Cautious Optimism: The Day After Friday

Lede

On Thursday 5-26-2022, we wrote Tomorrow Really Matters: Inflation and Recession.

Now we write about the results -- and they were good -- or they were a start to possibly good.

Preface

We said in late 2021 that inflation was the "only" thing that matters, where we used quotes around only to signify that of course we cannot totally discount company specific news (or wars).

We feel the same way today.

If there is a recession, then it's due to the Fed's action to tame inflation.

If supply chain snarls continue, its impact matters to inflation, for our purposes.

Even the Russian invasion of Ukraine, from a strictly financial cost, only matters due to inflation. (Obviously the human cost far outweighs the financial cost, but this is a post about finance.)

We will not reprise our prior posts on inflation, but rather share some updates. For a more complete picture, readers may prefer to start with the prior dossiers, and then continue with this one.

4-7-2022: Inflation in several key areas is cooling — yes it is.

5-26-2022: Tomorrow Really Matters: Inflation and Recession.

Data, Data, Data

First, the Federal Reserve (Fed) has a dual mandate to assure full employment and control inflation.

Even prior to the data we received yesterday, Fed Chairman Powell hinted that an equilibrium full unemployment rate of 3.6% (the current rate) may be too low.

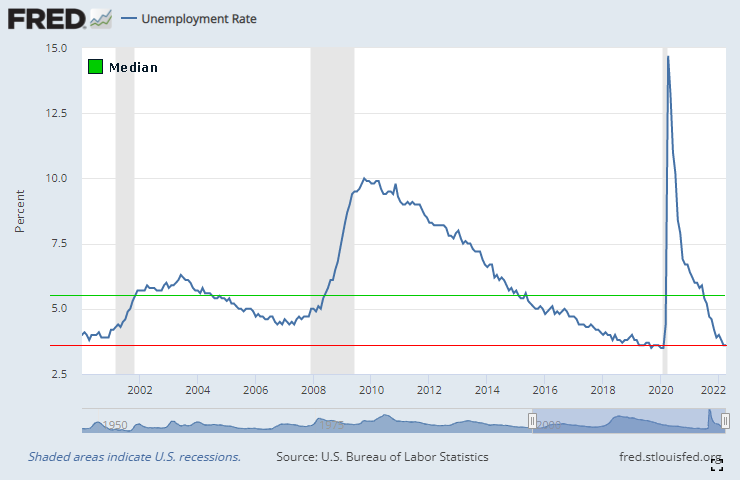

Here is a chart of the unemployment rate in the United States starting at Jan 1, 2002 and going to the most recent data from the Fed.

In the chart we have drawn a line at the current value of 3.6% (data for April 2022) in red, as well as the median value of 5.4% in green.

Since 3.6% is the lowest value over the time frame, the percentile is easy to compute -- the current unemployment rate is lower than 99.2% of readings (with 3.6% the same number as the prior reading in March 2022).

Since the United States is at full employment (or above) the Fed can now turn to the second portion of its mandate, which is to keep inflation at a 2% equilibrium level.

