Apple versus Facebook: The Two Most Disruptive Companies in the World

Apple versus Facebook

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%.PREFACE

As the mega caps of technology war, one thing has become apparent. The real threat to Facebook's throne is Apple's ecosystem. For now, Facebook still relies on the iPhone for substantial portions of its revenue and that's an enormous risk. Having said that, Facebook's growth is pushing higher and stands as a stark contrast to an Apple slowdown.

Discover the undiscovered:

Get Our (Free) News Alerts Once a Day.

THE BATTLEFIELD

When it comes down to it, Apple (NASDAQ:AAPL) and Facebook (FB:NASDAQ) span enormous thematic segments of transformative technology. While there is some overlap, most of their businesses don't -- yet. Here's just a taste of each company's markets.

First Apple

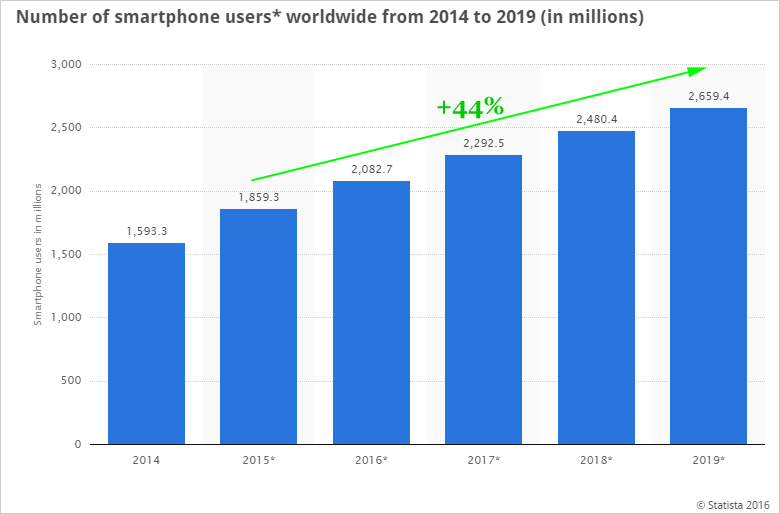

SMART PHONES

We're looking at 44% growth in the smart phone market and Apple's iPhone SE is the conduit to India, which represents a market larger than the United States as of this year. We refer you to the CML Pro dossier surrounding Tim Cook's secret handshake with the Prime Minister of India that has changed everything.

Next, the Apple TV is the technology that will make Apple the largest cable company in the world.

APPLE TV

Apple TV just had its best quarter ever. In our research dossier, "Apple's Genius: Kill Cable Then Take All of It," we learned that as the provider, the hardware, the interactor, the bundler, the ecosystem to TV, Apple will find hundreds of millions of subscribers paying our $30-$40 a month for cable and apps and the checks go to 'Apple, Inc.' This is an attempt to crush Google's (NASDAQ: GOOGL) YouTube and Netflix (NASDAQ:NFLX) by relegating them to 'apps' rather than destinations. All signs point to an early, and frightening success. Amazon's (NASDAQ:AMZN) Prime service is also threatened.

Then there's Mobile Pay:

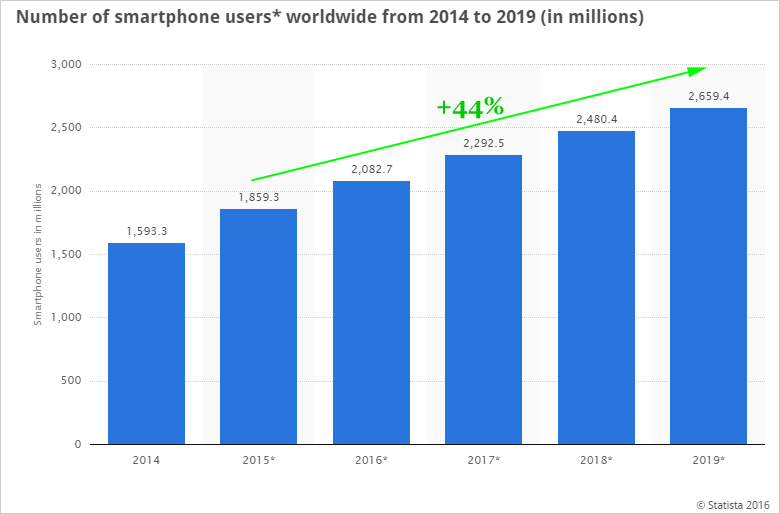

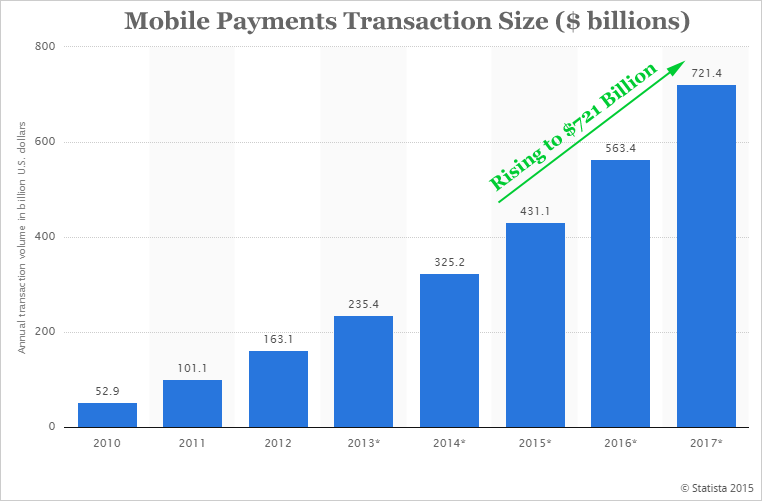

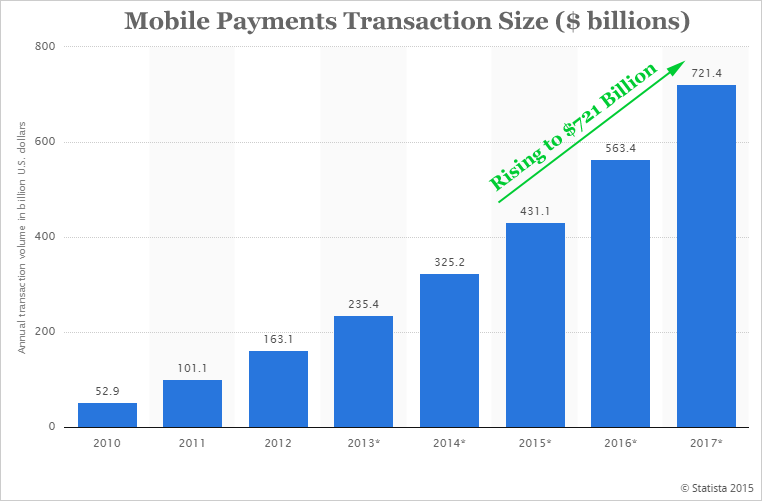

MOBILE PAY

Apple's iPhone and iPad combined to account for 65% of the mobile pay market and last quarter Tim Cook revealed that Apple Pay saw a 10-fold increase. Yes, 1,000% growth.

By 2022 bank of America predicts Mobile Pay will realize $3 trillion in transactions.

But Apple's move last week was one of the largest disruptions in a breaking technology we have ever seen. To keep it short and sweet, Apple Pay will soon be available on e-commerce sites, as well as desktops and laptops by simply touching our finger to the monitor. We're looking at a potential $200 billion business in terms of market cap addition to Apple from this area, alone.

There's actually so much going on at Apple we can't cover it in one report and certainly not one in which we need to compare it to Amazon. CML Pro has named Apple as one of its precious few "Top Picks," and the staggering details are available in Pro.

Next, Facebook

Not to be out done, Facebook exists in equally enormous thematic trends. We can start with the bread and butter of the business: advertising. Facebook generates 97% of its revenue from ads, and is the dominant mobile advertiser.

