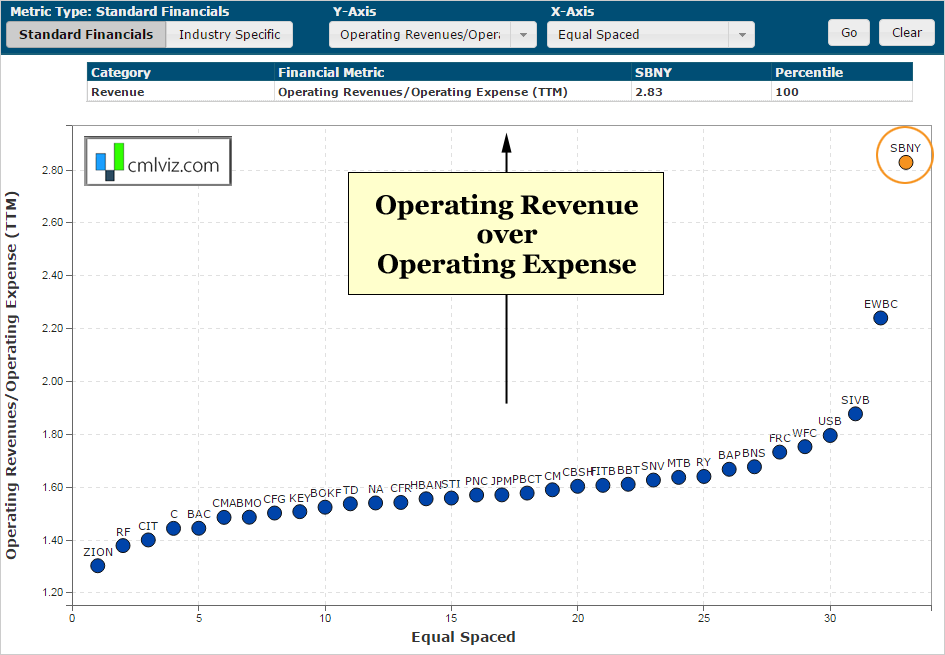

I. Operating Revenues/Operating Expense (TTM)

Simply stated, this measures much revenue is generated per $1 of operating expense. Below we plot the entire population and equal spacw them (rank them) on the x-axis, while measuring operating margin on the y-axis.

We're going to notice a trend here. Signature Bank, SBNY, has the highest operating margin by a large amount, earnings nearly $2.85 in revenue for every $1 in expense.

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

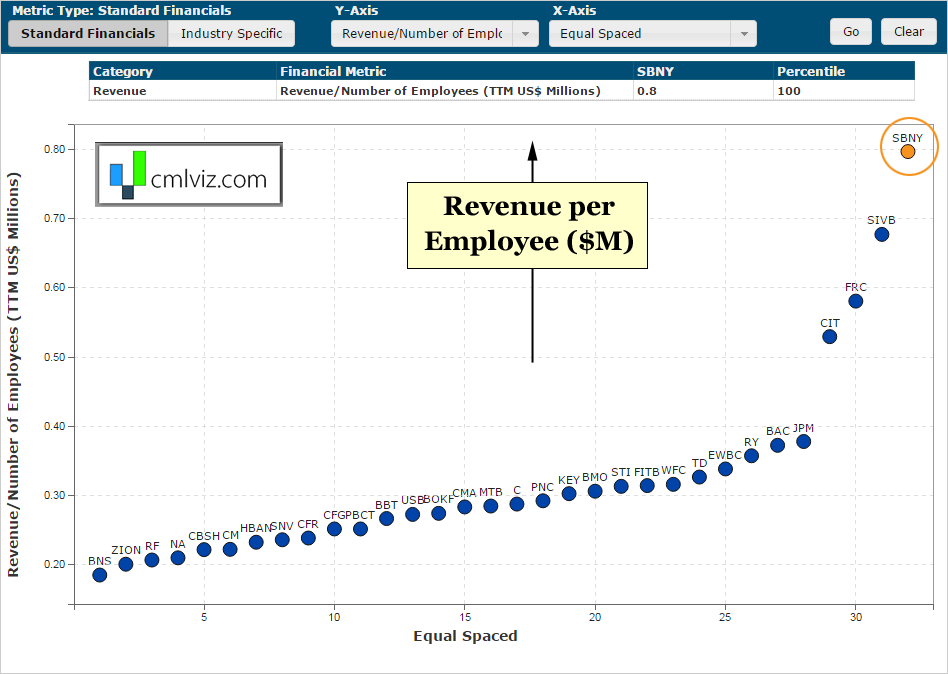

II.Revenue/Number of Employees (TTM US$ Millions)

Banks have a tendency to get bloated with employees and this is our favorite measure of the "anti-bloat." We plot revenue per employee in $million on the y-axis, and again, we will rank the companies on the x-axis.

