Constellation Brands Inc, STZ, earnings, options, volatility, iron condor

LEDE

This is a slightly advanced option trade that starts two calendar days after Constellation Brands Inc (NYSE:STZ) earnings and lasts for the 13 calendar days to follow, that has been a winner for the last 2 years with out a loss.

STZ has its next earnings due out on 3-29-2018 before the market opens according to our earnings data provider Wall Street Horizon. Two days after that would be a Saturday, the 31st, so this back-test would open the trade on the Monday, April 2, near the market close.

Constellation Brands Inc (NYSE:STZ) Earnings

For Constellation Brands Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move, and then sold a 2-week at out of the money iron condor (using two-week options), the results were quite strong. This trade opens two calendar after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

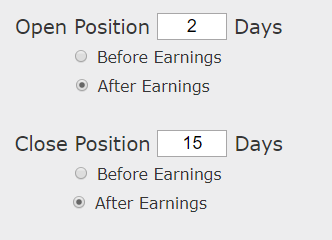

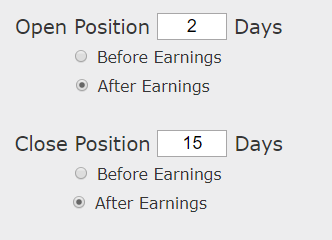

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor two calendar days after earnings

* Close the iron condor 15 calendar days after earnings

* Use the options closest to 15 days from expiration (but at least 15-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock is not volatile the three weeks following earnings and it will stand to lose if the stock is volatile.

RESULTS

If we sold this 35/15 delta iron condor in Constellation Brands Inc (NYSE:STZ) over the last two-years but only held it after earnings we get these results:

Tap Here to See the Back-test

We see a 85.3% return, testing this over the last 8 earnings dates

Setting Expectations

While this strategy had an overall return of 85.3%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 17.4% over just 13 actual calendar days.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

The Volatility Option Trade After Earnings in Constellation Brands Inc

Constellation Brands Inc (NYSE:STZ) : The Volatility Option Trade After Earnings

Date Published: 2018-03-16Author: Ophir Gottlieb

LEDE

This is a slightly advanced option trade that starts two calendar days after Constellation Brands Inc (NYSE:STZ) earnings and lasts for the 13 calendar days to follow, that has been a winner for the last 2 years with out a loss.

STZ has its next earnings due out on 3-29-2018 before the market opens according to our earnings data provider Wall Street Horizon. Two days after that would be a Saturday, the 31st, so this back-test would open the trade on the Monday, April 2, near the market close.

Constellation Brands Inc (NYSE:STZ) Earnings

For Constellation Brands Inc, irrespective of whether the earnings move was up or down, if we waited two-days after the stock move, and then sold a 2-week at out of the money iron condor (using two-week options), the results were quite strong. This trade opens two calendar after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor two calendar days after earnings

* Close the iron condor 15 calendar days after earnings

* Use the options closest to 15 days from expiration (but at least 15-days).

And a note before we see the results: This is a straight down the middle volatility bet -- this trade wins if the stock is not volatile the three weeks following earnings and it will stand to lose if the stock is volatile.

RESULTS

If we sold this 35/15 delta iron condor in Constellation Brands Inc (NYSE:STZ) over the last two-years but only held it after earnings we get these results:

| STZ: Short 35 Delta / 15 Delta Iron Condor |

|||

| % Wins: | 100% | ||

| Wins: 8 | Losses: 0 | ||

| % Return: | 85.3% | ||

Tap Here to See the Back-test

Track this trade idea. Get alerted for ticker `STZ` 2 days after earnings

We see a 85.3% return, testing this over the last 8 earnings dates

Setting Expectations

While this strategy had an overall return of 85.3%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 17.4% over just 13 actual calendar days.

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.