Enough Panic: The Market Isn't That Bad

PREFACE

The stock market is in full blown collapse mode. We have already hit the official 'bear market' level for some segments, which is a 20% decline from the highs. But contrary to the headlines and the pundits, all is not lost; far from it.

THE MARKET

While bear markets go down faster than bull markets rise, bull markets rise more than bear markets fall. The stock market is the greatest wealth redistributor from the impatient to the patient. Remain patient, own quality stocks and be properly diversified -- this too shall pass.

RETAIL

The U.S. consumer is the backbone of not only the American economy, but the world economy. In fact, in three of the last four quarters, consumer discretionary spending has been more than 100% of GDP growth (the other factors have been a net negative). We just got data from the Commerce Department that reported U.S. retail sales rose a better-than-expected 0.2% in January, while core sales rose a healthy 0.6%.

Even better: December's poor numbers, originally reported as 0.1% decline, was revised up to a 0.2% gain. (Source: IBD).

That doesn't mean the stock market is done falling, it just means the sky isn't falling.

WHAT NOW

The market is toppy, valuations are stretched and worldwide monetary policy is not at all aligned. China and the EU are easing as the United States is tightening. European banks are near crisis -- a point CML Pro published on MarketWatch back in December of 2014: European Banks are in Crisis.

But, owning stocks has been a wealth creating strategy for a century. No matter how bad the stock market has gotten, it has always gone higher after a collapse.

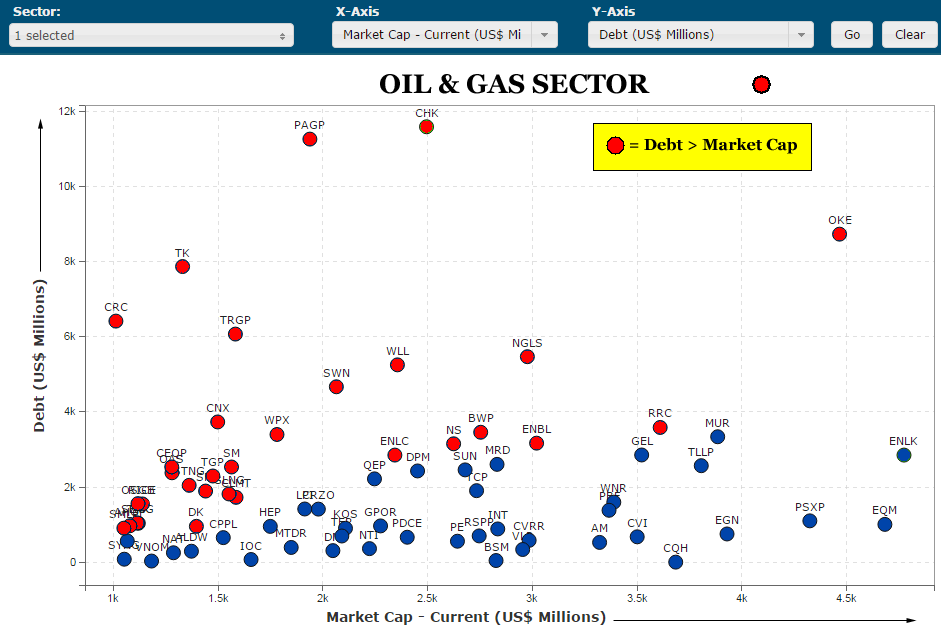

On a broad scale there has been substantial deflation in commodity prices, perhaps most famously in oil. The Oil & Gas explorers have been crushed this year as oil prices have collapsed and that means the debt they have taken to keep operations going has become quite tenuous.

Banks are tightening their purse strings -- which in English means, they don't want to lend s much anymore which, for a short-time, will put a bit of a strangle hold on small businesses looking to expand.

All of a sudden, there is an enormous amount of debt out there funding oil companies to keep running at a loss. The result is staggering. Here's a chart from CML Pro which plots the Oil & Gas sector with debt on the y-axis, and market cap on the x-axis.

We have colored the companies in red that have more debt than their entire market cap. Yep, we're now at a point where nearly half the entire industry has more debt than its entire market cap.

But, research just came out from Wood Mackenzie that revealed that "less than 4% of global oil supply, is unprofitable at oil prices below $35/b.