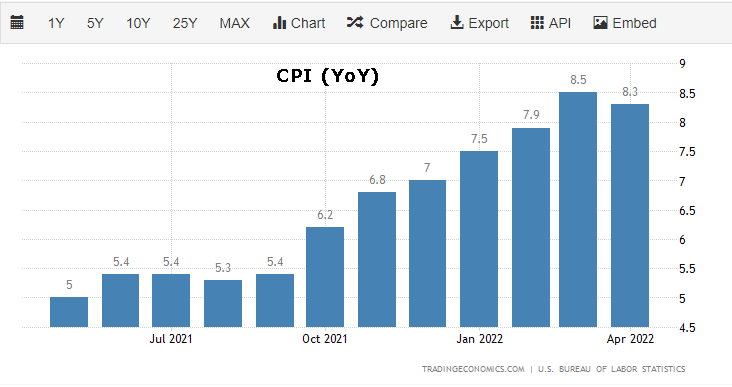

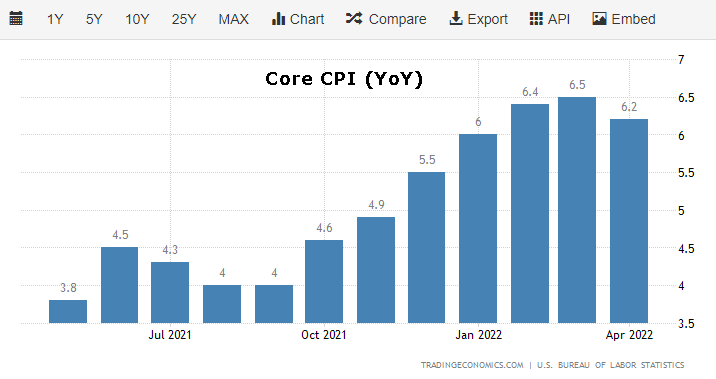

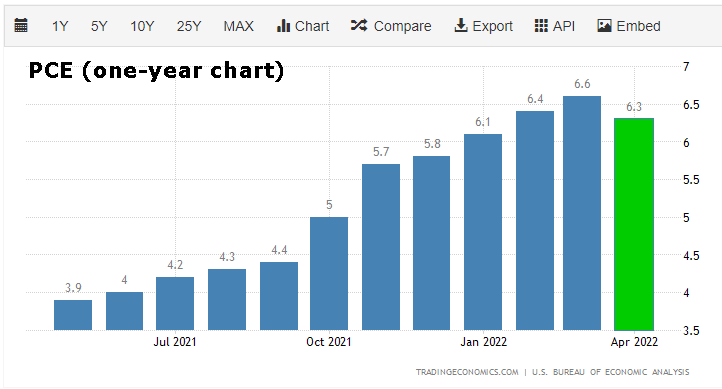

But inflation can be measured in many ways. We tend to focus on four measures:

• CPI

• Core CPI (which is CPI excluding food and energy)

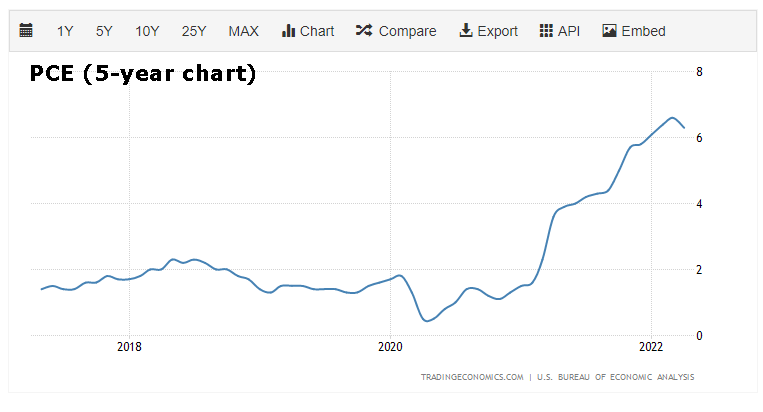

• PCE

• Core PCE (which is PCE excluding food and energy)

We will not review the differences between CPI and PCE, but we will note that it is widely believed that the Fed focuses on PCE and core PCE more than the headline CPI measures.

You can read about the differences between the two here from the Bureau of Labor Statistics (BLS).

The Results and What We Learned

Prior to new data received on Friday for PCE and Core PCE, we did have circumstantial evidence that overall inflation might be easing.

The following are a list of facts that we knew prior to Friday's data:

• Annual CPI rolled over last month from 8.5% in the prior month to 8.3%.

• Annual Core CPI rolled over last month from 6.5% in the prior month to 6.2%.

