Surprise: Apple Watch Demand is Astounding and Beating the Early iPhone

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.

PREFACE

What we're about to uncover is fact. Almost all of us have a natural bias against the idea of a smart watch so we will be driven by facts. The Apple Watch is selling better than the first iPhone and has turned the segment totally upside-down in one fell swoop.

Whatever we have been told to believe is wrong -- and the only way to get to right is through hard data. So, let's do it together.

THE PRIZE

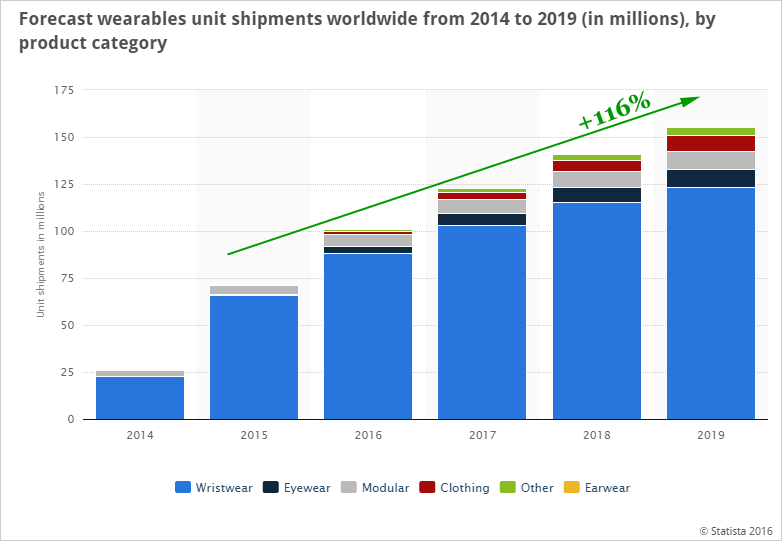

The smart wearables segment is exploding. Here is the forecast from our friends at Statista:

Worldwide shipments of wearable devices are expected to rise to 110 million units by the end of 2016, market research firm International Data Corp (IDC) finds.

That bright blue color dominating the bar chart - those are smartwatches. Fitbit (FIT), Garmin (GRMN), they are in trouble while the guts inside the Watches, like NXP Semiconductor (NXPI) and Qualcomm (QCOM) are set to see a nice surprise.

Even further, Facebook (FB) is getting a boost because its personal assistant for smart devices is the most anticipated of them all:

But that's just conversation. Here is the real news -- facts only, please.

APPLE WATCH NUMBERS ARE HUGE

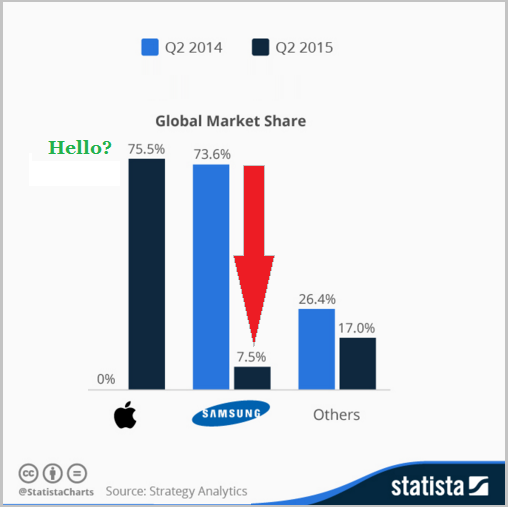

Let's start with a staggering chart from Statista. This is simply the market share of smart watches from last year to this year:

The Apple Watch didn't exist in 2014 so it carried no market share, while Google's device held nearly 75% of the market. Then 2015 happened.