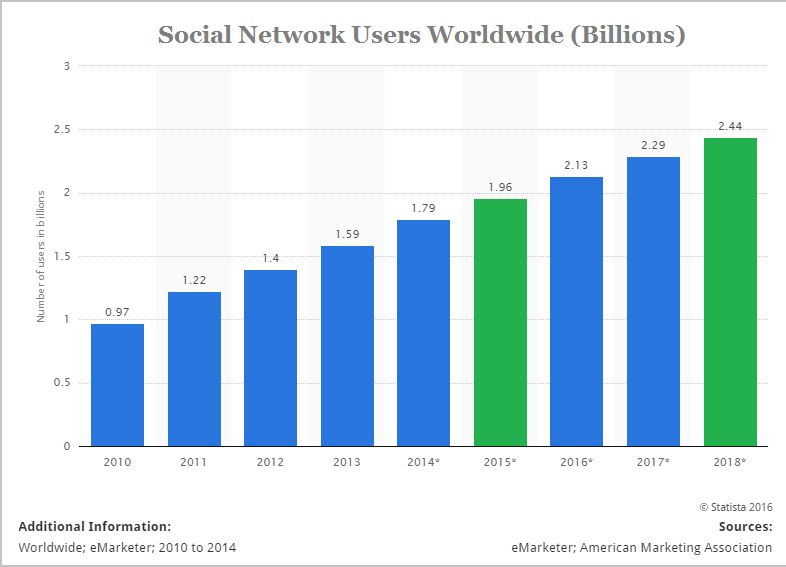

Here is how social media in general is growing. This chart is from our friends at Statista:

SOCIAL MEDIA USERS WORLDWIDE

As of 2015, the world saw just fewer than 2 billion social media users and that number will rise by 25% through 2018. But it’s really only the beginning. Still only 46% of the world is connected to the Internet. Active social media users are only reaching 31% of the globe. As technology proliferates, there is yet more room for growth in a segment that we are already measuring in multiples of billions.

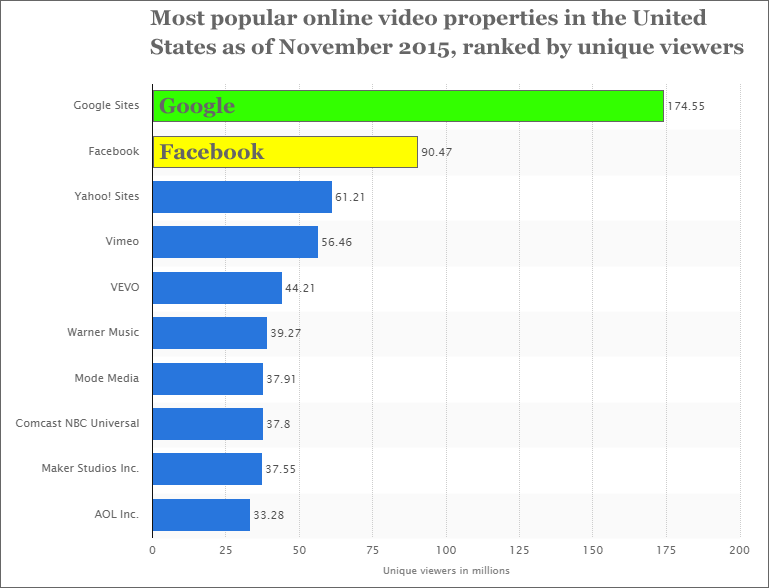

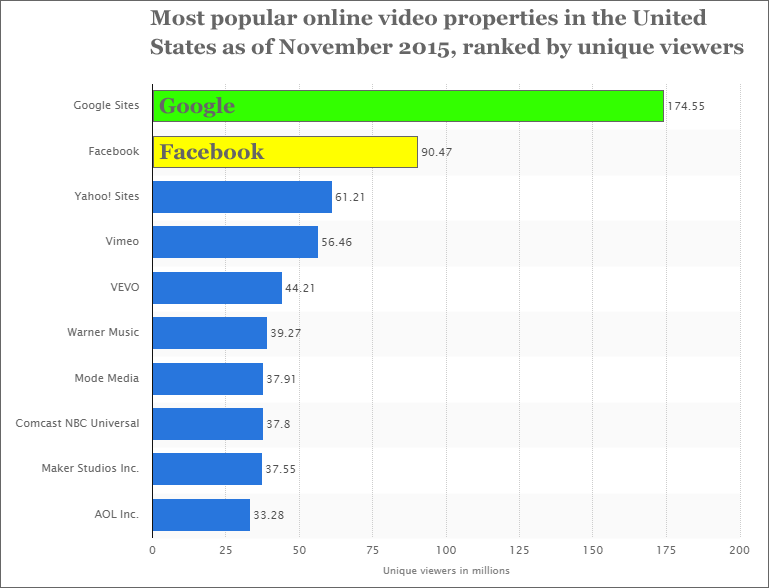

Turning to monetization, if we can rank the top used video sites, we get this (provided by Statista):

