10-5-2017

LEDE

Spotlight Top Pick Shopify stock has fallen nearly 20% in two-days on the heels of toxic accusations from a well known short seller, Andrew Left of Citron research. He may have stepped too far, this time.

STORY

Hello, all. This is Ophir writing. Rather than summarize Citron Research's short thesis, here it is, straight from Andrew's mouth in a seven minute video:

THE ACCUSATIONS

A lot of these accusations are quite serious and toxic. Let's take them one at a time with objective data that will help you decide if you agree or disagree.

I. GET RICH QUICK SCHEME

Just 19 seconds into the video Andrew says Shopify has mastered "the good old get rich scheme." At minute 1:10, Andrew tells us to "Google Shopify & Millionaire." He says, "sure enough, we see about 27,000 results."

So let's start here. Baird analyst Colin Sebastian was the first to take issue with this narrative, and here is what he wrote in a note to clients:

[T]he firm's survey of Shopify ads today indicate very few (1 out of 20) contain the word millionaire, whereas the vast majority of the marketing campaigns are focused on easy online store set-up, building a brand, selling on Facebook, or creating an online shop.

[]

Moreover, reviewing Shopify’s Facebook posts since the beginning of the year, we could find no references or promises to prospects of becoming a millionaire

[]

Moreover, reviewing Shopify’s Facebook posts since the beginning of the year, we could find no references or promises to prospects of becoming a millionaire

Just to take this point further, I did my own Google search, but this time it wasn't for Shopify, it was for:

"proof that superman is real"

Here is what I found:

The point here is not to be tongue-in-cheek, it is actually to echo yet further sentiment from Baird which read:

In fact, in order to find references to “millionaire ads,” even the short report suggests needing to search Google very specifically with the keywords "Shopify Millionaire" to uncover such ads, since they are not very apparent otherwise.

You can Google almost anything to find a result, so this first attempt at uprooting evil appears to be off base, based on both on Baird's research and a simple understanding of Google search proper.

II. PYRAMID SCHEME

At minute 1:49, Andrew Left brings up Herbalife and that Shopify is a pyramid scheme and how an FTC settlement by Herbalife is proof that "this will impact Shopify sooner rather than later."

That's sounds damning, and we will get to the false claims of a pyramid scheme right after this one little fact. If you zoom into Andrew's video, here is that smoking gun headline that proves "this will impact Shopify sooner rather than later."

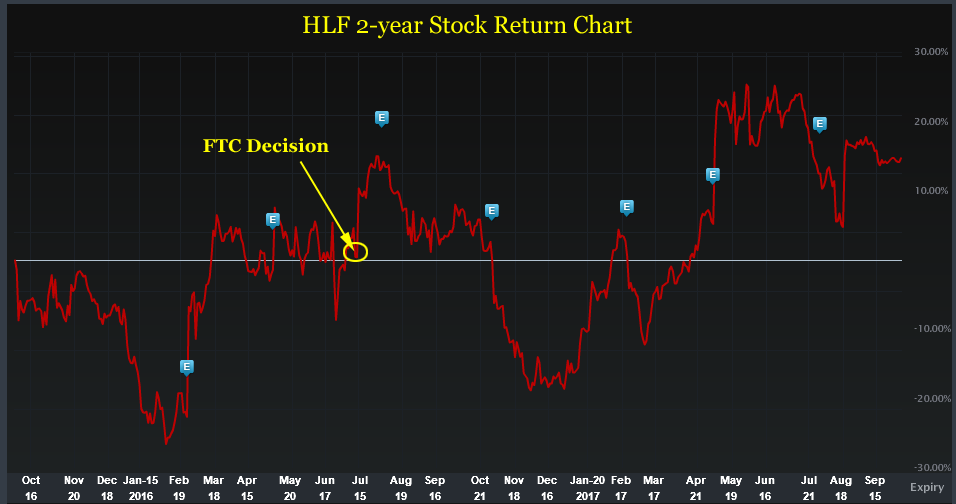

I am no supporter of Herbalife, please don't get me wrong, but we can see that the settlement was for $200 million. Here is the link to the FTC's website for that settlement: Herbalife Will Restructure Its Multi-level Marketing Operations and Pay $200 Million For Consumer Redress to Settle FTC Charges. Note that is was dated July 15, 2016.

