Starbucks Corporation (NASDAQ:SBUX) Here Comes the Growth

Starbucks Corporation (NASDAQ:SBUX) Here Comes the Growth

Date Published: 2016-12-10Author: Ophir Gottlieb

Written by Ophir Gottlieb

Preface

We will cover one of our favorite Spotlight Top Picks, Starbucks Corporation and why its growth potential is here.. In a world dominated by technology headlines, there is a reason this company makes it into not just Top Picks, but our precious few Spotlights.

STABUCKS

There has been a focus, and for good reason, on Starbucks Corporation (NASDAQ:SBUX) current CEO Howard Schultz's decision to step down as CEO. He will remain the company's executive Chairman and focus on Starbucks Reserve, the company's new super premium brand and chain of high-end stores, but, nonetheless, he will no longer be CEO.

Schultz also shrewdly noted that "he intends to remain a visible and active presence at the company - his office is connected to Mr. Johnson's" (NY Times).

Last time Schultz stepped down ten years ago, the stock fell, and there is a growing fear that history will repeat itself. Here's why we do don't believe it will and that Starbucks has a bright future ahead of itself.

THE 'NEW GUY'

Howard Schultz has handpicked his successor, Kevin Johnson, who is the company's president and been on the board for several years. So who is Kevin Johnson (KJ)? Try this:

"

Johnson joined Microsoft in 1992, where he served in a range of executive assignments for 16 years. Johnson was appointed group vice president of Microsoft's worldwide sales, marketing and services in 2003, and he was named co-president of the Windows and Online Services division in 2005.

When fellow co-president Jim Allchin retired a year later, Johnson was named president of the Windows and Online Services division.

"

And KJ's next role was to be the CEO of Juniper Networks, the technology company that was the first to battle Cisco Systems head-to-head and is now a $11 billion tech company. Following Juniper, of course, KJ joined Starbucks as its president. Here's what Steve Ballmer, the CEO of Microsoft during KJ's tenure said about him when he left to run Juniper:

"

Kevin has built a supremely talented organization and laid the foundation for the future success of Windows and our Online Services Business.

This new structure will give us more agility and focus in two very competitive arenas. It has been a pleasure to work with Kevin, and we wish him well in the future.

"

So let's just put this 'disaster' scenario off the table. Starbucks' new CEO, starting on April 3rd, is a rock star, but ever more importantly, he is a technologist.

BACK TO STARBUCKS

Starbucks Corporation (NASDAQ:SBUX) is a Spotlight Top Pick for many reasons, but one of the most critical is that the company is actually a technology company as we see it. Yes, it sells coffee, and yes, it serves food. But behind that is a technological backbone that is undeniably a core competency as a competitive advantage. Try this on for size, straight from our CML Pro Top Pick dossier:

Starbucks has more money on cards than large banks have on deposit.

Yes, the company's Starbucks cards and its mobile pay app make it larger than several United States banks. As of fiscal 2016, 41% of Starbucks transactions in the U.S. and Canada were conducted using a Starbucks card. The company is making waves here that are unmatched and continue to drive same-store-sales growth higher as well as customer retention and revenue per square foot.

The company already has 12 million Starbucks Rewards members and 8 million customers who use mobile pay, with one out of three are using Mobile Order & Pay. Further, we get from Yahoo! Finance:

[] the company will unveil My Starbucks Barista, an ordering system that uses artificial intelligence to place orders by voice command.

But, that's not the update we wanted to share. This is:

HERE COMES THE GROWTH

For those familiar with our Top Pick dossier, Starbucks Corporation (NASDAQ:SBUX) is nowhere near hitting the top of its growth cycle. Starbucks Corporation's five-year plan is to deliver earnings-per-share growth of 15% to 20%.

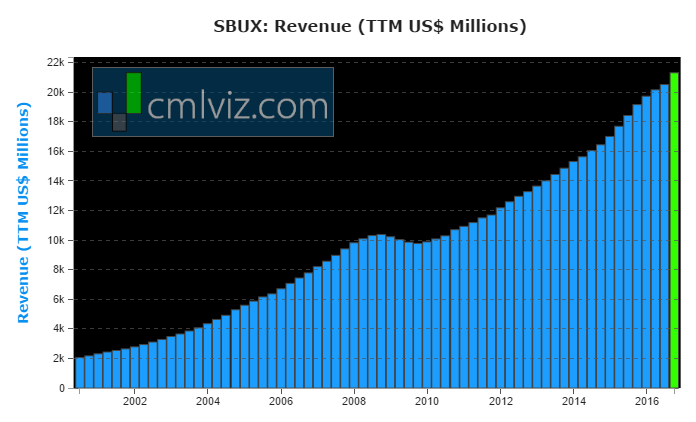

Here is the all-time revenue chart:

