Twitter's Truth and Wall Street's Misinformation

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. That means wading through misinformation. You're now a part of that change.

PREFACE

So by now we should all know that Twitter announced a bit of a stunner when it beat out Amazon, Verizon, Facebook, Google, Yahoo!, Apple and a host of other companies to stream the NFL's nationally broadcast Thursday night football games. The bears came out with a fury -- claiming everything from an over bid to an implication that the deal meant nothing and that Twitter's slowed user growth would be unaffected. Then more news came out, and the bears have just a tinge of an embarrassing moment to work through.

We'll touch on the breaing news and then lay down the seven facts that Wall Street is not telling us.

Discover the undiscovered:

Get Our (Free) News Alerts Once a Day.

BEWARE THE BEAR

While we knew initially that Twitter would pay $10 million for the rights to stream 10 of next fall's 16 Thursday night games, there is still a legacy of disbelief from Wall Street analysts on all things Twitter.

First up was Evan Wilson, an analyst at Pacific Crest, who said the partnership is unlikely to attract needed new users to the platform in a piece titled "Trading margin for user growth hope." It's reasonable to have a bearish view of Twitter, by all means it has underwhelmed and underperformed for a long time.

Having said that, the firm does have $2 billion in net cash and short-term investments -- that's $3.5 billion in cash and $1.5 billion in debt -- so "trading margins" seems a bit over the top for a $10 million investment which Twitter later disclosed was already accounted for in 2016 projections.

The "hope" part is certainly true, Evan is right, Twitter is hoping for a success and hope isn't a great investment strategy.

But then Evan Wilson kind of went off the rails when it was reported that he said Twitter may have outbid other networks for the rights at a price tag of $100 million. Now, let's allow for the possibility that Morningstar misreported that. But, if it did not misreport, then it's a little funny, and by funny we mean embarrassing now that more information has come out:

We got word from the NFL's executive vice president of media, Brian Rolapp, that the NFL package didn't go to the highest bidder. Here's snippet from an article published by Social Media Today:

"We didn't take the highest bidder on the table," The NFL's executive vice president of media, Brian Rolapp, told Bloomberg. "The platform's built around live events already. We want to see how they use the unique platform, and syndicated tweets all over the Internet is going to be interesting.

R/e code reported "people familiar with the bidding said Twitter paid less than $10 million for the entire 10-game package, while rival bids topped $15 million." Let's remember that outlandishly bullish theses and analysts can be mirrored by those that are bearish. The implication that Twitter paid $100 million, as of right now, seems absurd and colored by a subjective bearish tone.

Of course there were more bearish takes. Morgan Stanley lowered its price target.

Both firms have a bearish view in general, although Pac Crest's view of the deal in general was rather abrupt. Of course there's another way to look at it:

WHAT ELSE WE KNOW

We know that last year Yahoo! paid $20 million for a single game, and all parties agreed it was a "success." In fact, the NFL said it was "thrilled with the results."

Here is a slightly dated article from CNN Money that reviewed the results (emphasis added):

[I]f the stream averaged 2.36 million, as the data indicates, then the Bills-Jaguars game is one for the Internet record books, if not the NFL's.

CNN's recent debates peaked with almost 1 million simultaneous live streams. Last season's Super Bowl peaked with 1.3 million.

Source: CNN Money

CNN's recent debates peaked with almost 1 million simultaneous live streams. Last season's Super Bowl peaked with 1.3 million.

Source: CNN Money

Now, while viewership online was significantly lower than TV, obviously, we also got these numbers: "15.2 million people were exposed to the stream, many of them through Yahoo's (YHOO, Tech30) popular home page, where the video played automatically."

TWITTER AND THE TRUTH

While Wall Street has focused on Twitter's 320 million average users (MAUs), the company has time and again pointed to its additional 500 million MAUs that are not logged in. The NFL games will be made available to this non-logged audience as well. Here's a snippet from r/e code:

The win gives Twitter the ability to show the games to users around the world, without requiring them to sign in to the service.

Source: r/e code

Source: r/e code

Twitter's CFO, Anthony Noto, the former CFO of the NFL, said that Twitter and the NFL together was "a great, great product for logged-out users."

