The Cloud: Apple and Amazon Go To War But These 3 Gems Will Be the Winners

Written by Ophir Gottlieb and Jason Hitchings

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. You’re now a part of that change.

A COMPETITIVE SHIFT

Businesses across the globe are moving in droves to drop their own server infrastructures and instead to let a few large companies specialize in virtualizing and hosting servers, aka "the cloud", while companies focus their own resources on what makes them unique.

Less than a week ago we saw a surprising twist in this transition play out: we learned that Apple would be moving a part of its iCloud to Google. This sums up the development:

iCloud will soon be partially powered by the Google Cloud Platform by way of a deal that could also be used as leverage to cut its cloud costs with Amazon and Microsoft.

The deal is in the half a billion dollar range, per estimates. While many see this as a win for Google's young but growing cloud business, the true impact is much larger. This is a massive competitive shift by Apple which signals not only a recognition of Amazon's clear and present danger to Apple's ecosystem, but also likely an imperative for Apple to enter the cloud business itself.

9TO5MAC

Beneath the lingo and the news headlines that come and go, something much more fundamental, much more dramatic is developing that has huge implications for our economy and the future of technology. And we've identified the three companies that we see as the winners of the massive shift to the cloud.

A SEISMIC CHANGE

The transformation taking place isn't about who owns the servers and who rents them. The cloud is a colossal shift, the beginning of a change in the world economy and the structure of business. It is the evolution of technology, and of capitalism. Manufacturing economies shift to service economies, as we're now seeing in China. The service economy is now changing into what will be one of the defining themes for the 21st century.

We're moving out of the Ice Age, the Iron Age, the Industrial Age, the Information Age, to the age of the Cloud.

This is the beginning of a fundamental change in the economy, away from providing services to each other -- accounting, haircuts, interior design -- and toward technologies providing services to other technologies. As massive investment are poured into computer vision, virtual reality, cybersecurity, this specialization of the technology economy will define our time.

Forbes

Apple (AAPL), Facebook (FB), Google (GOOGL), Netflix (NFLX), Amazon (AMZN), Microsoft (MSFT) and Salesforce (CRM) are driving the change - all seven companies are racing to control its future. What's more, we've found a surprising company one tenth their size that may win out over all of them.

Here's how CML approaches the largest thematic changes in technology:

You can mine for gold hoping to be one of the lucky few to win the gold rush lottery, or you can sell pickaxes and shovels to the gold miners and guarantee you've won the lottery several times over.

THE PRIZE FOR THE CLOUD

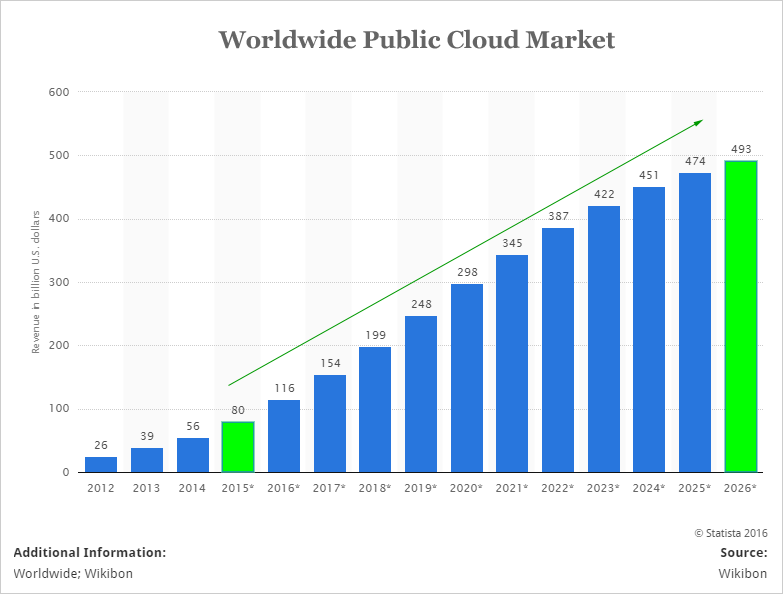

Projections for cloud computing see the market growing from $80 billion last year, to half a trillion within a decade, according to a study by Wikibon:

The biggest and most successful technology companies in the world are pouring resources into this field. To understand the trend, we must understand the players.

And once we know the players, we can find who is best positioned to rocket higher with this trend.

