Twitter Inc. (NYSE:TWTR) Has a Future

Twitter Inc. (NYSE:TWTR) Has a Future

Date Published: 2016-10-06Author: Ophir Gottlieb

Written by Ophir Gottlieb

Twitter Inc. (NYSE:TWTR) has a future and it has nothing to do with a takeover.

Preface Twitter Inc. (NYSE:TWTR) is a Spotlight Top Pick for CML Pro. The stock has catapulted higher on takeover rumors and today is tumbling lower based on yet more rumors that many of the potential suitors have stepped aside with no intention to bid for the company right now.

Here's why none of that matters at all.

BEFORE THE STORY, COMES THE THEME

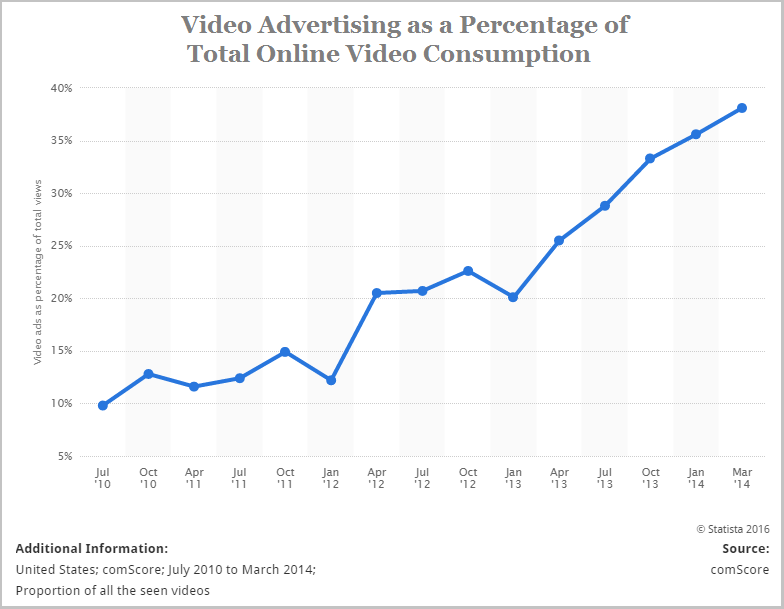

Before we get into the story, we remind everyone of the themes. Twitter Inc. (NYSE:TWTR) is a Top Pick for CML Pro in an attempt to participate in several thematic forces. First, we look at video advertising as a percentage of total online video consumption in the United States.

This chart, in English reads: this is what percentage of videos now have ads. This chart stops at 2014, but we can see the trend - if there's an online video, it's likely going to have an advertisement.

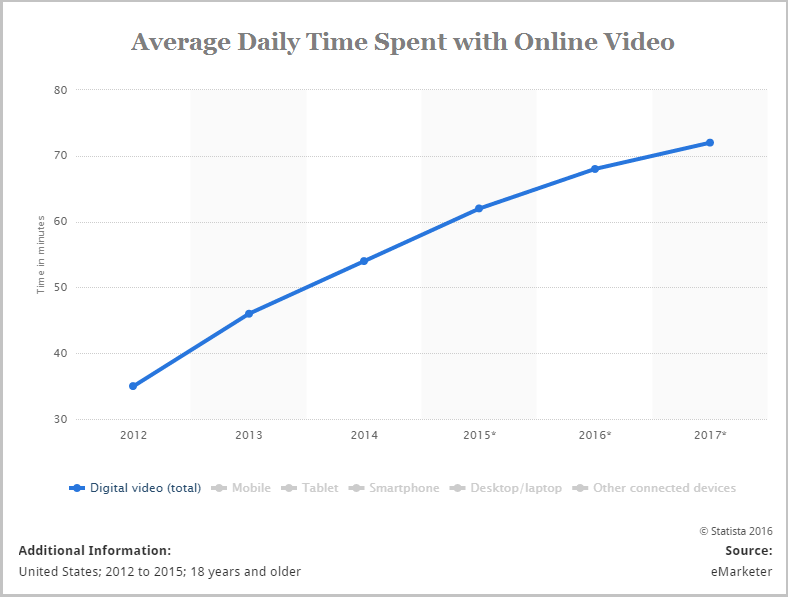

Here is our second thematic chart: This plots the average amount of time spent per day for U.S. adults with online video:

Again, the trend is decidedly upwards. In fact, if we take data back to 2011, we see that the time adults spend watching digital video each day has increased from 21 minutes in 2011 to one hour and 16 minutes in 2015. Even further, eyeballs are moving from regular television to online video:

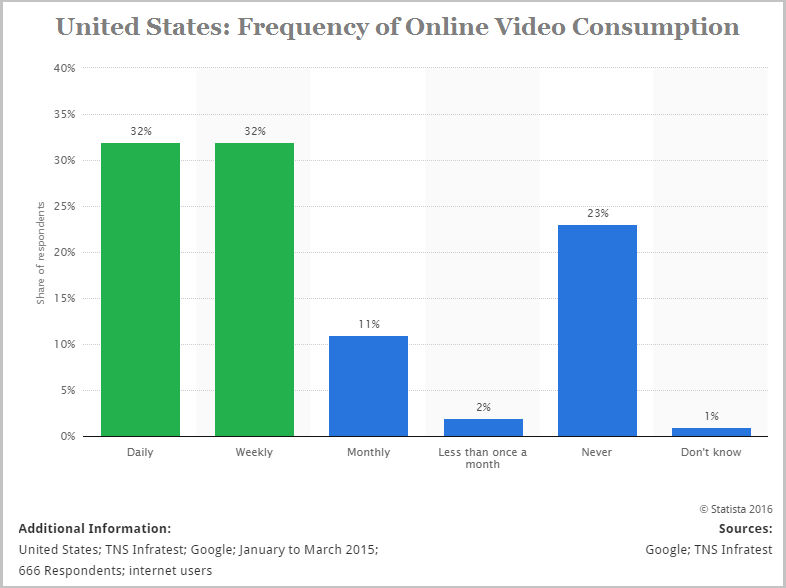

And our next to final thematic chart plots online video viewing frequency:

Nearly two-thirds of the population in the United States watch online video at least weekly, with a third watching it daily.

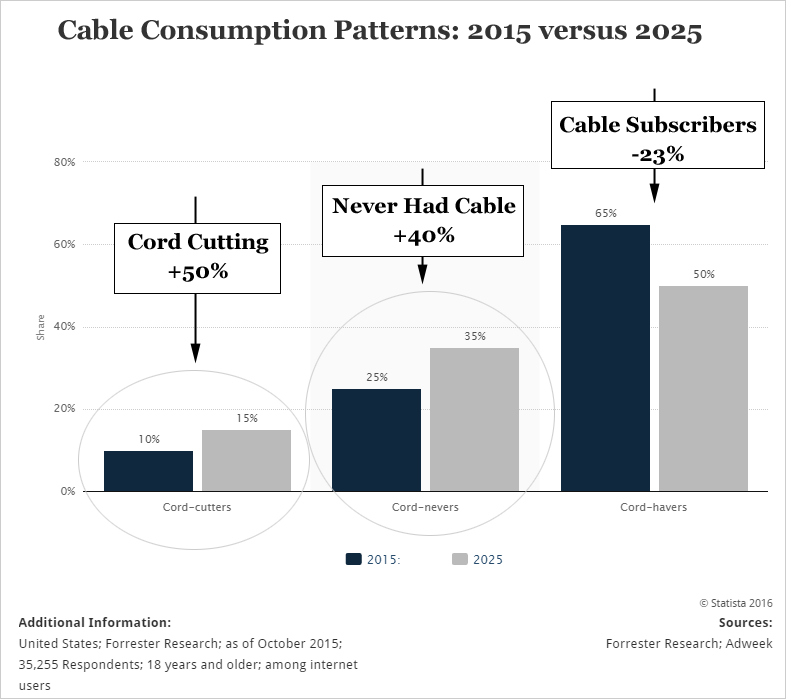

Finally, cable cord cutting is happening. This is a wonderful chart from our friends at Statista covering people aged 18-31:

None of these trends have anything to do with a takeover.

STORY

First, I do believe that owning a stock simply for the chance of a takeover is likely the worst investment thesis possible. If you find yourself in that position with Twitter Inc. (NYSE:TWTR), it may be time to sell, for no other reason than there are so many other fantastic investments out there, put your money to use in a company you really believe in.

Second, the real story...

We hold Twitter Inc. (NYSE:TWTR) as a Top Pick because we believe there is a reasonable bullish thesis that the stock could rise. That rather long thesis is elucidated in the Top Pick dossier which is available here: Social Media, Digital Advertising, Online Video: Twitter is Poised for Growth and in the charts we discussed above.

But, without diving head first into the long story, there's a shorter one to be told.

WHAT'S REALLY HAPPENING

I have no idea which rumors are true, but I have a pretty strong understanding of what is actually happening. These are the facts, and they are not disputed:

- On October 4th we divulged that Twitter signed its largest video advertising campaign ever through its Amplify ecosystem. To bring that dossier to the forefront, here is a snippet:

Twitter Inc. has had several deals through its Amplify video ad product, but according to Mike Park, the director of content partnerships and Amplify, Twitter has never signed a deal of this size before.

