Facebook's Marvel in Five Stunning Charts but Two Unfathomable Risks

Fundamentals

PREFACE

Facebook has developed a collection of technologies whose consumer base looks "increasingly like all of humanity." But, it also faces, perhaps for the first time ever, a true risk from the largest competitor in the world and another risk that may have twisted and turned into an inescapable death spiral. Of course, mark Zuckerberg's genius had evaded "inescapable death spirals" many times before -- this one is larger than ever.

We start with the magnificence of Facebook -- which is critically important before we get to the risk.

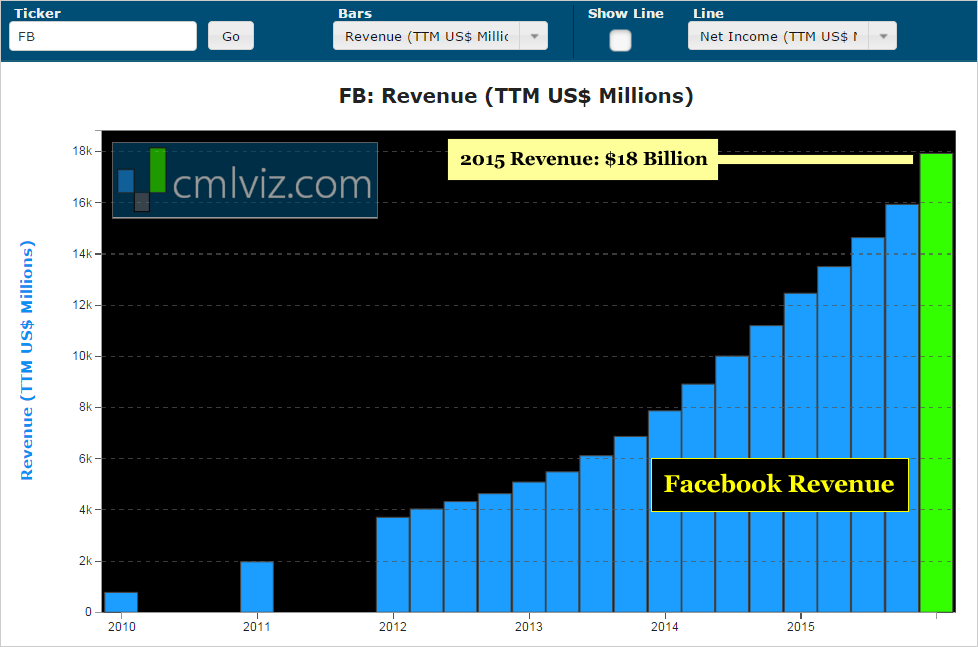

CHARTS 1 & 2: REVENUE

Facebook is part of an elite group creating a new era in business where the leaders are both large and nimble, where pioneering businesses optimize revenue streams while simultaneously taking huge risks with time horizons measured in decades. Here is the company's revenue (TTM) chart over the last sixteen years:

FACEBOOK REVENUE (TTM)

