The Container Store Group Inc, TCS, earnings, short put

Preface

As we look at The Container Store Group Inc we note that a short put is one of the most common implementations of an option strategy, but the analysis completed when employing the short put often times lacks the necessary rigor especially surrounding earnings. This is a risky strategy, but there is a clever way to reduce risk.

With relative ease, we can go much further -- to identify the risks we want to take, and those that we don't in order to optimize our results. This is one of those cases.

STORY

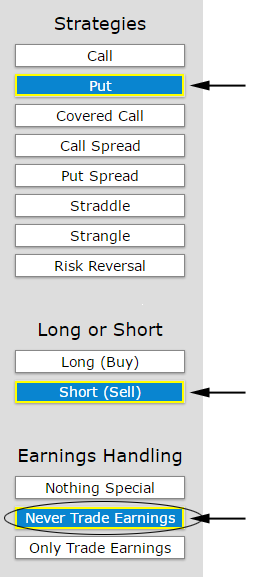

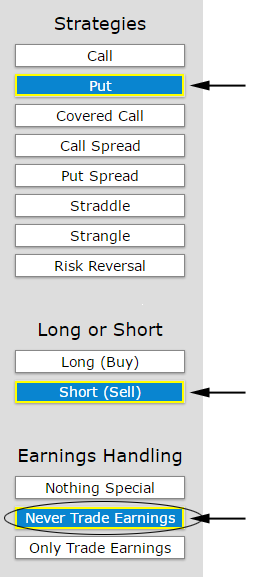

There's actually a lot less 'luck' involved in successful option trading than many people realize. We'll get specific with short puts on TCS. Let's look at a two-year back-test of a short put strategy with these quick guidelines:

* We'll test monthly options (roll the trade every 30-days).

* We will avoid earnings.

* We will examine an out of the money put -- in this case, 30 delta.

* We will test this short put looking back at two-years of history.

What we want to impress upon you is how easy this is with the right tools. Just tap the appropriate settings.

Now we can peruse the results.

RESULTS

If we did this 30 delta short put in The Container Store Group Inc (NASDAQ:TCS) over the last two-years but always skipped earnings we get these findings:

First we note that the short put strategy actually produced a higher return than the stock 24.3% versus -67.9% or a 92.2% out-performance.

Selling a put every 30-days in TCS has been a pretty substantial winner over the last two-years returning 24.3%. Even better, the strategy has outperformed the short put that was held during earnings. Let's turn to that piece, now.

GOING FURTHER WITH THE CONTAINER STORE GROUP INC

Just doing our first step, which was to evaluate the short put while avoiding earnings is clever -- certainly an analysis that gets us ahead of most casual option traders. But let's take the analysis even further.

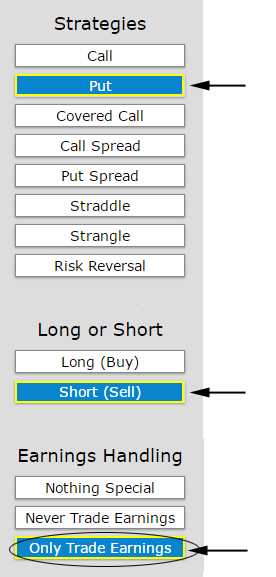

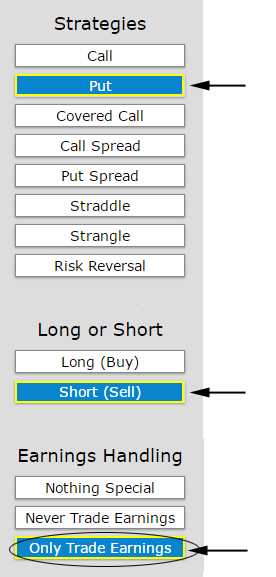

This time, we will do the exact same back-test, but we will only look at earnings. Specifically, we will short the put two-days before earnings, let earnings happen, then close the option position two-days after earnings.

