Shopify: Risk Alert and The Depths of Trickery

10-19-2017

LEDE

Hello all. This is Ophir writing.

We added Shopify to Top Picks on 22-Mar-17 for $66.50. As of this writing the stock is trading at $98, up 47.3%.

| Ticker | Date Added | Price Added | Return |

| SHOP | 22-Mar-17 | $66.50 | 47% |

We noted in great detail the rationale and impact of short seller Andrew Left's narrative on Shopify in our recent dossier The Reason Behind Shopify's Drop.

But, we have news, now, that we must urgently convey ahead of an event.

STORY

This dossier will not go point-by-point to cover, explain, and at times refute the short narrative presented by Andrew Left -- that was the purpose of the prior dossier. Today we remind all of our members that more bad news is coming -- Andrew left told everyone so much. But we also face the possibility of chicanery from Citron research that is almost inconceivable.

MORE BAD NEWS

On October 11th, 2017, Reuters published a story Citron's Left says follow-up report on Shopify likely. The takeaway from that story is quite simple:

Short-seller Andrew Left of Citron Research said on Wednesday he was investigating various aspects of software company Shopify Inc's business and would "most likely" publish a follow-up to an Oct. 4 report that sent its shares plunging.

Left told Reuters that "I am looking at many parts of the business." Then he revealed what it is that he will be criticizing if not catastrophizing.

* He wants Shopify to disclose data on so-called customer churn, or the rate at which clients leave, a key metric to evaluate companies that sell subscription services.

As for Shopify's defense of itself, at first it was quite weak, me must say:

We vigorously defend our business model and stand resolutely behind our mission and the success of our merchants.

But that defense gained some momentum, through of all places, Twitter.

Shopify's CEO Tobi Lutke posted two tweets directly in response to Andrew Left's accusations.

And then he followed it up with a rather appropriate message:

The totality of the response from Shopify was less than vigorous, but, the company is also in a quiet period, something Andrew left surely knows. Read this carefully -- this is one of those times where every word matters (our emphasis has been added):

In order to avoid giving analysts, journalists, certain registered investment advisors, private investors, and portfolio managers an unfair advantage that would amount to insider information, company executives are forbidden to speak to the public about the business during the four weeks prior to the close of the business quarter; a span known as "the quiet period".

That quiet period has been extended by many companies to not only include the quarter end, but the 4-weeks prior to an actual earnings announcement.

Now, follow this logic carefully. Shopify's quarter end is (was) Sep 30, 2017. The company is expected to announce earnings for that quarter on November 1st according to an estimate by Wall Street Horizon. Last year the announcement came out on 11-2-2016.

Four weeks before 11-1-2017 is 10-4-2017, and what do you know, Andrew Left dropped his bomb about Shopify on, you guessed it, 10-4-2017. So, you see, while investors want Shopify to stand up and go point-by-point to refute the accusations, their hands are tied, or, there could be a view from the general council that their hands are tied.

Just to be fully transparent, this "quiet-period" (which is different than the quiet-period before an IPO) is in fact not a law, it's a suggestion, by the SEC.

So, yes, Shopify could have, hypothetically, gone on Television and major media and point-by-point addressed the Andrew left accusations, but it's also possible that the company could not.

Now, let's read the tweet from Shopify's CEO again, with that context.

This is a little bit of tea leaf reading, but my interpretation of that tweet is simply that Shopify does feel they are in a quiet period, and the next time they can address these accusations is on the earnings call.

Whether you agree or disagree with this conclusion is up to you. You have the facts, and some of them are fuzzy -- which is to say, what and when is exactly a quiet-period?

I have spoken with many companies as an interview for Top Picks and always danced around quiet periods and have been told several times that they prefer not to speak until a date such that the SEC could not consider our discussions in bad timing. So, yes, this is a thing, it's not a little tid-bit that a crazy Google search uncovers.

MY TAKE

The worst possible view of this for those that are pro-Shopify and anti-Andrew Left is that Andrew left timed his accusations perfectly, and will time his next accusations perfectly and may in fact be a worse fraud himself than the accusations he has levied on Shopify (and other companies).

The best possible view of this for that are anti-Shopify and pro-Andrew Left, is that he levied his accusations openly, bluntly and was likely ready to take on a response from the company.

The truth likely lies somewhere in between, but not the middle.

NOW WHAT?

This is when I write about a ton of objective data and make it clear what the bullish and bearish narratives are. But I've already done that in the prior dossier. So now it's just a guess, so I will give you my guess, but this time I can't hand you facts, which is what we would all prefer.

I think Andrew Left can wreck a stock. We've seen it -- he uncovered a massive fraud in Valeant and did some good for the pubic as well, bringing drug pricing to the forefront of the news and to the floor of the United States Congress.

We also know he can have zero effect -- he shorted Nvidia (oops) and MBLY with a price target of $11. MBLY was acquired by Intel for $67 (oops, again).

I don't know what's going to happen. Shopify is yet to turn a profit, but that is very much on purpose. They are growing unlike almost any other legitimate tech company and the stock is still up 100% in the last year.

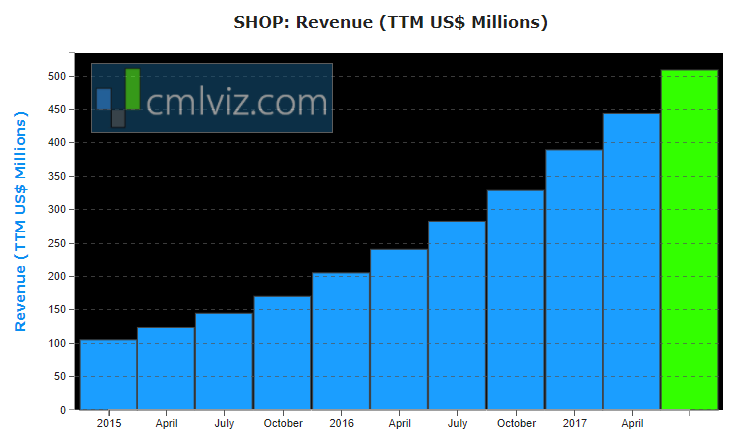

Here is the revenue chart from the prior dossier:

POSSIBILITIES

Thomson First Call has an average estimate of -$0.01 EPS for the quarter that ended on Sep 30th. So, the losses are shrinking. Estimates are actually for $0.02 EPS in the quarter to follow.

