Tesla Misses Estimates

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.

PREFACE

While the focus has been on the success of the Model 3 pre-order carnival, we just learned that Tesla delivered 14,820 vehicles in Q1 of 2016, according to Bloomberg. The company outlook guided for deliveries of 16,000 units.

StreetInsider reported that the firm is still holding full year guidance steady -- and that is a major point to this breaking news.

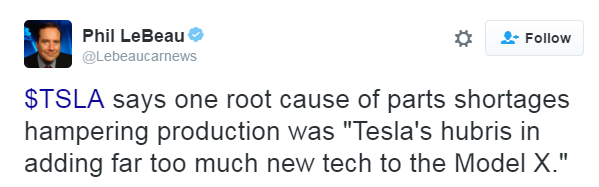

Remeber, Elon Musk called the Model X the most difficult car to manufacture ever -- and he did not wear that as a badge of honor. Rather, he sounded of a cautionary tale and a mistake the firm would not make on the Model 3.

The company noted:

The Q1 delivery count was impacted by severe Model X supplier parts shortages in January and February that lasted much longer than initially expected

We knew that good or bad, bullish or bearish, Tesla stock was going to shake hard in the coming days as it introduced its Model 3, began taking pre-orders and then released Q1 numbers.

Now we'll check out what's really going on.

SET UP

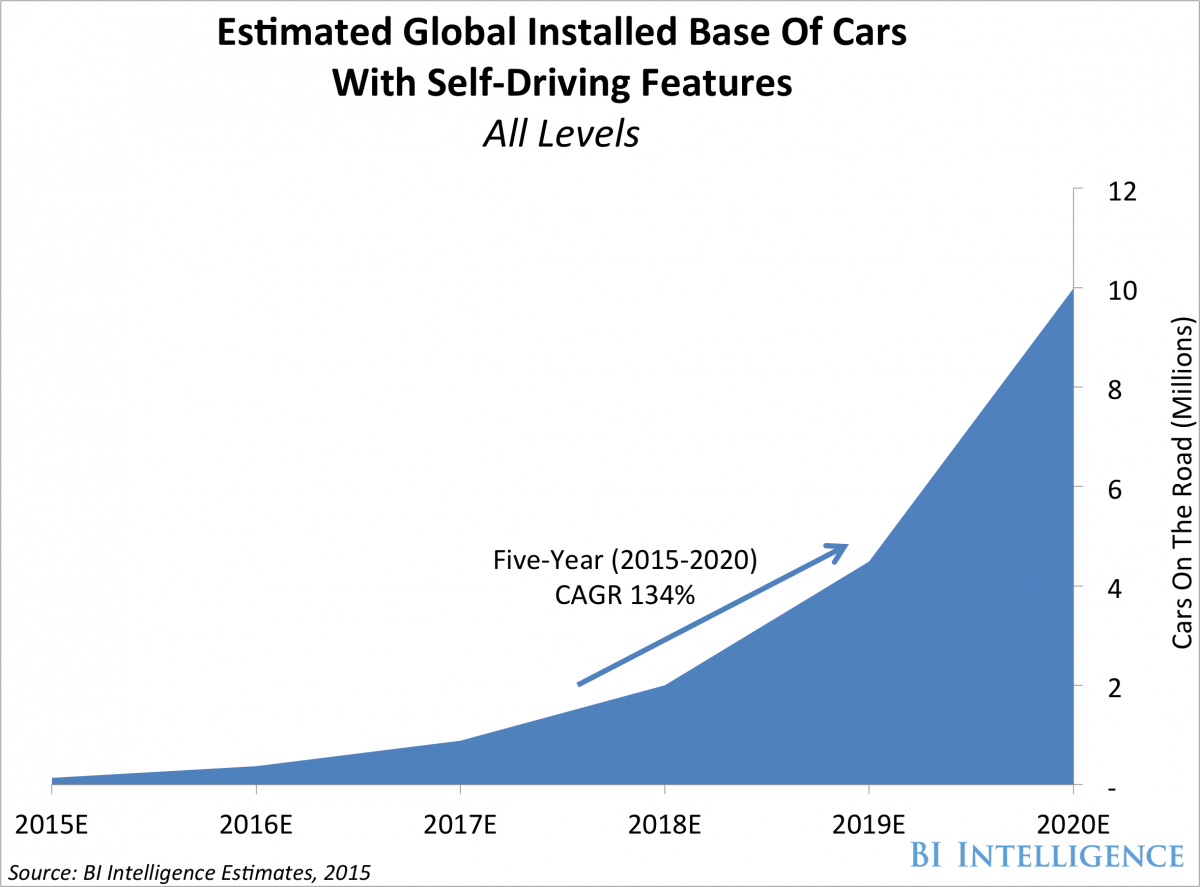

It has long been CEO Elon Musk's goal for Tesla to sell 500,000 vehicles by 2020. That's nearly ten-fold higher than the deliveries in 2015. This is the market he is going after:

We're looking at 134% growth every year, for the next six-years.

Tesla has built its $5 billion gigafactory -- the only manufacturing plant on the planet capable of building enough lithium ion batteries for that many electric cars. But it will take more than the factory to sell half a million cars.

Let's rip through what we know very quickly, and then get to the new data.