APPLE'S THRONE

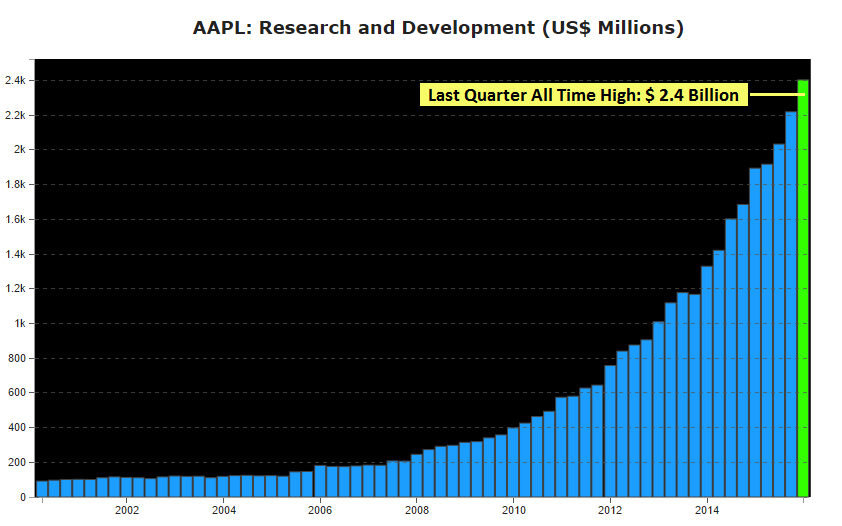

Apple is sitting atop the technology throne, making an almost unfathomable sum from its domination of the devices space. Apple is leveraging those cash flows and injecting massive sums into a spectrum of technologies. Not only are they investing billions, but the rate at which Apple is investing is accelerating. CML Pro will show us just how big their technological bet has become:

$2.4 billion dollars per quarter. Annualized, Apple will be investing more into R&D than the entire economic output of 60 different countries.

On January 26th, 2016, we learned that Apple has one billion active device as its install base. We can measure Apple's iCloud service in billions of users as of now. While Apple has shifted a part of its iCloud service to Google, this is temporary, Apple is going to enter the cloud business and soon Google, Amazon and Microsoft will be competitors in this area of technology.

Remember, the bearish thesis surrounding Apple falls precisely on the notion that Apple's revenue stream is far too dependent on a single product -- the iPhone. At the same time, one the great bullish theses for Amazon is how it has become a leader in the cloud.

Let's see what happens when Apple enters. We can say one thing with fairly high certainty -- the effect won't be trivial and Apple will enter a booming theme that isn't called the iPhone.

But Apple isn't the golden winner we see here.

AMAZON AND NETFLIX

Amazon's cloud product, called Amazon Web Services (AWS), is the dominant player in the field. It's famously known for hosting Netflix's (NFLX) video streaming, which at peak hours accounts for 30% of the entire United States bandwidth.

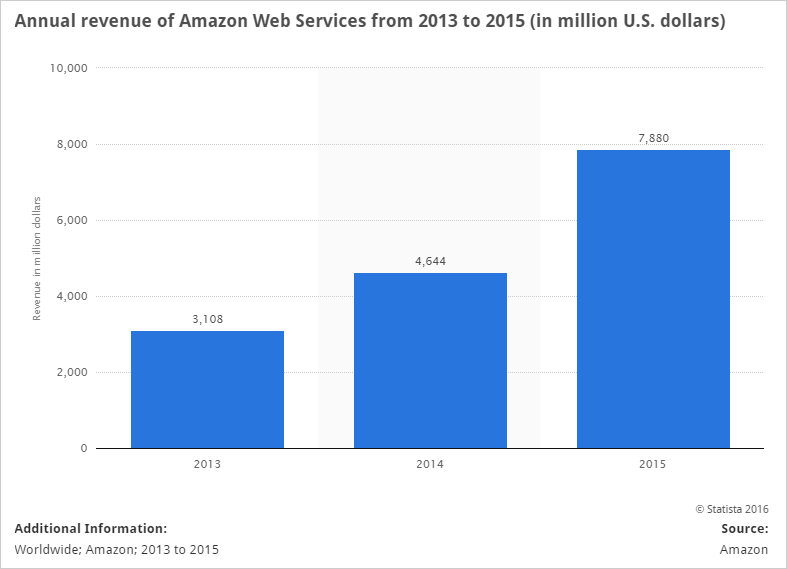

Here is the chart of revenue growth for Amazon Web Services (AWS):