ONLINE VIDEO SITES

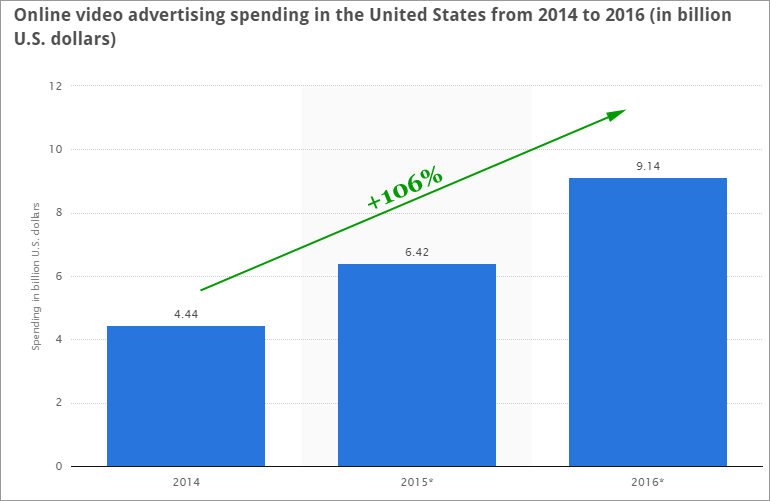

And here is the revenue growth that's being generated:

VIDEO AD GROWTH

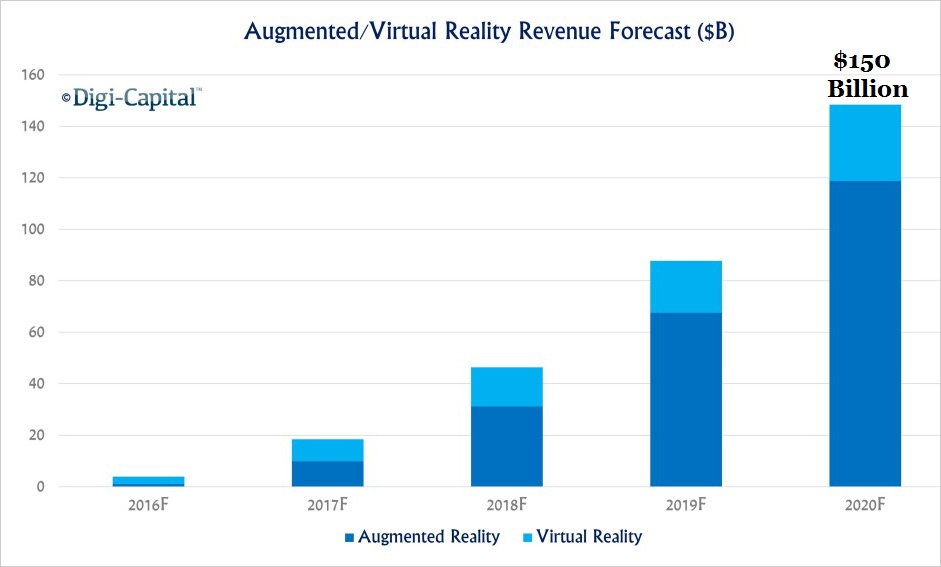

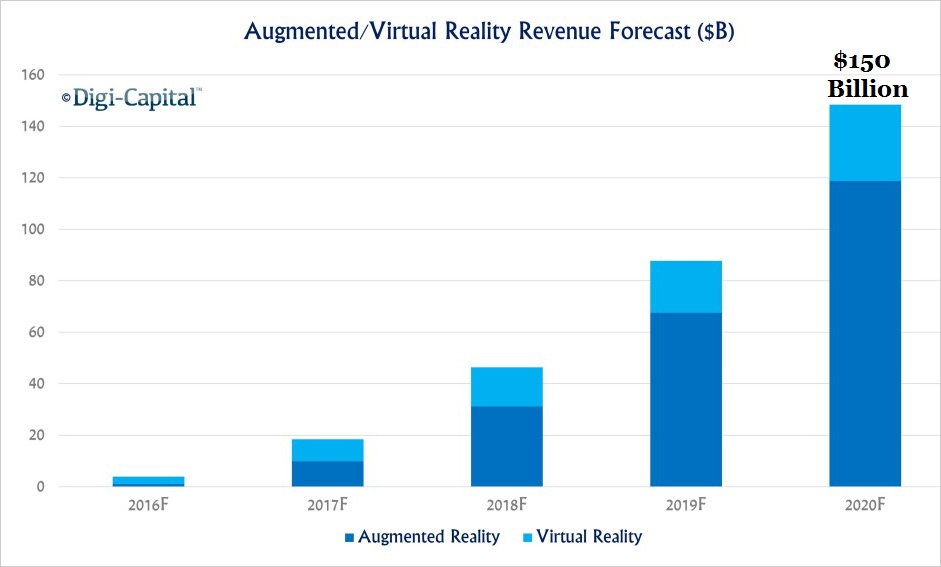

But Facebook is shifting a part of its business out of advertising into Virtual and Augmented reality with its Oculus Rift. Here is the wonderful market it's chasing:

VIRTUAL AND AUGMENTED REALITY

This technology is truly world changing. The idea that two people in different nations, even continents, can sit next to each other on the couch and have a meal, watch a movie or just have a conversation sounds like pure science fiction. But it isn’t — it's here.