SBNY generates $800,000 per employee. Incredibly, no other bank even generates more than $675,000.

Do you enjoy using visualizations to understand what's really going on in a company? We do too. Get Our (Free) News Alerts Twice a Week.

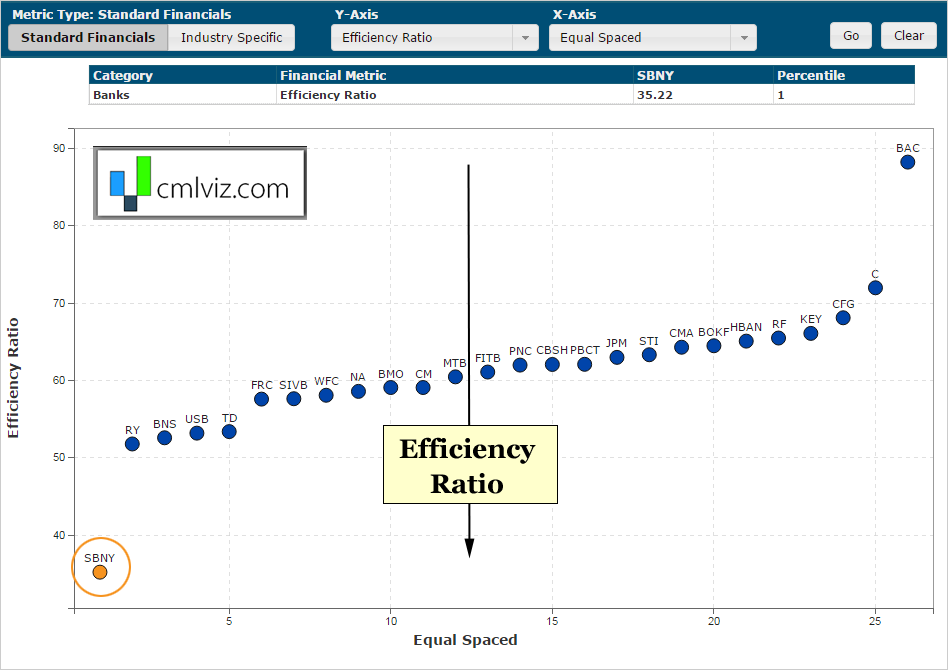

III. Efficiency Ratio

A bank's efficiency ratio is a measure of its overhead as a percentage of its revenue. On the y-axis, we now measure the bank population's efficiency ratio. The lower this number is, the better.

SBNY has incredibly high efficiency, showing by far the lowest overhead costs of all of its peers.

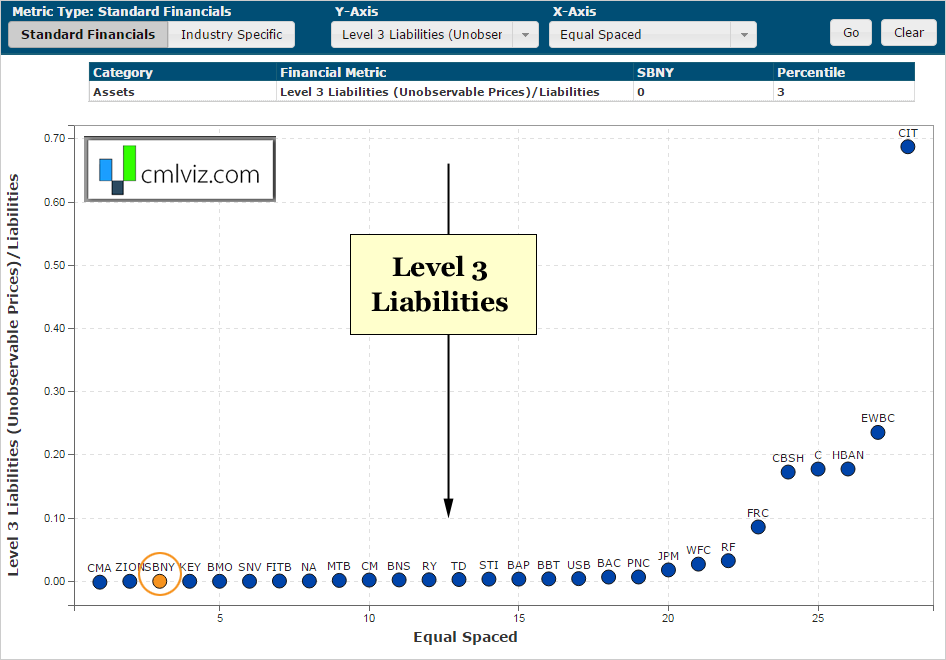

IV. Level 3 Liabilities (Unobservable Prices)/Liabilities

Level 3 assets and liabilities are those that sit on the balance sheet with a value that is created by a financial model. Level 3 assets and liabilities have not traded in so long, that their market prices are considered "unobservable."