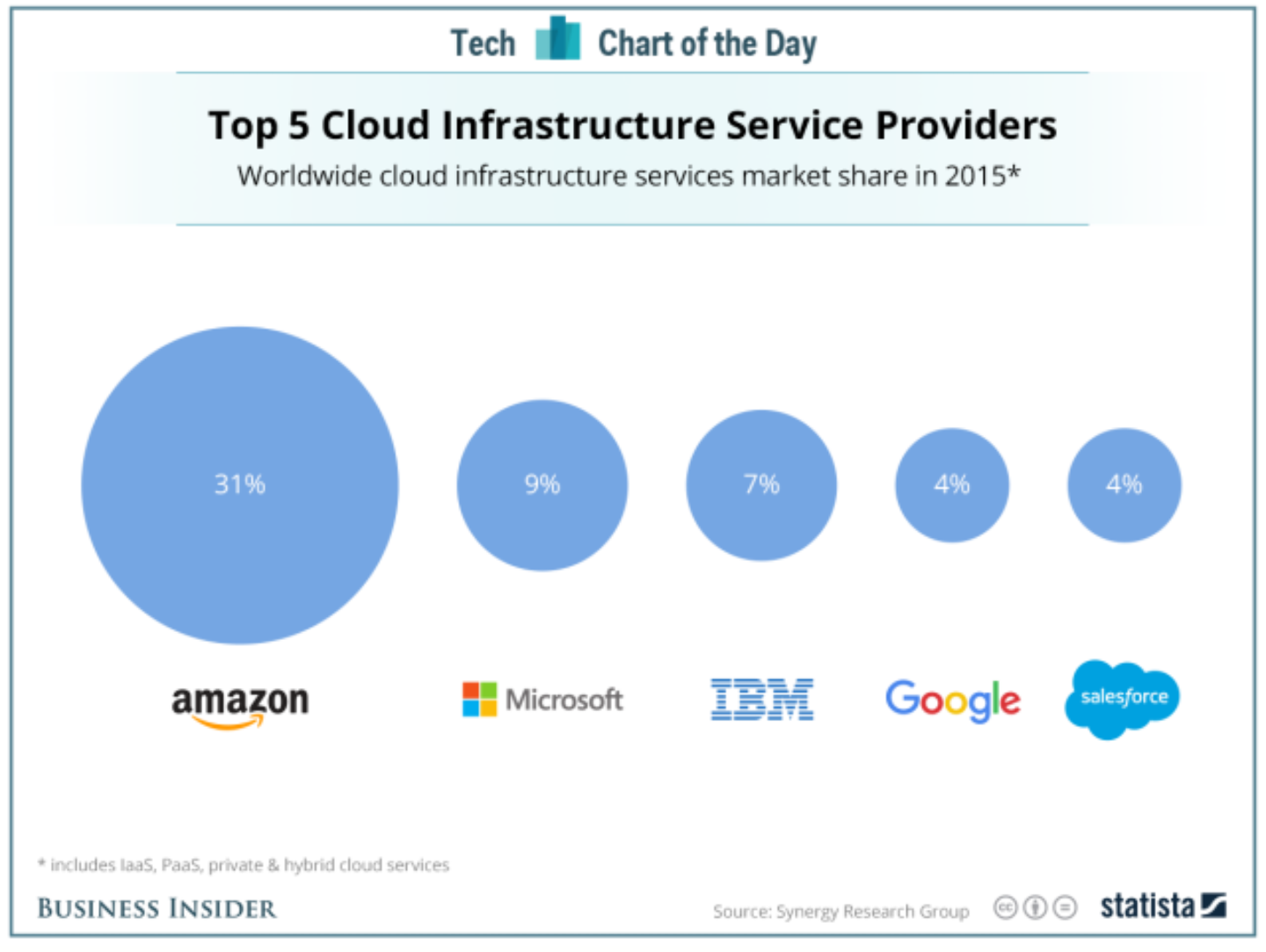

Here's how the market share breaks down from our friends at Statista:

If Amazon simply tracks segment growth, its AWS business will grow to $30 billion by 2020. If you're looking for a window into why Apple left AWS and MSFT -- here it is. Apple will enter the business and for now it has no interest in helping out the dominant players.

