Sentiment Change – Inflation has Peaked and Now Prices are Falling

Lede

Today we review a material amount of economic data since we last spoke.

This time, our sentiment has materially changed to optimistic; not delusional, just optimistic.

Now we write about the results -- and they were good.

A reader should leave this dossier with a strong understanding of recent economic data as it pertains to inflation in the United States.

Preface

We will not reprise our prior posts on inflation, but rather share some updates. For a more complete picture, readers may prefer to start with the prior dossiers, and then continue with this one.

Context

In 2021 we wrote this: inflation is the “only” thing that matters

We still feel that way so this is going to be a discussion in large part about inflation.

Like the webinar, we reprise our goals.

• Introduce facts, like A, B, and C

• From those facts we do an analysis A, B, and C. This analysis is not fact; one can agree or disagree

• From that analysis A, B, and C we make final conclusions (these can also be called opinions)

The nice thing about the A, B, C exercise is that an investor can choose to disagree with the analysis and conclusion, while at least gaining value from the process.

Intellectual adults make their own decisions, and we write for intellectual adults. Consider your own analysis and conclusions.

This dossier should deliver facts, analysis, and conclusions, of which only the first portion is (nearly) objective.

Facts: Data, Data, Data

We will share data in chronological data, meaning starting with the oldest and moving to the most recent from today.

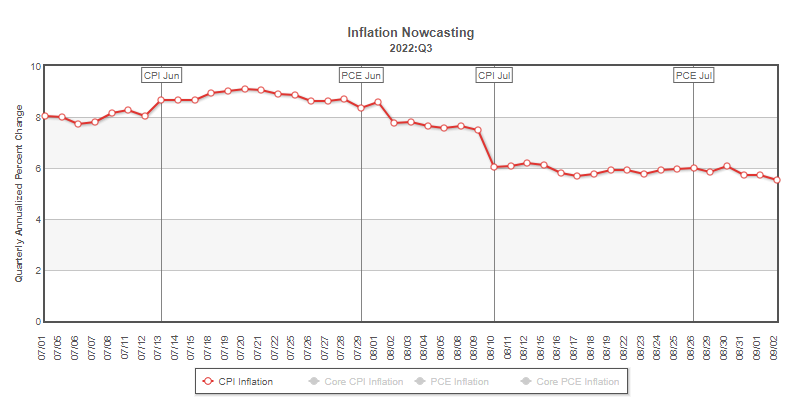

But, before that, as a motivator to demonstrate how quickly inflation and inflation expectations can drop, we turn to the Cleveland Federal Reserve's Nowcast Inflation forecast -- an algorithmic daily updated prediction of inflation.

We look to the forecasts for Q3 2022:

On 7-20-22, this fully objective forecast of CPI inflation for Q3 2022 read 9.1%. On 9-3-2022, just six-weeks later, this same fully objective forecast for the same quarter (Q3 2022) now reads 5.5%. Yeah, things can change fast; sometimes radically so.

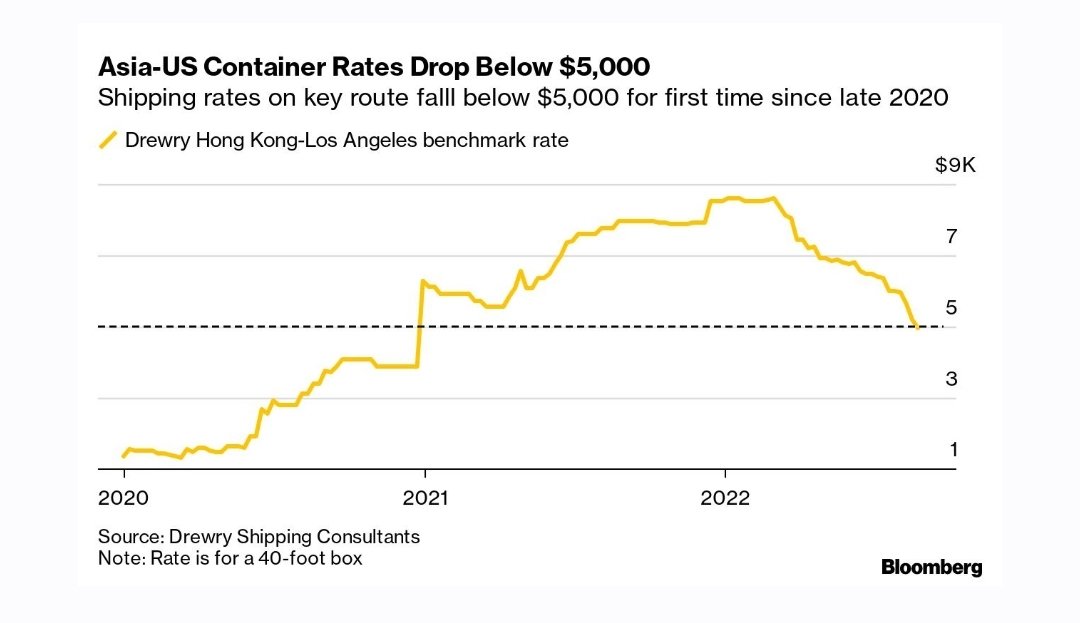

Shipping and Logistics

• Asia-US container rates dropped below $5,000 for the first time since 2020.

• Freightos Baltic Index is 50% off highs and wildly lower trajectory than 2021.

