The Secret's Out: This is How Tesla Becomes a $400 Stock

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.

PREFACE

The bulish thesis for Tesla is simple: the success the company has seen on a relatively small scale for wealthy buyers will translate into mass market appeal once its $35,000 Model 3 car is released to the general public. Pre-orders start March 31st.

The bearish argument is also simple: The gigafactory manufacturing monolith is too big, will never see demand to fill it and the Tesla product is in fact a luxury bauble made at a loss that will not translate into true success.

From breaking news today we just learned that the bears are wrong.

SET UP

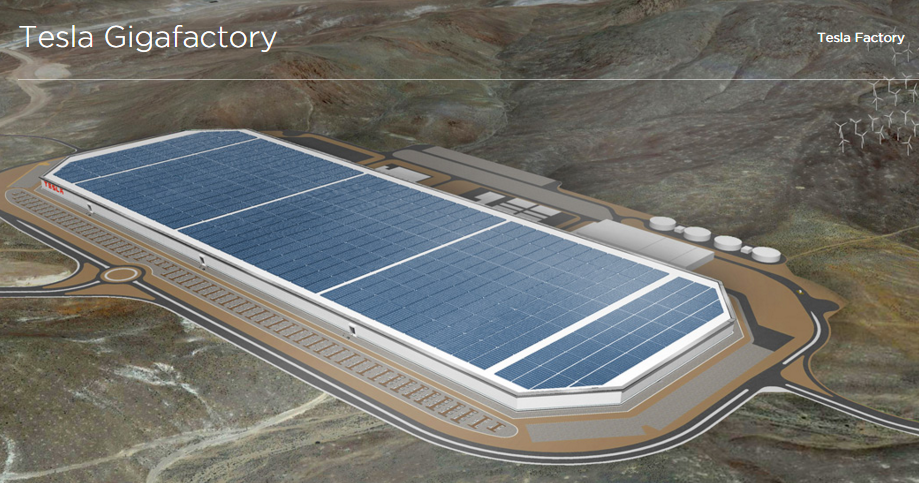

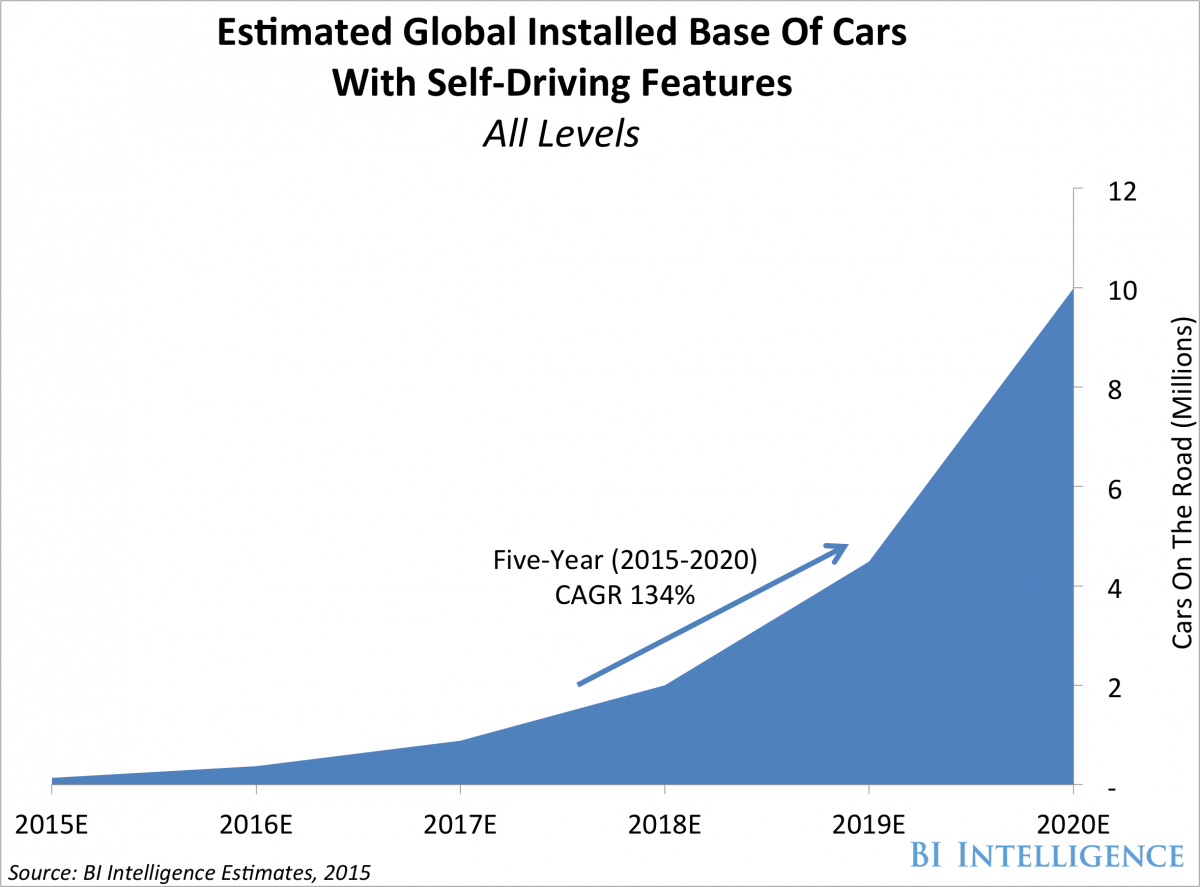

It has long been CEO and founder Elon Musk's goal for Tesla to sell 500,000 vehicles by 2020. That's nearly ten-fold higher than the deliveries in 2015. This is the market he is going after:

We're looking at 134% growth every year, for the next six-years.