But Amazon isn't one of the three clear cut winners we see either.

FACEBOOK'S CLOUD SERVES 2 BILLION PEOPLE

As early as 2012, Facebook announced it was entering the cloud storage realm. Back in 2006, Facebook faced an existential threat because it was growing so quickly that just its 10 million users almost brought the company down:

"its mere 10 million users faced serious problems as its servers were overwhelmed by user requirements."

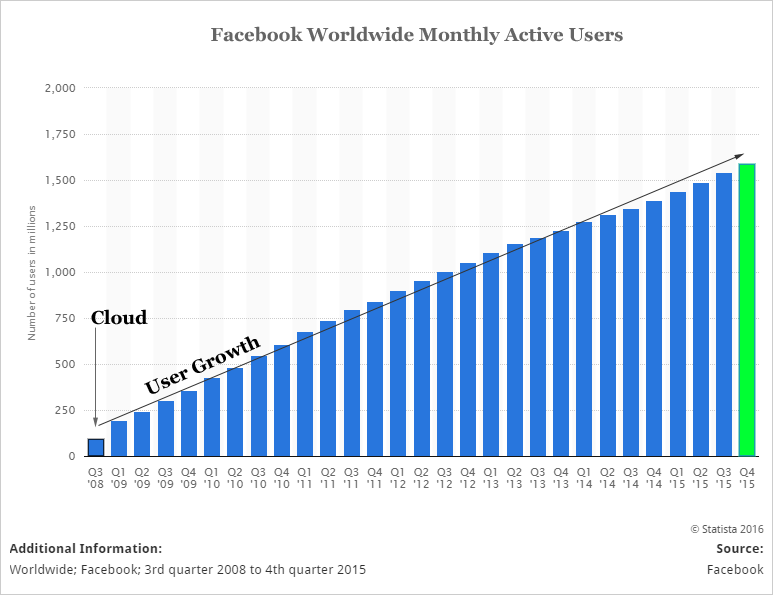

Here's a chart of Facebook's users which goes back to 2008. Remember, 10 million almost brought the company down, today we are looking at nearly 2 billion.

The success wasn't an accident -- Zuckerberg and Facebook were early to grasp the potential and need of Cloud Computing space.

"Now with one billion profiles and counting, Facebook has finally resolved this headache by entirely moving its myriad of operations to the cloud"

We believe Facebook may try to diversify its own revenue stream, which is 96% based on digital advertising and 80% on digital mobile advertising.

But Facebook is not one of the three companies we see as the big winners in the cloud either.

We know that Google just took a $500 million piece of Apple's iCloud business away from the two leaders, Amazon and Microsoft. But even internally, Google recently reported that it now has six distinct properties with over one billion users: YouTube, Android, Search, Maps, Chrome, and Google Play.

All of this is powered by its cloud. In fact, if you're looking for the most impressive images of a cloud computing station, Google is it:

Google has a data center built next to the Columbia River. Each building in this data center is about the size of a football field."

In fact, articles have been published with names like "Google's worst-kept secret: floating data centers off US coasts." Here's an image:

But Google has gone even further. While placing its cloud data centers to sit on water creates a source of cooling and possibly even a source of power, Google has a patent for the project. Here's a rendering from the US Patent and Trademark Office from Google's filing:

Google may be taking the technology behind cloud computing to the absolute ends of human knowledge. We do believe the Apple move is temporary, but it's a vote of confidence for Google's product, no matter how you slice it.

But, Google too is not one of the three winners we see benefiting the most from the cloud.

THREE REAL WINNERS

Apple, Google, Amazon and Microsoft will duke it out for market share in that half trillion dollar market, but massive opportunity lies elsewhere.

WINNER #1: THE OBVIOUS

If you're looking for safe and steady, you can stop with Intel as a compelling way to invest in the guts of the cloud computing transformation.

Intel reported that it sold $4.1 billion in chips for cloud data centers compared to $8.5 billion for PCs in the recent quarter. It's almost unthinkable, but the cloud is growing so fast, it's already nearing half of the PC market for Intel. But it's not just revenue, its profits:

Operating profit from PC chips was $2.1 billion, down 20 percent from a year ago, while data center chips had an operating profit of $2.1 billion, up 9 percent.

