Viacom Inc, VIAB, bullish, options, 90/40 delta, call spread, TTM Technical Squeeze

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

LEDE

VIAB just broke out of a squeeze into a bullish signal.

This is one of the those remarkable few times where in the midst of a bull market we can see that Viacom Inc (NASDAQ:VIAB) stock is actually down -40.98% over the last 5 years. Yet, in that same time frame, using a bullish technical signal on a stock that has dropped has actually shown substantial positive historical returns of 200% in the face of a stock down trend.

This is a technical analysis triggered momentum trade that bets on a bullish move in the underlying stock for a period that starts the day Viacom Inc (NASDAQ:VIAB) triggers a breakout from the TTM Squeeze signal and lasts until two-days in a row show reversed (bearish) momentum. It has been a winner for the last 5 years.

Viacom Inc (NASDAQ:VIAB) IDEA: TTM Squeeze Technical Trigger

The idea is simple -- stocks tend to move in tight ranges for the majority of the time, and then they move in bursts for the remaining periods. The breakout from the TTM Squeeze attempts to find these bursts.

Here is a simple graphic, where the gray line is the daily stock price, the blue bars comprise the tight squeeze zone, and then we see the break out into a bearish move. Roughly speaking, this is the pattern that this technical indicator is attempting to identify and back-test. The squeeze period must last at least 6-trading days for it to register as a squeeze.

And to bring this to a more tangible place, here is the actual chart of VIAB over the last three-months:

That's what a squeeze looks like, and what it looks like when there is a bullish breakout.

Rules

* Open the long 90/30 delta call spread on the day the TTM Squeeze has been broken with upside momentum.

* Close the call after that signal has seen a consecutive two-day reversal.

* Use the options closest to 15 days from expiration.

* Never trade earnings -- irrespective of the technical indicator, this trade will close 2-days before a scheduled earnings announcement.

This is a straight down the middle bullish bet -- this trade wins if the stock rises and will lose if the stock does not.

DISCOVERY

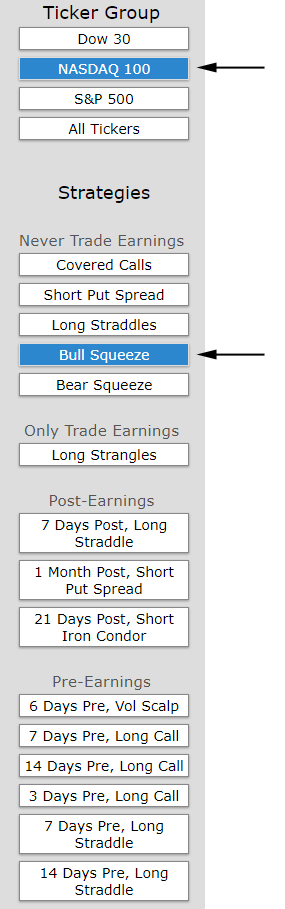

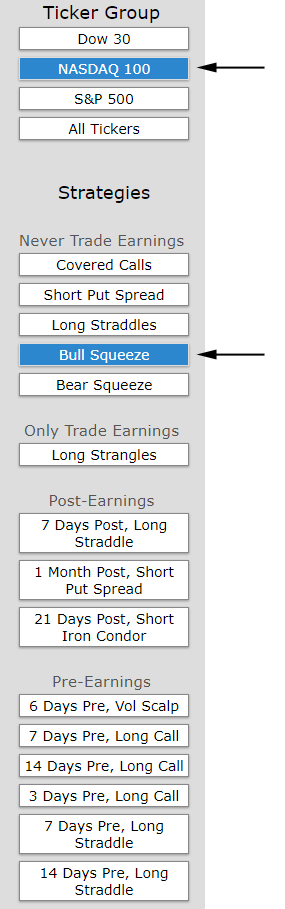

We found this back-test by using the Trade Machine Pro Scanner, looking at the NASDAQ 100 and Bull Squeeze candidates that are breaking out right now.