Even the majority of US shale and tight oil, which has been under the spotlight due to higher-than-average production costs, only becomes cash negative at Brent prices "well-below" $30/b, according to the study" (Source: McGRAW HILL)

WHY IT'S ALL OK

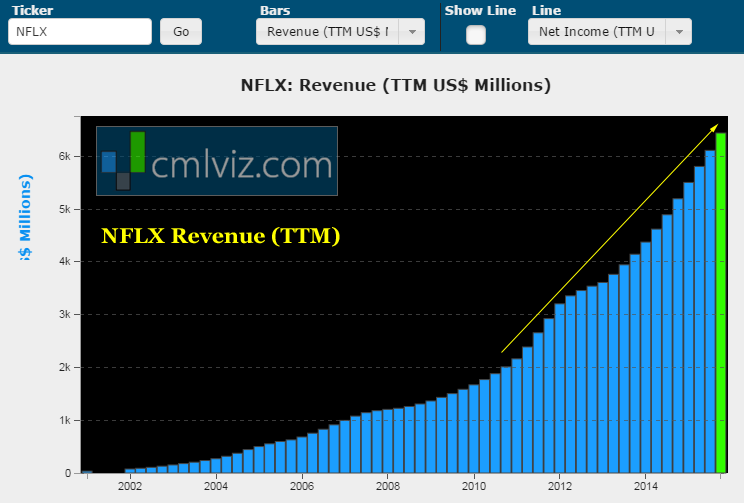

While stock prices will vacillate rather substantially, the truth is, core businesses rarely change that much. Yes, Netflix stock (as an example) is down 40% in just a few months, but the business hasn't changed at all -- it's still growing quite quickly. Here's the all-time revenue chart for perspective:

The stock is tumbling, the business is not.

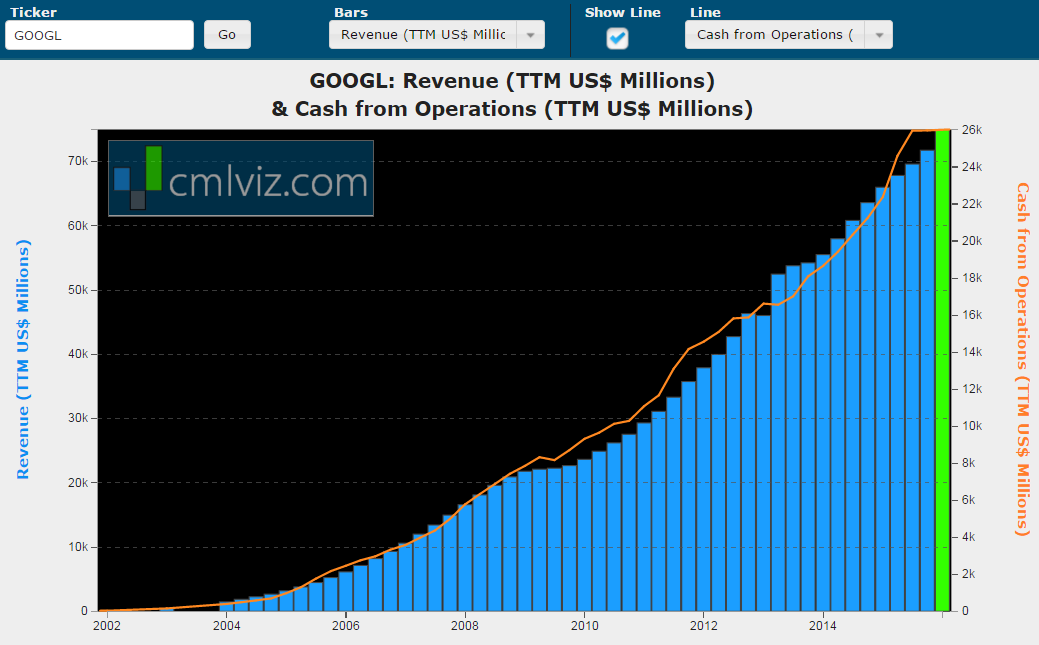

Google stock is down from $810 to now $698 -- a total collapse. But the business has never been stronger. It reported its largest ever revenue and free cash flow over a one-year period just a few weeks ago. Here's the revenue (TTM) in blue bars chart and cash from operations (TTM) in the orange line chart, below.