Tesla has built its $5 billion gigafactory -- the only manufacturing plant on the planet capable of building enough lithium ion batteries for that many electric cars. But it will take more than the factory to sell half a million cars.

Let's rip through what we know very quickly, and then get to the stunning news that just broke.

WHAT WE ALREADY KNOW

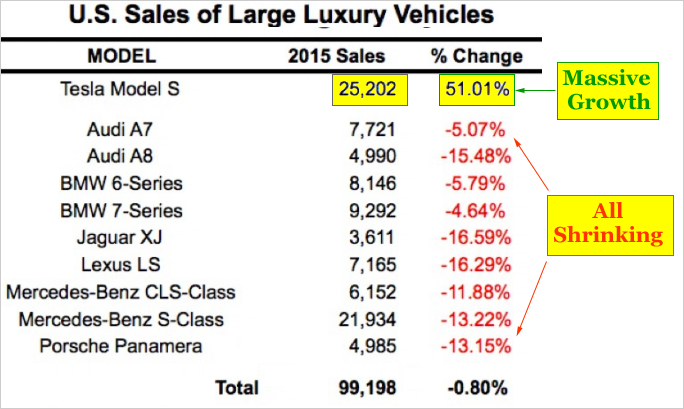

U.S. sales figures for 2015 reveal that Tesla's Model S rose to become the number one top seller within the U.S. market for large luxury vehicles, overtaking the Mercedes-Benz S-Class for the first time. Here's the incredible data (highlighting added):

All of these vehicles start around the same $70,000 as the Model S.

Just so we're perfectly clear on this data: Every other luxury sedan saw falling sales while Tesla saw a 51% increase. Tesla's Model S is now the single best selling large luxury vehicle and now owns more than 25% of the market. (Source: electrek). Tesla has already displaced the hallowed Mercedes brand.