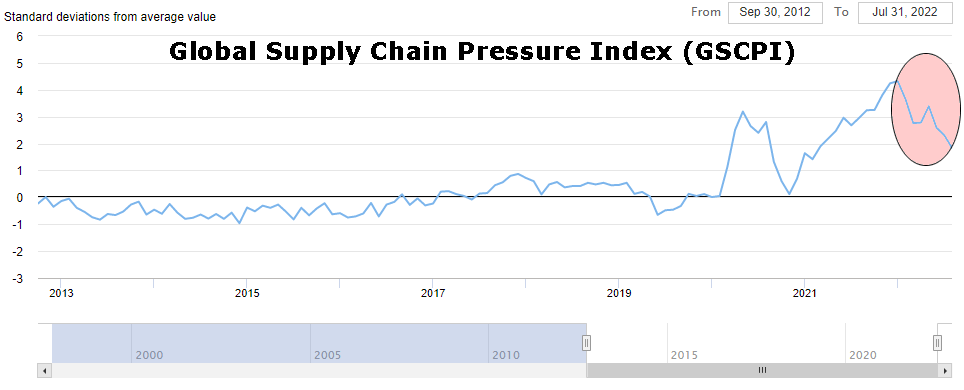

• The supply chain pressure index has tumbled from its highs and is now less than two standard deviations away from "normal."