To put that $200 million into context, Herbalife has generated $4.4 billion in revenue in the last year and has a market cap above $6 billion. And if you're wondering how this smoking gun FTC settlement affected the stock, well, here you go, objectively:

Yes, Herbalife stock, when the FTC decision was rendered, rose 10% on the day. Obviously the FTC news wasn't good, but the fact that it had so little bite was in fact a bullish push for the stock.

But, with that FTC reality out of the story, this is the real problem -- the original claim is false. Shopify is not a pyramid scheme and any argument to the contrary is in error.

Shopify is an e-commerce platform builder and ecosystem. In fact, Left says that at the start the video. Further, Shopify has created such a powerful ecosystem that it has now partnered with Amazon, eBay and Facebook's Instagram.

Further yet, it generates revenue from software as a service (SaaS), which is a fancy way of saying recurring software fees and as a payment provider. Many people felt that the 'Shopify Pay' initiative was worth trying but likely would not gain traction, but it has.

This is from the last earnings call:

* $2.2 billion of GMV in the quarter or 38% was processed on Shopify Payments. This compares with $1.3 billion or 38% in Q2 of 2016.

For the record, this how Shopify describes Shopify Pay:

Shopify Payments is the simplest way to accept payments online. It eliminates the hassle of setting up a third-party payment provider or merchant account and having to enter the credentials into Shopify. ... You’re automatically set up to accept all major cards as soon as you create your Shopify store.

Whether you believe in the short thesis as presented by Andrew Left or not, or if you even feel that the whole thing is a fraud (which he did not claim), whatever you feel, there is nowhere in this entire narrative where Shopify has built a business on a pyramid.

What we mean to say is, if you take the worst possible scenario, that Shopify is making up numbers by throwing darts at a number line, even that fraud is not about a pyramid scheme.

I did another Google search that I would like to share:

Is Citron Research Committing Securities Fraud?

This is where opinion comes in: I believe that unless Andrew Left backs away from this one claim in particular, that he will be investigated by the SEC and potentially fined or imprisoned. He takes a position in these stocks before he releases his research, which is fine, but even the most fantastical bear on Shopify doesn't believe this is a pyramid scheme. Call it many things -- but this is patently false.

III. RESIGNATION LETTER

At minute 2:10 Left says "when you see what Shopify does its to a level that you cannot even imagine." He makes reference to the fact that Shopify has a page on its website on how to write a resignation letter.

I found two posts on Shopify surrounding this subject here is the first, written on May 1, 2017:

Ready to Become a Full-Time Entrepreneur? Here's How to Quit Your Job.

Since there is so much misinformation floating around, I'm not even going to copy and paste the article, I am just taking a screenshot for you to read.

So, I won't comment here. You decide if that sounds toxic.

Now, here is the other post that Andrew referred to:

Again, I'll refrain from subjective analysis and let you decide how disturbing this is to you.

IV. CREATING A BUSINESS

At minute 3:20 Left discusses some dubious opportunities that Shopify offers clients -- namely to buy goods from other vendors, like Alibaba (Ali Express), and then re-sell them in the United States for more.

For those that aren't familiar with this practice, which Andrew Left appears not to be, this is actually quite a popular approach and is most used on Amazon -- yes, that Amazon.

On June 15th of this year, Yahoo! Finance actually penned an article "Think you’re buying on Amazon? It’s actually from Alibaba".

The article goes onto explain how people do this, with great regularity. Now, if the argument is that this is an odd business model, or that it violates FTC rules if promoted by the reseller (like Amazon or Shopify), then he may have an argument, I'm not a lawyer.

But, to call out Shopify as some special case is incorrect. Illustrating that Shopify has a special service to help this type of business get started is either bullish if it's legal, or it could be problematic if the FTC thinks this goes above and beyond what is allowed.

When it comes down to it, Left's final proclamation here is at minute 3:56: "This is a business opportunity and this will require the same business opportunities disclosures that other have in this country."