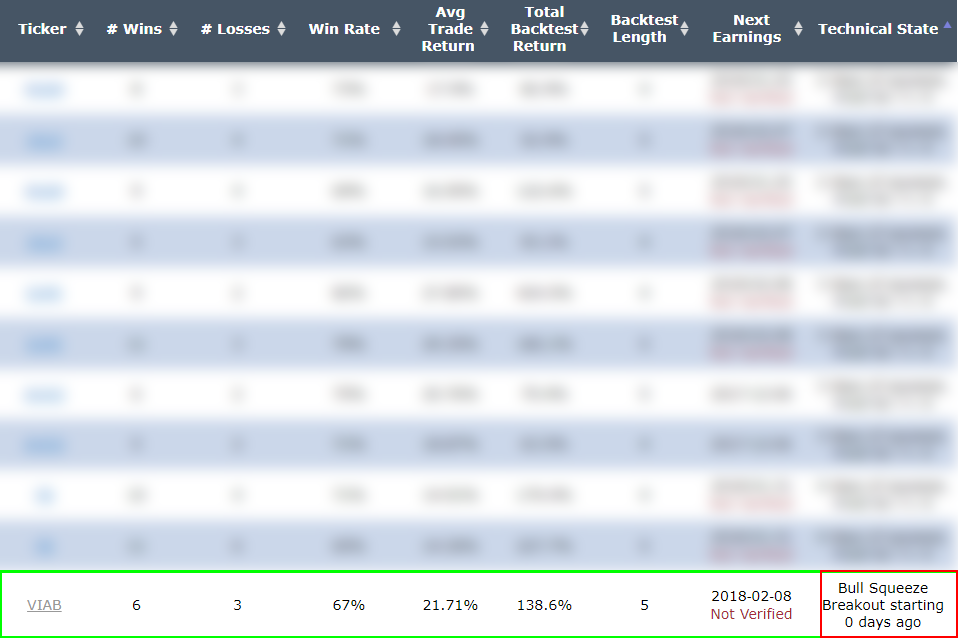

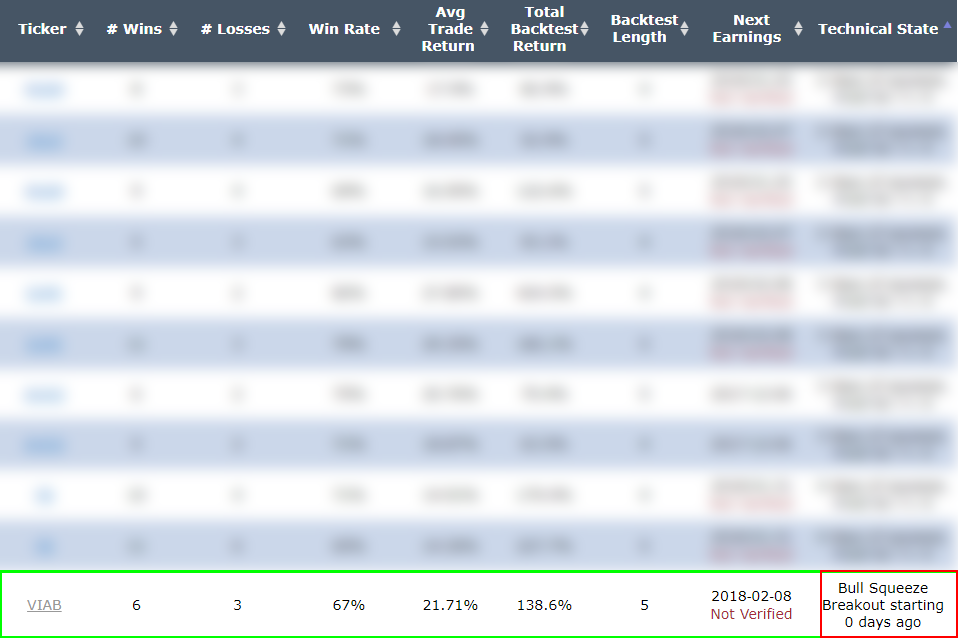

And this is what we fond:

RESULTS

Owning the 90/30 delta call spread in Viacom Inc (NASDAQ:VIAB) over the last five-years but only held it after a TTM Squeeze was triggered we get these results:

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 200% back-test return, which is based on 9 trades in Viacom Inc. A bullish breakout from the TTM Squeeze is a technical signal that doesn't happen often, but rather is designed to mechanically identify the times when a stock is in a low volatility period and may be about to thrust higher. It's a signal based on probabilities, not absolutes, so it won't work all the time.

Looking at Averages

The overall return was 200%; but the trade statistics tell us more with average trade results:

➡ The average return per trade was 25.6%.