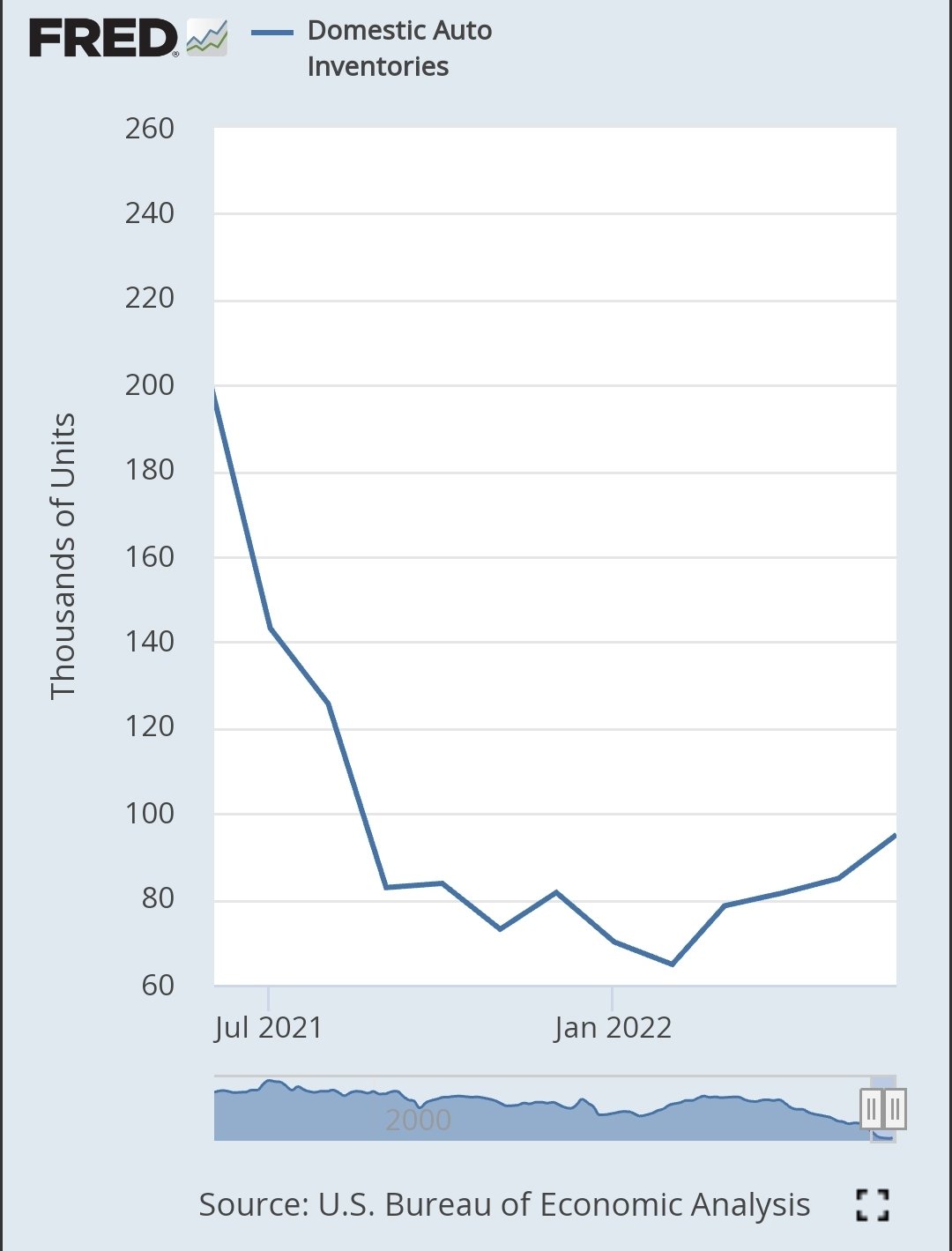

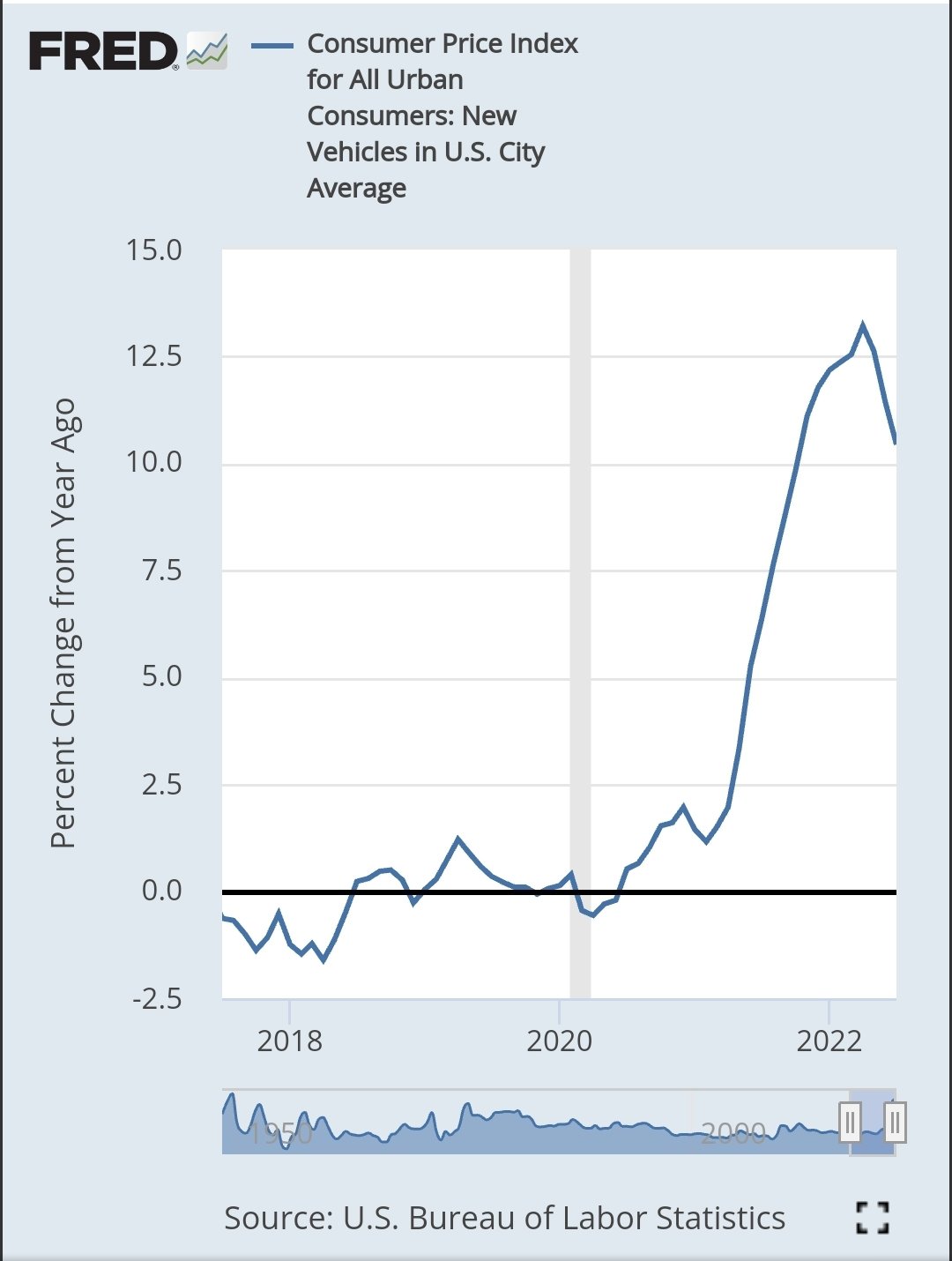

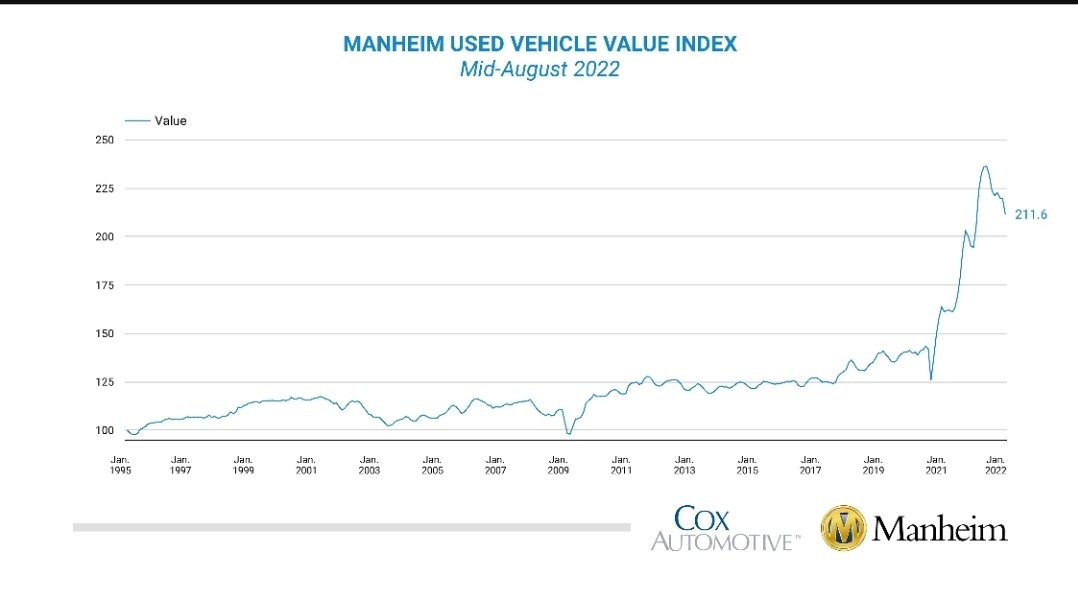

Autos - Inventories up and price growth cooling

• A massive shrinkage in automobile inventory on the way down.