WHAT WE ALREADY KNOW

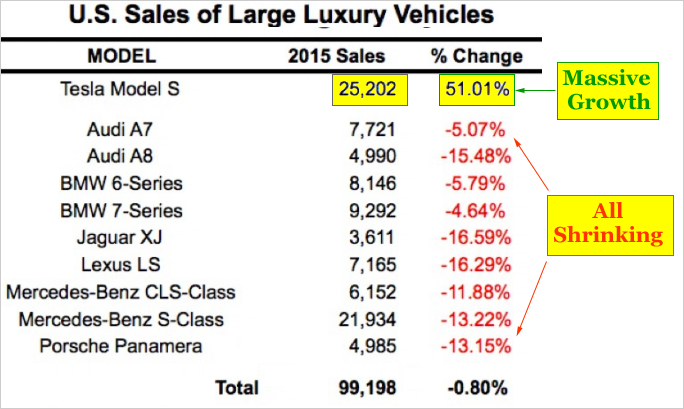

U.S. sales figures for 2015 reveal that Tesla's Model S rose to become the number one top seller within the U.S. market for large luxury vehicles, overtaking the Mercedes-Benz S-Class for the first time. Here's the incredible data (highlighting added):

All of these vehicles start around the same $70,000 as the Model S.

Just so we're perfectly clear on this data: Every other luxury sedan saw falling sales while Tesla saw a 51% increase. Tesla's Model S is now the single best selling large luxury vehicle and now owns more than 25% of the market. (Source: electrek). Tesla has already displaced the hallowed Mercedes brand.

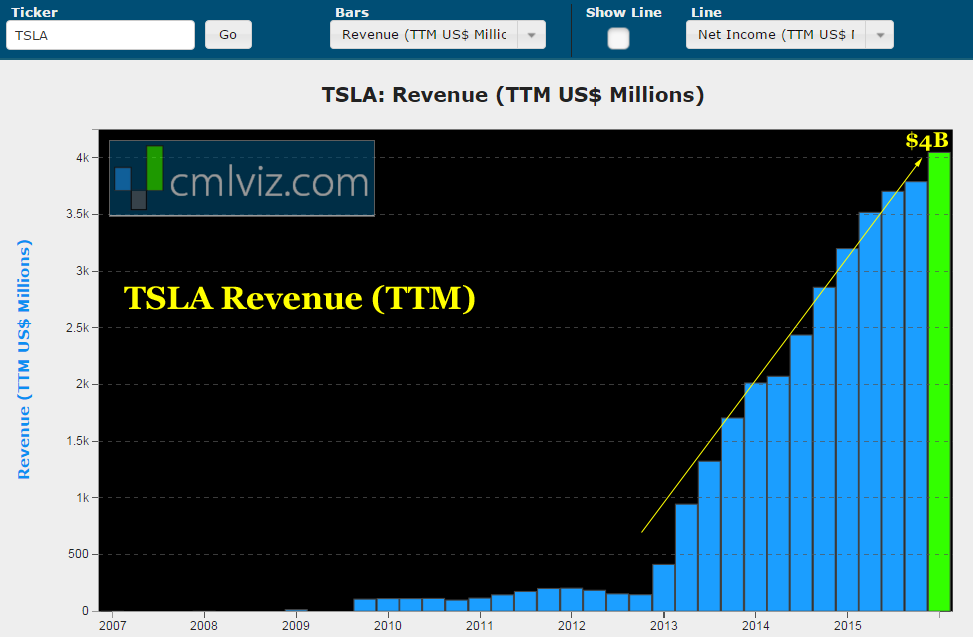

Here is Tesla's all-time revenue chart:

TESLA'S SECRET

Those numbers presented above are basically a mathematical impossibility if not for one stunning secret: Not everyone buying the Model S was an owner of a $70,000 car before.

In 2015, Jefferies conducted a survey of Model S owners and discovered that nearly 40% had previously owned a car that cost less than $40,000 (Business Insider). Tesla is not only moving people up -- it's moving people up by staggering amounts.

TESLA'S POWER LIES IN ITS BRAND

A car manufacturer can either be economy or luxury. As early as 2011, Elon Musk noted this reality in his personal blog and specifically introduced Tesla to the world as a luxury item, first and foremost.

If we look at four of the largest auto makers in the world: Volkswagen, Toyota, Honda and Nissan. Each has wonderful name recognition, but equally, each auto-maker had to create a new brand to sell luxury cars:

Volkswagen -> Bentley, Bugatti, Lamborghini, Audi, Porsche

Toyota -> Lexus

Honda -> Acura

Nissan -> Infiniti

By virtue of the hundred thousand dollar Model S 'scale breaking race car' and the Model X crossover, Tesla has established itself as a luxury automobile with one of the most valuable brand names in the segment.

There was a lot of polling done before the Model 3 was introduced and all of it pointed to rather large demand. But no one, even Elon Musk himself, could have guessed that the firm would have 276,000 pre-orders within a matter of days. In fact, the full year expectation was for about 115,000 orders.

While that has put the shine on Tesla stock, which has risen nearly 50% in less than two months, the new data was sobering. The company had a backlog for Model X that totaled more than all of 2015 revenue. While we knew that production would be slow, we didn't expect it to be slower than the company's already reduced estimates. But, that's what we got today -- deliveries were below expectations.

This news will push the stock down in the short-term but it isn't the real risk.

THE REAL RISKS: APPLE AND GOOGLE

The risk for Tesla is not any of the existing vehicles from Honda, Toyota, General Motors or Ford. We can see quite clearly that it is a total and utter disruptor, destroying demand for even the hallowed Mercedes Brand.

The risk is Apple (AAPL) and Alphabet / Google (GOOG, GOOGL). CML Pro users have access to a full research dossier: "Apple's Car Will Change Automotive History."

Google's plans are also disruptive and equally dangerous. If we're looking for the possible derailment of Tesla -- we can stop looking at existing auto manufactures and start looking at the best technology companies in the world.

SEEING THE FUTURE

There's so much going on with Tesla we can't cover it all in one report - it spans several different thematic shifts in technology and it will battle Apple and Google for decades. But, to find the 'next Tesla' or 'next Apple,' or better yet, the companies that power the mega cap companies inside the guts of their businesses, we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.