Brexit: Now What?

Preface

First, don't panic. No one knows the full impact of this vote and whatever it is, it won't be ironed out today. There is zero reason to panic.

In an historic vote, the populace of the United Kingdom has voted to leave the European Union. This is the first country to leave and it has stunned financial markets.

SAFETY

Safety is a relative term, and in that relativity the large cap technology sector, companies like Apple and Alphabet, with substantial cash balances and large free cash flow are the safest of the bunch relative to the financial sector or commodity based stocks.

Strong balance sheets are the magic armor that protects investments from catastrophe. The two strongest balance sheets in the world sit in Silicon Valley.

Now, onto the #Brexit.

WHY LEAVE: CONTROL

Contrary to popular belief, the leave vote was not just about xenophobia. Here are the reasons to leave from their side:

1. Control of law making

The unelected European court has been making laws for the entire European Union. For those that may have read a history book (ever), the United States fought for and won its independence from Britain because of unfair representation. It got the moniker "no taxation without representation," but it was really deeper than that -- it was, "we have no vote so we can't do anything if we don't like the rules."

This is precisely one of the arguments the leave campaign leaned on. It's a principle of democracy that people can vote in new representation if they feel undeserved by the current representation.

2. Control of borders

As a member of the European Union, all people within that union can move freely in between countries, much like a U.S. citizen can move from one state to the other without permission. This is called the "principle of free movement." While the leave campaign noted that over 1 million people have immigrated to the U.K. in the last ten years, the counter argument was that this was not the real concern, but rather a concern over national safety and refugees. This is where the counter argument brings up xenophobia.

3. Control of money

The U.K. sends a truck load of money to European Union, reaching about $USD 10 billion annually. The U.K, like almost every major economy, is in debt and deficit. The $USD 10 billion outlay was a big hit to the $USD 70 billion deficit.

IS THIS TRUE?

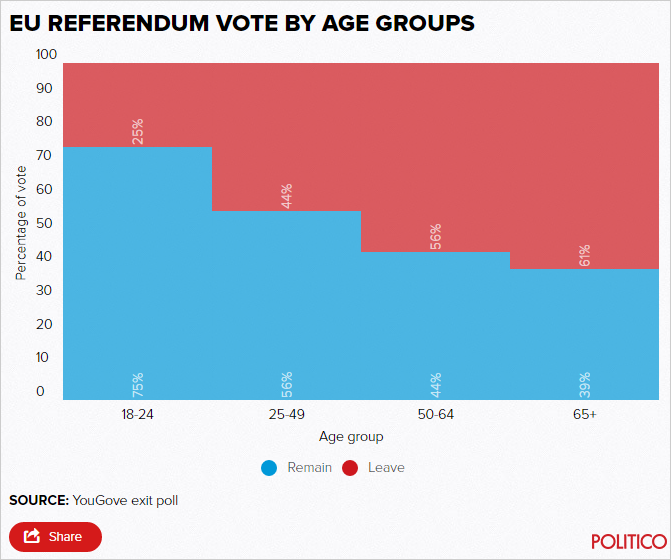

One view: Some would argue that all of this is a cover for a deeper xenophobia, perhaps even racism that runs deep in a very specific part of the U.K. Here is a stunning chart from politico.eu:

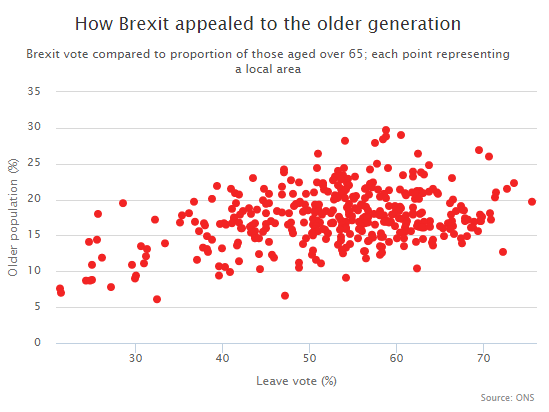

Another great chart from The Telegraph shows the same sort of result.

Moving up and to the right are older people and a higher percentage of the leave vote.