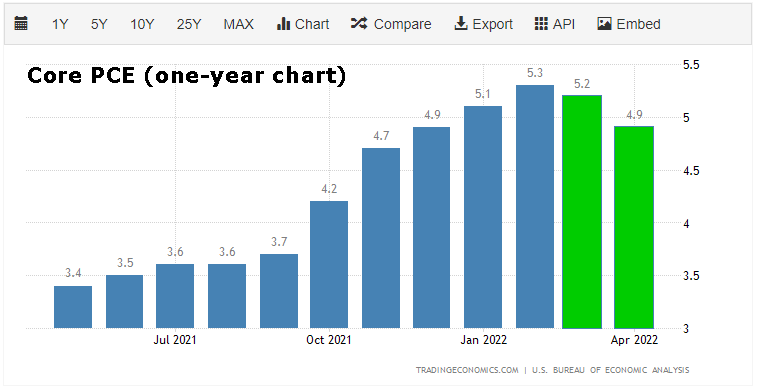

• Annual Core PCE rolled over last month from 5.3% in the prior month to 5.2%.

Things changed with yesterday's data and in response both equity markets and debt markets responded.

Now we can look at updated charts for PCE and Core PCE.

The good news from those charts reads like this:

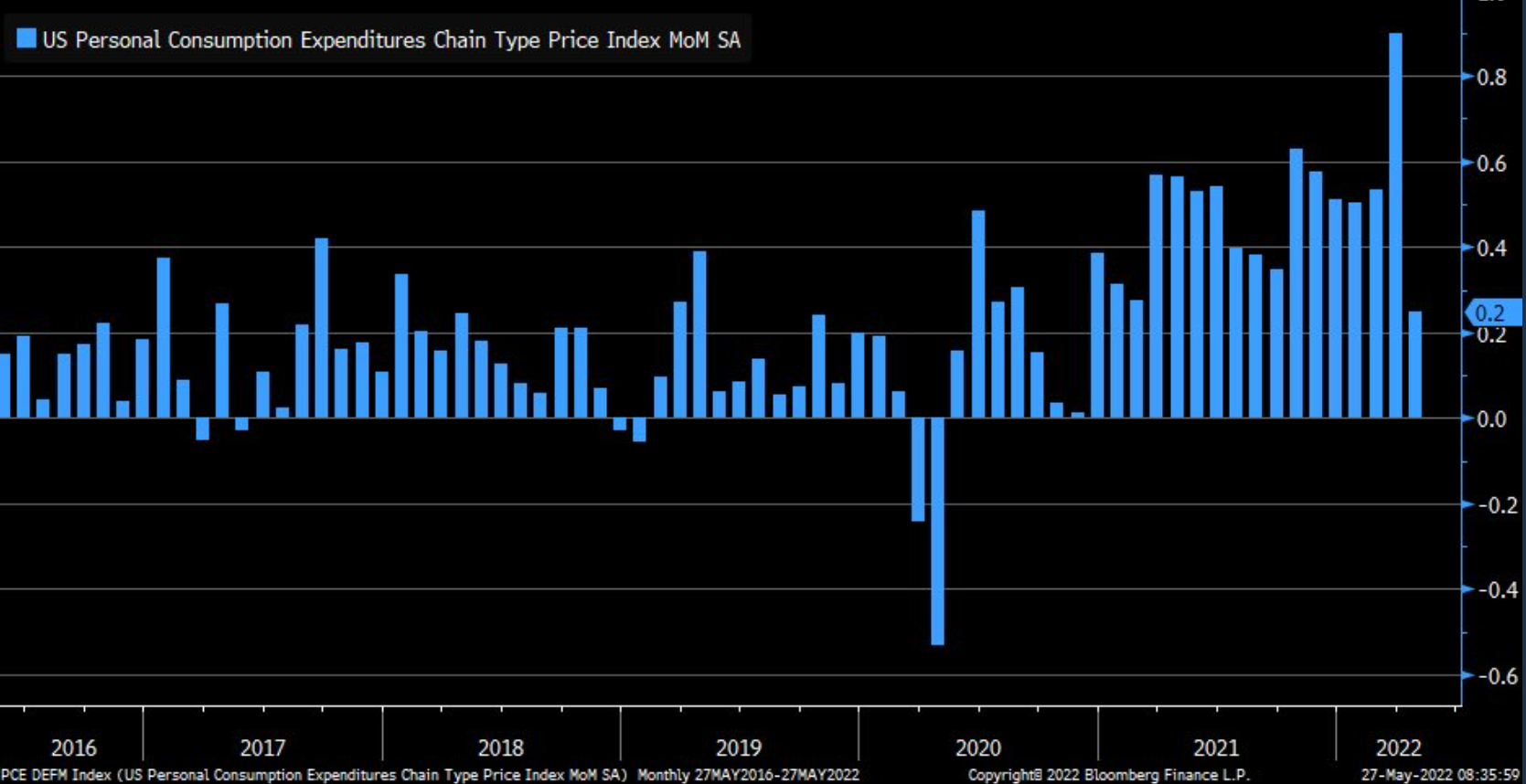

• PCE has rolled over, finally, if even for just one reading. Further, the month-over-month (MoM) change in PCE rose just 0.2% versus 0.9% in the prior month and this is the lowest level since November 2020.

Here is the month over month chart, for context:

