Twitter Earnings Disaster and Revolution

Preface

Twitter (NYSE:TWTR) stock was hit hard after the company released earnings on Tuesday, July 26th, after the market closed. Here is the real story, and it reads more and more fascinating as you go.

STORY: STEP 1 IS EARNINGS

First, the mainstream media stories that read that the stock drop was due to the quarter reported missing revenue is unimaginably wrong. The stock drop had nothing to do with the quarter that was reported. Here are the earnings numbers.

Revenue: $602 million versus a range from the company of [$590M, 610M].

EPS: $0.13 versus street estimates of $0.10.

Monthly Average Users (MAUs): 313 million, up from 310 million, which is the second quarter in a row of all-time high MAUs, albeit with quite slow growth.

The stock went down for one reason (and it was a good one) and one reason only. Twitter reported guidance for the current quarter of $600 million in revenue, well below Wall Street estimates of about $680 million, and just barely above last year's same quarter number of $570 million.

The short fall in guidance was awful, and further yet, not explained very well at all on the conference call.

THE BAD

The bad is easy -- with a presidential election coming and the Olympics as well, Twitter (NYSE:TWTR) should be buzzing with a lot to talk about in some very big areas, and that means the firm should have a lot of inventory to sell and what we would think is a compelling argument to drive demand for advertising. However, apparently this is not the case.

Twitter seemed to imply that the issue has to do with supply (aka Twitter's internal problems) rather than demand. CEO Jack Dorsey pointed out very clearly that a year ago the video advertising component didn't even exist, and as of this quarter, it was the largest part of revenue.

Adam Bain (COO) said that, for now, there are advertisement budgets that Twitter does not make it into consideration for, specifically referring to online video, which the company likes to call 'OLV.'

The company said that current "social media" budgets are moving to online video budgets, and these are in fact bought by different people at advertising agencies. For now, YouTube dominates this area with more viewers aged 18-49 than any broadcast or cable network on mobile alone.

Those are the facts and the comments from the company and they absolutely deserve a stock dive on that news.

THE GOOD

I have been peppered on TV shows and social media with a single narrative: "How can you still be bullish on Twitter given the facts above from earnings?" Here is my answer:

I. THE DEALS

Twitter had a prolific quarter of partnership deals signed during the quarter surrounding live streaming video including the NFL, NBA, MLB, MLS, NHL, Wimbledon and a lot of collegiate athletics, including the Pac-12, as well as a deal with Europe's Soccer Premier League. Beyond sports, the company signed a partnership with Bloomberg for two live streaming finance shows and CBS for both the republican and democrat national conventions.

None of these deals really take effect until Q4 and certainly not Q3 earnings forecasts.

II. THE REAL STORY IS A REVOLUTION

There's a reason this matters, and it's gigantic.

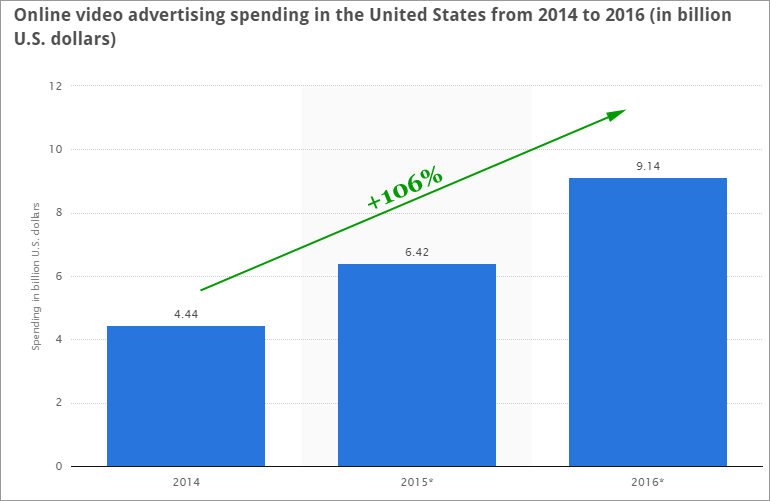

Online video advertisements are expected to grow from $6.42 billion in 2015 to $9.14 billion this year. Here's an image:

Just remember that forecast for 2016 – $9.14 billion – for a second. They are totally wrong.