• Auto inventories are recovering abruptly, up about 50% in a matter of months (but still low).

• This has driven the new car price index change YoY abruptly down.

• Manheim user car price index continues to fall.

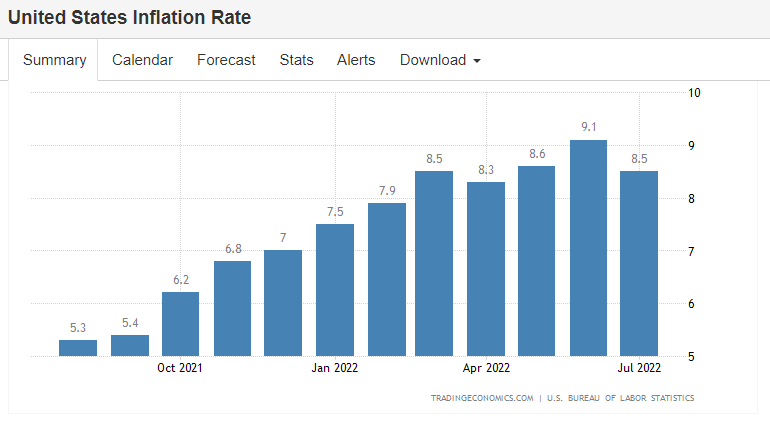

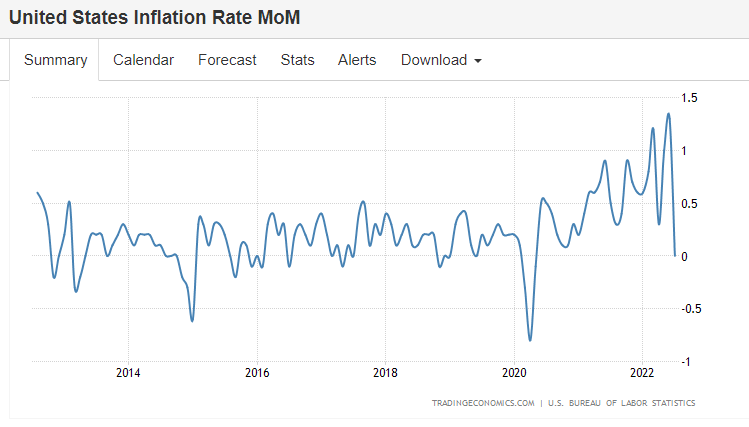

Inflation Indices

• CPI is cooling.

‣ 8.5% vs 8.7% est (YoY).

‣ 0.0% vs 0.2 est (MoM).

‣ New cycle low (MoM).

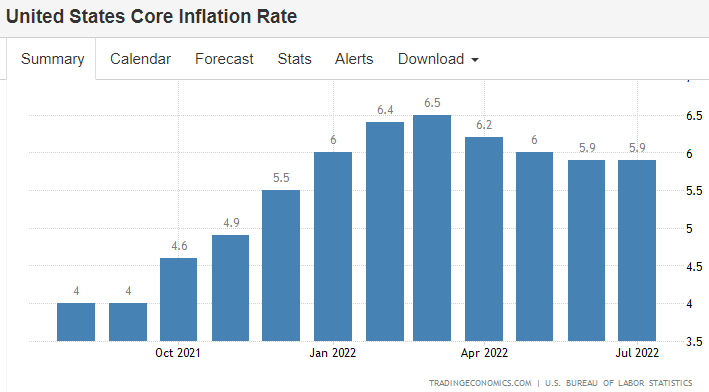

• Core CPI is cooling.

‣ 5.9% vs 6.1% est (YoY).

‣ 0.4% vs 0.5 est and 0.6% in the month prior (MoM).

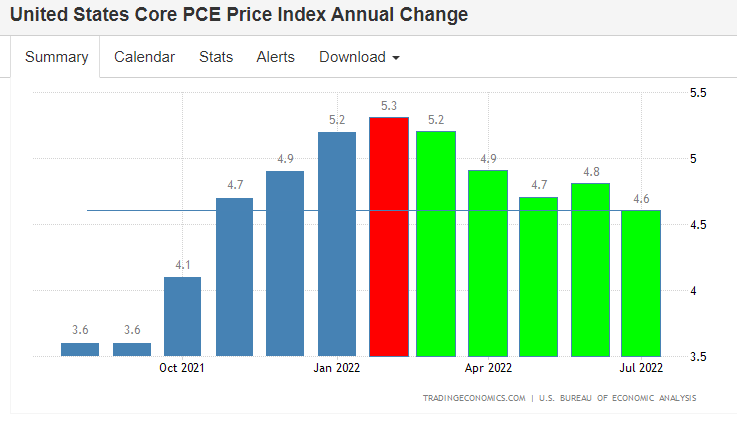

• Core PCE is cooling.