What?

V. Partners

Finally, at minute 4:10, Left discusses Shopify's partners:

"On their last conference call I think they may have had 13,000 partners. And you might ask, who are these partners? Well a few thousand of them, maybe a thousand of them might be technology developers, but the rest of them are bloggers and influencers [] and are actually being paid by Shopify."

Left's issue here again is with FTC rules. He notes an FTC page where it reads that "FTC Staff reminds Influencers and Brands to Clearly Disclose Relationship."

If you care to actually go to that post and read it, which it appears Andrew Left has not, it has very little bite at all. It is in fact, as the title alludes to, "a reminder." It's primarily focused on social media stars:

After reviewing numerous Instagram posts by celebrities, athletes, and other influencers, Federal Trade Commission staff recently sent out more than 90 letters reminding influencers and marketers that influencers should clearly and conspicuously disclose their relationships to brands when promoting or endorsing products through social media.

It's definitely possible that this is happening at Shopify, and yes, if so the influencers are already or will need to soon, disclose that relationship. This FTC note was written on April 19th, 2017.

Without further analysis, I'll let you decide how egregious any kind of poor disclaimers are.

Interestingly, at minute 4:52, Left says "if you go to the Shopify website it discusses the affiliate program. It says the Shopify affiliate program includes bloggers, publishers, educators, and other inspiring affiliates."

Then at minute 5:20 Andrew Left says, "Shopify is not only teaching you how to run a store but how to make money writing a blog about Shopify."

From that statement Left says at minute 5:30, "This is not an $11 billion company."

At Stake With Partners

Just to be perfectly clear, even if what Andrew Left is revealing is true, this is not a false business, it's simply noting a requirement of a disclaimer. Something to the effect of:

"The author of this post was compensated by Shopify for this content."

I don't exactly know what the right wording is, it is, after all, legalize, but this is the accusation, that blog posts don't have this notification, not that using influencers is somehow illegal. The very basis of worldwide advertising rests on influencers (read: celebrities).

Again, this really started with influencers on social media, say someone showcasing a beauty product while getting compensated by the brand. The FTC "reminded" everyone involved that a disclaimer was required ("I'm going to show you this new great face wash, and I want everyone to know that [fill in brand name] has compensated me for this review.")

So those are Andrew Left's statements. Again, you can watch the whole 7 minute video above. Here is a reminder of what Shopify is, to the rest of the investing world:

WHAT IS SHOPIFY?

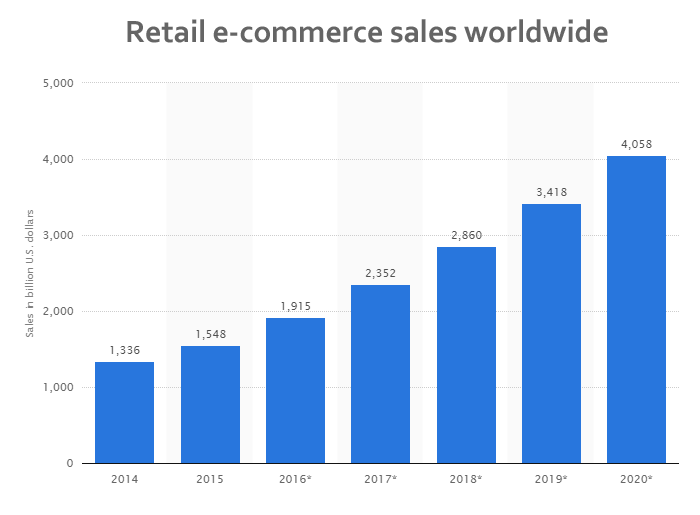

Retail e-commerce sales worldwide from 2014 to 2020 are pegged to grow from $2.3 trillion in 2017 to over $4 trillion by 2020. Here's the first chart from our friends at Statista:

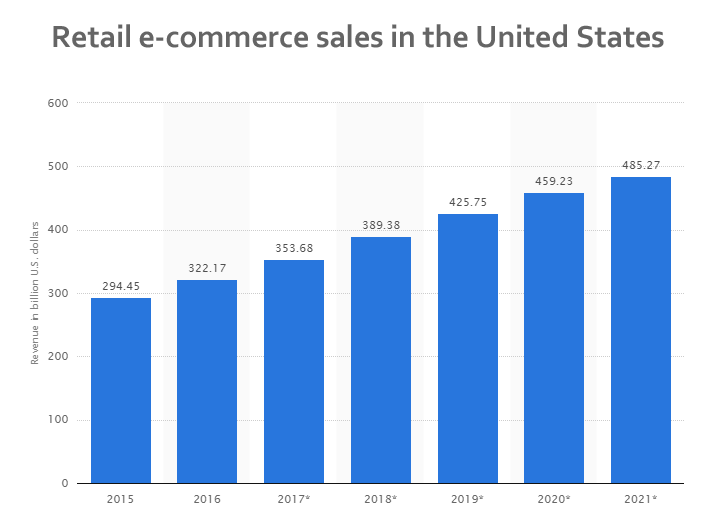

We can also focus on the United States, looking at the same data:

In this case, we are looking at growth from $354 billion in 2017 to 459 billion by 2020.

But, the real gem here is that even in today's world, the share of commerce that is done online is still tiny, even in the United States.

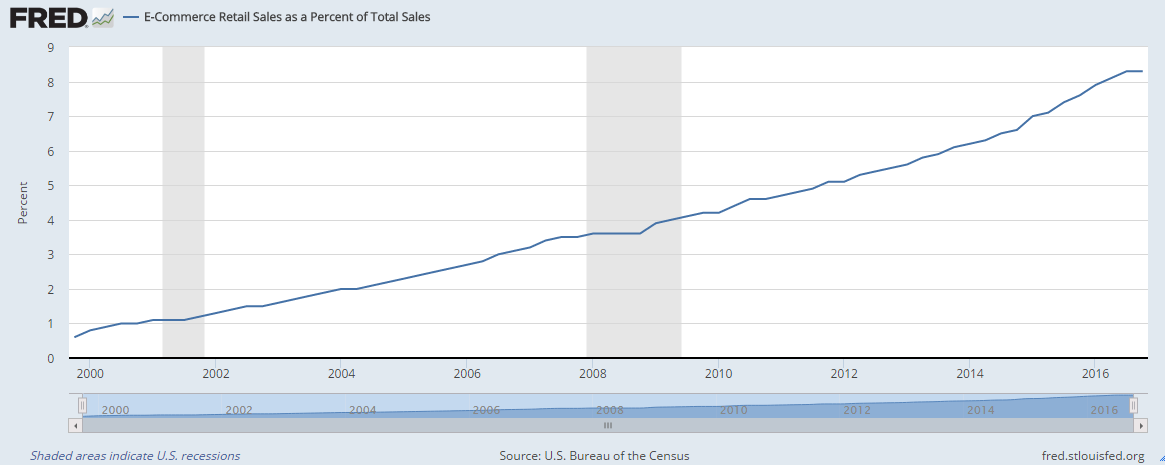

That chart comes to us from the Federal Reserve Bank of St. Louis (FRED). You're reading that right -- even in the US, we're still at less than 9% of retail sales done online. eMarketer projects that number rising from 8.7% today, to 14.6% in four years.

While all of that seems huge -- and it is -- there is a dirty little secret about e-commerce that no one likes to talk about: being the platform for selling goods online doesn't make money.

Yep, while the world marvels at Amazon.com Inc (NASDAQ:AMZN), its $120 billion (ish) in e-commerce revenue turns a smaller profit than its relatively small cloud computing (AWS) business. In fact, AWS is 1/10th the size of the Amazon's e-commerce, but generates more operating profit than that mountain of e-commerce.

So, why do we even care about Shopify?

SHOPIFY -- THE STORY

Shopify isn't just an investment in e-commerce -- that would never make our Top Pick's list -- it's an investment in the guts of the online shopping trend -- the part that's actually growing.