Here are those results for the same 30 delta short put:

Selling an uncovered put in The Container Store Group Inc during was not only a loser, more importantly, it returned less than the same short put that avoided earnings. While this clever use of avoiding earnings has outperformed the short put that was held during earnings, there's a bigger picture here. Let's turn to that piece, now.

TRADING TRUTHS

Moving through the analysis on The Container Store Group Inc (NASDAQ:TCS) has done more than show us returns, it has revealed that the concept of expertise in options has been made made overly complex. The point is simple: having the knowledge before placing a trade shapes the thought process about what to trade, when to trade it and even if the trade is worth it at all. Here's how all this works in real-life, beyond The Container Store Group Inc and short puts.

Successful Option Trading: The Container Store Group Inc (NASDAQ:TCS) Option Trading A Clever Short Put

The Container Store Group Inc (NASDAQ:TCS) : Option Trading A Clever Short Put

Date Published: 2017-01-9Preface

As we look at The Container Store Group Inc we note that a short put is one of the most common implementations of an option strategy, but the analysis completed when employing the short put often times lacks the necessary rigor especially surrounding earnings. This is a risky strategy, but there is a clever way to reduce risk.

With relative ease, we can go much further -- to identify the risks we want to take, and those that we don't in order to optimize our results. This is one of those cases.

STORY

There's actually a lot less 'luck' involved in successful option trading than many people realize. We'll get specific with short puts on TCS. Let's look at a two-year back-test of a short put strategy with these quick guidelines:

* We'll test monthly options (roll the trade every 30-days).

* We will avoid earnings.

* We will examine an out of the money put -- in this case, 30 delta.

* We will test this short put looking back at two-years of history.

What we want to impress upon you is how easy this is with the right tools. Just tap the appropriate settings.

Now we can peruse the results.

RESULTS

If we did this 30 delta short put in The Container Store Group Inc (NASDAQ:TCS) over the last two-years but always skipped earnings we get these findings:

| short 30 Delta Put | ||||

| * Trade Frequency: 30 Days | ||||

| * Back-test length: two-years | ||||

| * Always Avoid Earnings | ||||

| Gross Gain: | $530 | |||

| Gross Loss: | -$400 | |||

| Wins: 18 | Losses: | 7 | ||

| Short Put Return: | 24.3% | |||

| Stock Return: | -67.9% | |||

| Option Out-performance | 92.2% | |||

First we note that the short put strategy actually produced a higher return than the stock 24.3% versus -67.9% or a 92.2% out-performance.

Selling a put every 30-days in TCS has been a pretty substantial winner over the last two-years returning 24.3%. Even better, the strategy has outperformed the short put that was held during earnings. Let's turn to that piece, now.

GOING FURTHER WITH THE CONTAINER STORE GROUP INC

Just doing our first step, which was to evaluate the short put while avoiding earnings is clever -- certainly an analysis that gets us ahead of most casual option traders. But let's take the analysis even further.

This time, we will do the exact same back-test, but we will only look at earnings. Specifically, we will short the put two-days before earnings, let earnings happen, then close the option position two-days after earnings.

Here are those results for the same 30 delta short put:

| short 30 Delta Put | ||||

| * Trade Frequency: 30 Days | ||||

| * Back-test length: two-years | ||||

| * OnlyTrade Earnings | ||||

| Gross Gain: | $155 | |||

| Gross Loss: | -$600 | |||

| Wins: 9 | Losses: | 4 | ||

| Short Put Return: | -72.7% | |||

Selling an uncovered put in The Container Store Group Inc during was not only a loser, more importantly, it returned less than the same short put that avoided earnings. While this clever use of avoiding earnings has outperformed the short put that was held during earnings, there's a bigger picture here. Let's turn to that piece, now.

TRADING TRUTHS

Moving through the analysis on The Container Store Group Inc (NASDAQ:TCS) has done more than show us returns, it has revealed that the concept of expertise in options has been made made overly complex. The point is simple: having the knowledge before placing a trade shapes the thought process about what to trade, when to trade it and even if the trade is worth it at all. Here's how all this works in real-life, beyond The Container Store Group Inc and short puts.