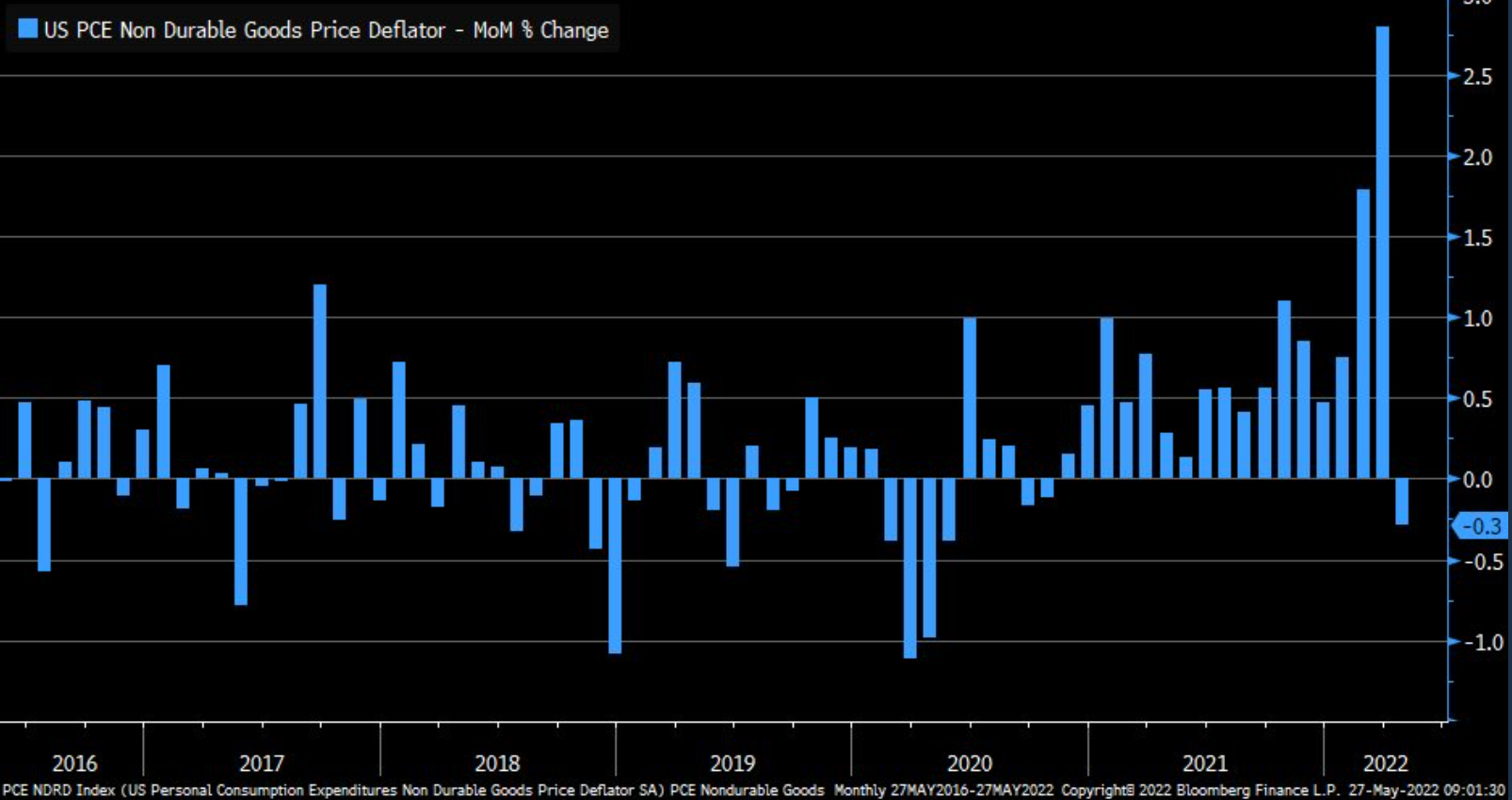

• Non durable goods PCE not only came in lower than the prior month, but illustrated a substantial reversal in April PCE at -0.3%. This is the first negative MoM print since October 2020 and largest drop since May 2020.

(Consumer nondurable goods are purchased for immediate or almost immediate consumption and have a life span ranging from minutes to three years. Common examples of these are food, beverages, clothing, shoes, and gasoline.)

• Core PCE has now seen two consecutive months of lower annual readings.

• There is some evidence that US wage increases are showing signs of peaking (this is a welcome sign for the Fed and inflation).

528.PNG)

Bloomberg writes this:

All of this data reads very well for those of us hoping to see lower inflation.

But, while all this part of the story is inarguably optimistic, this is not the entire story.