But that's not the real news. Twitter is making strides to come out from under the underdog label and it's trying to be the next technology giant. In fact, that same article from Social Media Today, reads:

While Facebook's pushing hard to promote their own live-stream offering, and YouTube’s reportedly set to introduce their own, dedicated live-streaming app, don't think Twitter and Periscope are going to concede to the bigger players anytime soon."

Now, here we go with the real battlefield and we fight through the drudgery that is misinformation.

REAL NEWS

Twitter's play here is to engage the logged out user base and turn those people into active users. The company already announced a plan to monetize the non-logged in user base into $1.3 billion -- that's straight from COO and Head of Revenue, Adam Bain.

Now, make no mistake, this NFL announcement was a win for Twitter -- not a gift or a de-facto landing. Twitter simply beat the tech giants and that includes Apple's silent attempts. Here's another snippet from re/code:

The fact that Amazon didn’t land the NFL games is somewhat surprising[]. The company bought Twitch, the video game live streaming startup, which had been slated to sell to YouTube.

But there's so much more going on. Let's get to it.

THE SEVEN FACTS

First: Since Periscope's launch last March, more than 110 years of live video has been watched via Twitter's live streaming video app everyday. But, as of August 12th, 2015 that number was just 40 years. So, we see nearly a triple. This data comes straight from Periscope on their medium channel.

Second:Since Periscope was enabled within Twitter users' timelines, it has reached more than 200 million live broadcasts. That's more than double the number of broadcasts Twitter announced just three months ago -- when it started the launch within user timelines. This data, too, comes straight from Periscope.

Third: Twitter also revealed that the number of direct messages grew over 60% in 2015 and yet more, the number of Tweets shared privately has grown by 200% in just the second half of last year. This information comes straight from Twitter's blog.

"Now — in just a few taps — you can share unique Twitter content from your timeline right into your private conversation."

Fourth (reprise): "Twitter says that it has seen across-the-board increases in likes per-user favorites, retweets, replies, tweets and daily usage following the new timeline's debut." This comes straight from Twitter itself, this time via TechCrunch.

Fifth: Twitter was selected by the NFL to carry the live national broadcasts and submitted lower bids that the other large firms in the fray. This data was given to us straight from the NFL.

Sixth: The Yahoo! and NFL first attempt at streaming a game was, by most accounts, unprecedented in terms of live streaming. CNN's recent debates peaked with almost 1 million simultaneous live streams. Last season's Super Bowl peaked with 1.3 million. The game streamed with Yahoo! averaged 2.36 million.

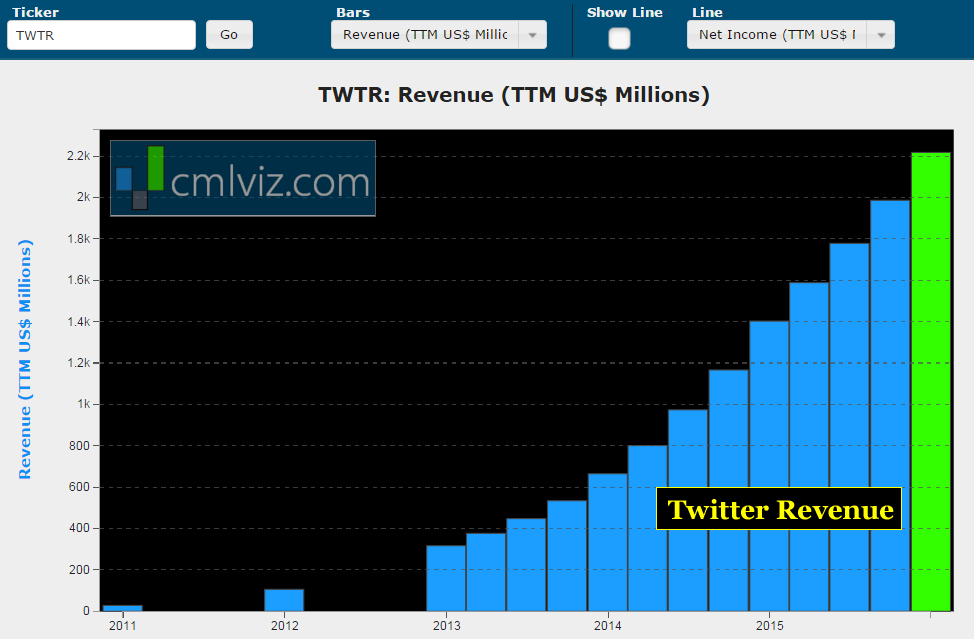

Seventh: 82 percent of Twitter users watch video content on the platform and 90 percent of those came from mobile.

