Why Apple TV is Brilliant and Seismically Disruptive

Fundamentals

Follow @OphirGottlieb

The Apple TV represents a seismic shift of epic proportions for Apple, the likes of which we have never seen before with an impact that could lift the stock price much higher.. and that's not my opinion, that's from Goldman Sachs.

PREFACE

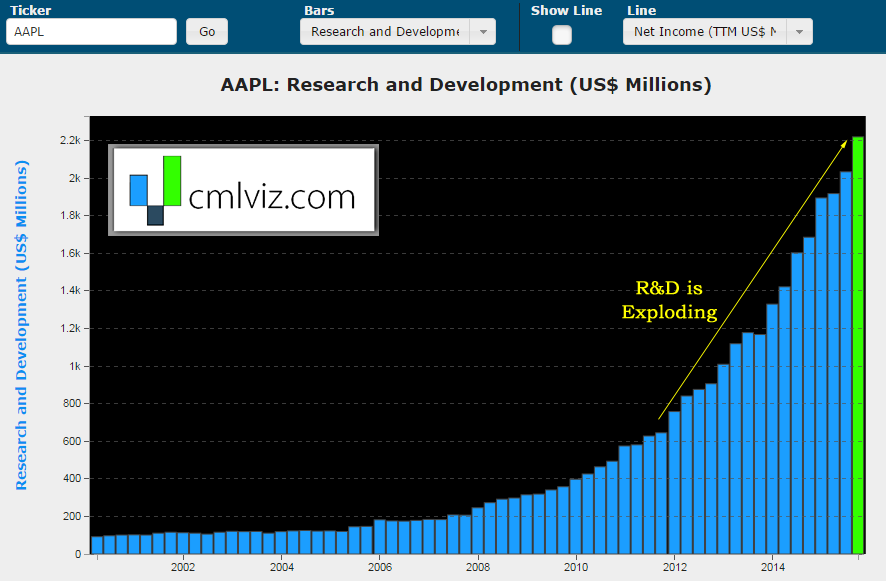

Apple is humiliating Wall Street's analysts and the main stream media because both lack the lexicon to understand what's actually happening in technology. Apple's spending in research and development (R&D) is up 90% in the last two-years and friends, we are about to see a ridiculous amount of innovation.

Do you enjoy using visualizations to understand what's really going on in a company? We do too. Get Our (Free) News Alerts Once a Day.

Apple is investing in a lot of innovation and the iPhone is the hub that powers all of it. While we wrote a complete piece on Apple covering Apple Pay, Apple TV, Apple Watch, Apple Car, 'A-chips', Apple Music and of course the iPhone, and then wrote a stand alone article on Apple Pay, this article will focus on Apple TV.

The Apple TV, though at first blush seem like the easiest to understand, is in fact massively complex in the way it will drive Apple's ecosystem and stock valuation. And by complex, I mean totally brilliant.

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

APPLE TV: INTRODUCTION

Apple started taking orders for the new Apple TV on October 26. (Source: Fortune). A review of Apple TV from WSJ has such a good title, that I'll just leave right here: Apple TV Review: A Giant iPhone for Your Living Room. And a quote:

"Think of Apple’s fourth-generation box as a way to turn your TV into a giant iPhone."

Barron's reported on Global Equities Research's Trip Chowdhry when he said that the Apple TV platform "provides strong indication" that Apple TV will come with its own software development kit and its own app store, i.e. its own Apple TV ecosystem. And there\'s the problem for Netflix, he argues, since in this ecosystem Netflix would be just another app, or a "second-class citizen." (Source: New Apple TV Platform Is Bad News For Netflix: Global Equities).

Expectations are for Apple to sell 25 million TVs in 2016 at price points from $149 to $199. That would yield about $5 billion in revenue, which is about 2% of sales for 2015. But of course, that's not at all what Apple is doing.

Do you thrive on seeing data that goes way beyond headlines and turns you into an expert? Try CML Pro. No credit Card. No Payment Info. Just the Power.

APPLE TV: CONNECTED HOME

Apple TV is the next big move Apple is taking to bring its ecosystem into your home, literally everywhere.

A company called Grid Connect launched new ConnectSense electrical plug sockets with integrated Wi-Fi that support control via Apple’s Siri voice recognition system. So you can turn products on or off with just your voice (Source: Forbes). Of course, the technology goes much further.