We learned more from the economic data released on Friday, and learned more from some headlines.

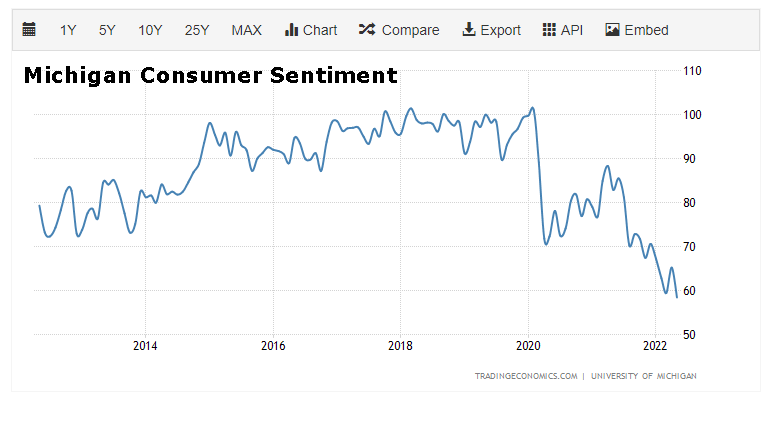

• Consumer sentiment as measured by the United States Michigan Consumer Sentiment fell to its lowest level since August 2011.

Consumers continued to have negative views on current buying conditions for houses and durables, as well as the future outlook for the economy, primarily due to concerns over inflation.

But we also have this:

• US Consumers Expect Inflation Shock to Pass, NY Fed Survey Finds.

Also, while those one-year bar charts of various inflation measures look better, we must also have the longer-term perspective.

Please find the charts of PCE and Core PCE over the last five-years, rather than the one-year window presented above.

So, we cannot ignore the tenuous position we are in.

That's data, now let's analyze it.

Head Spinning is Appropriate

If your head is spinning, it should be and you're in good company.

