The CML Close - Stocks rose sharply; Microsoft cut its guidance due to currency headwinds; Saudi Arabia will pump; Hiring stalls

Markets

Stocks rose sharply even though Microsoft (NASADQ:MSFT) cut its guidance citing currency headwinds.

Saudi Arabia is ready to pump more oil if Russian output sinks, but oil prices still rose.

| • SPX | 4,176.82 | +75.59 | (+1.84%) |

| • NASD | 12,316.90 | +322.44 | (+2.69%) |

| • DJIA | 33,248.28 | +435.05 | (+1.33%) |

| • R2K | 1,897.67 | +42.85 | (+2.31%) |

| • VIX | 24.72 | -0.97 | (-3.78%) |

| • Oil | 117.42 | +2.16 | (+1.87%) |

• Private businesses in the United States hired the least since the job losses in 2020, and well below forecasts.

• US-based companies announced plans to cut 20,712 jobs from their payrolls in May of 2022, the lowest reading in three months.

• Jobless claims numbers still signal a tight labour market.

Headlines of the Day

Unit-labor costs, a key measure of U.S. wage inflation, was revised up to a 12.6% gain in the first quarter from the initial estimate of an 11.6% gain, the Labor Department said Thursday.

Over the past year, labor costs are up 8.2%, the largest four-quarter gain since 1982. Overall, U.S. first-quarter worker productivity shrank a revised 7.3%, slightly better than the initial estimate of a negative 7.5% rate. This is the largest quarterly decline in productivity since the third quarter of 1947.

US Economy Shows Signs of Downshifting as Rates, Inflation Bite

Beige Book: Four districts noted that the pace of growth had slowed. Three districts said price increases had ‘moderated somewhat’

Saudi Arabia ready to pump more oil if Russian output sinks under ban

Riyadh aware it must not ‘lose control’ of oil prices as energy sanctions hit Moscow

World’s Biggest Truck Manufacturer Says Chip Crunch Easing

Daimler Truck says factories busy amid signs of slowing growth. Comments chime with Mercedes indicating improving chip supply.

Supply Snarls Promise Southeast Asia Bigger Slice of Trade Pie

EU, Japan seen leading efforts to diversify supply chains. Asean presents cost-effective option to tweak linkages.

Economic Data Results for 6-2-2022

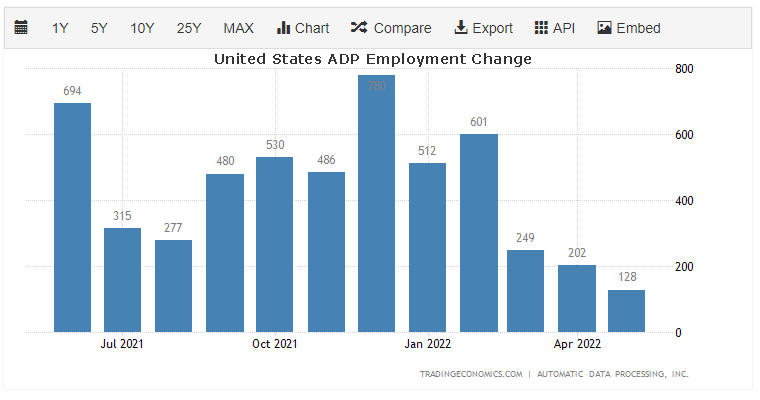

United States ADP Employment Change

Private businesses in the United States hired 128K workers in May of 2022, the least since the job losses in 2020, and well below forecasts of 300K.

April Factory Orders

April factory orders rose 0.3% versus 0.7% estimates and 1.8% in prior month (which was revised down from +2.2%).

United States Challenger Job Cuts

US-based companies announced plans to cut 20,712 jobs from their payrolls in May of 2022, the lowest reading in three months. It is 15.8% lower than the 24,586 cuts announced in May of 2021. So far this year, employers announced plans to cut 100,694 job cuts, the lowest on record for the first five months of the year. Hoever, the tech sector announced 4,044 cuts in May, up 781% from the 459 cuts in January thru April (highest monthly total since Dec 2020 when sector announced 5,253 cuts)

United States Initial Jobless Claims

The number of Americans filing new claims for unemployment benefits fell by 11 thousand to 200 thousand in the week ended May 28th, from the previous week's revised level of 211 thousand and below market expectations of 210 thousand, signaling a tight labour market.

Economic Data Due Tomorrow on 6-3-2022

Unemployment Rate

Non Farm Payrolls

ISM Non-Manufacturing PMI

Participation Rate

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."