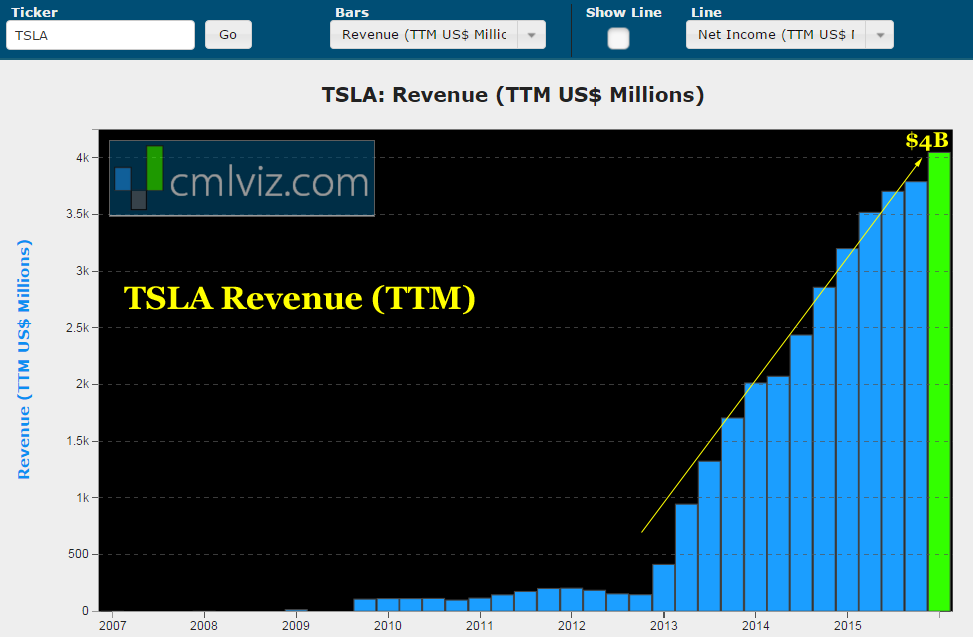

Here is Tesla's all-time revenue chart:

TESLA'S SECRET

Those numbers presented above are basically a mathematical impossibility if not for one stunning secret: Not everyone buying the Model S was an owner of a $70,000 car before.

In 2015, Jefferies conducted a survey of Model S owners and discovered that nearly 40% had previously owned a car that cost less than $40,000 (Business Insider). That's borderline ludicrous. Tesla is not only moving people up -- it's moving people up by staggering amounts.

TESLA'S SECRET IS BRAND

A car manufacturer can either be economy or luxury. It's nearly impossible for a brand to transition to being a luxury item after targeting itself for the mainstream consumer.

Look at four of the largest auto makers in the world: Volkswagen, Toyota, Honda and Nissan. Each have wonderful name recognition, but equally, each auto-maker had to create a new brand to sell luxury cars:

Volkswagen -> Bentley, Bugatti, Lamborghini, Audi, Porsche

Toyota -> Lexus

Honda -> Acura

Nissan -> Infiniti

You see, each of those manufacturers came onto the scene as economy cars, so entirely new brands had to be created to sell luxury items.

By virtue of the hundred thousand dollar Model S 'scale breaking race car' and the Model X crossover, Tesla has established itself as a luxury automobile with one of the most valuable brand names in the segment.

This was, in fact, Elon Musk's stated plan which he posted to the world on his blog as 'The Secret Tesla Motors Master Plan.'

Here's why that reality changes everything.

MODEL 3

Keep in mind that Prius sales were down 11% last year and we have data from vehicle registrations that point to Tesla's $70,000+ vehicles as a main culprit.

Enter the Model 3 -- even if it becomes a $40,000 vehicle as cynics insist, based on the brand appeal, we get this:

All of a sudden, we're now talking about Model 3 potentially competing with the Camry and Honda Accord and other non-luxury sedans. Camry and Accord alone sold a combined 784,742 vehicles in the U.S. in 2015.

Source: Business Insider

Source: Business Insider

So, Tesla's Model 3 will be going after two markets. First, the agreed upon "Midsize Luxury Vehicle" segment with its 508,000 unit sales in 2015. These are cars like The Audi A4, BMW 3-series, Mercedes C-Class, Acura TLX, Infiniti Q50, etc.

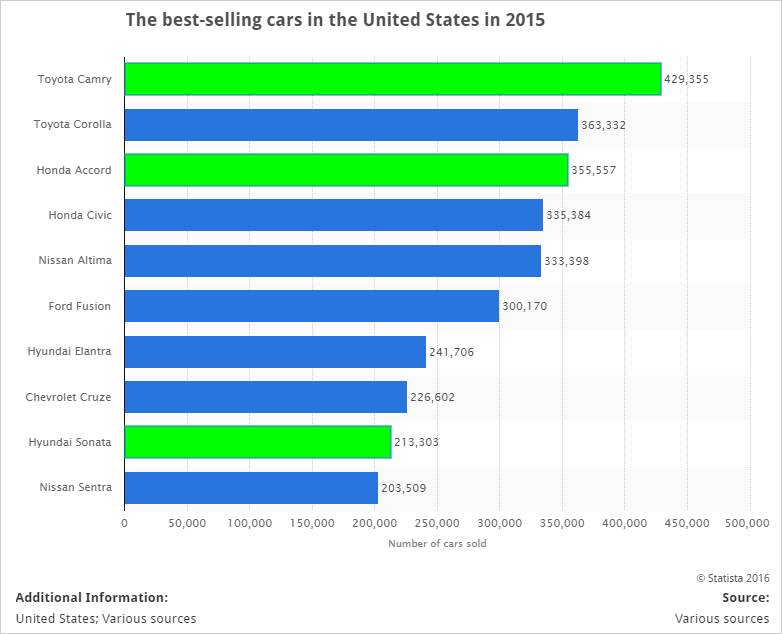

But, if that market isn't big enough, consider our new reality where Tesla brings buyers of less expensive cars up. The Model 3 is absolutely in play for at least some of the non-luxury sedan market. Here are the best selling cars in the United States for 2015 via Statista:

Those three highlighted in green are in play, and here's why:

The MSRP for the Honda Accord is listed in the range of $22,205 - $34,680 by KBB.com. The Toyota Camry's MSRP comes in at $23,070 - $31,370. The Hyundai Sonata is $21,750 - $34,075. Just those three vehicles alone totaled nearly one million vehicles.