‣ 4.6% vs 4.7% est (YoY).

‣ 0.1% vs 0.2 est (MoM).

‣ New cycle low.

July Personal Spending

• +0.1% vs +0.5% est.

• Was +1% prior month.

• Weakest performance this year.

Home Prices

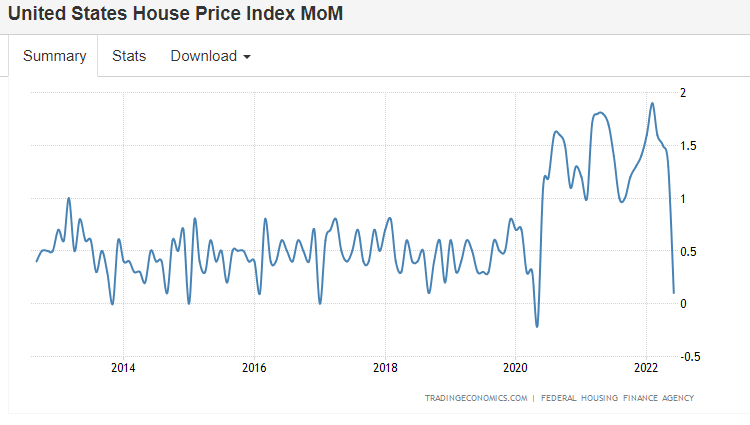

• Home prices fell for the first time in 3 years last month – and it was the biggest decline since 2011.

‣ While the drop may seem small, it is the largest single-month decline in prices since January 2011. It is also the second-worst July performance dating back to 1991.

• A different measure of prices, the S&P/Case-Shiller Home Price Index

‣ MoM +0.4% vs 1.5% est.

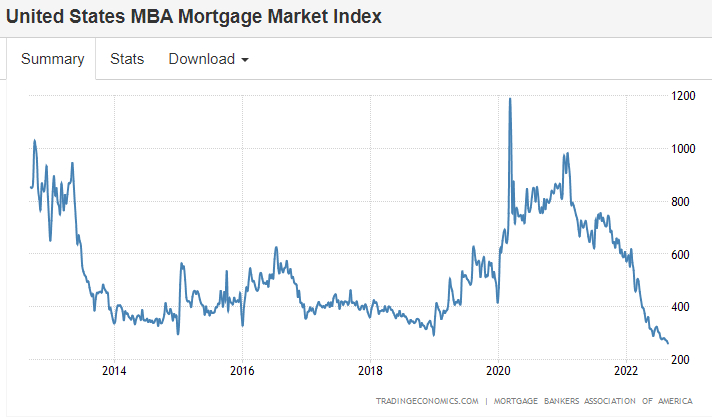

The MBA Mortgage Market Index (mortgage applications)

• -3% for week ending August 26th.

• The lowest reading since 1997.

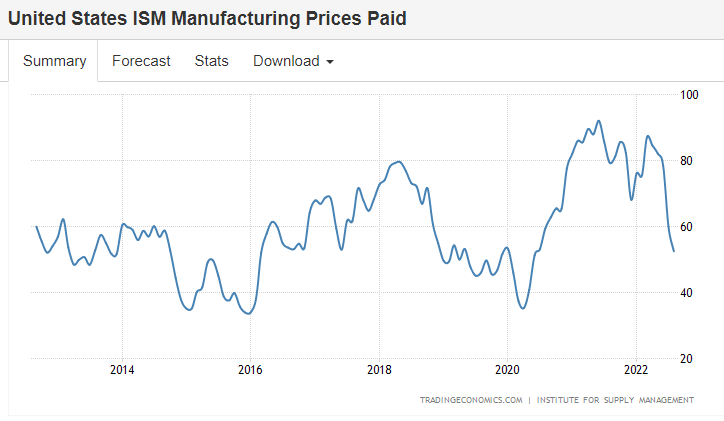

ISM Manufacturing Prices

• The prices paid index fell to 52.5 vs 55.5 est.

• Fell in August for the fifth month in a row.

• Lowest reading since June 2020.

And now to Friday's data (9-2-2022).

Fed Chairman Jerome Powell has communicated clearly that he wants to see multiple consecutive months of inflation measures below target.

Further, he is focused on the employment market; specifically he wants to see the unemployment rate rise from the unnaturally low 3.5% so that wage inflation slows and a wage-price spiral is averted.

