What Really Happened on the Tesla Earnings Call

THE TESLA PROMISE

The was originally published to news.cmlviz.com.BREAKING

Tesla reported earnings yesterday after the close and CEO Elon Musk announced some news that was nothing short of shocking, if not incredulous.

THE NUMBERS

Before we get into the real story, here is a quick top line review:

Revenue: Tesla delivered $1.6 billion in revenue which was in line with estimates.

EPS: Tesla delivered a $0.57 loss in EPS, beating FactSet estimates of a $0.60 EPS loss.

• Advancing 500,000 unit build plan by two years to 2018

• Volume Model 3 production and deliveries to start in late 2017

• Model S orders up 45% compared to Q1 last year, accelerating globally

• Model X production increased from 507 in Q4 to 2,659 in Q1

• Affirming 80,000 to 90,000 deliveries this year

Further, while just about every analyst I read warned of slowing growth in the current Model S, we learned this:

“

Q1 Model S net orders rose 45% compared to a year ago, and grew at a faster pace than last quarter.

Q1 Model S net orders rose 45% compared to a year ago, and grew at a faster pace than last quarter.

”

- Tesla Motors, Inc. 8-K Filing

Now, on to the bigger news:

We break news every day. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

THE REAL NEWS

The much bigger news came from Elon Musk's guidance. While he has long stood by what many have considered an absurd goal of selling 500,000 cars by 2020, he changed his mind. Now he has given guidance that 500,000 cars will be delivered two-years earlier, by 2018. He said that by the year 2020 deliveries will be "something like a million."

“

Tesla is going to be hell bent on becoming the best manufacturer on Earth.

Tesla is going to be hell bent on becoming the best manufacturer on Earth.

”

- Elon Musk

That was startling news, to say the least. At first blush, the stock spiked in the after-hours trade, then it started falling. Here's what happened:

REALITY CHECK

Before the announcement of ramped up production, Tesla had a stated goal of reaching both profitability and positive cash flow by year end. With this new goal, those two metrics will be missed. In fact, before the bold new statement, analysts were already forecasting full-year cash burn of about $820 million (Bloomberg). If we factor in new capital expenditure guidance that provided on the earnings call -- which Tesla is still "re-evaluating" -- that cash burden widens to almost $1.6 billion.

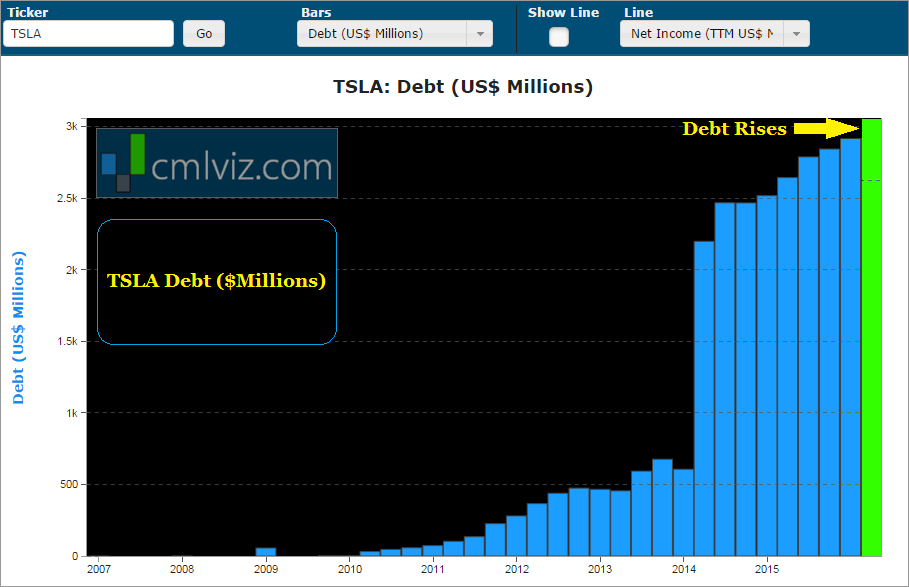

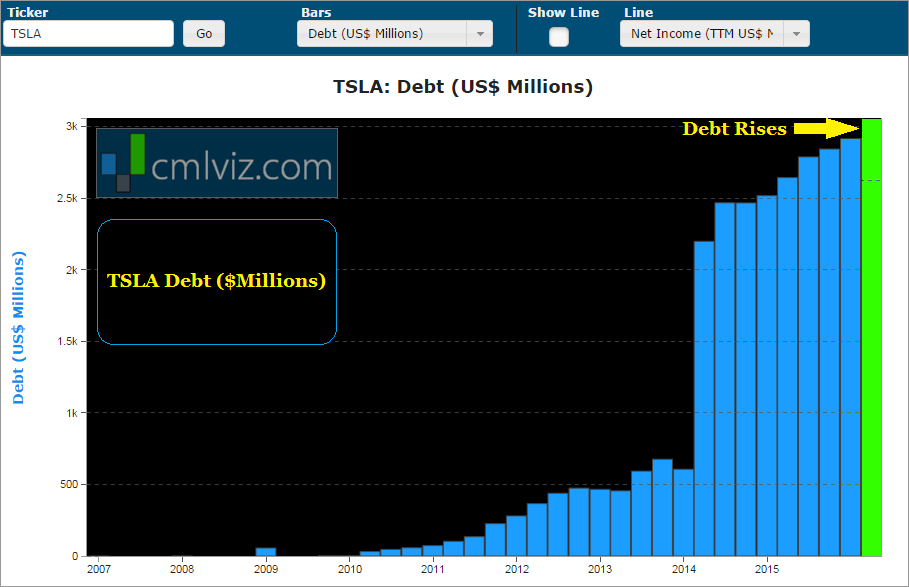

Here is a chart of Tesla's debt, with the latest quarter included:

TESLA DEBT

We do note that Tesla does have $1.44 billion in cash and equivalents per the latest 8-K filing and $318 million in accounts receivable. ElonMusk also said:

“

Increasing production five fold over the next two years will be challenging and will likely require some additional capital, but this is our goal and we will be working hard to achieve it.

Increasing production five fold over the next two years will be challenging and will likely require some additional capital, but this is our goal and we will be working hard to achieve it.

”

- Elon Musk

The bulls saw Musk's vision as incredibly positive and there have been a number of upgrades. The bears see it as an "impossible" goal and just yet another reason for Tesla to raise capital. Actually, both camps are wrong -- here's what really happened:

REASON NOT INSANITY

Just like everyone else, Elon Musk was also blown away by the initial demand for the Model 3 -- which now stands at over 325,000 pre-orders which the firm estimates at $14 billion in future sales. Whether you like Tesla or not, whether you think it's a revolutionary new company or a cash losing machine, one thing that is simply inarguable, the best reason ever for a company to raise capital is to satisfy existing orders.

That friends, is a fact.

The risk to Tesla is not added capital raising, the risk is that the demand goes away when it's unsatisfied. Elon Musk is absolutely right here -- Tesla can't punt the deliveries down the line -- he must deliver as soon as reasonably possible. While Wall Street is looking at capital raising, Musk wasn't speaking to Wall Street -- he was speaking to everyone out there that wants their car and he was speaking to his employees.

But there's more:

MORE

While the main stream media simply repeats everything analysts say, which means the media will repeat ad nauseum that Tesla has missed every production goal it has set, what the media will not do is use critical thinking.

Remember, Elon Musk is not speaking to Wall Street when he sets goals. When he says that the Model 3 will start manufacturing as of July 2017, he is pushing his team to meet the goal. The Model 3 will not be delivered by July 2017, but it will likely be built by October. A Wall Street driven CEO would have simply "guided" for a December 2017 manufacturing date and hoped to "surprise" to the upside while likely not.

HOW DO YOU KNOW?

OK, so now we sound like we're super smart and everyone else is stupid. So, the next question is, "how do we know that's what Elon Musk is doing?" Here's how:

Prior to yesterday's announcement, even the great bullish analysts felt that 500,000 vehicle deliveries by 2020 was likely a wing and a prayer, and if the firm even hit 70% of its goal (350,000 deliveries) that it supported a much higher stock price. Analysts do this to give themselves wiggle room if they are wrong.

Those same analysts today are anchored to the newly announced goal of one million deliveries by 2020. Following their always linear logic, if the company now delivers 70% of that goal, the company will be at 700,000 deliveries by 2020. Magic -- the bullish analysts have gone from expectations of 350,000 deliveries in 2020 to 700,000. And more importantly, so have Tesla engineers, scientists, and other employees.

OPPORTUNITY

The dip in Tesla shares was expected -- all CML Pro members were told to get ready for a dip to buy shares. The dip has happened.

WHY THIS MATTERS

Research must go further than the headlines into the trends that will shape the next decade. Tesla is just one of CML Pro's precious few 'Top Picks.' But, to find the 'next Tesla' or further the 'next Apple,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Here's cyber security:

There's just no stopping the growth in the need for cyber security and we are right at the beginning. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn't do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.