The Clever, Effective, Winning Pattern in the S&P 500 Using Options

The Clever, Effective, Winning Pattern in the S&P 500 Using Stock Options

Date Published: 2018-08-13

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.LEDE

Flexibility and customization are the backbones to testing an idea in the option market, then altering the initial settings, and optimizing.It's through this process that we build knowledge and precision. While this dossier details a specific custom strategy, the value of this content goes beyond "this idea," and into the realm of demonstrating the power that institutions have, and retail tools lull us into believing we also have. We do not; until now.

Preface

We spend a lot of time researching individual stocks, but let us never forget that option trading is volatility trading, whether we mean it to be or not. In fact, we have a seminal webinar that covers this reality and dates back to the Great Recession for back-test results.Today we turn back to option volatility trading -- and this time it's in the S&P 500 and Russell 2000. We present back-test results of a clever, risk controlled strategy that can built in Trade Machine using the custom strategy feature, and the results are staggering.

Unlike most of our prior posts, this is not conditional entry -- this has nothing to do with earnings or technical charting.

Building the Strategy Before We See the Results

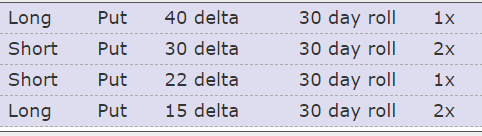

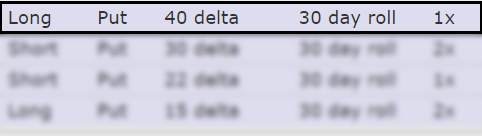

We constructed a multi-leg strategy, but that is not code for complicated -- it has just a few steps. Here is the entire image, and then we will break it down, leg by leg.

Now, let's review each leg.

Rules

The first leg of this trade is simply a long, out of the money (40 delta) put. That's it.* Buy a 40 delta monthly put.

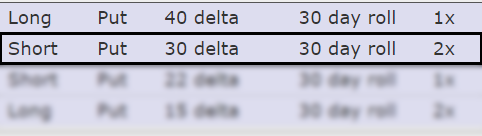

The second leg of this trade sells two further out of the money (30 delta) puts.

* Sell two 30 delta monthly puts.

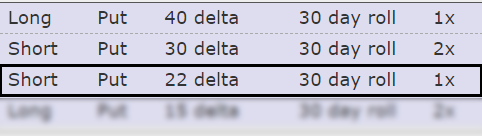

The third leg of this trade sells an even further out of the money (22 delta) put.

* Sell a 22 delta monthly put.

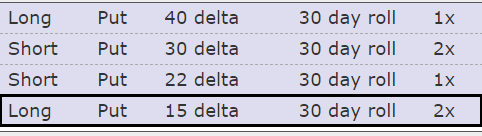

The fourth and final leg of this trade purchases two even yet further out of the money (15 delta) puts, leaving the entire strategy long 3 options and short 3 options -- the risk is well defined.

* Buy two 15 delta monthly puts.

What Does This Mean?

This is casually called a ratio spread, and specifically this is a 1 x 2 x 1 x 2 (read out loud as "1 by 2 by 1 by 2") put spread.The idea is to create an option position that creates a credit, has no upside risk (if the ETF rises it's a winning strategy), has some downside bias (if the ETF goes down "a little" it profits at the maximum level), and finally covers the short positions with a final out of the money put purchase to limit total downside.

But, words do us little good, let's just look at one trade, and the profit and loss graph exactly.

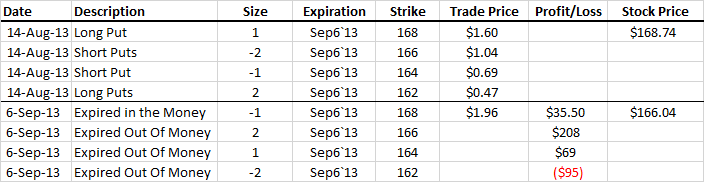

Here is the first set of trades for a 5-year back-test in SPY, the top four lines are the opening trades, the bottom four lines are the resulting closing profit and losses.