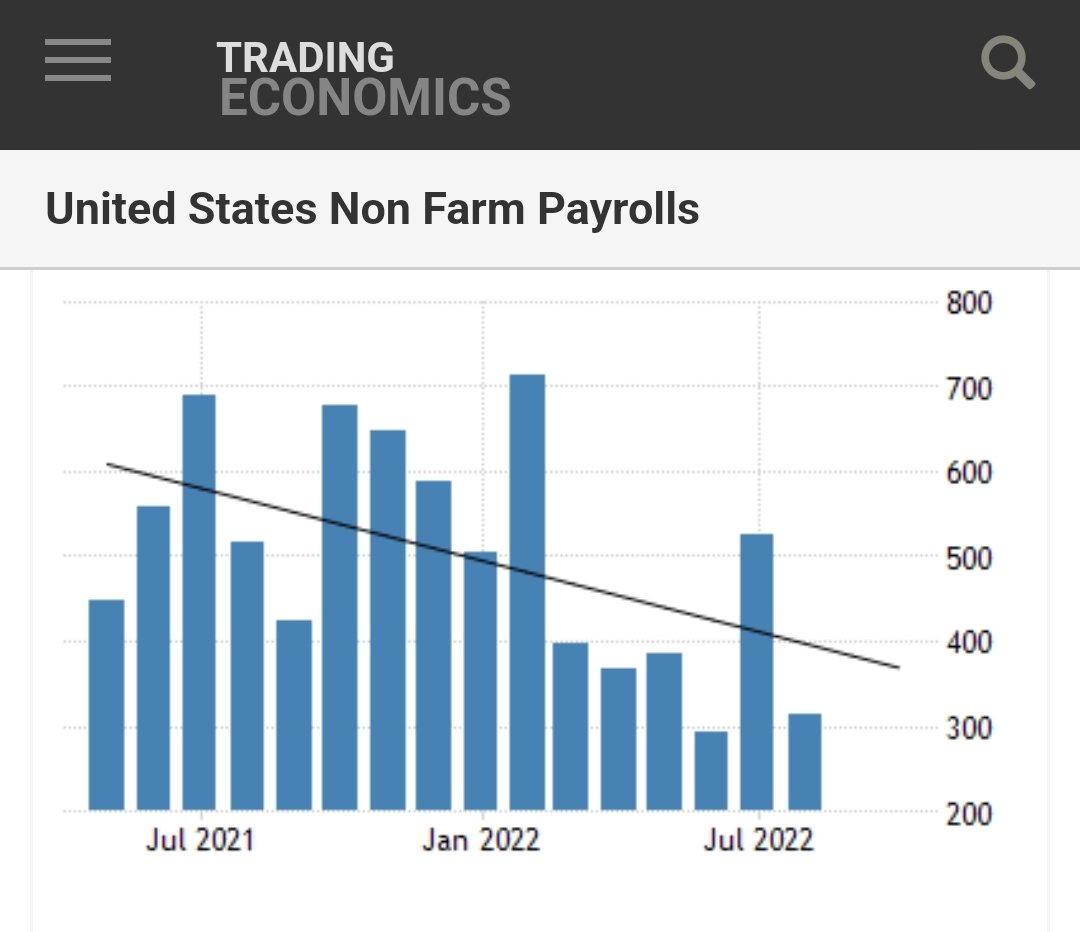

Ideally this would happen not from lost jobs, but from the labor force participation rate rising, which still is below pre-COVID levels.The non farm payrolls (NFP) report on 9-2-2022 provided a remedy that also allowed, for now, no recession.

NFP

• 315K v 295K estimates but that is below last month's 526,000, the lowest since April 2022, is now in a down trend.

• In fact NFP private is the lowest since April 2021.