BofA put out a note that was turned in to a summary headline that the mega bank likely regrets, but it reads about as confused as the data:

Investors now expect a bear market in 2022, but don't rule out the bull: BofA

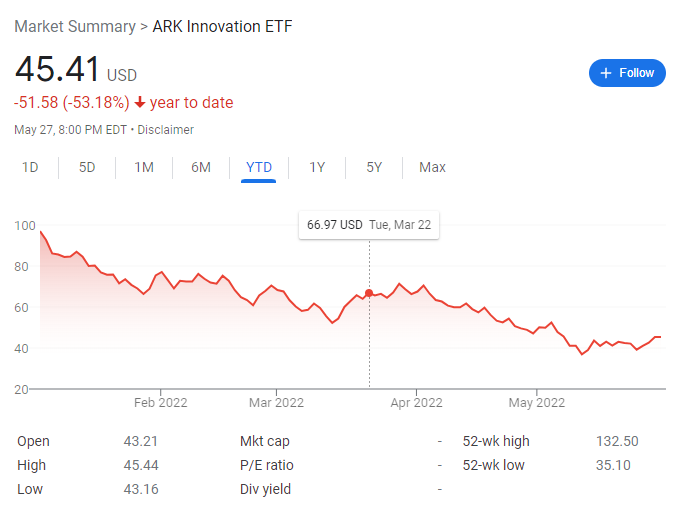

We also see the benchmark for small- to mid-cap growth, the ARKK ETF, is down 53% year to date (that's less than five-months) and before the recent rally in the market was down 74% from its all time high. That's a benchmark -- not a single stock.

But it's not just Ark. Not at all.

The once hallowed name of Tiger Global, the institution synonymous with exceptional investing prowess in both public and private markets, was down more than 40% in the first four months of 2022.

Tiger was held in such high regard that the principals that left the firm to start their own funds were nicknamed 'Tiger Cubs,' and were consecrated by presumption.

The irony in the genetic nature of the nickname (a tiger cub refers to an infant tiger) is difficult to miss. The reverence for the Tiger Fund was so great that simply being 'related' to it was enough to earn an imprimatur.

But, Melvin Capital Management, the fund that was obliterated by shorting meme stocks -- yep, that's a Tiger cub.

Viking Global Investors and Coatue Management -- yep, Tiger cubs with smashed returns.

Archegos, the firm now infamously run by Bill Hwang who faces 11 felony counts and whose firm has been characterized as a vast, criminal scheme to mislead banks and manipulate markets -- yep, not only a Tiger cub, he ran Tiger Asia.

As for Wall Street banks -- don't look to them for clarity either.

Just four days ago Evercore put out a note encapsulated by CNBC with this headline:

No recession ahead: Evercore ISI predicts S&P 500 will jump 22% from current levels.

Mega bank Citi also made a bullish call, or so it seemed:

Citi’s bear market model says it may be time to buy the dip

Lost in the headline is that Citi is predicting a bear market.

CNBC just wrote that influential investment bank Morgan Stanley sees things getting worse:

Morgan Stanley strategist who called sell-off sees it getting worse

As we wrote -- "if your head is spinning, it should be and you're in good company."

So, now what?

Is Ark full of lost analysts? Was the reverence for Tiger, built over decades, a mirage — and a one in a thousand draw of luck?

Is mega bank BofA generating random headlines? Or is it that mega bank Citi sees it clearly? No, wait, it’s Morgan Stanley, right?

It’s none of these things.

It is this one thing:

It is this one thing:

On 1-13-2022 we wrote a dossier musing about 2022, far before the war in Ukraine had begun and we noted the discombobulation we have just traversed and even gave it a reason:

(Let’s call it four years so we don’t have to repeat “three to five years” over and over again.)

It’s this four year compressions that has made long-term stories seem like they are changing so quickly (they are, but it’s not a year, it’s four years).

All of this has discombobulated the landscape for growth. What was an easy long-term story to tell, has been told. In this world 2020 + 2021 = five years, at least.