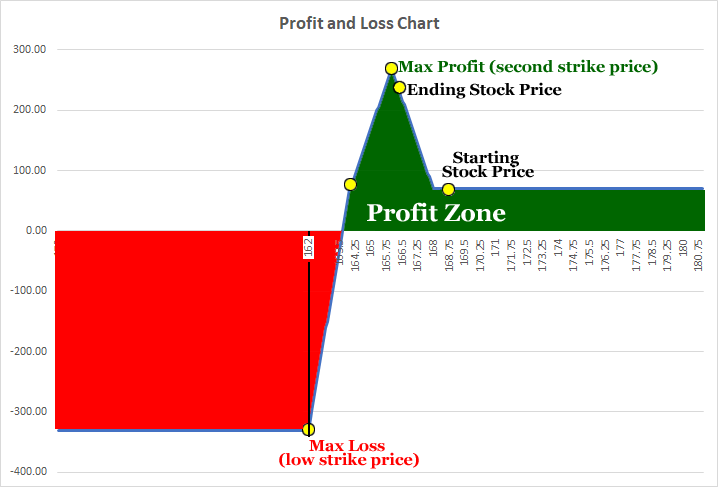

And here is how all of that looks in a profit and loss chart:

This strategy is profitable in the green shaded area, and shows a loss in the red shaded area.

To get your bearings:

* The maximum loss starts at the lowest strike price, in this case, $162. Any stock price there or lower shows a capped loss at its maximum.

* The maximum gain occurs right at the second-strike price (the first short strike price), in this case $166.

In English

This strategy does well in a bull market but does best in a slightly bearish market. It does worst when there is a large stock drop, but that loss is capped.Finally, The Results

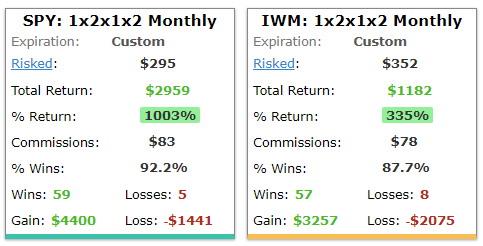

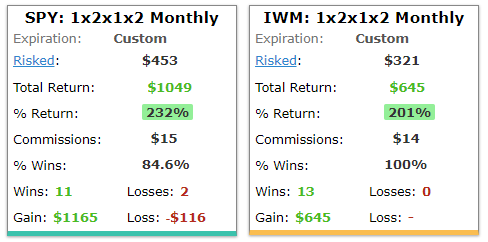

Here are the results of this strategy over the last three-years in the S&P 500 ETF, ticker SPY, and the Russell 2000 (small cap stocks) ETF, ticker IWM:And here are the results over the last year:

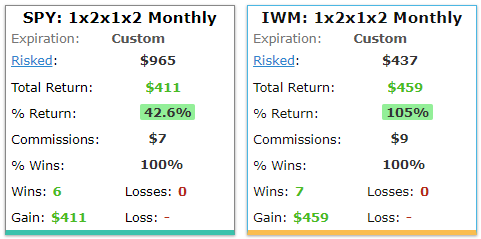

And finally, for completeness, over the last six-months:

How to Try This Yourself

We simply used the Trade Machine® Custom Strategy builder. You can create it yourself immediately as a Trade Machine member, by simply clicking on any of the back-test links above.You can become an expert at custom strategy building, by watching our video which can be accessed in the link directly below the custom strategy button:

A few clicks of the mouse buttons gave us the results that were presented above.

What Do We have

We now have one, of nearly infinite, custom strategies to back-test the index ETFs. In this case we looked at the S&P 500 proxy, SPY, and the Russell 2000 proxy, IWM.This back-test can be run on individual stocks as well -- once the strategy is built, you can use it to test anything you like. But the broader point is, we now have a tool to create back-tests that don't depend on momentum ,technicals, or have anything to do with pre- or post-earnings dates.

MOVING FORWARD

There's a lot less luck to successful option trading than many people realize. Take a reasonable idea, test it, and apply lessons learned.But there's a lot more to a successful back-tester than even advanced traders realize a well. Don't get handcuffed, be freed.

Tap Here, See for Yourself

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.