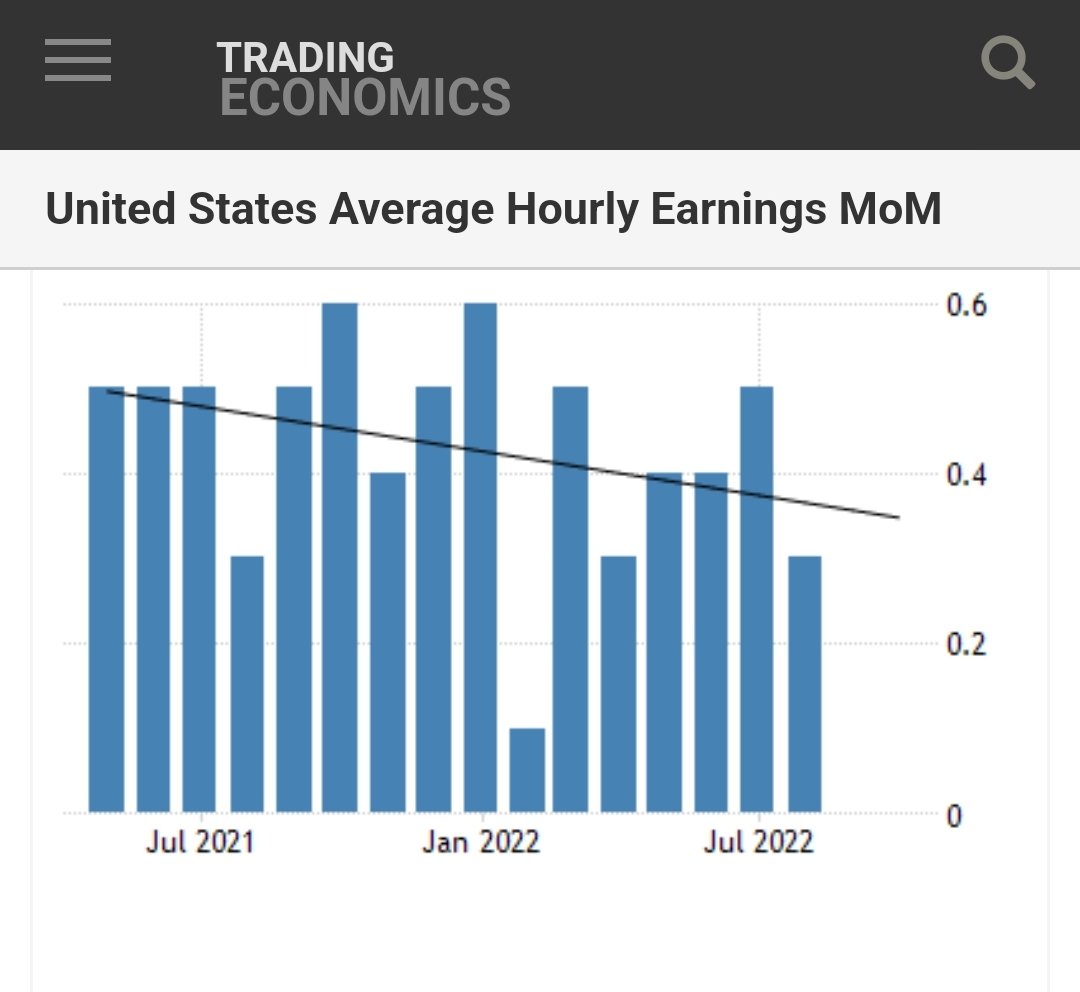

Hourly Wages (wage inflation)

• +0.3% v 0.4% MoM and 0.5% the month prior.

• This too is in a down trend.

• The unemployment rate rose to 3.7% vs 3.5% estimates while payrolls beat estimates meaning this was a Goldilocks report -- labor participation rose faster than the number of jobs added; perfect.

• More people in the job market - Prime Age Participation hit 82.8%, the highest since COVID.

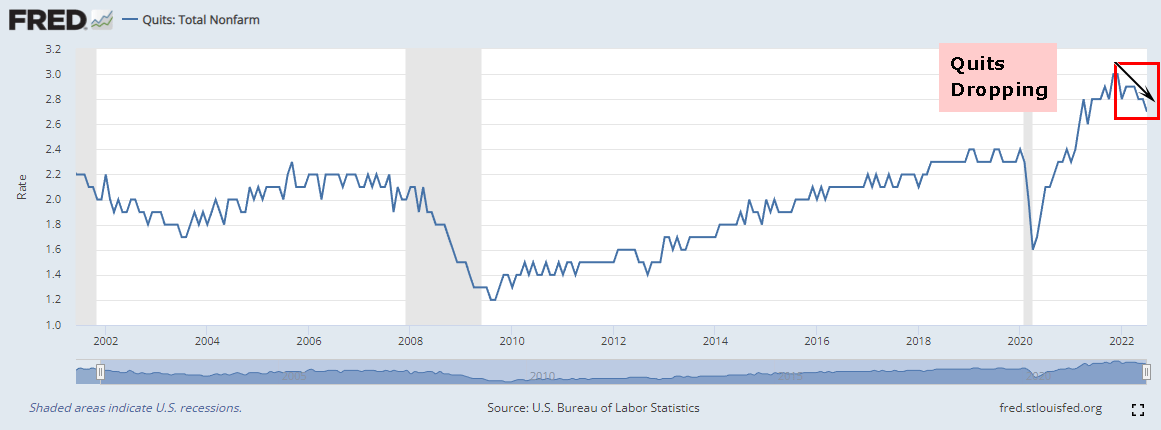

• The number of people quitting their jobs is dropping.

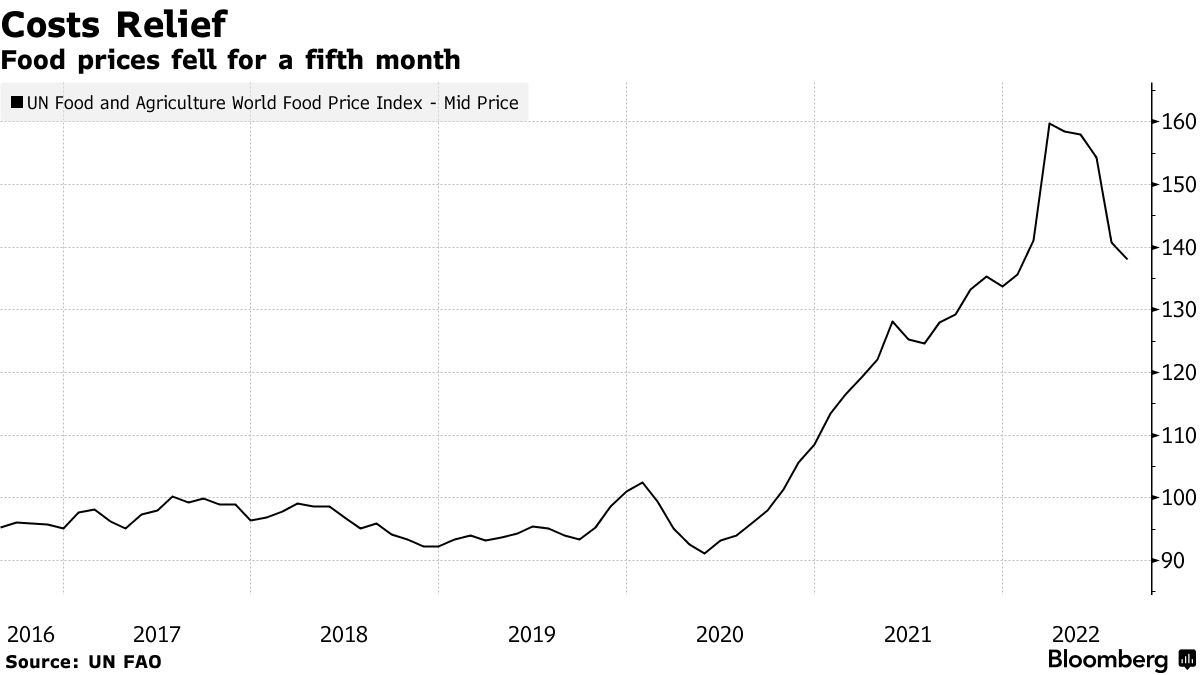

Finally, food prices.