➡ The average return per winning trade was 52%.

➡ The average return per losing trade was -27.2%.

CAUTION: A NOTE ON RISK

While this is a back-test which is based on probabilities, we do note that over the last three-years, this signal has not been strong in VIAB, showing 1 win, 3 losses, and a negative average return of -8.6%. We have seen stronger back-tests that have lasted a full five-years. But, this is happening right now, and is worth noting.

Technical Details

For the details about the TTM Squeeze, how it works, when it's triggered and what it means, you can read our dossier The details behind the TTM Squeeze Technical Indicator .

WHAT HAPPENED

To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

The Bullish Technical TTM Squeeze With Options in Viacom Inc

Viacom Inc (NASDAQ:VIAB) : The Bullish Technical TTM Squeeze With Options

Date Published: 2017-11-29Author: Ophir Gottlieb

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

LEDE

VIAB just broke out of a squeeze into a bullish signal.

This is one of the those remarkable few times where in the midst of a bull market we can see that Viacom Inc (NASDAQ:VIAB) stock is actually down -40.98% over the last 5 years. Yet, in that same time frame, using a bullish technical signal on a stock that has dropped has actually shown substantial positive historical returns of 200% in the face of a stock down trend.

This is a technical analysis triggered momentum trade that bets on a bullish move in the underlying stock for a period that starts the day Viacom Inc (NASDAQ:VIAB) triggers a breakout from the TTM Squeeze signal and lasts until two-days in a row show reversed (bearish) momentum. It has been a winner for the last 5 years.

Viacom Inc (NASDAQ:VIAB) IDEA: TTM Squeeze Technical Trigger

The idea is simple -- stocks tend to move in tight ranges for the majority of the time, and then they move in bursts for the remaining periods. The breakout from the TTM Squeeze attempts to find these bursts.

Here is a simple graphic, where the gray line is the daily stock price, the blue bars comprise the tight squeeze zone, and then we see the break out into a bearish move. Roughly speaking, this is the pattern that this technical indicator is attempting to identify and back-test. The squeeze period must last at least 6-trading days for it to register as a squeeze.

And to bring this to a more tangible place, here is the actual chart of VIAB over the last three-months:

That's what a squeeze looks like, and what it looks like when there is a bullish breakout.

Rules

* Open the long 90/30 delta call spread on the day the TTM Squeeze has been broken with upside momentum.

* Close the call after that signal has seen a consecutive two-day reversal.

* Use the options closest to 15 days from expiration.

* Never trade earnings -- irrespective of the technical indicator, this trade will close 2-days before a scheduled earnings announcement.

This is a straight down the middle bullish bet -- this trade wins if the stock rises and will lose if the stock does not.

DISCOVERY

We found this back-test by using the Trade Machine Pro Scanner, looking at the NASDAQ 100 and Bull Squeeze candidates that are breaking out right now.

And this is what we fond:

RESULTS

Owning the 90/30 delta call spread in Viacom Inc (NASDAQ:VIAB) over the last five-years but only held it after a TTM Squeeze was triggered we get these results:

| VIAB: Long 90/30 Delta Call Spread

Signal: TTM Technical Squeeze |

|||

| % Wins: | 67% | ||

| Wins: 6 | Losses: 3 | ||

| % Return: | 200% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 200% back-test return, which is based on 9 trades in Viacom Inc. A bullish breakout from the TTM Squeeze is a technical signal that doesn't happen often, but rather is designed to mechanically identify the times when a stock is in a low volatility period and may be about to thrust higher. It's a signal based on probabilities, not absolutes, so it won't work all the time.

Looking at Averages

The overall return was 200%; but the trade statistics tell us more with average trade results:

➡ The average return per trade was 25.6%.

➡ The average return per winning trade was 52%.

➡ The average return per losing trade was -27.2%.

CAUTION: A NOTE ON RISK

While this is a back-test which is based on probabilities, we do note that over the last three-years, this signal has not been strong in VIAB, showing 1 win, 3 losses, and a negative average return of -8.6%. We have seen stronger back-tests that have lasted a full five-years. But, this is happening right now, and is worth noting.

Technical Details

For the details about the TTM Squeeze, how it works, when it's triggered and what it means, you can read our dossier The details behind the TTM Squeeze Technical Indicator .

WHAT HAPPENED

To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.