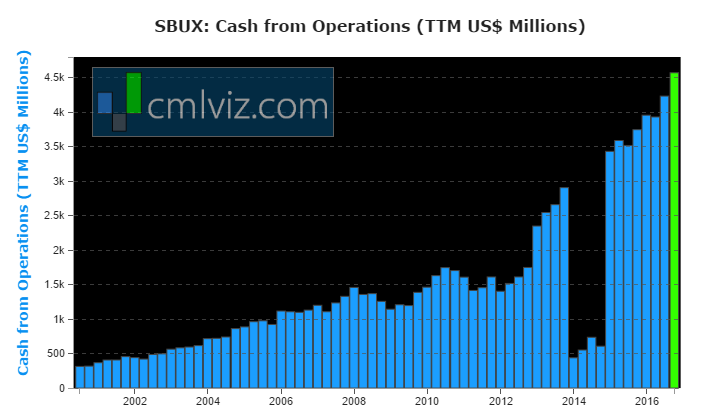

If you find yourself reading an article from one of our main stream media friends that calls on the end of growth for Starbucks Corporation (NASDAQ:SBUX), please put the article down and slowly walk away not to frighten the mad man (woman) that wrote the piece. You don't have to take our word for it, just look at revenue growth (above), or, look at cash from operations, below:

But those charts are the past, the future is still quite bright. Starbucks Corporation (NASDAQ:SBUX) is just now entering China with plans to open a new store every day on average for five years. Our CML Pro dossier discusses the details of the strategy, and friends, it goes much further than "opening stores and hoping for the best."

Here is our take from the dossier:

"

Howard Schultz just gets it. He's not putting the word China on a white board and putting an arrow next it with a tag line, "growth." He is actively engaged in the community and the culture and that is exactly what he did in the United States.

Source: CML Pro

"

And why China?... Here's why:

Over time, Starbucks Corporation believes China will overtake the U.S. as its largest global market, powered by new store openings and some 300 million Chinese moving into the middle class within the next few years spending more at its locations. (Source: TheStreet.com)

Beyond the CML Pro Top Pick dossier, here is the next step in evolution for China, straight from Starbucks Executive VP and Global Chief Strategy Officer Matt Ryan during the company's bi-annual investor conference:

"

We remain very interested in delivery, we have just shifted the priority focus from the U.S. to China.

"

Matt is talking about Starbucks new initiative to bring delivery services to China. Starbucks is opening stores in the most densely populated cities in China and the Chinese are way ahead of the United States when it comes to delivery.

According to iResearch, Food delivery apps in China will bring in $30 billion in sales this year, powered by the giants of technology in the country, Tencent and Alibaba.

Starbucks Corporation (NASDAQ:SBUX) is taking its focus away from the US delivery business and putting its efforts into China where the population is denser, larger and had has an appetite (no pun intended) much greater than that of the United States.

When we combine the company going form 2,500 stores in China today to more than 5,000 in six years, along with the incredibly clever entrance strategy Shultz has implemented, we see this as yet another feather in Starbucks' cap and another driver of growth for several years to come. Here was Ryan's final take, short and sweet:

"

We haven't given up long-term on the U.S., but we see the first order of business [with delivery] being in China,

"

Thanks for reading, friends.

The author's family owns shares of Starbucks Corporation (NASDAQ:SBUX) in a Trust account.

WHY THIS MATTERS

If you feel like you learned something useful from this dossier about Starbucks, this may be right up alley: Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. We work for the 99.9% that is under represented.

Of our Top Picks, Nvidia is up 110% since we added it. Ambarella is up 80% since we added it. Relypsa was taken over for a 60% gain and TubeMogul was taken over for a substantial gain as well. We are already up on Twitter when we added it to Top Picks for $15.60.

We just added a new Spotlight Top Pick that has the potential to be "the next Apple" in the genomics space.

To become a CML Pro member it's just $19 a month with no contract. It's that easy -- you cancel at any time, instantly.

Each company in our 'Top Picks' portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro at a discount for $29/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.