The stock is tumbling, the business is not.

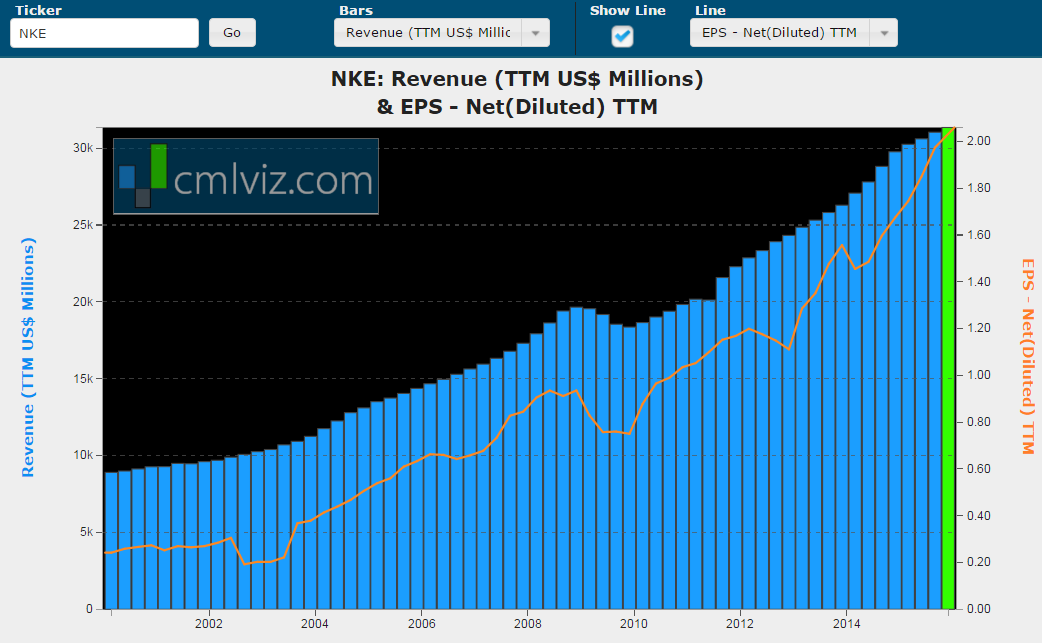

Nike (NKE) has seen its stock roll over quite abruptly, but if we look at revenue (TTM) in the blue bars and net diluted earnings per share (EPS) in the orange line, we see a business literally booming.

The stock is tumbling, the business is not.

We could do this exercise for hundreds, if not thousands of high profile companies, and we will see the same thing: The stocks are tumbling, the businesses are not.

Is China weakening? Probably -- a little. But even Goldman Sachs just put out a note stating that if we take the very worst case scenario for China -- a net shrinkage in real GDP -- the effect on the global economy would be pretty small.

We can do the same for the oil explorers. Yes, many will be doomed to bankruptcy, and for those shareholders and people whose lives deepened on those companies that's terrible -- but it's not even a blip on the global macro-economic scale.

We break news every day. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

WHAT TO BUY AND WHY

Having said all of that -- watching portfolio values go down is sickening. It turns out there are a few themes leading the future that are simply unstoppable.

Whether or not we hit a recession, the Internet of Things (IoT) is going to be the largest market in the history of the world, measured in trillions of dollars within a year, and then several fold that in the years to follow. Here's the revenue chart for IoT.

The cyber security market, which is driven by the growth of IoT is absolutely exploding.

There's just no stopping the growth in the need for cyber security and we are right at the beginning. Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening.