If a bank has large amounts of level 3 liabilities (or assets), there could be some gamesmanship to understate how bad the situation really is. We prefer zero or next to zero level 3 liabilities.

SBNY is in a tie with a few banks. The level we are looking at is zero. Perfect. There are no liabilities on the balance sheet that have a valuation that is created out of a model.

We publish research that uncovers new opportunities everyday.

Try CML Pro. No credit Card. No Payment Info. Just the Power.

V. Net Income Margin %

Simply stated, this is after tax income / revenue. The higher, the better.

SBNY shows the the second highest net income margin, at a whopping 38%. That 38% is nearly 50% higher than the median value. Of course, this all makes sense given what we have seen above.

Get one uncovered stock gem a day: Get Our (Free) News Alerts Once a Day.

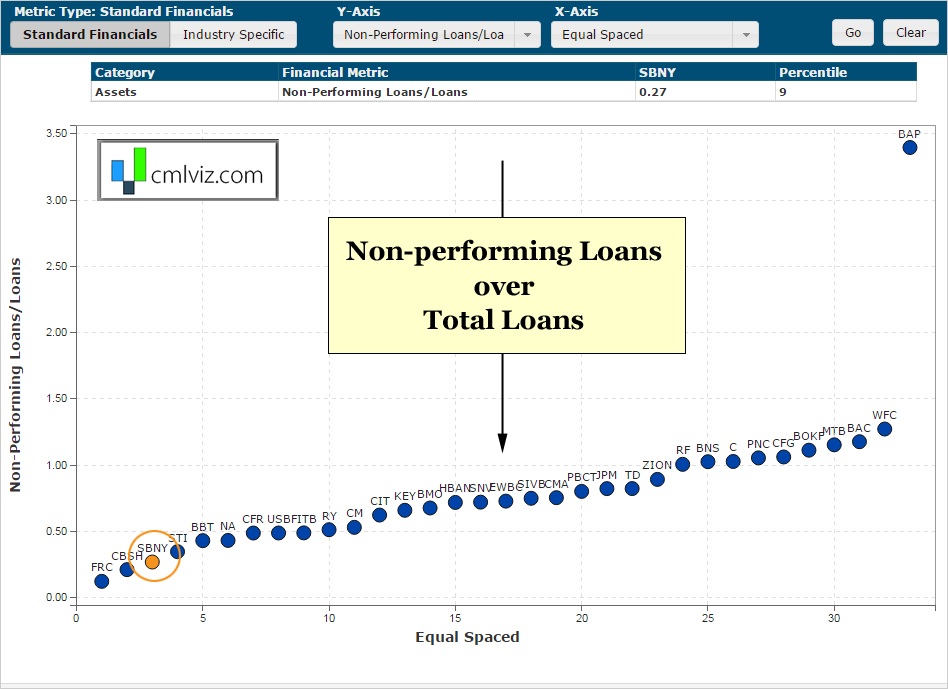

VI. Non-Performing Loans/Loans

A non-performing loan is one that is in default or close to being in default. It usually hits the books as "non-performing" after 90-days, although that can vary. We want to see this metric low, but not zero.

If a bank has zero non-performing loans, it isn't taking on enough risk. On the other hand, if it has large non-performing loans, it has poor risk management and may face a massive write-down.

SBNY sits perfectly in the low range, but taking on enough risk that it has incurred some bad loans. In total, the bad loans represent just 0.27% of total loans. Nice, neat, small, and not zero.

WHY THIS MATTERS

The stock's institutional ownership sits at 100% and there's a reason for it. The analysts that serve the top 1% are keenly aware of the deep data that will move markets.

CML Pro has research reports on the top picks for Artificial Intelligence, The Internet of Things, Cyber Security, Social Media, Biotech, Apparel, Banks and more. A group of 12 companies that are the crown jewels of the future.

CML Pro research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we make the research accessible to the public along with visualization tools, the precious few top picks for 2016, and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.