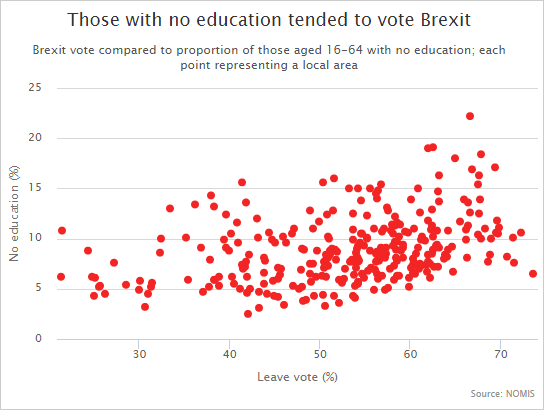

Interestingly, the higher the level of education, the higher the EU support (remain vote):

In this chart, moving up and to the right is less education and higher percentage of "leave" vote.

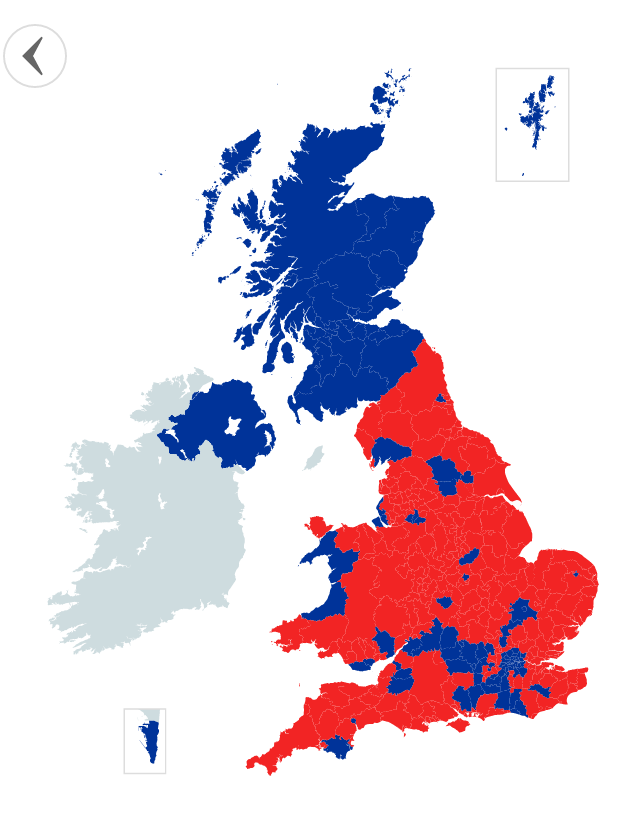

But, there's an easier way to look at this as well and it mirrors the United States, really. The U.K. is not "united" in politics, just as the United States is not "united." Here is a map colored by vote and we can see a divided U.K. just as we see a divided United States if we were to do this for democrat versus republican:

The Economist put it best by simply writing: "The Brexit vote reveals a country split down the middle."

NOT TRUE

The EU does not have a bilateral agreement with China or the United States, so the U.K. is not walking away from the largest trade deals outside of the EU.

IS TRUE

This has incredibly far reaching impacts on the U.K. The EU agreements range across all areas of politics and economics and the U.K. is now an outsider rather than a part of the block that represents the second largest economy in the world.

Whether for remain or exit, any idea that this vote is trivial to the U.K. is absurd. The impact will be large, we just don't know what it will be yet. Here are some implications.

IMPLICATIONS

The U.K. now has two-years to unravel from the EU. While many people, including me, felt that it would take much longer to extract the U.K. from the EU, we are always reminded of how punitive the EU can be (see Greece).

The Guardian reported that the Presidents of European bodies say there will be no renegotiations and Britain must act on vote to avoid prolonging uncertainty.

“

Germany's foreign minister, Frank-Walter Steinmeier, called the result "truly sobering... It looks like a sad day for Europe and the United Kingdom."

The vote "causes major damage to both sides”, Weber said. “Exit negotiations should be concluded within two years at max. There cannot be any special treatment. Leave means leave."

Source: The Guardian

Germany's foreign minister, Frank-Walter Steinmeier, called the result "truly sobering... It looks like a sad day for Europe and the United Kingdom."

The vote "causes major damage to both sides”, Weber said. “Exit negotiations should be concluded within two years at max. There cannot be any special treatment. Leave means leave."

”

Source: The Guardian

Watch for more punitive action from the EU to try to keep the rest of the union together.

MORE IMPLICATIONS

The leave vote has destabilized the EU much further than just the U.K. The Pandora's box is now open -- it's a near certainty that other countries will have similar referenda. Watch for news from Spain, Greece, Italy, France, Denmark and likely others. It's possible, but not certain, that a single exit will lead to a flood of exits.