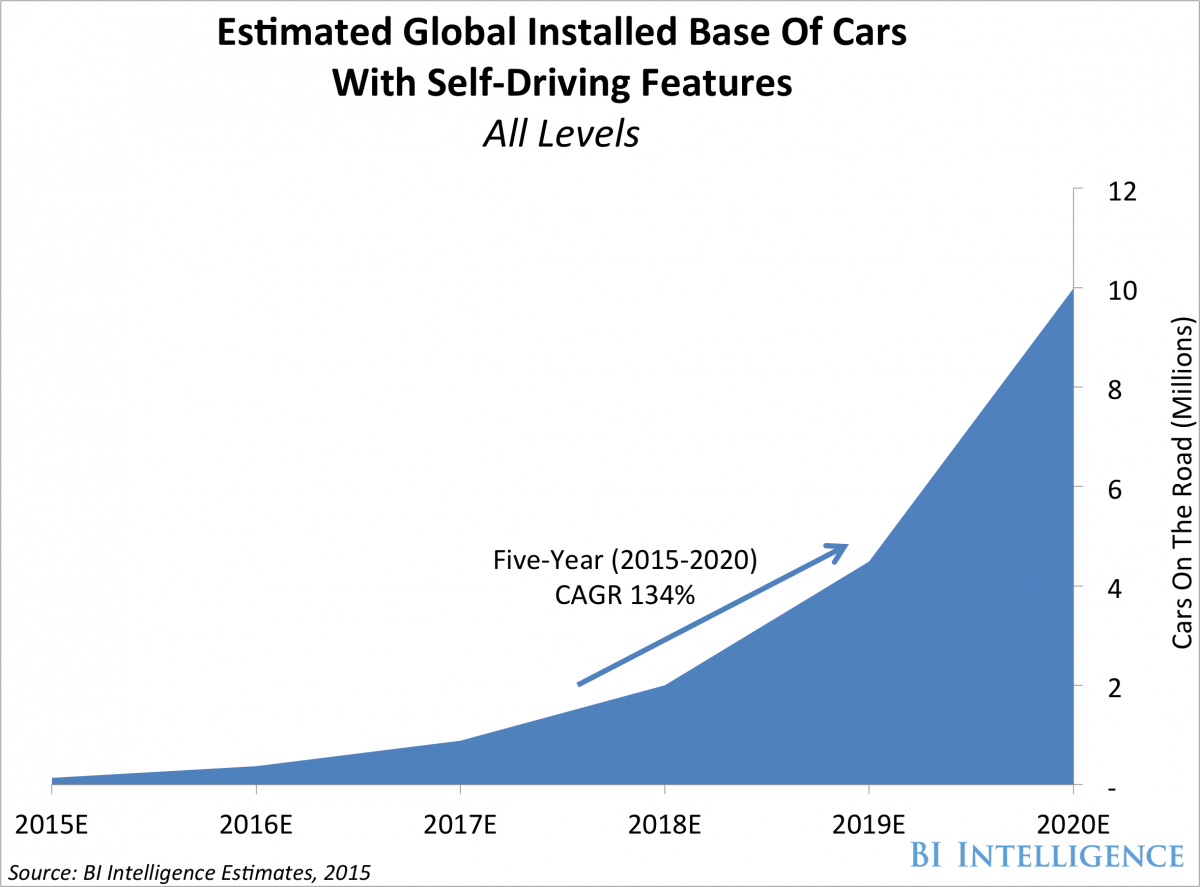

Here's the growth in the driverless car realm:

We're looking at 134% growth every year, for the next six-years.

Other themes that will simply happen -- no matter what -- are drones, mobile pay, smart TVs, artifical intelligence and many others. These charts should ease some fears, these are trends that cannot be stopped as our world and technology move forward.

THE KEY

The key here is rather simple, although it feels a bit painful. Identify the trends that are truly unstoppable, then find the best company or companies in those segments that will rise. There are such companies -- in fact, at CML Pro we call them our 'Top Picks.' There are 14 of them right now -- we will uncover 20.

While the wealthiest top 1% already know all of this, they have done their best, for decades (if not centuries) to keep this information private. This is how the great wealth redistribution to the top 1% has persisted.

Do you thrive on understanding what's really driving a company's stock price? Sick of always being one step behind the market? Join us. Level the playing field, get the same analysis hedge fund managers do. CML Pro.

THE GOOD NEWS

Capital Market Laboratories ('CML' for short), research does sit side-by-side with research from Goldman Sachs, Morgan Stanley, Merrill Lynch and the rest as part of the famed Thomson Reuters 'First Call' service.

But, while institutional research costs tens of thousands of dollars a year, CML Pro was created for the anti-institution. We invite our retail family to all the data, all the visualizations and all the research for just $10 a month.

If you're feeling uneasy about this market and would like to share a voice of reason, patience and knowledge -- join us. The information asymmetry is now broken.

This is just one of the fantastic reports CML Pro members get along with all the charting tools, top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.