Shopify is the leading cloud-based commerce software for small- and medium-sized businesses. But the company makes money from more than e-commerce sales, it makes money from businesses coming online. Remeber that chart from the Federal Reserve plotting e-commerce as a percentage of total retail sales and how it is supposed to go from ~9% to ~15% -- that's what Shopify is after, the influx of new e-commerce businesses.

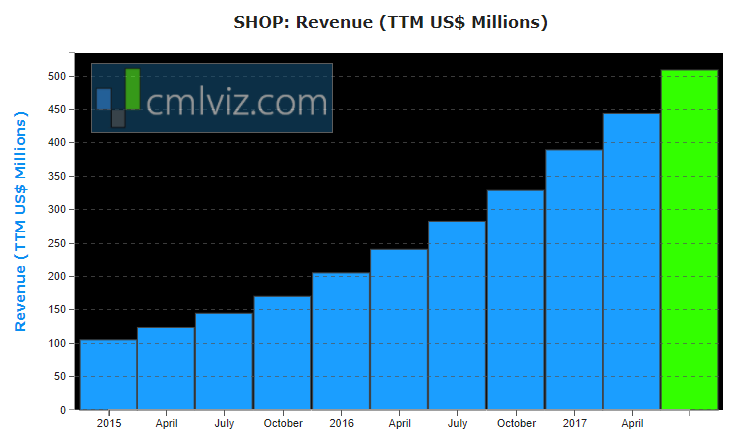

As of the last earnings call, more than 500,000 businesses now rely on Shopify for their sales and back-office software needs. That's up from 325,000 in the third quarter and 243,000 in the fourth quarter of 2015. Here is the revenue trend:

As an aside, Andrew Left never makes any claims that Shopify is fabricating financial results.

LAST EARNINGS CALL

We can also look at some snippets from the last earnings call -- and none of these facts are being questioned by Andrew Left:

* Revenue rose 75% to $151.7 million versus estimates of $144.3 million. This was the ninth time in nine quarters since its May, 2015, initial public offering that Shopify had beaten analyst forecasts.

* Revenue forecasts were raised for the full to $642 million - $648 million, up from $615 million - $630 million.

* GAAP operating loss forecasts were reduced to a $62 million - $68 million loss from a prior range of $69 million - $73 million.

* Subscription Solutions revenue growth accelerated from last quarter to 64%, coming in at $71.6 million. This strength was driven by the monthly recurring revenue growth of 64% to $23.7 million, as we had another record number of merchants join Shopify in Q2.

* Merchant Solutions revenue grew 86% to $80.1 million.

* Gross merchandise volume (GMV) rose 74% to $5.8 billion.

* The value of GMV processed through Shopify Payments rose 69% to $2.1 billion.

* We recently announced that we'll be adding eBay as a channel, making it the second large e-commerce marketplace, natively available to Shopify merchants.

* More than a quarter of Shopify merchants that are shipping from the U.S. and nearly 20% of those shipping from Canada use Shopify Shipping in Q2

* Scale makes a difference here. The number of submissions to our App Store in Q2 doubled over last year

* Gross profit dollars once again grew faster than revenue in the quarter.

* We continue to expect to achieve operating profitability on an adjusted basis in the fourth quarter of this year

* The company now has 500,000 merchants using its platform up from 300,000 in the year ago quarter.

* With more than 0.5 million merchants and more than 1 million staff accounts now in the Shopify platform, it is clear we are extending our lead as the go-to platform for sellers.

Conclusion

We can't say what will happen with these new acquisitions from Citron Research. I think it's fair to assume we will soon see a headline in the news that reads something like: "FTC Investigates Business Practices at Shopify," or something along those lines. So, be prepared for that.

Generally speaking, we maintain our Spotlight Top Pick status on Shopify but do note, while Andrew Left was wildly wrong on many shorts including Nvidia and Mobileye, he is famously right for his call on Valeant Pharma.

As always, control risk, size appropriately and use your own judgement, aside from anyone else's subjective views, including my own.

Thanks for reading, friends.

The author is long shares Shopify at the time of this writing.

WHY THIS MATTERS

It's understanding technology that gets us an edge on finding companies early, the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at an 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.