If, on the earnings call, Shopify raises EPS estimates, whether it be due to a direct response to Left's attacks or simply because the company is doing better than analysts have projected, the stock could absolutely rip higher.

But... and this is a big one, if the company misses estimates, and further yet takes down guidance for EPS in the next quarter to the point of a loss, even if we are talking about pennies in earnings per share, the stock could crater.

Normally, these reactions would all be rather subdued, but with the short narrative out there and the media attention to it, along with yet to come, but soon to come, new accusations, this has become the Wild West. It's dangerous, lawless, senseless, and everyone is out for blood.

So, this is the new reality we live in because of Andrew Left, and no objective data I can provide, even that thorough analysis from the prior dossier, can take that risk off.

CONCLUSION

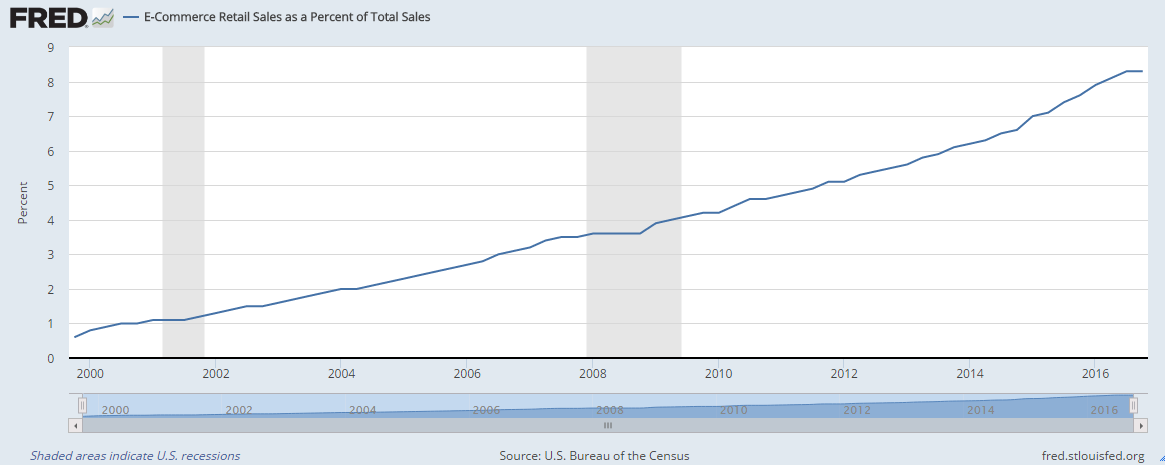

We re-iterate our Spotlight Top Status on Shopify and much of that has to do with its enormously powerful partnerships -- Amazon, eBay, and Facebook's Instagram, but also the undeniable, even by Andrew Left, thematic trend of e-commerce. Here are our favorite two charts:

That chart comes to us from the Federal Reserve Bank of St. Louis (FRED). You're reading that right - even in the US, we're still at less than 9% of retail sales done online. eMarketer projects that number rising from 8.7% today, to 14.6% in four years.

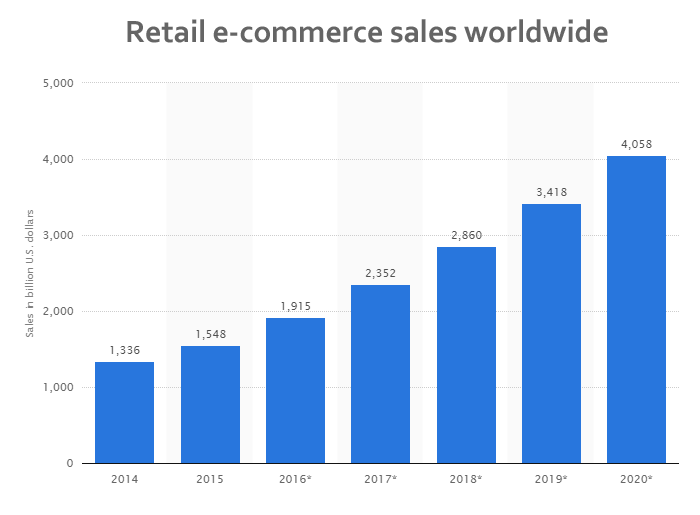

And here are the retail e-commerce projections worldwide

Retail e-commerce sales worldwide from 2014 to 2020 are pegged to grow from $2.3 trillion in 2017 to over $4 trillion by 2020.

So that's it. We see those trends, and Shopify's growing moat, and remain bullish, even though that bullish call could leave us looking a stock, that in the short-term, gets decimated from an exogenous, albeit powerful, force.

SEEING THE FUTURE

It's understanding technology that gets us an edge on finding companies like Invitae early, finding the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty. We are Capital Market Laboratories. Our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution as a member of the famed Thomson Reuters First Call. But while those people pay upwards of $2,000 a month on their live terminals, we are the anti-institution and are breaking the information asymmetry.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

As always, control risk, size appropriately and use your own judgment, aside from anyone else's subjective views, including my own.

Thanks for reading, friends.

The author is long shares Shopify at the time of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.