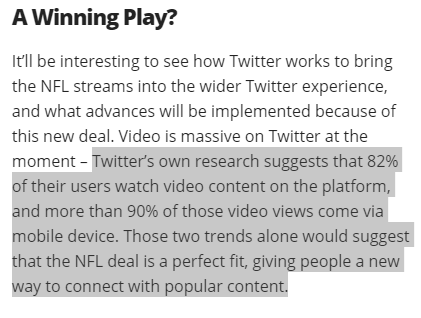

You see, these are the facts and they are not disputed. It's amazing what we can find when we stick with facts. And yes, there are facts that show slowing user growth. In fact, here it is, from our friends at Statista:

You see, facts. And since we're on the subject of facts...

SPEAKING OF FACTS

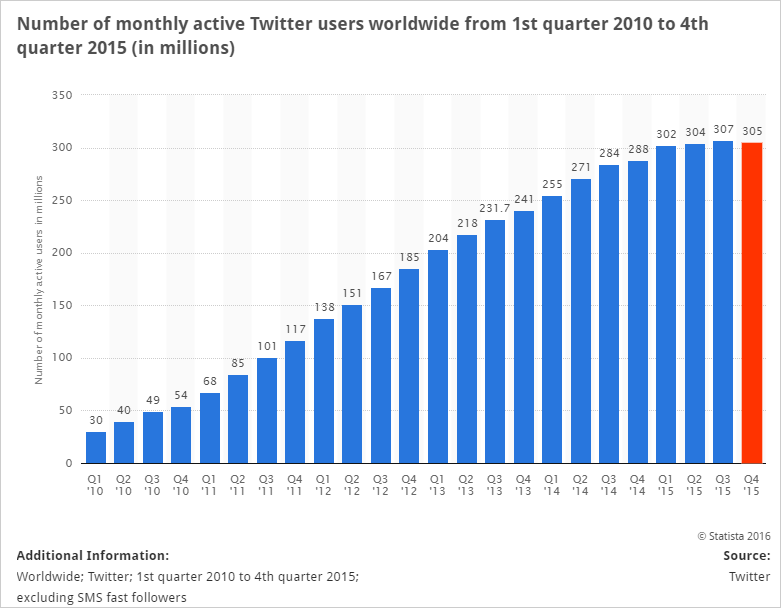

Here is Twitter's all-time revenue (TTM) chart via Capital Market Laboratories (CML Pro):

And the growth, too, is outsized relative to peers. Here is a chart that compares Twitter's revenue (TTM) growth over the last year with other technology companies of similar market caps:

Twitter is growing faster than all but one other technology company in this peer group.

RECONCILING THE NUMBERS

If we were all waiting for a part of Twitter to show growth in anything other than revenue, we now have it - factually. We don't know if it will continue, but we sure have an opinion about it.

There's a reason Google is cozying up to Twitter and it goes way further than search results. Google has found a weapon in Twitter that can compete with Facebook and the Apple TV. We discuss those details in CML Pro, but Facebook may now be finding a legitimate competitor from a Twitter / Google team.

SEEING THE FUTURE

While Google, Facebook, Amazon and soon Apple, with its new social network patent filing, will battle for MAUs, they lack the advantage that Twitter has. There is one king of real-time communiqués and it's Twitter. But that's not what we're talking about here. We're talking about information and we hope that the facts have given us all a clearer view of reality. Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%.

Now, to really understand why Twitter will finally be a winner, and then to go further, to find yet again the 'next Amazon' or the 'next Apple,' we have to get ahead of the curve -- with facts. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

The author and the author’s household hold shares in Twitter as of this writing.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.