Friends, the market Tesla is aiming at for its Model 3 isn't the 508,000 luxury sedan market, it's all of it -- totaling well over 1.5 million vehicles.

And now, we get to the breaking news: Tesla has the demand.

BREAKING

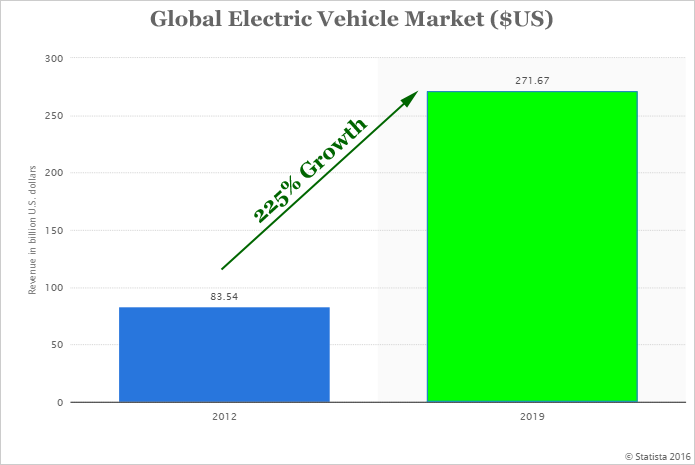

We know that the electric vehicle market is booming. Here are the forecast from Statista:

And then this happened: In an article just released by the Silicon Valley Business Journal, we learned this:

"Prospective electric vehicle (EV) buyers are more excited about the Tesla Model 3 than any other EV in the market."

Details: This is where it gets incredible:

A poll found that 55 percent of electric vehicle (EV) fans were more likely to buy a Tesla Model 3 when it becomes available, according to Clean Technica.

Almost 39 percent of current EV owners plan to buy the Model 3 as their next car purchase.

BREAKING: BIGGER

As if those numbers don't exhibit market dominance, try this: Tesla's $70,000+ Model S placed third among potential buyers with 20 percent ranking it as their top choice, while the Tesla Model X took fifth place, with 17.37 percent of pollsters selecting it.

Together, Tesla's three models make up 55% + 20% + 17% = 92% of the market, per this survey. We must note that more than one answer was allowed, but if you check out the survey it's just Tesla... and then everybody else.

Yes, 92%. And just so we're clear, the poll listed 75 vehicles for consumers to choose from -- this wasn't some garbage survey with five choices.

Even further: 65% of potential EV drivers are either much more or significnatly more attracted to an EV that can use Tesla's Supercharger network.

Game. Set. Match.

Tesla will start taking pre-orders on March 31st for its Model 3. A $1,000 down payment will be required. Soon after that, Tesla will tell the world how many pre-orders it received. This will be one of "the moments" for Tesla as an enterprise.

THE REAL RISK: APPLE AND GOOGLE

The risk for Tesla is not any of the existing vehicles. We can see quite clearly that it is a total and utter disruptor, destroying demand for even the hallowed Mercedes Brand.

The risk is Apple (AAPL) and Alphabet / Google (GOOG, GOOGL). CML Pro users have access to two full research dossiers about exactly this: "The Secret's Out: Apple and Tesla are Going to War," and "Apple's Car Will Change Automotive History."

Google's plans are a bit less disruptive, but equally dangerous. If we're looking for the possible derailment of Tesla -- we can stop looking at existing auto manufactures and start looking at the best technology companies in the world.

THE NEXT HUGE WINNERS

We actually have three entire research dossiers dedicated to Tesla because there is so much going on and this company is one of our precious few 'Top Picks.'

But true innovation, the kind that turns companies from small caps into mega caps, the kind that sees stocks double, triple or even quadruple, that only occurs when two critical phenomena collide.

To idenitfy Tesla and then go beyond, to find the 'next Tesla' or 'next Apple' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, the cloud, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.