The Moment's Now: Apple Pay Will Explode in China

Fundamentals

PREFACE

As of February 18th, Apple Pay is going to be live in China. But, what has been missed by the headlines and Wall Street goes much deeper than a "launch date."

FIRST

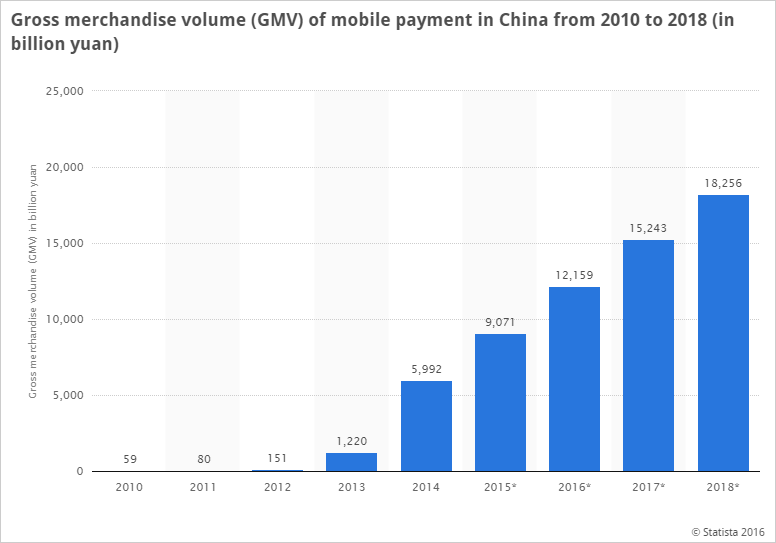

The payment system extended to Apple will allow cardholders to make payments via Apple iPhones, Apple Watches and iPads. (Source: AP). Here’s how big China’s mobile pay market is going to get.

Apple Pay is, in general, so large and so impactful for the company that CML Pro has an entire research dossier dedicated to just this product. But let's focus on the news of China.

APPLE'S DOMINANCE

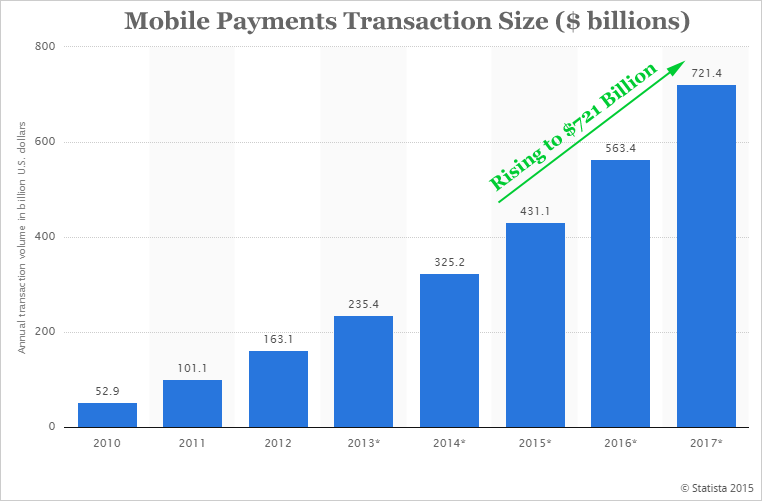

Outside of China, Apple holds 65% of the mobile pay market share. Here's the colossal size of the worldwide mobile market and its growth.

The number of people getting into mobile pay is expected to hit nearly half a billion users within two years and they will generate three-quarters of a trillion dollars in transactions. The battleground is set.

There's a reason why Facebook is desperately trying to enter this market.

APPLE PAY'S ABSURD GROWTH

On the last Apple earnings call, Tim Cook said (this is a quote):

In the second half of 2015, we saw significant acceleration in usage, with a growth rate ten times higher than in the first half of the year.

Yes, he said ten times higher growth in six-months.

NOW CHINA

We know that Mobile payment transactions in China increased by 134 percent last year according to Chinese central bank data. (Source: International Business Times). But analysts point to the competition for Apple Pay, specifically that Alibaba accounts for 80% of the mobile pay market. In fact, Alipay has more than 350 million registered users and 270 million monthly active users (Source: TheStreet.com).

In order to get into China, Apple partnered with the state-controlled China UnionPay, which owns all the NFC terminals in China and issues all the credit and debit cards.

We break news every day.

Get Our (Free) News Alerts Once a Day.

WHAT IS NFC?

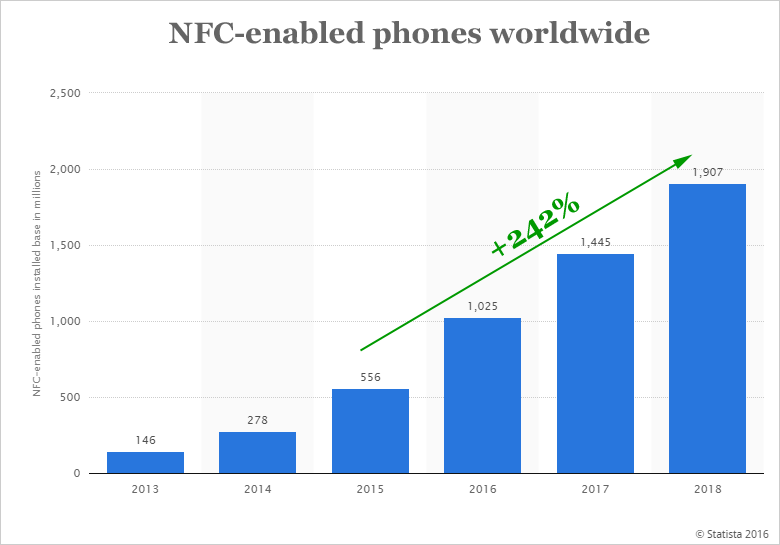

NFC stands for 'near field communications', and it’s the technology that powers mobile pay, and anything else the requires a device to be 'near' another device to communicate.