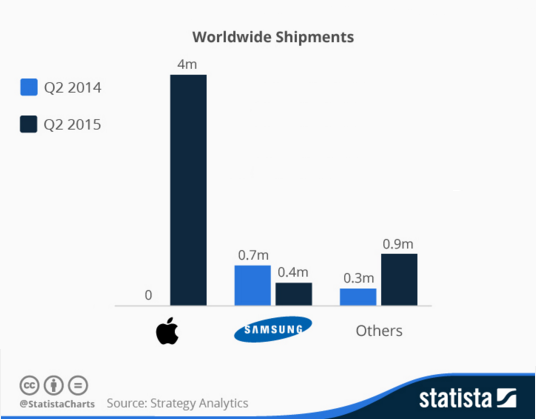

Apple jumped to 75% of the market while Alphabet / Google (GOOG, GOOGL) fell to single digits. We can also just look at raw numbers from Q2 of 2014 and 2015:

The same result -- Apple Watch is dominating. So, before we discuss how large this market can become, let us end the argument about whether or not Apple will lead -- it does and it will. Next subject -- market size.

SIZE OF THE MARKET

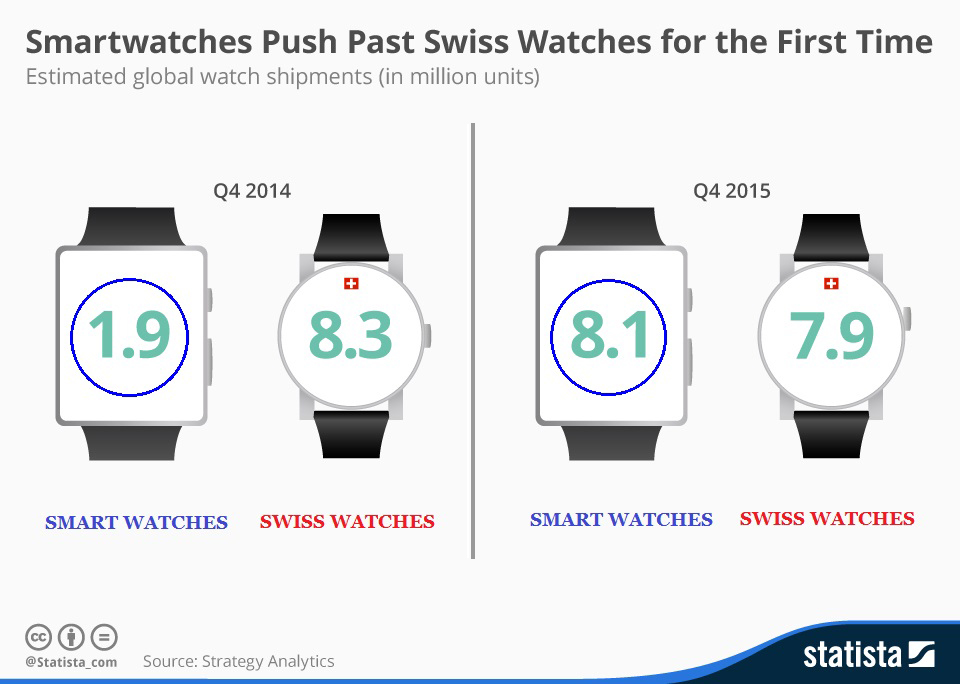

Almost all of us have a natural bias against the smart watch, so let's just be totally data driven. To start, for the first time ever last quarter we saw that the smart watch segment sold more units than the Swiss watch market:

Just to be pefectly clear: Smart watch sales rose more than 4-fold just as Swiss watch sales started to dip. Again, throw out our biases -- this is data driven.

Now, taking it yet a step further: Benzinga reported on a JPMorgan analyst report that reported that Apple sold more than 5 million of its Apple Watches in the fourth quarter of 2015.

Further IDC estimates that Apple will sell 14 million watches in 2016, up from 11.6 million units (estimated) in 2015. None of those numbers mean anything until we look at context, and I warn you, this is going to sound unreasonably good. But again, these are the facts, and they are not disputed.

COMPARISONS

What do 14 million watches mean? What is the context?

