The Companies Buying Back Stock; And Then The Real Secret

Stock Buybacks

Written by Ophir Gottlieb

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.

PREFACE

A hot topic of late has been stock buybacks. Is it a worthy investment of money or a borderline accounting shenanigan to boost earnings per share (EPS)?

Couldn't the money better be spent on a dividends or research and development? Or is this a wonderful line in the sand drawn by the best companies in the world saying out loud, "our stock is worth more than the market says, and we're buyers in size right now?"

We'll review this with beautiful visuals, and then we'll talk about the single most powerful metric that the top .1% are using and beating the market because of it.

Discover the undiscovered:

Get Our (Free) News Alerts Once a Day.

STOCK BUYBACKS

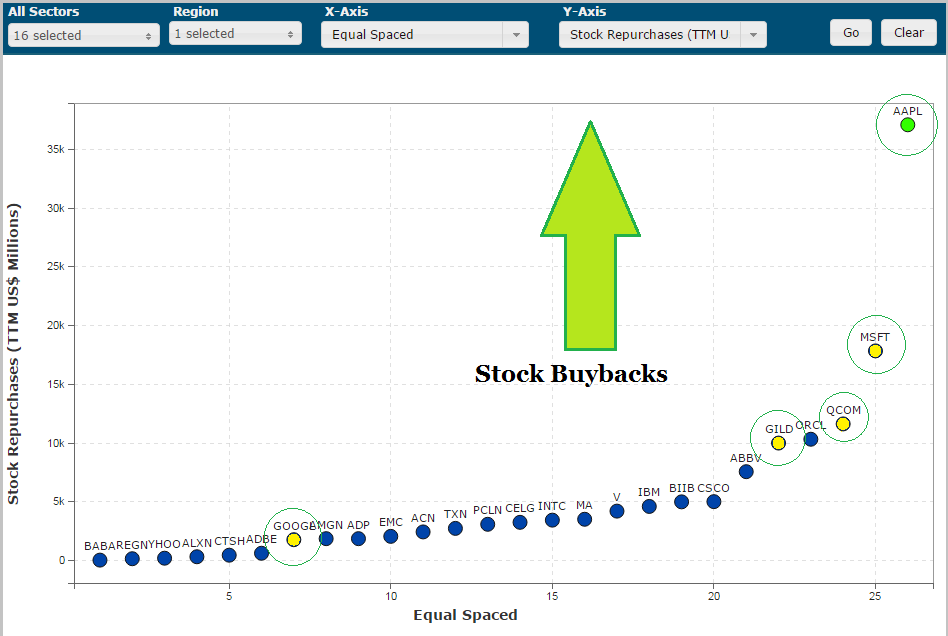

Let's examine all technology and biotech companies over $30 billion in market cap. We'll start with the raw numbers -- simply rank the companies buy the size of their stock buy backs, without adjusting for company size.

The headlines have told us about Apple, but my goodness, seeing it in context is breathtaking. In the last year, Apple has purchased nearly $40 billion of its own stock. That amount is larger than the market caps of Tesla and Twitter combined. That amount is now larger than the market cap of all of Netflix.

Moving down the line we see Microsoft coming in at number two, then Qualcomm, Oracle, and finally our first biotech, Gilead. Note that we won't find Facebook (FB) or Amazon (AMZN) on this chart -- the firms do not purchase their own stock -- and since they don't pay dividends, we know they invest all free cash flow into R&D.