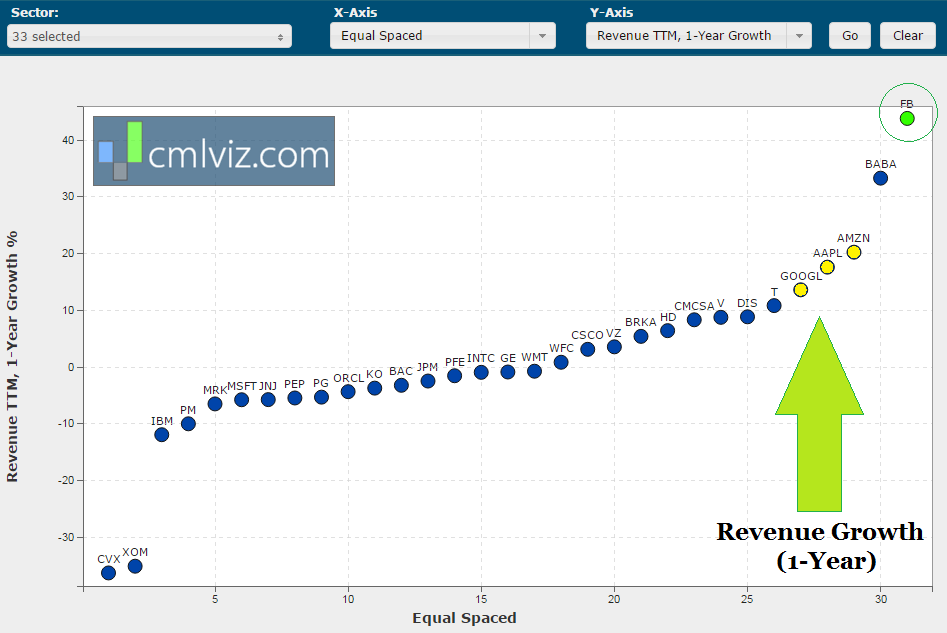

We see 43.8% year-over-year revenue growth. If the company hits 2017 projections, that would be 87% more growth. These are astonishing numbers. But don't take our word for it, here's how it looks relative to every other mega cap in the market:

FACEBOOK REVENUE GROWTH COMPS

That's a chart of every company in every sector over $125 billion in market cap and we can see that FB sits on an island by itself.

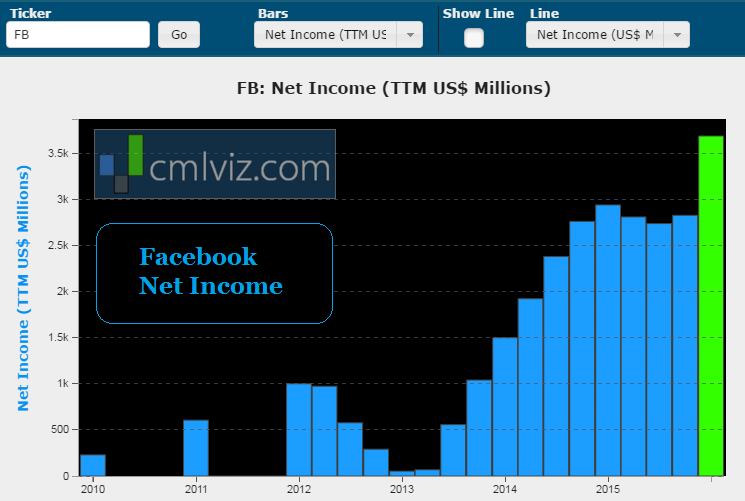

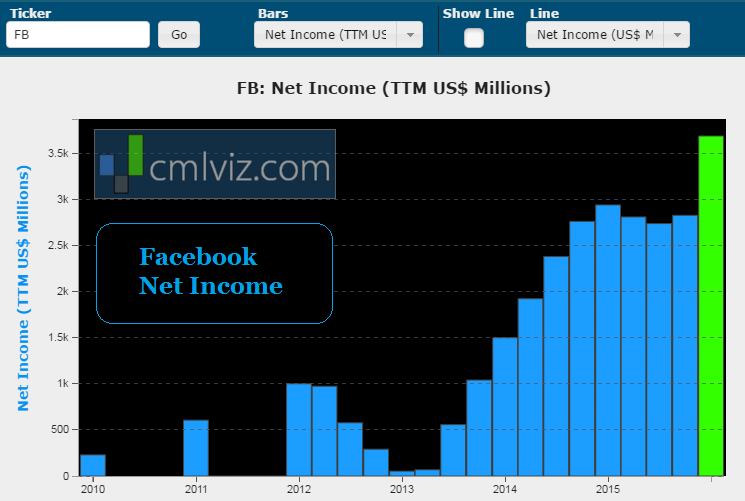

CHART 3: EARNINGS

Facebook is well beyond the phase of young start-up, where companies sacrifice earnings for revenue growth. Here is a chart of the firm's net income through time.

FACEBOOK NET INCOME (TTM)

For the most recent trailing-twelve-months (TTM) the company reported net income of $3.688 billion for a 25% year-over-year rise.

Looking further out, EPS estimates call for $3.14 for calendar 2016 and $4.13 for calendar 2017.

