Breaking: Tesla Gigafactory Completion Date Moved Up

Tesla (NASDAQ:TSLA) Gigafactory

7-25-2016BREAKING

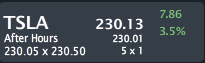

In breaking news we have found that the Tesla (NASDAQ:TSLA) Gigafactory will now be completed one full year ahead of schedule. The stock market likes then ews, with Tesla finding one of the few bright spots in the market today.

But, the impact of the Gigfactory goes much further than simply the Tesla car business.

“

The size of the current building is less than 20% of what the final outcome is expected to be.

The Gigafactory will be one of the only U.S. sites of lithium-ion battery production. Nearly all lithium-ion batteries are currently produced in Asia.

The size of the current building is less than 20% of what the final outcome is expected to be.

The Gigafactory will be one of the only U.S. sites of lithium-ion battery production. Nearly all lithium-ion batteries are currently produced in Asia.

”

Source: Fortune

STORY

Tesla has two luxury vehicles in production, the Model S and the Model X. Here's an all- time revenue chart:

Tesla revenue is up 21% year-over-year and over 100% in the last two-years.

Of course the real story is the yet to be produced Model 3 -- a less expensive vehicle for mass production. While Tesla sold 50,000 cars in 2015, the company aims to sell 500,000 by 2018 and the conduit to that massive uptick in volume is the Model 3. And, of course, the Model 3 will depend on the construction of the Gigafactory to produce the lithium batteries.

While Tesla CEO Elon Musk initially announced a goal of half a million vehicle sales by 2020 to a growing cacophony of doubt from Wall Street, once the Model 3 pre-order numbers came in and crushed estimates, Musk went further to push that 500,000 goal up two-year to 2018.

If the first goal was incredulous to skeptics, the acceleration must have felt a little but like Alice falling in Wonderland. But, true to his nature, Musk has now pushed the Gigafactory completion date up one full year with the focus on hitting his lofty goal.

Tesla (NASDAQ:TSLA) SO MUCH MORE

While the hyper focus has been on vehicle deliveries and now the breaking news surrounding the Gigafactory, there is more going on at Tesla that is under reported. The company has a second business, power storage, that in and of itself could actually be larger than the entirety of the car business and that segment too depends on the Gigafactory.

While the mainstream media will focus on the breaking news surrounding the Gigafactory and its impact on battery manufacturing for Tesla cars, the battery power storage story will be brushed aside even though it's the same manufacturing facility.

Tesla is going to compete with Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL) as well as Detroit and Japan's auto makers for the EV market – it will likely not face competition from these same companies in the power storage world.

While ramped up vehicle production is great, we must note that Tesla does in fact have a hedged business with its Powerwall. The Gigafactory will serve as the production facility and with its newly announced completion date fully a year ahead of schedule, that means the multi-billion dollar opportunity that is power storage is also fully one-year ahead of schedule.

It is also a little known fact that the Gigafactory itself is actually built to be replicated. If Tesla reaches its goals, there will be several Gigafactory footprints that look identical around the United States and perhaps even internationally.

The author is long shares of Tesla (NASDAQ:TSLA).

WHY THIS MATTERS

Tesla is more than a car manufacturer and it is attacking some of the most critical and revolutionary themes coming to technology. It's identifying trends and companies like this this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.