The Tide May Be Turning for Twitter (NYSE:TWTR)

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. You're now a part of that change.

PREFACE

In the latest earnings call Twitter (NYSE:TWTR) saw disappointing revenue and even more disappointing revenue guidance.

Twitter has its annual shareholder meeting today which I will be attending, but this time the team has some powerful bullish themes to discuss.

QUESTIONS AND NO ANSWERS

Twitter has floundered. Each of the recent earnings calls have turned the stock into a punching bag and top management was the head piece. Users and investors alike have appropriately asked, where's the growth coming from? What's the bullish thesis? Where is the innovation? What happened to communincations?

It turns out, those questions may actually have answers, and those answers may be quite bullish. We start with the growth and bullish thesis.

ONLINE VIDEO

Twitter (NYSE:TWTR) hit an all-time high in MAUs last quarter. Yeah, that happened -- it sounds almost impossible given the cacophony of rage, accusations and disappointment, but that little sentence fragment is a fact. But that isn't the bullish thesis -- not even close.

We've heard it ad nauseum -- Twitter is live. Twitter is real-time. And investors have responded with, "so, where's the value proposition to that?" And now, we have an answer.

The most successful form of advertising has shifted quickly and abruptly to online video. While forecasts were for the medium to grow 106% from 2014 through the end of this year to $9.14 billion, those numbers are going to be way (way) too low.

Not too long ago juggernaut advertisement buying firm Magna Global, responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola, moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads. That was meaningful in its size, but more meaningful in the shifting sentiment.

THE SET UP

In an article on Ad Age we got this:

“

RBC and Advertising Age have found that the percentage of marketers using TV ad dollars as a source of funding for digital campaigns is on the rise.

In February 2016, 40% of respondents said they were doing so, up from 37% in September 2015.

Source: Ad Age

RBC and Advertising Age have found that the percentage of marketers using TV ad dollars as a source of funding for digital campaigns is on the rise.

In February 2016, 40% of respondents said they were doing so, up from 37% in September 2015.

”

Source: Ad Age

If that survey was repeated today, we can be almost certain that it has risen again. Facebook, Google and Twitter (NYSE:TWTR) all noted that online video was becoming the preferred outlet for advertisers across their various properties.

While Facebook claims it receives 10 billion video views a day, Google announced this on its latest earnings call:

“

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

YouTube on mobile alone now reaches more 18 to 34 and 18 to 49 year olds in the U.S. than any TV network, broadcast or cable.

”

Though much smaller, Twitter reported that 82 percent of its users watch video content on the platform and 90 percent of those came from mobile. Further, since August 12th, 2015, Twitter's live online video app Periscope has nearly tripled.

But that's not the news, yet.

THE MONEY

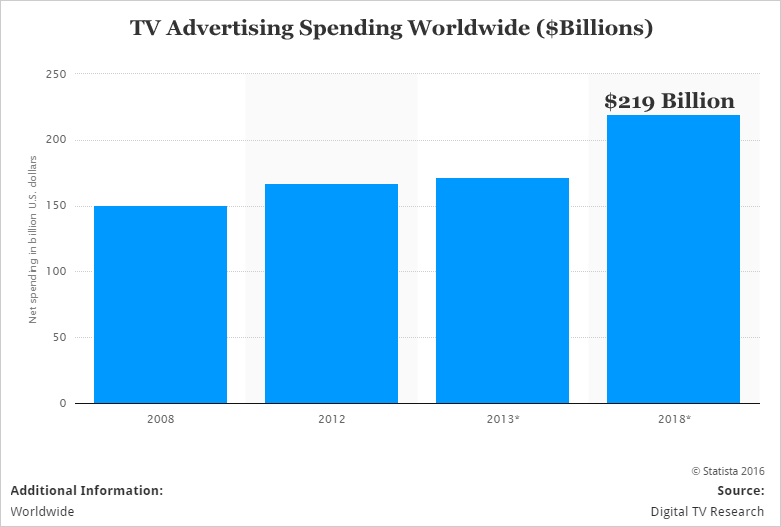

There are 133 million households in the United States alone with a cable TV subscription and 75% of those people watch TV everyday (Source: AYTM). Check out how much is spent on standard Television advertisements:

In stark contrast to online video advertising, which is pegged at market size of less than $10 billion, TV advertising is pegged at around $200 billion -- or 20-fold larger.

SO WHAT?

As we stated earlier, we can throw that 106% growth and $9.14 billion estimate for online video advertising in 2016 out the window. Given the circumstantial evidence we received from each of the company's individual earnings reports and then the empirical evidence we just got from Magna Global's shift from TV ads to online video ads, it's now plainly clear:

Online video advertising is going to be one of the largest advertising media in the world and there are just a few tech companies that will take all of it.