• Food prices are dropping: Global food prices fell for a fifth month after demand for some products weakened and there was a seasonal uptick in supplies.

All of this was just three-weeks of data, unbelievably.

Economic Data Tells Us...

Now we can turn to the analysis portion, after the facts portion.

First, Powell wants the unemployment rate higher and wage growth to cool and he got both today and that is due to the following:

• Prime age labor force participation rose to highest level since COVID.

• Overall labor force participation rose above estimates.

• There are now more people employed than pre-COVID.

• Quits are dropping.

We believe that wage growth will slow based on higher participation rates and fewer job openings.

We see actual deflation (as opposed to disinflation) in PCE -- prices that consumers paid dropped from June to July.

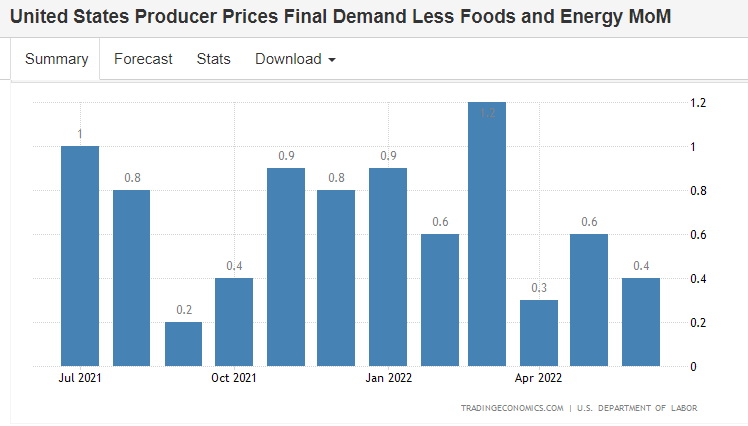

Factory growth is slowing to levels not seen since June 2020 and that in turn has resulted in the prices paid index seeing values now at those not seen since June 2020.

We believe that slowing factory growth will lead to price deflation, and that is also driven by tumbling logistics prices and a supply chain well on its way back to normalcy.

The home price data we looked at was from homes that closed in June, meaning they likely were contracted in April and May.

Given that the mortgage activity index has plummeted as inventories rise, we see continued home price deflation to come for future months.

Given the headwinds to the macro environment, that July personal spending cool off (+0.1% MoM) could well turn into shrinkage (less spending) which will yet further push prices down.

In all, we see about 90% of economic data pointing to rather abrupt price disinflation (slowing inflation) and actual deflation (prices dropping). CPI, PCE, and PPI were all slightly negative month over month, and that makes for the first in what we believe will be a series of readings that satisify the Federal Reserve.

Our conclusion is that we believe that the Federal Reserve will raise interest rates slower than the market anticipates, to a lower peak than the market anticipates, and for less of a period than the market anticipates.

We do, absolutely, still see rates rising.

These are our analyses and conclusions, which are both subjective, after ingesting the the facts (data).

Please make your own analysis and conclusions.Moving Forward

September and October tend to be bad for the market and there just always seems to be some sort of catastrophe that falls into these months. We would call it a part of a shock cluster, but it might just be "September."

The market has been poor for participants for 12 months.

For a long time, while I shared updated economic data that I continued to say, though it pained me, "I see no reason to be overly bullish over the immediate and short term."

That statement for 12 months of "I see no reason to be overly bullish over the immediate and short term," is no longer my sentiment.

I do now see a reason to be bullish over the intermediate term. The short term is still Sep / Oct trouble, likely, as it tends to be most years.

But this time, after that, I'm bullish on the intermediate-term.

This conclusion is based, again, on facts ABC, but this time it's facts A-Z + another 70. It's all the economic data I have shared over the last several months.

This time, I see the light at the end of the tunnel. I am not a perma-bull, I was rather overtly bearish.

My conclusion has changed.

I'm bullish with a large helping of "Well, inflation can still get worse with exogenous factors and Sep / Oct defaults to OMG."

My sentiment now is "pretty bullish, pretty soon."

But, Inflation is still the "only" thing that matters....

... And we expect lower inflation... finally. It might not be linear, but we do expect it.

If we're wrong, this will get much worse.

If we're right, this will get much better.

Conclusion

We know abrupt change can be uncomfortable, but it does not have to be.

Investors are not lost in a war torn sea -- you can be found in a sea of tranquility.

It just doesn't feel like it right now.

But it will.

Not yet.

But it will.

The speed of disinflation will dictate the abruptness of future Fed moves, but we expect higher unemployment to equilibrium levels, and a continuum of possibilities from the Fed all based on inflation readings.

There is no paranoia, but we still feel that inflation is the "only" thing that matters and my sentiment has changed for the slightly positive; particularly after some bumps in September and October.

You can receive updates like these along with a list of top stock picks and ongoing research combined with one-on-one conversations with the CEOs of these Top Picks here:

Join Us: Discover the undiscovered companies that will power technology’s future.

Thanks for reading friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.