This Small Cap Technology Stock Just Broke Huge News

Fundamentals

BREAKING

TubeMogul (TUBE) provides self-serve software that allows advertisers to plan, buy and measure the effectiveness of video ads. But we just received news from the company that it has stepped into another market segment that is already 20-fold the size of its current market. First the news, then the analysis:

“

TubeMogul (TUBE), announced that marketers can now purchase linear television inventory through TubeMogul's programmatic TV (PTV) platform via private marketplaces and automated direct deals.

Source: TubeMogul

TubeMogul (TUBE), announced that marketers can now purchase linear television inventory through TubeMogul's programmatic TV (PTV) platform via private marketplaces and automated direct deals.

”

Source: TubeMogul

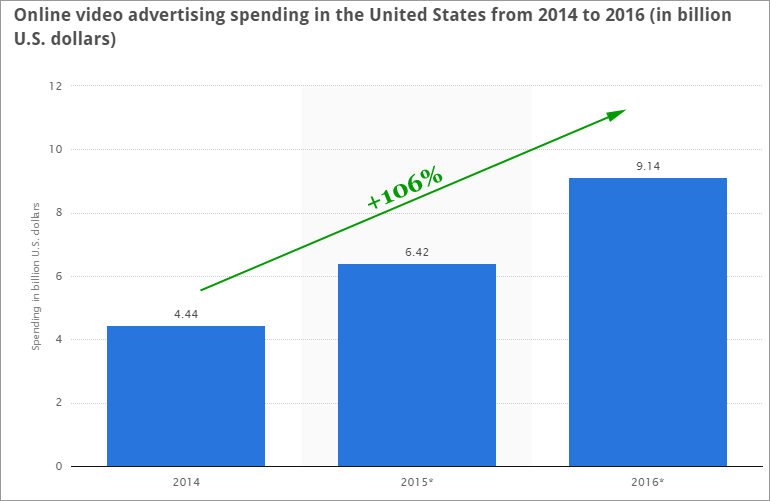

It may seem like a tame announcement, but it's far from it. First, here's the online video advertising market size (via Statista):

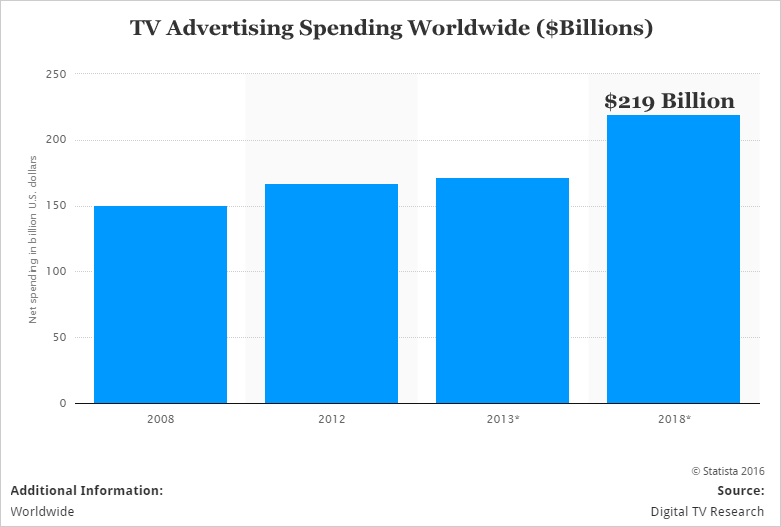

While that 106% growth over two-years and a $9 billion industry by this year is impressive, it pales in comparison to standard TV ads, often referred to as "linear TV." Check out these numbers (via Statista):

Now we're looking at a $220 billion industry and TUBE's announcement yesterday has just opened that market up. But TUBE is much more than a small tech company -- or at least it has aspirations well beyond that.

TUBE wants to do for TV and video advertising what Google did for text advertising. Yes, TUBE wants to be the next Google, and it may well be on its way.

GOOGLE AND FACEBOOK

If advertising sounds boring then it's time for an update: 97% of Facebook's revenue comes from ads and the company stands at a colossal $320 billion market cap. But that's small.

Google changed the world with its AdWords advertising platform for Google Search. It has made Google the largest, most successful advertiser ever, with a market cap nearing half a trillion dollars. But the next salvo isn't text advertisements, it's video.

Facebook (NASDAQ:FB) recently announced that it receives 10 billion video views a day and Snapchat reported 8 billion views a day. Twitter (NASDAQ:TWTR) reported online video consumption by 90% of its users. Google's YouTube numbers are yet more staggering:

“

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

”

The opportunity is so large that Amazon.com (NASDAQ:AMZN) just announced its own online video service to compete directly with Google's YouTube:

“

Amazon.com Inc. launched a service on Tuesday that allows users to post videos and earn royalties from them [] to compete directly with Alphabet Inc.’s YouTube.

Source: Yahoo! Finance.

Amazon.com Inc. launched a service on Tuesday that allows users to post videos and earn royalties from them [] to compete directly with Alphabet Inc.’s YouTube.

”

Source: Yahoo! Finance.

THE WINNER

There's an investing philosophy we have at CML Pro:

“

You can mine for gold hoping to be one of the lucky few to win the gold rush lottery, or you can sell pickaxes and shovels to the gold miners and guarantee you've won the lottery several times over.

Source: CML Pro

You can mine for gold hoping to be one of the lucky few to win the gold rush lottery, or you can sell pickaxes and shovels to the gold miners and guarantee you've won the lottery several times over.

”

Source: CML Pro

Google, Facebook, Twitter, Amazon, Snapchat, even Apple will battle for the online video ad space, but we don't care which firm wins and how the market share is distributed. That's hunting for gold.

We want the pick-axe and the shovel and it turns out there is a company that very well may be the guts to this incredible booming thematic shift.

WHY THIS MATTERS

Online video is one of the major thematic trends that will shape the future . But, to find the 'next Apple' or 'next Google,' to find the "shovels that will power the gold miners," we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

The author is long shares of TUBE. Thanks for reading, friends.