Trading Options in Skyworks Solutions Inc (NASDAQ:SWKS)

Skyworks Solutions Inc

Date Published: 2017-01-26Written by Ophir Gottlieb

PREFACE: Trading Skyworks Solutions Inc (NASDAQ:SWKS)

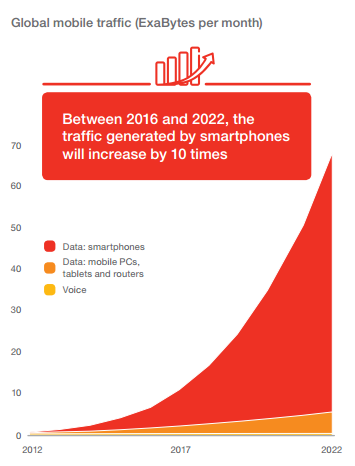

Skyworks Solutions Inc (NASDAQ:SWKS) is one of the tech marvels that will power the incredible data consumption trend coming in the next few years, out to several decades. While this is an option trading story, here's just one example of the massive data consumption growth the world will see starting, basically, right now.

As the caption reads, "between 2016 and 2022, the traffic generated by smartphones will increase 10 times." For more information on the real details behind the company, we recommend you check out CML Pro, here.

BACK TO OPTIONS

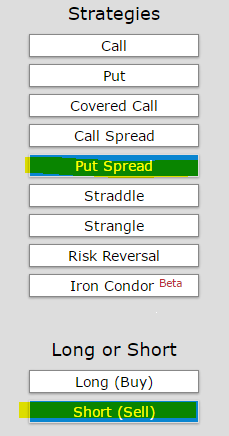

But let's turn back to options. While it seems like a simple bullish option strategy would work, if we did so, we just fell into a trap. It's the trap that likely 99% of traders fall into. We can look at how selling out of the money put spreads did in Skyworks Solutions Inc over the last three-years, rolling the trade every 30-days (monthly options). Here's the set-up:

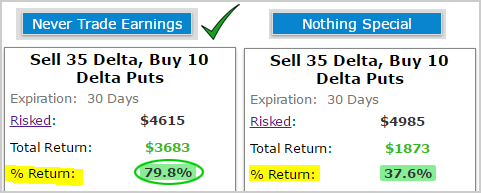

Now, what we also did, to take us beyond the obvious and in to the realm of finding edge, is we looked at selling these put spreads but avoiding earnings on the left and then simply ignoring earnings (doing nothing special) on the right:

Incredibly, we see that avoid earnings, which is vastly less risky than holding during earnings, returned 79.8% compared to 37.6% if we just traded every 30-days and never paid any attention to earnings. Yep, we got better returns with less risk.

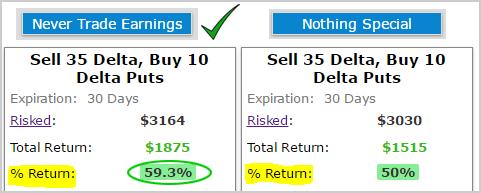

And the next step, of course, is to do this same analysis but look at the last year, to make sure we aren't picking up an anomaly that worked three-years ago but has all but disappeared in the last year.

We see 59.3% returns in just one-year and avoiding earnings while the alternative, to simply trade every 30-days and just let earnings happen, returned 50%. While both numbers are huge, taking less risk with better returns is exactly what we're after in trading, generally speaking.

SO WHAT JUST HAPPENED?

This isn't a guarantee of future success -- but this is exactly how to calculate edge for a back-test. Now this process goes yet further -- beyond SWKS, and beyond just short out of the money put spreads and well into every stock and every ETF.

The author is long shares of Skyworks Solutions Inc (NASDAQ:SWKS) at the time of this writing.

WHY THIS MATTERS

There's a lot less 'luck' and a lot more planning in successful option trading than many people know. Below we demonstrate what we share with institutional investors on the live terminals.

Here is a quick 4-minute demonstration video that will change your option trading life forever:

Tap here to see the demo movie on YouTube

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.