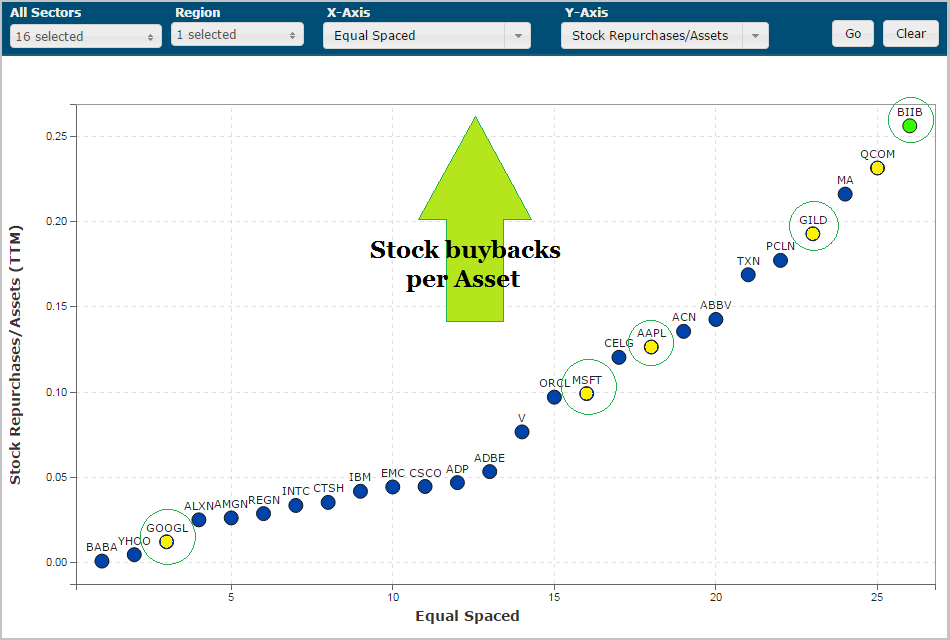

But let's do this together with a bit more finesse. Next we will chart these same companies, but we will rank them by stock buy backs per dollar of asset. The story is quite different.

Biogen has spent more 25% of its asset value on stock buybacks as its price has tumbled from $480 to $250.

In fact, the bear market in the IBB biotech index in 2008 saw a 33% drop. In the latest fall, the bear market has seen IBB drop 40%. Yes, the biotech sector is in a worse bear market than during the "Great Recession," and we haven't even seen a correction in the broader market. In fact, the Dow Jones Industrial Average is up on the year.

We note that on this chart, Apple and Microsoft hardly look like outliers.

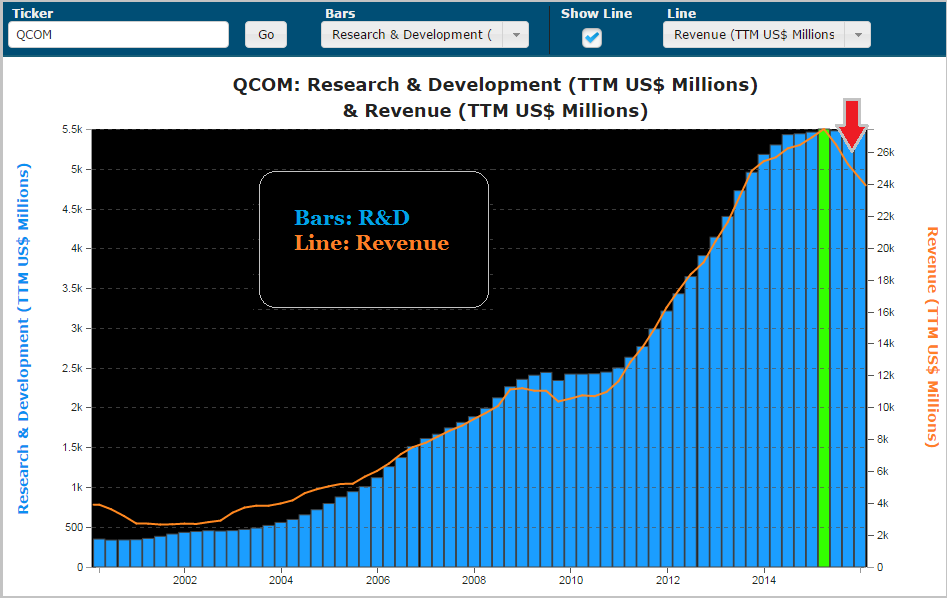

Finally, we note that Qualcomm comes in second on this chart -- no matter how you slice it, Qualcomm's woes in revenue growth have turned the company to buybacks, not investment. In fact, here is a chart isolating QCOM -- the blue bars chart R&D while the gold line charts revenue:

QCOM dominates the smartphone chip market, but it has seen competition come in and for the first time in a decade or more, its innovation is not necessarily seen as cutting edge. Samsung, Nvidia and NXP semiconductor are chopping away at this giant's world.