This is a market whose "customer base looks increasingly like all of humanity" according to Dave Thiel at Forbes, and he's right. But Apple has made waves as well. Here's a quick snippet about Apple's late but legitimate entry into VR:

On May 28th 2015, Apple acquired Metaio, an augmented reality startup. Then, in November Apple acquired Faceshift; the company that created motion capture technology used in the latest Star Wars film. We also learned that Apple hired Doug Bowman, Ph.D. who is considered to be one of the world's top virtual reality researchers.

Even before all of this, Apple was filing patents like this one:

"Method and system for creating an image-based virtual reality environment utilizing a fisheye lens"

As the virtual reality landscape heats up, Apple is fighting to ensure they are at the cutting edge. Best of all, a new wave of VR headsets are being created as mounting devices for existing smartphones.

Patent: US5960108A

Just like with Apple, there's actually so much more going on at Facebook we just can't cover it in one report. Let's move forward and try to compare these marvels.

HEAD-TO-HEAD

➤ Income Statement

* Earnings: Apple's earnings last quarter were the largest earnings ever reported in the history of financial markets. Facebook is still in growth mode -- a side-by-side comparison does us little good.

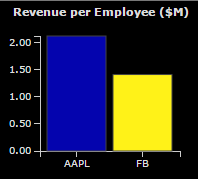

* Revenue per Employee: AAPL generates substantially larger revenue per employee ($2.1 million) than FB ($1.4 million).

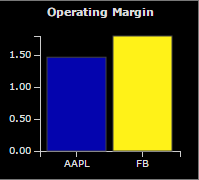

➤ Margins

* Operating Margin: FB generates $1.80 in revenue for every $1 of expense, notably higher than AAPL's $1.47. Here's the side-by-side chart:

Again, two totally different businesses, but a comparison of margins is at least a part of a head-to-head examination and Facebook is winning in the midst of torrid growth.

* Free Cash Flow: FB generates $0.32 in levered free cash flow for every $1 of revenue, notably higher than AAPL's $0.24.

Now, we move to growth:

➤ Growth

* Revenue Growth: Apple's revenue growth is actually forecasted to shrink this year while FB is forecasted to grow 40% year-over-year, yet again. Apple's wonderful opportunities are taking shape -- but 2016 will not be a great year for comps -- wait until 2017, we'll see the revenue spigot turned back on.

* Net Income Growth: Both companies are also growing net income (after tax earnings), but again, Apple is seen to come to a screeching halt this year, whereas Facebook is seen growing its relatively small base of after tax earnings into true mega cap status in the coming years.