In fact, as an aside, there is one company that helped invent NFC technology and owns thousands of patents to defend its position -- it has been identified by CML Pro as the single crown jewel of technology's future in our 'Top Picks.'

NFC enabled phones will rise from 556 million last year to nearly 2 billion by 2018. Here's the growth chart:

WHY APPLE WINS

It's so interesting that the bearish overhang on Apple surrounds the fact that the firm has gotten so big and owns so much of every market, that sheer scalability means it can't grow much further.

Now the bearish tone has flipped 180 degrees -- noting that Apple can't possibly enter a market that is already dominated by an incumbent company.

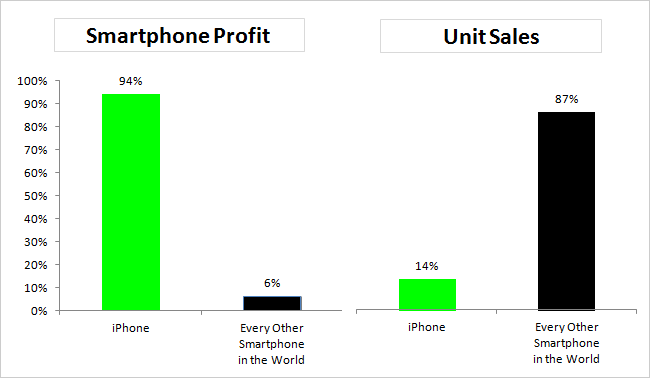

It's easy to forget, but when Apple entered the smartphone world, it accounted for 0% (zero) of smartphone profits, obviously. As of today, the iPhone accounts for 94% of worldwide smartphone profits. Here's the absurd chart:

When Apple enters a technology segment, it both grows the market by an order of magnitude, and then it takes that new massively larger market and dominates it. The year before the iPhone, 60 million smartphones were sold. We now measure annual smartphone sales in billions.

Apple will grow mobile Pay in China, and then take its rather large fair share.

MORE

Bank of America just released its research which came from a survey of more than 1,000 respondents in China. The net result: the iPhone results were stunning. Here are snippets from the report:

57% of responders plan to buy their next (or first) smartphone within a year.

When asked which brand respondents would likely purchase when buying their next (or first) smartphone, 39% of the respondents said that they would buy Apple next, compared to 25% for Huawei and 17% for Samsung.

Source: Bloomberg

When asked which brand respondents would likely purchase when buying their next (or first) smartphone, 39% of the respondents said that they would buy Apple next, compared to 25% for Huawei and 17% for Samsung.

Source: Bloomberg

Apple is positioning itself to be a dominant player in the mobile pay space, and the implications are huge. There are 270 million monthly active users on Alibaba's mobile pay system -- that's an entire market for Apple to go after.

Any reasonable assumption of market share accumulation from Apple -- bullish or bearish, big or small, leaves Apple with yet another colossal business inside of China.

WHY THIS MATTERS

If any of this information like 'NFC' technology, Apple Pay, China's smrtphone market and the rest of the data feels like a surprise, in many ways it is. The analysts that represent the wealthiest 1% have no interest in sharing this data.

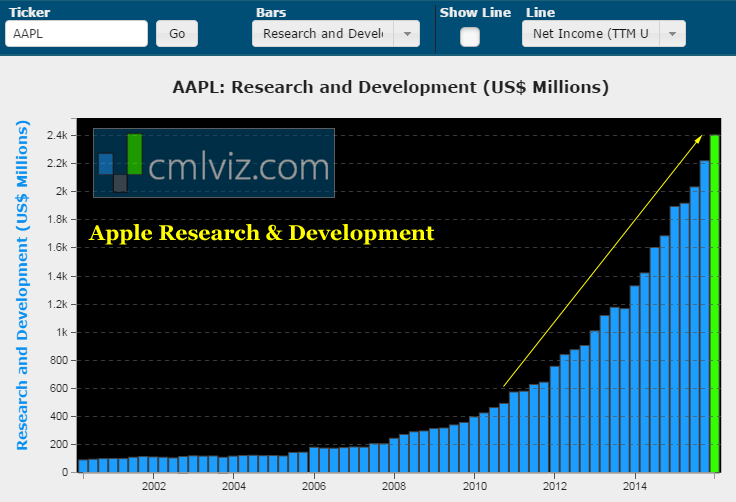

Apple has increased its R&D expense by 80% in the last two-years and the fruits of that labor are an enormous pipeline of products, each sitting within young, booming segments of technology. Here's the trend chart:

In fact, CML Pro also just published the article "The Apple Car Will Change Automotive History." That is available to CML Pro members.

But this is the secret to thematic investing -- find the trends and invest in them. Apple has done that. In fact, in our CML Pro research dossier "Apple's Growth Opportunity Is Stunning," we identify eight massive markets Apple is growing in.

Apple is one of just a precious few 'Top Picks' for CML Pro. Each company identified as the single winner in an exploding thematic change like artificial intelligence, Internet of Things, biotech and more.

This is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.