CHARTS 4 AND 5: R & D

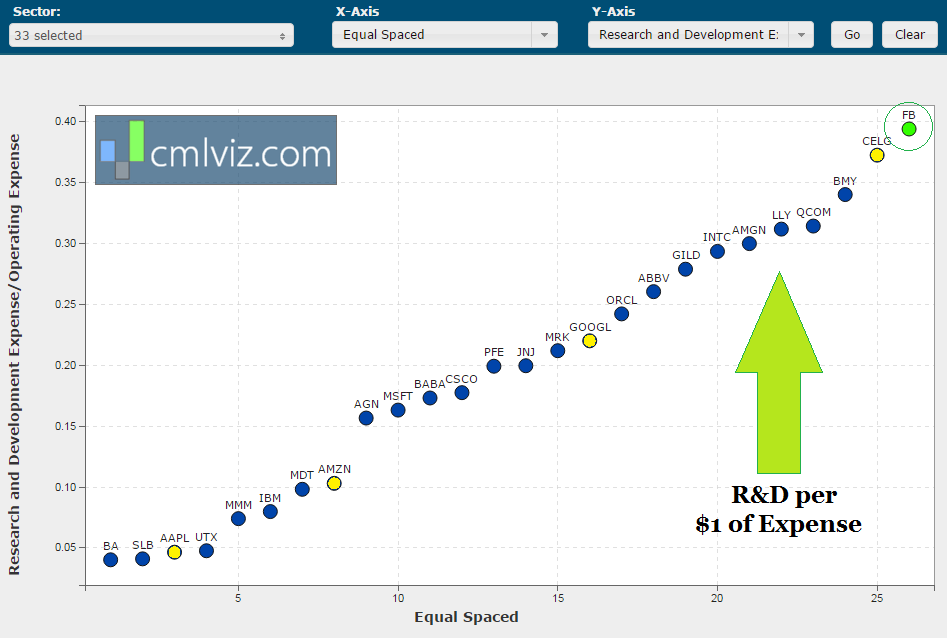

The risk with any high tech company that must stay on the bleeding edge to keep growth moving forward is lack of innovation. We can't say if Facebook will be successful in its efforts, but we can say that the company pours more money in research and development (R & D) per dollar of operating expense than any other company in the market. Here's the chart:

FACEBOOK R & D per $1 OF EXPENSE

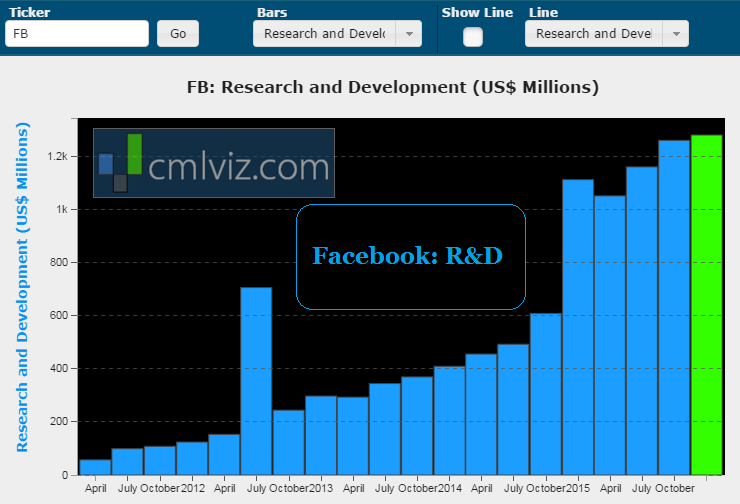

As for the trend through time, here's the chart:

FACEBOOK R & D

Research and Development in the most recent quarter for Facebook was $1.3 billion, up 15% from last year's value and 213% from two-years ago.

And now two incredible risks. The first we know about, the second may be the death spiral.