Here we go: Most analysts forget, rather quickly, that the first version of Apple products, like iPod, iPhone and iPad, don't sell very well. In fact it's not until generation two or even three, that the opportunity becomes apparent. Apple Watch is bucking the trend, already. Here we go:

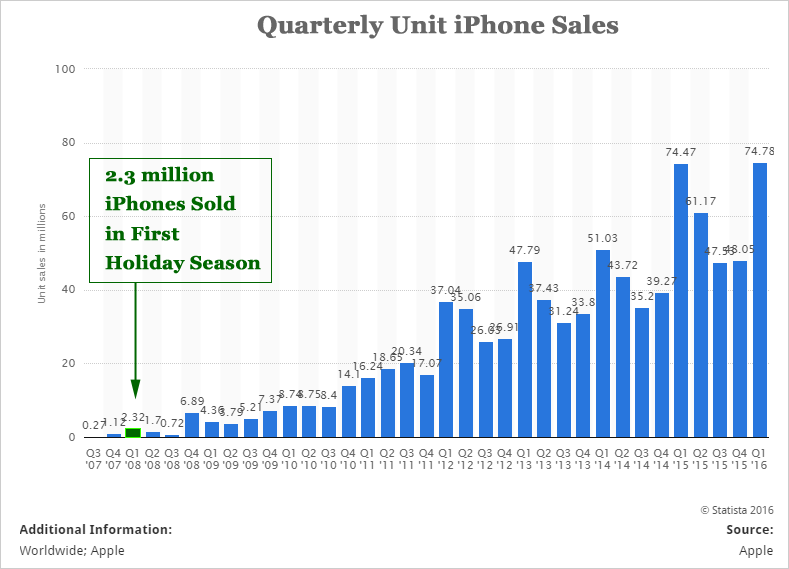

Start: Apple's iPhone sold a total of 2.3 million units in its first holiday season. In fact, here's the all-time iPhone unit sales chart by quarter from Statista.

Now, the Apple Watch sold 5 million unit sales in its first holiday season.

Comparison and Context

Apple Watch sold 117% more units in its first holiday season than the iPhone sold in its first holiday season (5 million versus 2.3 million).

Next Comparison: Apple Watch sold an estimated 11.6 million units in 2015 which wasn't even a full year. The iPhone sold 5.3 million units in its first year. Conveniently, that also turns out to be 117% greater sales from the first Apple Watch when compared to the first iPhone.

Going further: The iPhone sold 15 million units in its second year, and Apple Watch is estimated to hit 14 million. So, the Watch is keeping track. Here's the bigger news:

STAND ALONE CAPABILITIES

The argument against mass adoption of any smart watch, not just Apple's, is simply that it doesn't provide enough functionality beyond the phone to make it a mass market product. Fair enough, but Apple knows that.

It's true, until now, the Apple Watch has been an adjunct to the iPhone. We said, "until now," and now is over.

NOW IS OVER

The soon to be released Apple Watch 2 will have Wi-Fi capabilities so that users will have connectivity when they're not near their smartphone. But let's go further.

It appears that either Apple Watch 2 or Apple Watch 3 will have a FaceTime camera. In English, that means the device will be able to perform face to face video calls -- Facetiming, Skyping, everything. If we can digest that and then slow down the data, we realize rather quickly that the Apple Watch will become a stand-alone product -- untethered from the iPhone.

We may be able to call, text, Skype, video conference, whatever, via Bluetooth with just a Watch on our wrist.

PUTTING IT TOGETHER

The facts show that demand is remarkably high for the Apple Watch and that the segment momentum in general is taking everyone higher. Remember, this was all data driven. Removing our biases allows us to get ahead of the curve and here's why that matters:

SEEING THE FUTURE

The Apple Watch is just slice of the real innovation that's happening at Apple. In fact, we have named eight separate thematic trends that Apple is leading the way in. This is how it works -- true innovation, the kind that turns companies from small caps into mega caps, the kind that sees stocks double, triple or even quadruple only occurs when two critical phenomena collide.

To understand Apple and then go beyond, to find the 'next Apple' or the 'next FANG stock' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Apple is one of just a precious few 'Top Picks' for CML Pro. Each company identified as the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.

The author is long Apple shares as of this writing.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn’t do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.