As of 2014, globally, more than 1.4 billion households owned at least one TV set and "virtually all" households in the developed world now own a TV set while 69% own at least one set in developing countries. In Africa in particular, fewer than a third of the households own a TV set; one of the main reasons for the low rate is the limited access to electricity.

There are about 730 million people paying for cable TV.

Source: TV Technology

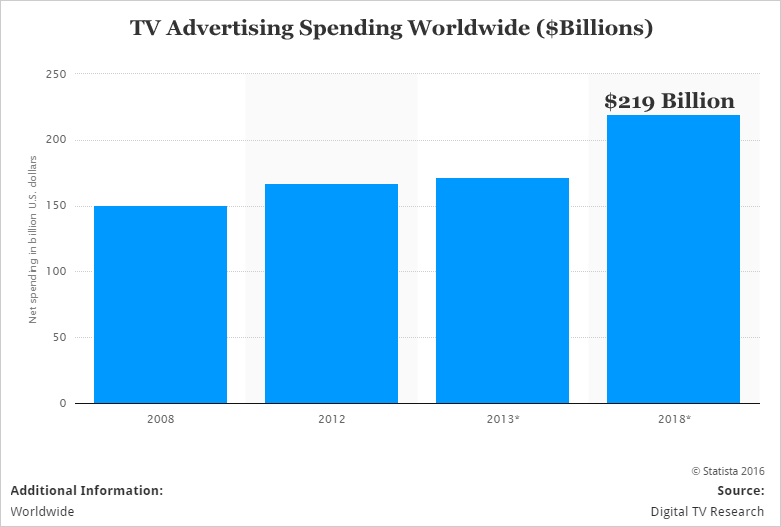

There are 133 million households in the United States alone with a cable TV subscription and 75% of those people watch TV everyday (Source: AYTM). Check out how much is spent on standard Television advertisements:

Worldwide, we're looking at $219 billion in linear TV advertising. Now, we have two numbers -- $219 billion for worldwide TV ads, and $9.14 billion for US online video ads.

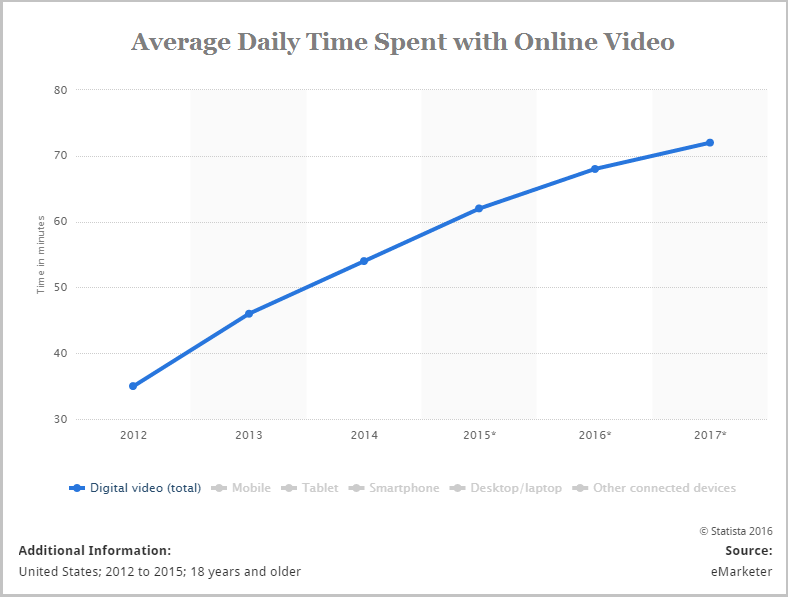

Take a step back. There are nearly 4 billion people worldwide online, substantially higher than the number of people with a TV. Further, online video consumption is exploding.