RISK #1: AD BLOCKING

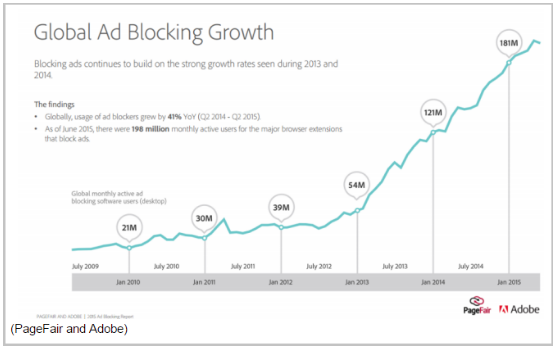

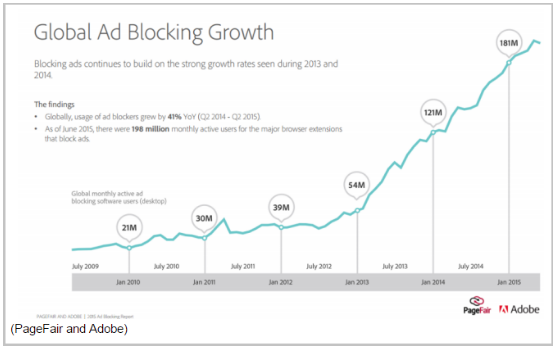

Mark Zuckerberg openly stated on the last earnings call -- the risk of ad blocking apps. According to a report published by PageFair and Adobe, ad blocking software worldwide has increased 41% year-on-year to 198 million monthly active users and is expected to cost publishers more than $21.8 billion in 2015 in lost revenue (BusinessInsider).

Here's the incredible chart:

PROLIFERATION OF AD BLOCKING

Facebook is protected in many ways because access to its various properties sit inside an app, as opposed to exposure to a web browser. But take a step back -- is it really unimaginable for app developers to produce advertising blocking software to be activated inside apps? I'll answer -- no. It's not unimaginable, it might even be likely.

But that's speculation. Risk number two isn't speculation, it's fact.

RISK #2: SOCIAL MEANS FICKLE

In an article from Inc. entitled, "The worst thing that could happen to Facebook is already happening," we learned about a serious threat to Facebook's growth. Here it is:

In the past few months, Facebook has quietly shifted into crisis mode.

According to The Information, "original broadcast sharing"--i.e., posts consisting of users' own words and images--fell 21 percent from 2014 to 2015, contributing to a 5.5 percent decrease in total sharing.

In response, the company created a task force in London whose mission is to devise a strategy to stem the ebb and get people sharing again.

According to The Information, "original broadcast sharing"--i.e., posts consisting of users' own words and images--fell 21 percent from 2014 to 2015, contributing to a 5.5 percent decrease in total sharing.

In response, the company created a task force in London whose mission is to devise a strategy to stem the ebb and get people sharing again.

The article goes on to point out that Facebook, for the past several years, had followed a strategy of getting media companies and celebrities to put more of their premium content on Facebook. it appears that very strategy has "backfired."

In the past few months, Facebook has quietly shifted into crisis mode.

The more Facebook feels like a big stage, the less inviting it becomes to the sorts of people who aren't comfortable performing in public--which is to say, most of us.

The more Facebook feels like a big stage, the less inviting it becomes to the sorts of people who aren't comfortable performing in public--which is to say, most of us.

Facebook has faced the risk of dipping engagement before and stemmed the tide, or in reality, totally flipped the tide, by acquiring companies that have started to take on more relevance. Facebook bought WhatsApp for about $20 billion. Facebook bought Instagram for $1 billion. Further, even in the face of uproarious protest, Facebook broke its messaging system out of the Facebook app and turned it into its own app, now called Facebook Messenger.

While the crowd booed and promised never to use it, Mark Zuckerberg knew better. Facebook Messenger no stands at 900 million monthly average users (MAUs) and now it has the conduit for the firm's forward looking strategies with robot interactions, mobile pay and so much more.

But the reality is, if your ecosystem is entirely social, then it's fickle. And if it's fickle, then there is never a time to rest and never a time that risk isn't seemingly always existential.

This is the magnificent reality of Mark Zuckerberg's genius, Facebook's meteoric rise and the undeniable risk; again.

MORE BURN

Yet more frustrating for Facebook as an investment thesis is that its largest competitors, Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOG) and Amazon (NASDAQ:AMZN) are not based on social fickleness. Apple is an ecosystem of hardware. Google is an ecosystem of search and utility. Amazon is an ecosystem of from device, to application store, to streaming media, to delivery of products to your home.

Facebook is none of these things -- which make it a unique investment and a unique risk. So far, Mark Zuckerberg has won, and he has won huge. But here comes the risk again.

WHY THIS MATTERS

There's so much going on with Facebook it's impossible to cover in one report. It spans almost all of technology's transformative themes. But, to find the 'next Facebook,' 'next Apple,' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.