The CML Close - Stocks rise, oil falls, manufacturing and services is dropping, analysts push back and raise 2022 earnings guidance. - 06-23-2022

Markets

Stocks rose, continuing herky-jerky behavior while oil fell. Economic data surrounding manufacturing and services is dropping quickly, analysts are more optimistic about earnings, and more job offers are getting rescinded.

| • SPX | 3,795.73 | +35.84 | (+0.95%) |

| • NASD | 11,232.19 | +179.11 | (+1.62%) |

| • DJIA | 30,677.36 | +194.23 | (+0.64%) |

| • R2K | 1,711.67 | +21.40 | (+1.27%) |

| • VIX | 29.05 | +0.10 | (+0.35%) |

| • Oil | 104.02 | -2.17 | (-2.04%) |

• More companies are rescinding job offers.

• Analysts push back -- raise 2022 earnings guidance.

• The labor market is still tight.

• Manufacturing and services indices are all falling.

Headlines of the Day

Powell Is Focused on Curbing Inflation, Even at the Risk of Provoking a Recession

Federal Reserve Chairman Jerome Powell spent several hours testifying before members of the Senate Banking Committee Wednesday. When you tune out the politics, he offered some fresh insights into the path of monetary policy and the U.S. economy.

More Companies Start to Rescind Job Offers

The labor market remains hot. Yet businesses in a range of industries are pulling back job offers to recruits they were courting just a short time ago.

Analysts Are Very Sure of Profit Estimates Everyone Else Hates

Not seeing corporate-profit crisis in data, says CS’s Palfrey. Analysts have been upping their 2022 earnings guidance.

Europe’s industries are slashing their usage of natural gas so the fuel can be stored for winter

Drop of 49% in the UK’s usage is ‘staggering’: Citigroup. Germany preparing to trigger second stage of emergency plan.

Europe’s Top Economies Slow Significantly as Manufacturing Cools

Gauges of French, German factory output enter contraction. Services momentum from removal of virus restrictions is easing.

Economic Data Results for 6-23-2022

United States Initial Jobless Claims

The number of Americans filing new claims for unemployment benefits decreased by 2K to 229K in the week that ended June 18th, below market forecasts of 227K, pointing again to a tight labor market.

United States Kansas Fed Manufacturing Index

The Kansas City Fed’s Manufacturing Production Index fell further to -1 in June of 2022 from 19 in the prior month, reaching the lowest level since May of 2020. The slower pace of factory growth was driven by reduced activity at durable goods plants in June.

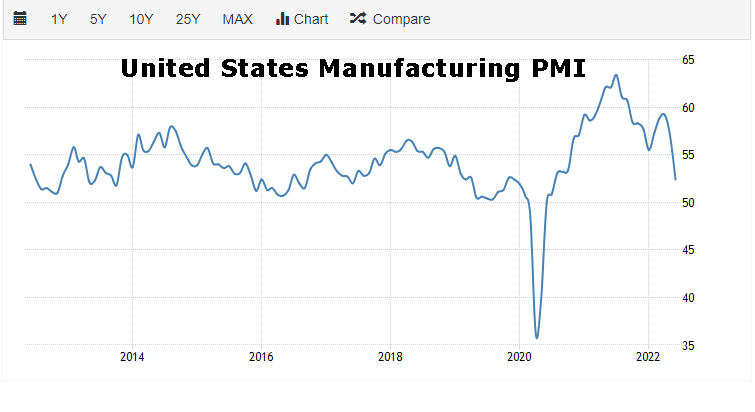

United States Manufacturing PMI

The S&P Global Flash US Manufacturing PMI fell to 52.4 in June 2022 from 57 in May, well below market expectations of 56 and pointing to the slowest growth in factory activity for almost two years as contractions in output and new orders weighed.

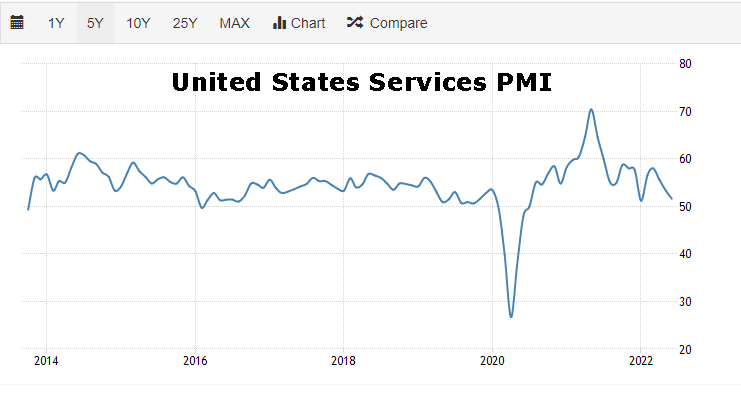

United States Services PMI

The S&P Global US Services PMI fell to 51.6 in June of 2022 from 53.4 in May, the lowest in five months and well below forecasts of 53.5, a preliminary estimate showed. Primary downward pressure came from a sharp fall in new orders, with demand falling for the first time since July 2020.

Economic Data Due Tomorrow on 6-24-2022

Durable Goods Orders MoM

Pending Home Sales MoM

Dallas Fed Manufacturing Index

Non Defense Goods Orders Ex Air

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated."