Twitter Inc Deals Continue

Twitter Inc (NYSE:TWTR) Deal Making Stays Hot

Preface

Facebook and Google just crushed earnings and both firms are now at all-time highs in stock price. Twitter, on the other hand, wiffed on its revenue guidance for this quarter and the stock plummeted off of that news. But, while the revenue growth has been weak, the deal making has not.

Twitter Inc (NYSE:TWTR) has had a prolific last few months in terms of making deals surrounding streaming video and the trend will continue as it has now added the English Premier League through a partnership with Sky Sports.

STORY

Twitter Inc has penned a deal with Sky Sports, the number one digital destination for sports in the UK, to stream English Premier soccer highlights and even some live games. Here's a snippet from The Guardian.

“

Twitter users in the UK and Ireland will be able to see video clips of key moments and goals from all games broadcast by Sky in real time via the SkyFootball Twitter account

Twitter users and Sky Sports subscribers in Ireland will also be able to see video content in real time from the Saturday 3pm games, which are traditionally not shown on TV.

Twitter users in the UK and Ireland will be able to see video clips of key moments and goals from all games broadcast by Sky in real time via the SkyFootball Twitter account

Twitter users and Sky Sports subscribers in Ireland will also be able to see video content in real time from the Saturday 3pm games, which are traditionally not shown on TV.

”

While this deal is isolated to the United Kingdom and Ireland, Sky Sports has a tremendous footprint, with 30 million viewers. But the real story is how these deals continue to define the identity that Twitter Inc has long needed.

Twitter Inc has had a prolific quarter of partnership deals signed during the quarter surrounding live streaming video including the NFL, NBA, MLB, MLS, NHL, Wimbledon and a lot of collegiate athletics, including the Pac-12. We can now add the English Premier League.

While the company disappointed investors with its guidance for Q3 revenue coming in at $600 million versus analyst expectations of $680 million, the deal making side of the business is clearly on a hot streak.

THE NARRATIVE

The narrative for Twitter is now much simpler than it was just a few months ago. The company aims to be a leader in online streaming video, much of it live. While the company has secured a host of sports deals, it goes further and should continue. Twitter Inc has also secured deals with Bloomberg for two daily shows and with CBS surrounding the upcoming U.S. presidential election.

While Twitter Inc has 313 million monthly average users that are logged in, the company has continually boasted its 500 million additional monthly users that are not logged in. One of the great concerns and failures for Twitter Inc has been its ability to turn those users into repeat visitors, logged in users, and eventually a part of the Twitter Inc advertising ecosystem.

With live streaming sports deals, Twitter has paved the way for an easier usage experience for the non-Twitter expert. Landing on a live stream of sports, a highlight show, or any other online video event is much easier than bending a new visitor's mind around how to use the Twitter Inc platform.

If Twitter Inc (NYSE:TWTR) is able to turn its technology on so it can grab some of the online video advertising in budgets which have traditionally come from a different part of the budgeting process than generic social media budgets, then the company may in fact be paving the road for an increase in new users, engagement and advertising revenue. The deals must continue, and the technology must hold up.

But there's more to this story.

A REVOLUTION

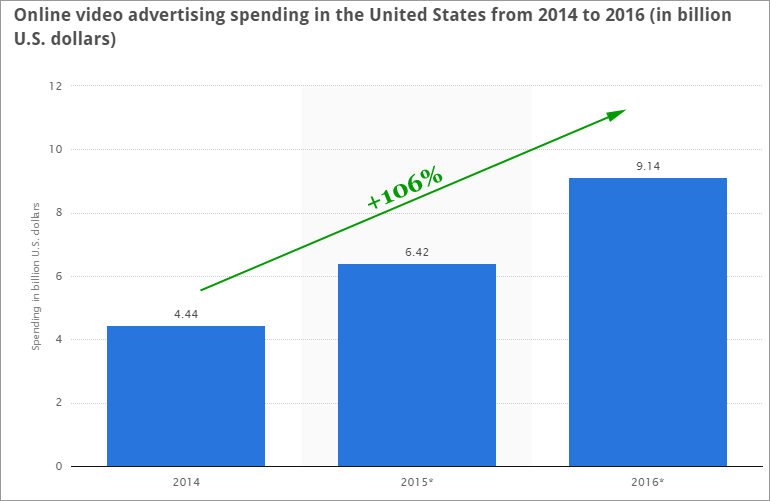

Online video advertisements are expected to grow from $6.42 billion in 2015 to $9.14 billion this year. Here's an image:

As of 2014, globally, more than 1.4 billion households owned at least one TV set and "virtually all" households in the developed world now own a TV set while 69% own at least one set in developing countries. In Africa in particular, fewer than a third of the households own a TV set; one of the main reasons for the low rate is the limited access to electricity.

There are about 730 million people paying for cable TV.

Source: TV Technology

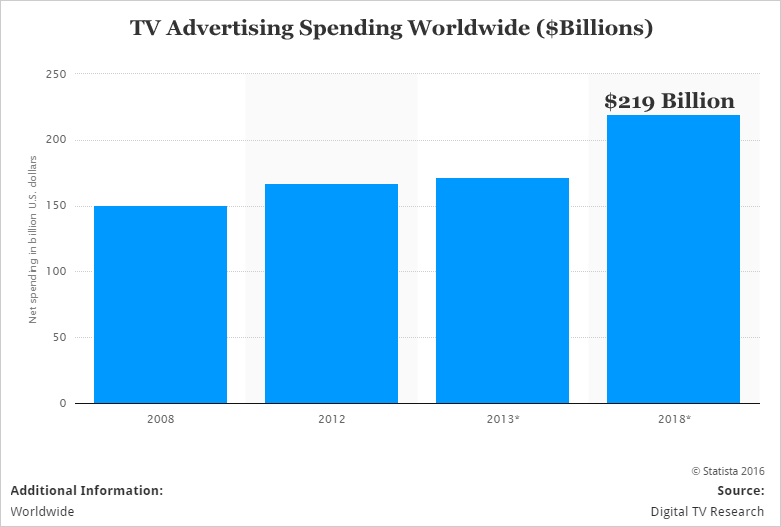

There are 133 million households in the United States alone with a cable TV subscription and 75% of those people watch TV everyday (Source: AYTM). Check out how much is spent on standard Television advertisements:

Worldwide we're looking at $219 billion in linear TV advertising. Now, we have two numbers -- $219 billion for worldwide TV ads, and $9.14 billion for US online video ads.

Take a step back. There are nearly 4 billion people worldwide online, substantially higher than the number of people with a TV. Further, online video consumption is exploding.

Remember, not only does YouTube crush the entire linear TV world on its own, but both Facebook and Snapchat receive over 10 billion video views a day on their platforms. Check this data out:

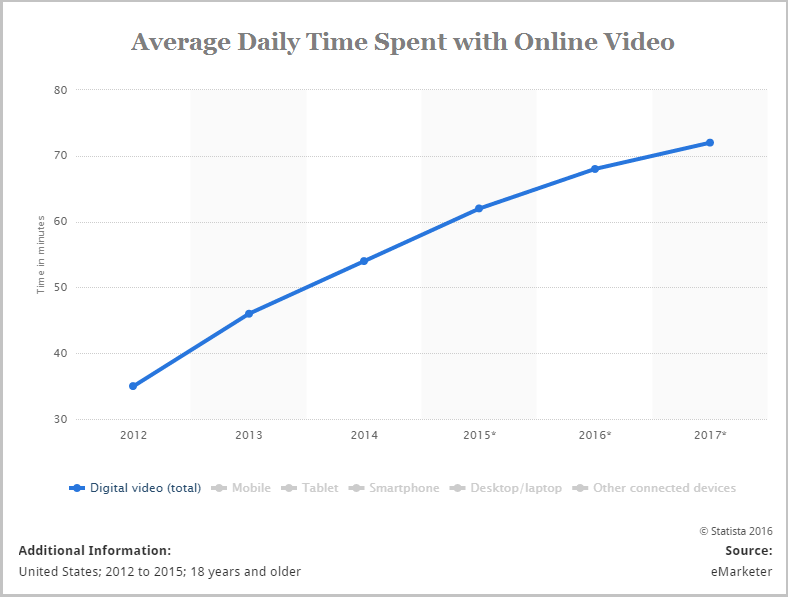

If we take data back to 2011, we see that the time adults spend watching digital video each day has increased from 21 minutes in 2011 to one hour and 16 minutes in 2015. Even further, eyeballs are moving from regular television to online video:

The red portion is linear TV, the black portion is online video. Online video will have twice as many viewers as linear TV, growing time spent per day and a disastrous cord cutting phenomenon for cable companies. Friends, that linear TV advertising number is going to go to online video, and then some.

You want proof? Here's what the beginning of a revolution looks like: On May 24th, CML Pro reported this:

“

There is a juggernaut advertisement buying firm called Magna Global that is responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola.

The company just announced that it has moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads.

There is a juggernaut advertisement buying firm called Magna Global that is responsible for around $37 billion in marketing investments on behalf of clients like Johnson & Johnson and Coca-Cola.

The company just announced that it has moved $200 million in ad spends away from TV ads and to Google's YouTube for online video ads.

”

Source: CML Pro

Now, recalling everything we have just learned about online video and we can see plainly that this is not about a $200 million win for YouTube, it's about a quarter trillion tsunami coming to online video.

The author is long shares of Twitter Inc (NYSE:TWTR).

WHY THIS MATTERS

Facebook and Google just crushed earnings and nearly all of their business comes from advertising. But that world is changing dramatically toward video. It turns out that there is one technology company that will power this revolution, regardless of whether it's Facebook, Google, Twitter, or whomever that will end up with the largest audience.

It's identifying trends and companies like this this that allows us to find the 'next Apple' or the 'next Google.' This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usages worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.