Twitter's Turnaround Is Upon Us

Preface

Twitter Inc. (NYSE:TWTR) has seen its stock plummet 52% over the last year and 25% in just the last six-months. But the stock is up 15% in the last month, has outperformed all of its peers, and the innovation that the company is bringing is staggering. Twitter's turnaround is upon us.

As a preamble to this article, here is the three month stock return for Twitter, Alphabet (GOOGL) and Facebook (FB) on one-chart.

TWTR is the only one with a positive return, and the reason lies in the innovation that has been coming.

TWITTER INC. (NYSE:TWTR)

The innovation at Twitter in just the last 30-days has been staggering and that's really the impetus to believe that the turnaround, spearheaded by CEO Jack Dorsey, is upon us. We've written about it multiple times, as each new development to the application and its advertising platform has been released. The firm has gone from frighteningly slow innovation to almost unbelievably fast.

You can read the full recap of the momentous month the firm just had in our prior article ICYMI: Twitter is Dominating and Jack Dorsey is The Reason . But this note takes yet a further step back, and reminds us all that overblown calls for the death of Twitter are absurd, and you don't even need a crystal ball and magic hat to see the facts.

TWITTER THE FACTS

We'll show three simple charts for TWTR, each of which is simply drawn from Twitter's financial statement data. Let's start with revenue rolled up into trailing twelve month periods.

While Twitter has delivered several consecutive unremarkable earnings reports, let's not lose the forest for the trees. Twitter's Revenue (TTM) is up 50% year-over-year, and even with the major cut to forecasts for 2106, the company still sees 25% growth on the low end from here on out.

Next we turn to cash from operations, also rolled into trailing-twelve-month operations. While the mainstream media and anti-Twitter fanatics will have you think the company is on the verge of going bankrupt, that's just not true. If there's one metric to measure a company's financial health, it's the amount of cash it drives from standard business operations. Here is the chart for Twitter Inc. (NYSE:TWTR).

Twitter's cash from operations (TTM) is up 246% year-over-year and has made an all-time high each of the last seven consecutive quarters. In the most recent year, TWTR has delivered $454 million in cash from operations, up from $141 million a year ago.

And finally, we look at earnings. While Twitter is generating a cash profit, as we saw with the prior chart, it is certainly not generating a GAAP profit. Here's that chart, now broken into quarters.

Twitter's quarterly net income numbers have improved for four straight quarters and now sit -$80 million dollars. Since stock based compensation alone, a non-cash expense, is well over $100 million. In fact, Twitter has $3.6 billion in cash on its balance sheet, and while the firm also carries $1.1 billion in debt, that leaves the company with a net cash balance of $2.5 billion.

With cash from operations booming at triple digit percent growth, whether analysts like the company's future or not, the idea that the firm is in dire straits isn't up for opinion, it's factually false.

While the competition from Google and Facebook is fierce, oddly, Twitter finds itself in a position where just small market share win would mean a large increase in revenue and earnings. But even without a market share increase, the explosive growth in the online video realm which will propel advertising dollars for Facebook and Google up tens of billions of dollars in just the next few years will also benefit Twitter.

From sports deals, like the NFL, to Periscope, Twitter's strength in real time communiques stands to deliver future growth in the new era of advertising that is online video.

WHY THIS MATTERS

Twitter is one of our Top Picks, added for $15.60. At Capital Market Laboratories we identify thematic trends that will revolutionize our futures and the companies that will benefit most from them to find the "next Apple" or the "next Google." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, social media, biotech and more. In fact, here is just one of the trends that will radically affect the future that we are ahead of:

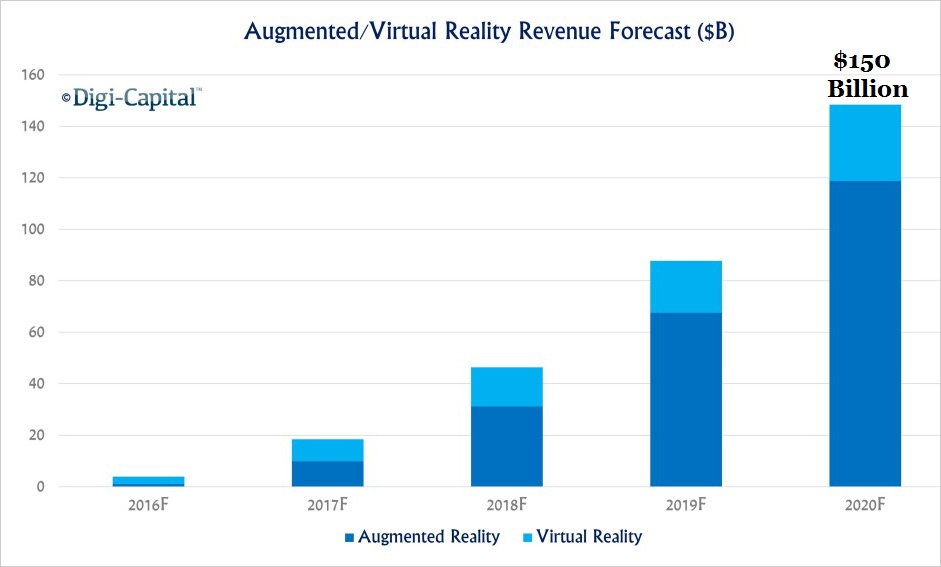

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is the opportunity so many investors say they welcome - that say they search for. The opportunity to find the "Next Apple," or the "next Google." Friends, it's coming right now, and it lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.