Apple Pay is Going to be a Colossal Success

Fundamentals

Follow @OphirGottlieb

Apple is humiliating Wall Street's analysts and the main stream media because both lack the lexicon to understand what's actually happening in technology, and that goes for Google, Facebook, Amazon, Microsoft and dozens of technology and biotechnology companies. But this reality is especially apparent when it comes to Apple and the firm is making a fool out of many analysts and journalists.

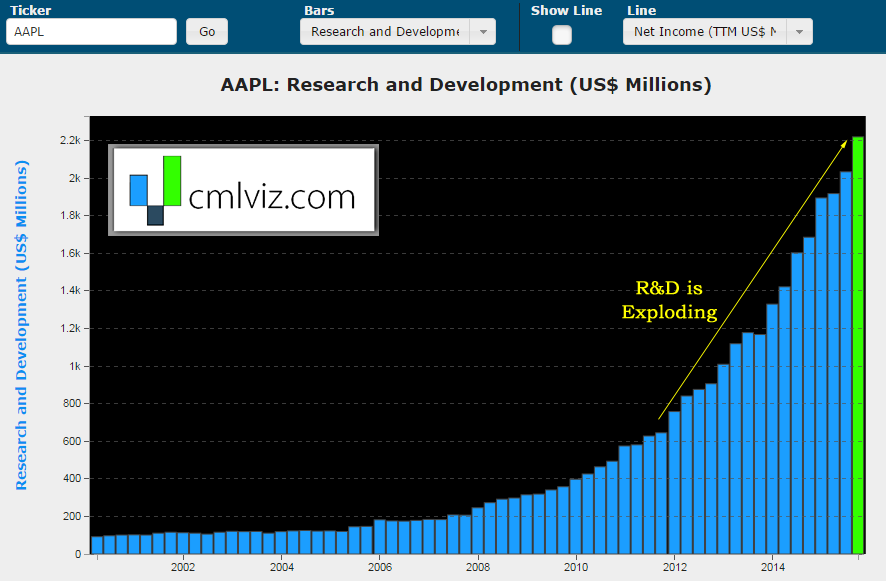

Here's a fact for you that you won't hear elsewhere. Apple's spending in research and development (R&D) is up 90% in the last two-years. Hello?

Do you enjoy using visualizations to understand what's really going on in a company? We do too. Get Our (Free) News Alerts Once a Day.

Apple is investing in a lot of innovation and the iPhone is the hub that powers all of it. While we wrote a complete piece on Apple covering Apple Pay, Apple TV, Apple Watch, Apple Car, 'A-chips', Apple Music and of course the iPhone, we will focus this piece on Apple Pay. Although there has been slow adoption, it appears everything is about to change.

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

When a person holds their iPhone in their hands, they aren't holding an upgraded Ericsson flip phone from 2003. They're holding their wallets. They're holding their keys. They're holding their TV remote. More iPhones means more of Apple in the middle of everything we do. Here's an image of the iPhone as a control center.

iPhone Powers Apple Pay

The largest banks are not only aware, but in bold support of the shift to mobile payment. To the extent that a mobile platform like Apple's increases payment volumes, the banks are ecstatic. Almost every major bank in the world is now an explicit partner to Apple Pay and most have happily agreed to cut transaction costs.

"[Bank of America is] convinced of growth that measures fully 200 fold in just seven years. By the year 2022, the mobile payments growth will reach a combined total of around $3 trillion."

Source: Investor Place

Source: Investor Place

Soon, people will no longer have their wallet in one hand, and their phone in the other and that means an absolutely enormous industry is forming. It also means cash as payment method will all but disappear. This is not a small adjunct, this is a huge, future business line that in and of itself is easily worth $100 billion in market cap.

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

CHINA

It's simply a fact, the mega cap technology companies in the US like Google, Faebook and Amazon can't crack an inch into China while Apple is dominating in the region.

We learned from the Wall Street Journal that Apple aims to launch Apple Pay in China by February of 2016. Apple has finalized deals with China's big four state-run banks (Source: WSJ).

We know that Mobile payment transactions in China increased by 134 percent last year according to Chinese central bank data. We do note that Apple will face serious competition with Alibaba's Alipay and Tencent's WeChat that already dominate the mobile payments sector and we also note that state-run UnionPay holds a monopoly on credit and debit card processing (Source: International Business Times).

But there are a lot of Chinese technology companies trying to fight for space in the smartphone realm, and the bottom line is, Chinese consumer loyalty to Apple is just like American consumer loyalty -- it knows no limits. Remember that Apple grew 99% year-over-year in China per its latest earnings report and that the country accounts for about 50% of operating profits.

Do you enjoy discovering new companies and opportunities and really understanding them? Get Our (Free) News Alerts Once a Day.

UNITED STATES

Stateside, tech firms are obsessed with the getting their payment technology in front of people to send cash to friends using an app, which is already a $7.5 billion market. It's a money losing business, but we see PayPal and its subsidiary, Venmo, are among the most popular, though they face a growing list of competitors, including Google, Facebook, and Square. Here comes Apple.

Why Does This Matter?

Bloomberg reports:

Apple isn't likely to find a way to profit directly from the feature. Instead, the company will probably use it to increase adoption of Apple Pay in stores.

A VP of Paypal put it this way: "We think of it as an engagement play; there’s a monetization aspect that comes second." Richard Crone, chief executive officer at Crone Consulting said that adding the ability for owners of newer iPhone models to send each other money could double usage of Apple Pay by those customers in 18 to 24 months.

"If I send you $50, and you are not on Apple Pay P2P service, you have to enroll in it. It's a viral application."

Source: Bloomberg

Source: Bloomberg

The bottom line is as mobile pay gains traction, people won't be using ATMs or credit cards as much. "If iPhone users start connecting Apple Pay to their bank accounts, they could bypass credit cards entirely when sending money to friends and potentially for in-store payments, cutting out middlemen" (Source: Bloomberg). And, if you want to make a bet on which company will lead the mobile revolution, I'm gonna say it's Apple.

Do you thrive on seeing data that goes way beyond headlines and turns you into an expert? Try CML Pro. No credit Card. No Payment Info. Just the Power.

MONETIZATION

Although the charges in China are unknown, in the U.S. Apple gets 0.15% of all credit-card transactions and 0.5 cents per debit transaction, according to people familiar with the matter. Rickard Crone said "in three to five years, [mobile pay] could take 20 percent of credit transactions." For the record, Visa (V) and masterCard (MA) combined have market caps above $300 billion.

CONCLUSION

Friends, this is a colossal business in and of itself, and it makes up just one little piece of what Apple is becoming. Never has Apple shown so much innovation, spent so much on R&D and at the same time held so much power in the consumer market. Apple Pay is going to be massive. And let's not forget iPhone, iPhone 'mini,' Apple TV, Apple Watch, Apple Car, Apple Music, Mac and the next thing Apple is going to do -- which we don't even know of yet.

This is just one of the fantastic reports CML Pro members get. For a (very) limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the Most Advanced Visual Tools, Data and Stock Research.