Remember, not only does YouTube crush the entire linear TV world on its own, but both Facebook and Snapchat receive over 10 billion video views a day on their platforms. Check this data out:

If we take data back to 2011, we see that the time adults spend watching digital video each day has increased from 21 minutes in 2011 to one hour and 16 minutes in 2015. Even further, eyeballs are moving from regular television to online video:

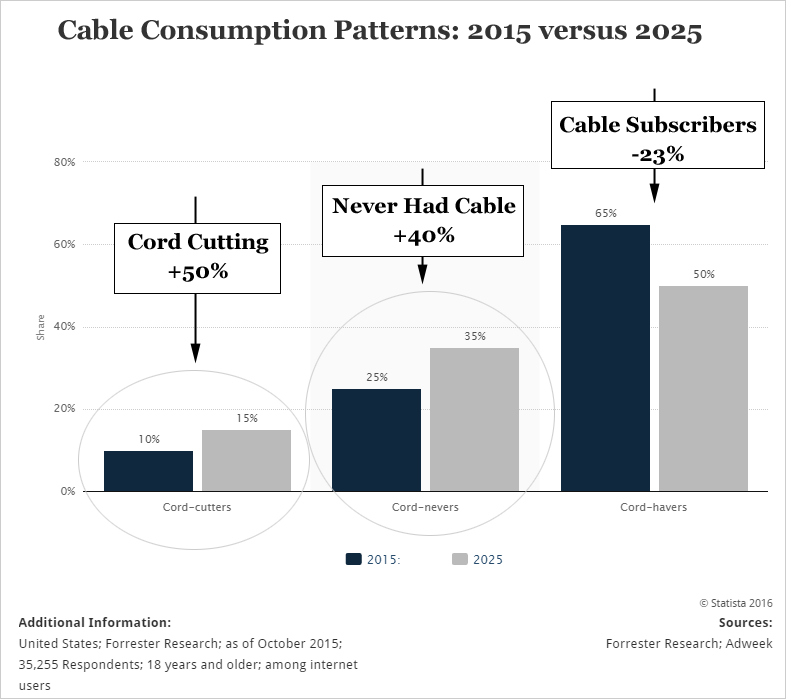

The red portion is linear TV, the black portion is online video. And, just to hammer the point home further, here is a chart surrounding cable cord cutting. This is a wonderful visual from our friends at Statista covering people aged 18-31:

There is a revolution coming and it's right in front of our eyes. Online video will have twice as many viewers as linear TV, growing time spent per day and a disastrous cord cutting phenomenon for cable companies. Friends, that linear TV advertising number is going to go to online video, and then some.

You want proof? Here's what the beginning of a revolution looks like: On May 24th, CML Pro reported this:

“

There is a juggernaut advertisement buying firm called Magna Global that is responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola.

The company just announced that it has moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads.

There is a juggernaut advertisement buying firm called Magna Global that is responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola.

The company just announced that it has moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads.

”

Source: CML Pro

Now, recalling everything we have just learned about online video and we can see plainly that this is not about a $200 million win for YouTube, it's about a quarter trillion tsunami coming to online video.

BACK TO Twitter (NYSE:TWTR) and Future Earnings

And now, finally, we can see what's going on with Twitter We can reprise it:

The company has signed deals for live video with the NFL, MLB, NHL, NBA, MLS, Premier League, Wimbledon, Pac-12 and more NCAA. Further, the firm has signed partnerships with politics and financial TV. And it's only the beginning.

So what is Twitter doing? The company is getting out in front of the tsunami of advertising dollars that will be spent and it's going to get more than its fair share. It's a wave (pardon the repeated metaphor), a radical shift in the way advertising dollars will be spent that will have no other comparison. It will be bigger than the advent of the TV, because there are more people on line, who are more engaged.

This is the bullish thesis for Twitter and there is no other one. This is also the bullish thesis for Facebook and Google. The belief is that earnings will grow from the online video revolution at accelerated rate for a decade to come.

A revolution is coming, and owning Twitter (NYSE:TWTR) stock is a bet that the company will get a more than fair share of that revolution. That's it.

WHY THIS MATTERS

Twitter, Facebook and Google will generate nearly all of their business from advertising and they are both leading the way in the revolutionary new ad format that is online video which is growing so quickly that it will someday over take standard linear Television ads. It turns out that there is one technology company that will power this revolution, regardless of whether it's Facebook, Google, Twitter, or whomever that will end up with the largest audience.

It's identifying trends and companies like this this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.