The Apple integration means we can monitor the energy use of any devices attached to a ConnectSense socket. Better yet, we can control those devices even when we're away from home through the ConnectSense app now available for the new Apple TV.

The media simply isn't equipped to understand the stock market beyond headlines. Try CML Pro. No credit Card. No Payment Info. Just the Power.

The Critical Element

The ConnectSense sockets make use of Apple's HomeKit technology. Here's how Forbes describes HomeKit:

HomeKit has been designed to provide a secure integrated wireless electronic control system – operated through the new Apple TV – capable of managing almost every aspect of your home. So the relatively straightforward HomeKit application demonstrated by the ConnectSense sockets is just an early toe-dip into what will surely become much deeper home automation waters.

Source: Forbes

Source: Forbes

Our physical homes are going to become the next market place and the Apple TV is now the front door.

Do you enjoy discovering new companies and opportunities and really understanding them? Get Our (Free) News Alerts Once a Day.

APPLE TV: THE REAL MONEY

Sales of Apple TV could still be significantly larger than that $5 billion number, and in fact, if we look back at forecasts of Apple products, basically you can multiply them by some larger number to get the actual result. Given the reviews of Apple TV, I think a 2x is not unlikely.

But, Apple TV will rise revenue and earnings earnings indirectly by increasing more software sales and subscriptions, and strengthening Apple's larger ecosystem.

The Motley Fool reports that Apple is rumored to be working on a subscription TV service, one that would serve as a replacement for traditional pay-TV providers. This service is expected to be priced at around $30 to $40 per month. Now, take a breath here.

I want you to imagine that as cable dies (and we all know cable is dying), that the millions of Apple customers will start to look for alternatives and find one that is totally and beautifully integrated into their iPhones, iPads, iPods, Apple Watches, Macs and Apple Music. This is where Netflix becomes an "app" rather than a stand alone service, and it's where Apple starts to dominate in yet another area of our lives.

We will have connected homes, connected phones, wearables, cars (yes, cars), TVs and music. In fact, in that same Motley Fool article we read, "Apple Music is also likely to get a boost, as Apple TV owners will be able to send their streaming music to their home theater setup."

We write one story a day to uncover new opportunities and break news. Come on in: Get Our (Free) News Alerts Once a Day.

WHY THIS IS HUGE

Up until now, Apple has been priced as a hardware maker -- after all, that's what it does. But Goldman Sachs added Apple to its "conviction buy list" recently and a good part of that thesis surrounded the idea that Apple would start to get a valuation of a service and software company. As point of reference, Apple's price to earnings ratio is 9 today, while Google's is 32. You see, Google's ad model is considered recurring revenue, as opposed to Apple's hardware model.

Apple TV is just the start to a shift for Apple into subscription businesses, and that shift could literally lift the stock by 50% simply by changing the way the market values the firm, aside from the obvious massive opportunities in revenue and earnings growth.

Do you thrive on really understanding opportunities, beyond headline noise? Come on in: Get Our (Free) News Alerts Once a Day.

We know that Apple's App Store revenue continues to grow quickly and revenue in its services segment -- which includes the App Store -- rose 12% year-over-year last quarter, breaking the $5 billion mark and hitting an all-time high.

Apple's management cited growing demand for mobile apps as the key driver. Apple TV will give app developers a new way to reach consumers, and makes developing for Apple more attractive.

Source: The Motley Fool

Source: The Motley Fool

And better yet, if people are buying Apple TV's, they aren't dropping their iPhones, Apple Watches, iPods, iPads, whatever; they will be adding to them. You see, the Apple TV isn't a TV, it's a seismic shift of epic proportions for Apple, the likes of which we have never seen before.

Becoming an expert is a choice. Get Our (Free) News Alerts Once a Day.

COMPETITION

Watch out for Amazon. The company just filed some insane patents and is now not allowing Apple to sell Apple TV on the site. Amazon also has an ecosystem to defend, and it's working.

This is just one of the many fantastic reports CML Pro members get every week. There is a complete Apple report that will blow your mind. Get CML Pro for $10/mo and Get the Most Advanced Visual Tools and Stock Research.