"

Twitter Inc. has had several deals through its Amplify video ad product, but according to Mike Park, the director of content partnerships and Amplify, Twitter has never signed a deal of this size before.

That comment is critical because the NFL deal with Twitter was also through Amplify, and as far as the world has been told, that deal will generate $50 million in video ad revenue.

Twitter Inc. has had several deals through its Amplify video ad product, but according to Mike Park, the director of content partnerships and Amplify, Twitter has never signed a deal of this size before.

That comment is critical because the NFL deal with Twitter was also through Amplify, and as far as the world has been told, that deal will generate $50 million in video ad revenue.

"

- On September 21st we reported that Twitter Inc. (NYSE:TWTR) had struck a deal with Bloomberg. Shortly thereafter, Twitter announced that the first debate was the most tweeted event ever.

- On September 19th we reported that Twitter reached 2.1 million viewers for its first NFL game and the next week we learned the number climbed to 2.3 million.

- On September 14th we noted that Twitter had struck a deal with Amazon.com, Apple and Microsoft to bring a stand-alone Twitter app for the FireTV, Apple TV and Xbox 1, respectively, reaching audiences without a Twitter Inc. account.

- Throughout the year we have learned of Twitter's numerous partnerships to live stream sports. The deals include every major sports franchise in the United States: Football, Basketball, Baseball, Hockey and Major League Soccer. The company also has partnerships with many of the major collegiate conferences, as well Wimbledon and the English Premiere league.

- Last earnings call we learned that video advertising now makes up the largest single contributor to revenue for Twitter, which is remarkable given that the facility didn't even exist a year ago.

As we know, streaming video and video advertising are one of the revolutionary changes coming to technology that will change the advertising landscape like the radio did in the 1920s and the television did in the 1950s. This is a part of the bullish thesis for other Top Picks Alphabet (GOOGL) and TubeMogul.

- Last earnings call we also learned that Twitter added 5 million monthly active users (MAUs) for the quarter, the largest addition in a year, albeit, still small.

CIRCUMSTANTIAL EVIDENCE

The next bit is circumstantial, so we cannot in good faith declare it fact.

- On October 4th in that same dossier where we discuss the largest video advertising deal for the company, we also saw pretty compelling evidence that Twitter Inc. had received advertising purchases from political parties and that they were delivered using a targeted marketing strategy. "Targeted" is code word for "more expensive."

- In early October Twitter Inc. (NYSE:TWTR) announced that it now allowed all users to create "Moments" and any regular Twitter user can see them popping up fairly often now. That indicates engagement.

- Since the NFL deal we have circumstantial evidence that Twitter Inc. is adding more new users by observing the apps 'popularity' in the Apple App Store.

SO, NOW WHAT?

I don't mean to sound crass, but I don't really care about a takeover. It would be great if it happened, but we never invest in companies for that reason. The road to success for Twitter will be a tough one, but the narrative surrounding the company and its "failures" are old, look back years rather looking forward even months and are essentially useless.

An investment in any company is a belief in the future. While the past can guide us, it doesn't have an actual impact on the future value. We believe Twitter has an opportunity to show growth and reinvigorated importance as an advertising alternative to Facebook and Google. But we could be wrong -- it's just our opinion based on a collection of facts and some circumstantial data.

WHAT HAPPENS TO TWITTER STOCK?

If there is no takeover, the next big event for Twitter Inc. is the earnings release on October 27th. If the company doesn't show growth or signs of future growth, this could be a $10 stock. On the other hand, if it does show signs of growth, the stock could rise abruptly, and I can almost assure you, the takeover saga will start all over again.

The author is long shares in Twitter Inc. (NYSE:TWTR).

WHY THIS MATTERS

Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals. Of our Top Picks, Nvidia is up 110% since we added it. Ambarella is up 112% since we added it. Relypsa was taken over for a 60% gain and we are already up 60% on Twitter when we added it to Top Picks for $15.60.

To become a CML Pro member it's just $25 a month with no contract. It's that easy -- you cancel at any time, instantly.

Each company in our 'Top Picks' portfolio is the single winner in an exploding thematic shift like self-driving cars, health care tech, artificial intelligence, Internet of Things, drones, biotech and more. For a limited time we are offering CML Pro at a 75% discount for $25/mo. with a lifetime guaranteed rate. Get the most advanced premium research along with access to visual tools and data that until now has only been made available to the top 1%.