The presidents of the European council, commission and parliament – Donald Tusk, Jean-Claude Juncker and Martin Schulz respectively – and Mark Rutte, the prime minister of the Netherlands which holds the EU’s rotating presidency noted unanimity when they said "the special settlement negotiated by David Cameron earlier this year was void and could not be renegotiated."

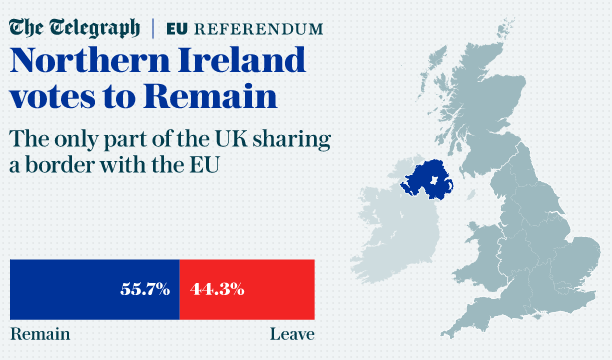

Northern Ireland's Deputy First Minister Sinn Fein said "[the] British government has forfeited any mandate to represent economic or political interests of people in Northern Ireland." Here is the N. Ireland vote from yesterday:

MORE, MORE IMPLICATIONS

Nobody really knows what will happen to the financial institutions in the EU and in particular the U.K. There is a massive sell-off on day one after the vote in the financial sector and it spans essentially all countries.

The effects of this decision will not be felt today and certainly will not be reflected in one day of trading.

WHAT NOW?

The market is tumbling for good reason. It's healthy. As the Atlantic put it: "The bottom line is that no one really knows what will happen in either Great Britain or the EU—and that is in and of itself an economic problem. Markets don’t respond well to uncertainty. Then there's the fact that Great Britain will need a new leader to oversee these new changes, since Prime Minister David Cameron—who called for the vote in the first place—stepped down after its conclusion. That, too could make the road to stability a long, arduous one."

The market will go on. Bargain hunters will snap up assets being sold in a panic and only time will tell if the sellers will end up proving that prudence is the better of valor.

WHY THIS MATTERS

At Capital Market Labs our vision is toward the future and the themes we pursue cannot be derailed by a political stumble. We use this vision to find the "next Apple" or the "next Google." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

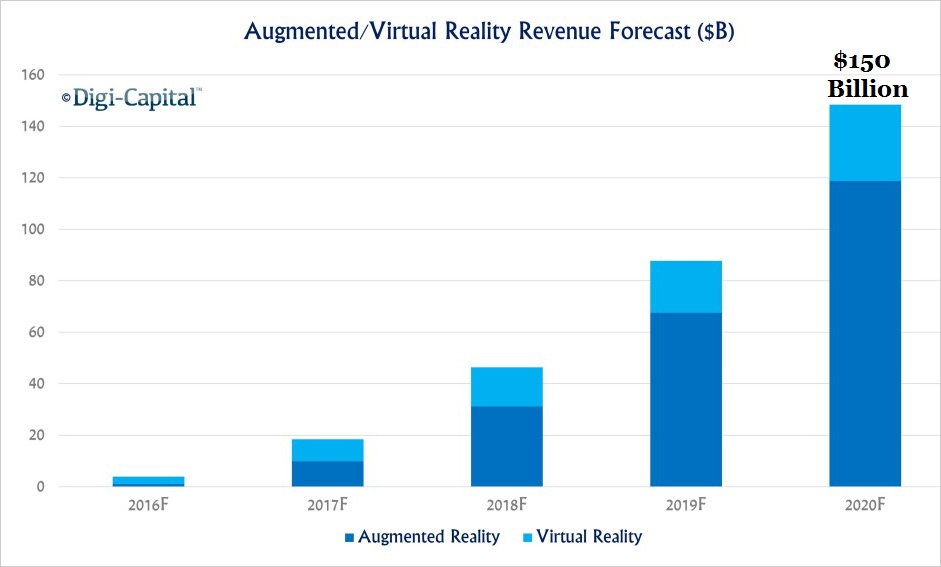

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here is just one of the trends that will radically affect the future that we are ahead of:

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is the opportunity so many investors say they welcome – that say they search for. The opportunity to find the "Next Apple," or the "next Google." Friends, it's coming right now, and it lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.