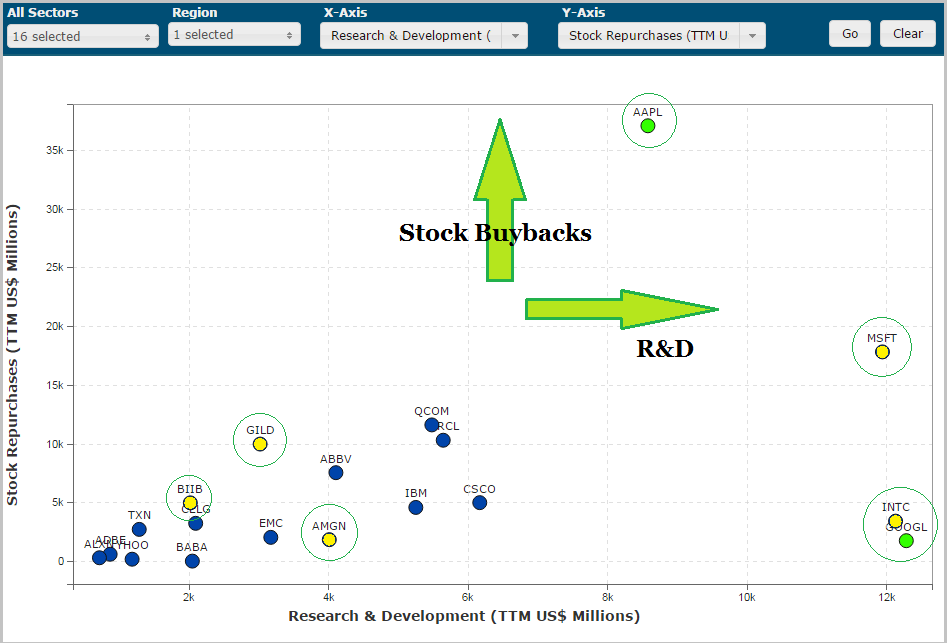

Finally, let's really dig into this data and plot stock buy backs on the y-axis and R&D on the x-axis:

We can see that no other company in the world spent more on R&D than Alphabet / Google; check it out way on the right hand side of this chart. Intel and Microsoft come in second and third. Again, this population only includes companies that buy back their own stock. If we added Amazon to this chart, it would rival Google for the largest spending in R&D.

We can also see that Gilead spends 200% more on stock repurchases than it does on R&D and Biogen spends 150% more on stock repurchases than it does on R&D. Amgen spends more on buybacks than R&D. The trend is clear -- the biotech giants are buying back stock en masse -- they are all standing up in a crowd and saying, "enough is enough -- our stock will rise from this bear market."

Now, let's get to what really matters -- the gem that really drives stock value.

THE NEXT HUGE WINNERS

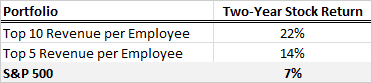

How a company spends its cash is critical to its life blood. Buybacks are good to a point, but investment in R&D is better as long as revenue growth continues. It turns out there is one single measure that if you take the top five companies in the entire large cap market over the last two-years, they have doubled the S&P 500. If you take the top 10 companies, they have tripled the S&P 500.

We won't hide it from you -- this isn't a teaser -- here it is: revenue per employee:

Friends, this is the information that the top 0.1% use. This is how the greatest transfer in wealth we have ever experienced has moved money to the top 0.1% from everybody else. It's just access to information, that's all. Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Here's how we do it:

True margins, revenue and profits, the kind that turn companies from small caps into mega caps, the kind that see stocks double, triple or even quadruple, that only occurs when two critical phenomena collide:

To find the 'next Apple' or 'next Google' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, the cloud, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.