WHAT ABOUT TWITTER?

If Twitter has an advantage, it's in real-time communiqués. The company revealed that the number of direct messages grew over 60% in 2015 and yet more, the number of Tweets shared privately has grown by 200% in just the second half of last year.

We also know that since Periscope's launch last March, more than 110 years of live video has been watched via Twitter's live streaming video app every day. But, on August 12th, 2015 that number was just 40 years. So, we have seen nearly a triple.

Finally, we just learned this:

PERISCOPE

Periscope videos used to only live for 24 hours, then they automatically got deleted. That was a major problem with the monetization strategy since everything had to be in real-time. But, we just learned that Live streaming app Periscope is following their rival Facebook, testing a feature to allow users to permanently save their broadcasts in a bid to attract more brands and advertisers.

“

All a user needs to do is put "#Save" anywhere in their broadcast title.

All a user needs to do is put "#Save" anywhere in their broadcast title.

”

Source: CNBC

Here's why this matters: Jack Kent, senior mobile analyst at IHS, told CNBC:

“

The (previous) challenge (for Periscope was) getting viewers within that 24 hour time frame. This new feature will make it a better position to make it a big brand attention Periscope and Twitter need.

The (previous) challenge (for Periscope was) getting viewers within that 24 hour time frame. This new feature will make it a better position to make it a big brand attention Periscope and Twitter need.

”

Source: CNBC

AND DON'T FORGET

In that same article from Ad Age we got this:

“

One of the last bastions of sure TV ratings success -- and loads of brand advertising revenue -- has been live events.

Source: Ad Age

One of the last bastions of sure TV ratings success -- and loads of brand advertising revenue -- has been live events.

”

Source: Ad Age

Now, Facebook and YouTube can talk about live streaming all they want, but there's only one social media company that has the rights to stream the most popular sports franchise in the United States and that company is Twitter.

In fact, Twitter was selected by the NFL to carry the live national broadcasts even though it submitted lower bids than the other large firms in the fray.

Further, CNBC reported last month that Twitter beat Facebook over the acquisition of these rights because NFL felt that Facebook undervalued content rights and has a poor monetization model, according to sources close to the situation.

TWITTER STOCK IS GETTING CRUSHED

There's no easy way to say this -- Twitter (NYSE:TWTR) stock has been crushed and is now right on all-time lows. While a longer-term view shows promise, Facebook also has a longer-term view but that stock is doing just fine in the short-term as well.

The fact that it took Periscope this long to allow its videos to be saved is embarrassing. But, as only Twitter can, it has moved progress forward at a painstakingly slow pace -- yet somehow, you get the feeling that it matters. You get the feeling that it might actually win.

Remember, Twitter disclosed that it has seen across-the-board increases in likes per-user favorites, retweets, replies, tweets and daily usage following the new timeline's debut.

Simply by virtue of being a real-time engine with a real-time video component, Twitter does stand to see outsized revenue growth. Look for revenue guidance to come up in the back half of the year as the NFL deal starts, video advertising in general outperforms and Twitter, ever so ploddingly, shows user growth and a competitive advantage to Facebook in one sliver of a segment that just happens to be exploding.

COMMUNICATIONS

One last note: In an irony not to be outdone, Twitter's communication with the outside world has been rather poor, especially with respect to real-time news surrounding the company itself. That irony has ended abruptly.

On February 22nd Twitter announced that it had hired former Apple executive Natalie Kerris as its new VP of Communications. Here's a snippet on her background:

“

Kerris spent 14 years at Apple before retiring last year, and helped launch many of the company’s important products and initiatives, including the Apple Watch, and worked alongside Apple's late CEO, Steve Jobs.

According to Re/code, Kerris was "one of the top public relations and communications staffers at Apple."

Source: Digital Trends

Kerris spent 14 years at Apple before retiring last year, and helped launch many of the company’s important products and initiatives, including the Apple Watch, and worked alongside Apple's late CEO, Steve Jobs.

According to Re/code, Kerris was "one of the top public relations and communications staffers at Apple."

”

Source: Digital Trends

Perhaps most importantly, Ms. Kerris actually uses the platform fairly regularly. Combined with new CMO Leslie Berland, a former American Express executive, Twitter may have turned the corner in yet another critical part of its business: communicating its goals and future to the people outside of 1355 Market Street.

Good for Twitter. Now it's time for them to show investors the results.

SEEING THE FUTURE

This is the beginning of analysis, not the end. To really understand why Twitter will finally be a winner, and then to go further, to find yet again the 'next Apple' or the 'next Facebook,' we have to get ahead of the curve -- with facts. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

The author and the author’s household hold shares in Twitter as of this writing.