Intel's customers for the cloud: Google, Amazon Web Services, Microsoft and Facebook, as well as Baidu, Alibaba and Tencent of China.

The Intel story has become a tale of two divisions according to Edward Jones' Bill Kreher. Cloud computing will overtake PC chip shipments and the revolutionary change for the hallowed firm is well under way.

This is why everyone will tell you that Intel will be the winner and it will be a winner. But the future, as Google has shown, is far more complex, and demands far better technology, and this where Intel will fall short in one aspect. Let's look at the next two winners.

WINNER #2: LESS OBVIOUS

A lesser known winner is a company called Box (BOX). The company allows organizations around the world to share and collaborate securely on their most important content, which usually sits in the cloud.

In July of 2015, the company announced that "Airbnb, LinkedIn, Spotify, Twitter and Zenefits have chosen Box to power secure collaboration and to enable mobile access to information. These companies join Box's growing technology customer base, which includes Cisco, eBay, Avago Technologies, Flextronics, Symantec and others."

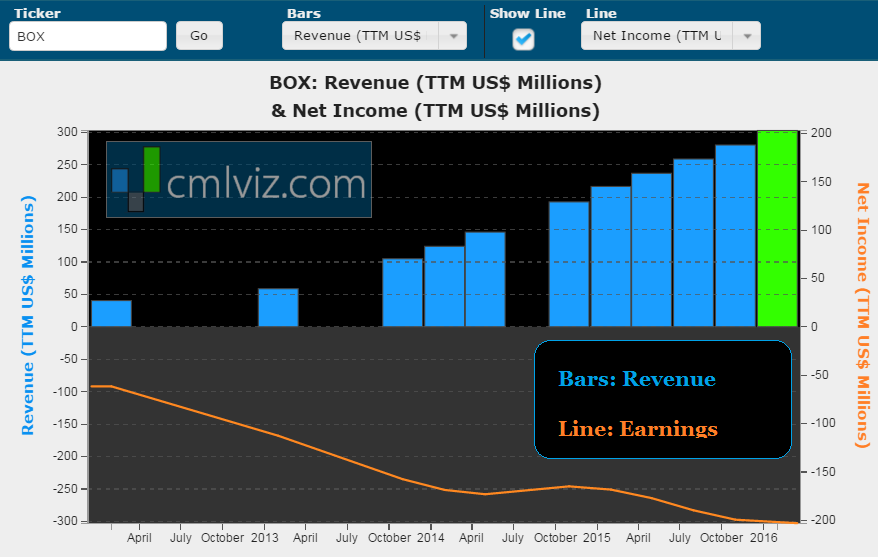

Now that's quite a line-up, but we must recognize that BOX is not a hardware maker and a lot of that business is about cloud collaboration, not necessarily cloud hardware. Also, one note on BOX -- while revenue is booming, earnings are tumbling and are negative. Here's the chart of both:

Finally, here is the biggest winner, in our eyes:

WINNER #3: THE HIDDEN GEM

The real winner behind the radical cloud computing boom is a mid-sized technology company based in the US and trading on the NASDAQ. Its chips enable artificial intelligence which can learn and improve without the assistance of human programmers.

Chips are being used to teach machines to think like humans.

While Intel's standard central processors are limited when it comes to doing multiple things in parallel, the technology gem that will power the cloud literally invented the technology that allows for the fastest and most reliable parallel computing.

Drama

Like a Hollywood blockbuster, the drama has built. Apple just hired away this technology company's head of a division. This company already has Google, Tesla, and Amazon as customers. You have to dig deep, but you can even find a reference to the firm in the depths of the AWS documentation:

You can use this company to accelerate scientific, engineering, and rendering applications.

The 99% market share that Intel controls is vulnerable -- and even a chip off that market share stands to turn into tens of billions of dollars. This crown jewel of technology’s future is one of our few "Top Picks" for 2016. To find out which company we think will be the true winner in the massive cloud computing trend, join us at CML Pro and get the full research dossier.

WHY THIS MATTERS

Cloud computing will change everything about the way we use data -- our health, our national security, our streaming video, artificial intelligence and even the entire Internet. While our research pieces provide in-depth coverage of who is likely to dominate this theme, this is only one of CML Pro's precious 'Top Picks.' To find the 'next Apple' or 'next Google' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.