Stories have been told; quickly.

Stories that are two-years old in real-time are fully five-years old due to market forces.

When there is a compression like that, long-term stories can turn into shorter term stories.

Even though all of the firms we cited above have seen bear markets in the past - even as far back as the 1970s - none of us have ever experienced a global pandemic the magnitude of COVID-19.

The fact that four years have been compressed into one means that there will be five years' worth of information smashed into a blitzkrieg of earnings announcements.

The resulting discombobulation is not to due risk obliviousness, but rather due to the fact that no one has ever experienced five years of bad news coming out in a single quarter (or whatever). That makes even the most celebrated and experienced names look foolish.

This is where we are.

But all of that is in the past and we even know the reason for it. And knowing the reason is going to help us get out.

As we have written before in dossiers and presented on webinars, this is all due to COVID:

1. COVID caused a catastrophe of fear, so in response…

2. Millions of people dropped out of the job market to either handle child care or simply to avoid COVID risk, so in response…

3. COVID caused the fastest bear market ever, so in response…

4. The Fed cut rates to 0% and added massive layers of QE, based on experience from the GFC, so in response…

5. We got the fastest bull market recovery ever, so in response…

6. Technology in particular ripped, so in response…

7. E-commerce boomed right as people were getting sick, so in response…

8. The supply chain suffocated with 3x demand and 1/3 capacity, so in response…

9. Prices rose as Economics 101 will tell us (a demand curve). Demand up / Supply down means prices up, so in response…

10. The Fed has to fulfill its dual mandate (jobs and inflation) and with jobs OK, here comes the inflation reconciliation, so in response…

11. Interest rate hikes are coming, so in response…

12. Technology stocks dip, so in response…

13. With a weakened world economy, a delusional dictator started a war, so in response…

14. A resolute and cohesive West imposed massive sanctions on Russia, including massive sanctions on oil and gas, so in response…

15. Energy prices have exploded higher, so in response…

16. Rather than expectations for a cooling of inflation into the Spring of 2022, we have the reality that inflation will likely spike even higher and…

17. Inflation pressures are rising just as we had peaked inflation (February was supposed to be the peak), so in response…

18. Stocks were down huge (again)

If this reads as familiar, it should be, it's a copy and paste from the slides for the prior CML Pro webinar and this dossier from 3-15-2022.

And, this has all led us to the point I wanted to make, and it's optimistic.

There is Good News in the Bad News

All of this does have a silver lining, and it may be a gold lining in the next few quarters and years to follow.

We know the irritant -- COVID -- and that means a rational actor can see a world after the irritant is pacified. But there's better news than that:

In the realm of small to mid cap growth, virtually everything has been hit hard; it is the perverbial baby out with the bathwater.

As a result, if we are able to identify growth companies that were able to establish themselves without interference from mega caps and are able to thrive after COVID, investors can replace stocks that simply lacked time to complete proper business development with those that did.

Economic Data Tells Us...

We expect decreased wage inflation.

We expect increased unemployment.

We expect higher interest rates.

We allow for the possibility of a recession, with data from Target, Walmart, Apple, Samsung, and more pointing to that very possibility.

But that doesn't matter.

Inflation is the "only" thing that matters....

... And we expect lower inflation... finally. It might not be linear, but we do expect it.

If we're wrong, this will get much worse.

If we're right, this will get much better.

Conclusion

We are not lost in a war torn sea -- we are found in a sea of tranquility.

It just doesn't feel like it right now.

But it will.

Not yet.

But it will.

The speed of disinflation will dictate the abruptness of future Fed moves, but we expect higher unemployment to equilibrium levels, and a continuum of possibilities from the Fed all based on inflation readings.

There is no paranoia, but we still feel that inflation is the "only" thing that matters.

Thanks for reading friends.

Each company in our 'Top Picks’ has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks, research dossiers, and alerts are available for a limited time at a 30% discount.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.