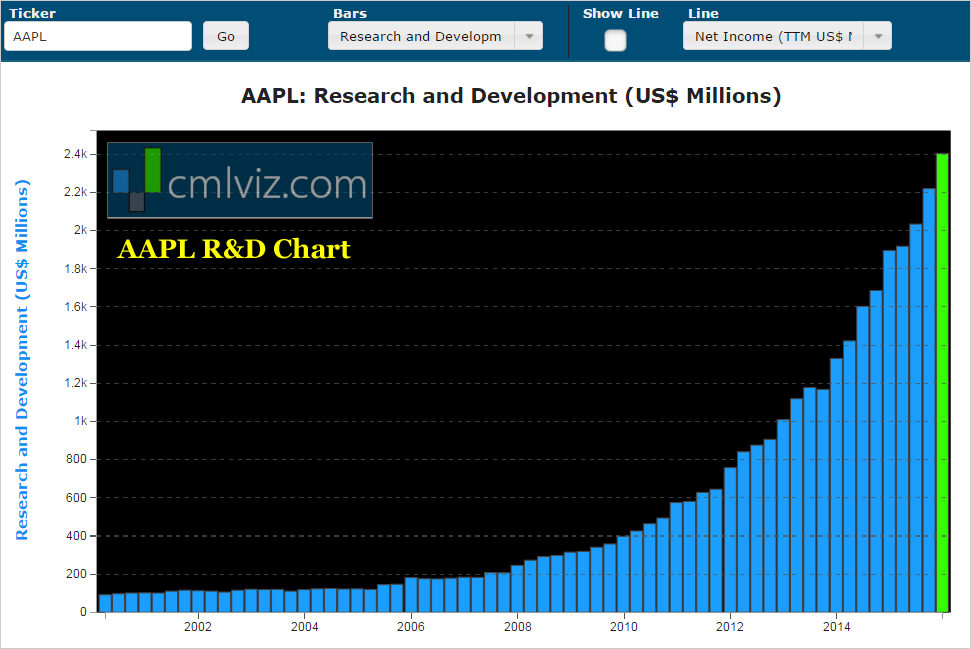

➤ Innovation

This is a knock-down drag-out battle for the ages. Apple has increased R&D by 80% over the last two-years. Here is the chart:

Not to be out done, if we look at the amount of R&D spent for every $1 dollar of operating expense, there's Facebook, and then there's everybody else:

Facebook spends more on R&D per dollar of operating expense than any large cap technology company in the world. Period.

THE RISK

Apple's growth is coming and it will be frantic -- covering all sides of technology from smartphones and wearables, to mobile pay and a devastating blow to Netflix, Amazon and all of cable TV as it turns itself in to the largest Cable bundler in the world. Even self-driving cars are well on their way for Apple.

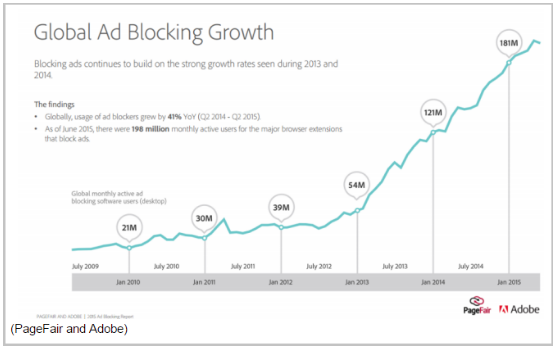

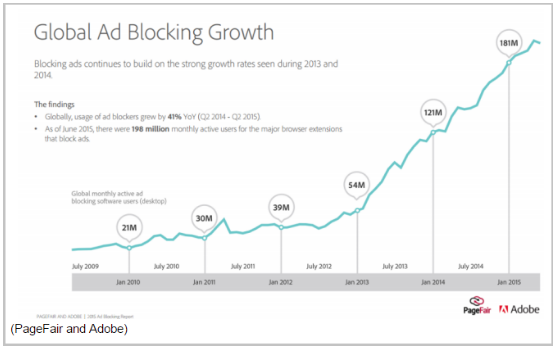

Facebook's growth is now -- mobile video, virtual reality and social media in general. But here's the rub for Facebook, and it isn't trivial. On its latest earnings call, Founder and CEO Mark Zuckerberg noted the material risk to Facebook of ad blockers. Here's what he means:

According to a report published by PageFair and Adobe, ad blocking software worldwide has increased 41% year-on-year to 198 million monthly active users and is expected to cost publishers more than $21.8 billion in 2015 in lost revenue (BusinessInsider).

Here's the incredible chart:

PROLIFERATION OF AD BLOCKING

A second risk Apple brings to Facebook is yet more direct. CML Pro broke news of a filing that Apple submitted to the US Patent and Trademark Office for a new social network, loosely referred to "Social Groups." It's too big of a report to go over here, but if you want to see the filing broken down, including renderings from Apple, you can read it as a member of CML Pro.

THE WINNER

Picking a winner between Apple and Facebook is incredibly difficult and turns in to a rather heated argument. We believe Apple is the better buy right now and do so with the one singular reality that may plague Facebook's future: Apple owns the hardware, Facebook exists on it.

If ad blocking proliferates and makes its way into apps rather than web browsers, Facebook faces trouble. If Apple's social media is released and instantly connects the one billion device install base Apple recently announced, that's more trouble for Facebook. Finally, the threat of Snapchat is real: TechCrunch noted that Snapchat briefly took the number one spot on US App Stores for the first time.

But, of course, these are two of the best mega cap technology companies in the world. Facebook is an absolute marvel, while Apple's position for future growth and an unbreakable death grip on the hardware that powers much of what Facebook does gives it the edge.

WHY ANY OF THIS MATTERS

As we said, together we have just started the analysis. But, to find the 'next Apple' or 'next Facebook,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.