Shopify Inc (US) (NYSE:SHOP) Delivers - Upside is Still In Play

Shopify Inc (US) (NYSE:SHOP) Earnings Delivers - Upside is Still In Play

Date Published: 2017-05-08Written by Ophir Gottlieb

This article is a snippet from the original published to CML Pro members on 5-3-2017.

LEDE

Shopify Inc (US) (NYSE:SHOP) beat earnings handily, the stock rose, and what we learned from the earnings conference call re-iterates our bullish thesis.

We added the company for $66.50 on 3-22-2017, and as of this writing the stock is trading at $86.65, up 30%. Based on the earnings results, as promised, Shopify is now promoted to a Spotlight Top Pick.

RESULTS

Shopify Inc (US) (NYSE:SHOP) reported revenue of $127 million for the quarter versus estimate of $122 million. The company reported an EPS loss of $0.15 versus estimates of a $0.22 loss.

The quarter for Shopify Inc (US) (NYSE:SHOP) showed 75% year-over-year revenue growth and gross merchandise volume up 81%, to $4.8 billion. Shopify also raised revenue guidance for full year 2017 to $615 million to $630 million, up from the high $590 million range.

Before we get to the critical elements of the earnings call, let's touch on the story behind Shopify.

STORY

From our Top Pock dossier, Shopify is the Pick-Axe to the E-commerce Gold Rush, we get:

Shopify isn't just an investment in e-commerce - that would never make our Top Pick's list - it's an investment in the guts of the online shopping trend - the part that's actually growing.

Shopify is the leading cloud-based commerce software for small- and medium-sized businesses. But the company makes money from more than e-commerce sales, it makes money from businesses coming online.

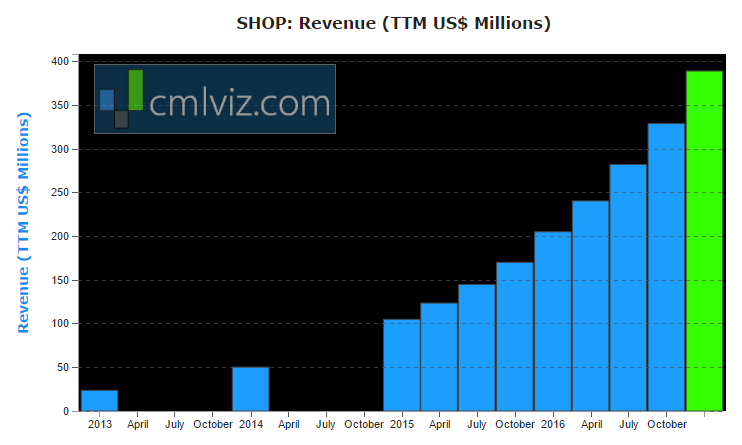

As of the last earnings call, more than 375,000 businesses now rely on Shopify for their sales and back-office software needs. That's up from 325,000 in the third quarter and 243,000 in the fourth quarter of 2015. Here is the revenue trend (this does not have the latest quarter yet):

And, yes, Shopify merchants can now enable Login and Pay with Amazon, as well as take advantage of Amazon's fulfillment centres in the U.S., Canada, U.K., Germany, France, Italy, Spain, and Japan to make it faster, easier and cheaper to ship their products around the world.

HOW SHOPIFY MAKES MONEY

Shopify allows prospective merchants to set up an online storefront. Online sellers are able to set up a shopping cart, accept credit cards and more than 70 other payment methods, determine shipping rates, and automatically calculate taxes based on jurisdiction. On top of that, Shopify provides web hosting services, optimizes webstores for search engine results, and provides the needed business analytics.

For these services, Shopify charges a subscription fee ranging from $29.00 to $179.00 a month. Shopify also generates additional revenue from the sales of storefront themes, apps that the company claims increase functionality, the registration of domain names, and processing payment fees.

Shopify's total addressable market is the small to medium sized business (SMB) world. In the company's IPO filing it listed that market at "10 million merchants with less than 500 employees operating in our key geographies, and approximately 46 million such merchants worldwide."

But, that's just the tip of the iceberg. As we wrote in the Top Pick dossier, data could be a crown jewel -- it could be the biggest asset Shopify is building.

And now, the good stuff from earnings:

EARNINGS CALL

* In Q1 we grew revenue 75% year-over-year to 127.4 million as we saw continued strong growth in both subscription solutions and merchant solutions revenue.

* Subscription solutions revenue grew 60% to 62.1 million driven by growth of a monthly recurring revenue of 62% to 20.7 million.

* Merchants solutions revenue grew 92% to 65.3 million mainly driven by continued strong growth in gross merchandize volume and the expanded adoption of Shopify Payment, Shipping and Capital.

* GMV grew 81% to 4.8 billion as we continue to track merchants to the Shopify platform and make it easier than ever for merchants to capitalize on the shift to multi-channel commerce to grow their sales.

* 1.8 billion of the GMV in the quarter or 38% was processed on Shopify payments. This compares with 1 billion or 37% in Q1 of 2016.

* Gross margin dollars once again grew faster than revenue in the quarter

* More than 12,000 partners from over 110 countries have referred merchants to us in the past 12 months.

* The percentage of our merchants using Shopify Shipping continues to grow as well, with nearly one in four merchants with orders originating in the US now on board.

* We hit a major milestone in mid-March where our machine learning algorithms, fully automate our offers to merchants for these advances. This means offers are now personalized based on individual merchant performance, rather than the more general criteria had merchants in to groups.

* Our sold-out Unite conference for Shopify partners brought together more than 1,000 app developers and web designers to talk shop, as we introduced our new APIs and platform functionality

* [T]he Shopify wholesale channel addresses a long standing need for merchants to seamlessly tap in to their wholesale market.

* Shopify Plus clients that have launched in the past few months includes fashion brands like Fossil Group, [scotch] and watches; Iowa retailer, Harley Quinn; event producer, Live Nation; Sears' new Canadian discount chain. Health and beauty brands like Borghese; Tyra Banks' cosmetic line called Tyra; and Miranda Kerr's Kora Organics.

WHY THIS MATTERS

It's finding the technology gems that will turn into the 'next Google,' 'next Apple,' or 'next Amazon,' where we have to get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' is has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Shopify Inc (US) (NYSE:SHOP).

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.