Apple Growth is Back: Here are 5 Mind-blowing Facts

Fundamentals

Written by Ophir Gottlieb, 4-14-2016. This was originally published on news.cmlviz.com

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Here we go:

PREFACE

The headlines will have you believe Apple is dead and other than a handful of institutions like Goldman Sachs, RBC and Capital Market Laboratories (CML), Wall Street is yet again underestimating the demand for Apple's brand. But forget opinions, here are six facts about Apple's growth that you would swear were hidden inside classified government documents if you read some of the mainstream media coverage.

FACT #1: SMARTPHONE GROWTH

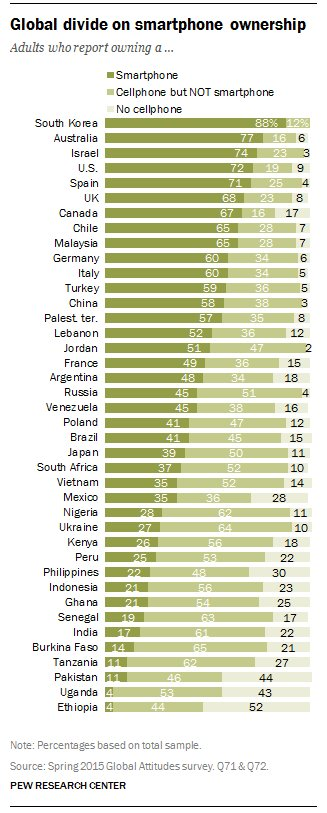

The first "classified government document" surrounds growth. First, if we were worried about smartphone growth in general, we shouldn't be: By 2020, 6 billion people will own a smartphone. Today, there are just 2.6 billion.

Just so we're perfectly clear, that's 130% growth in five-years. And where is this growth coming from? Well, to be short and sweet about it, it's coming from everywhere.

Eventually, every country will see that dark green color, which represents smartphone ownership, reach nearly 90%.

FACT #2: IPHONE IS GAINING MARKET SHARE

While the headlines would have you think that Apple is losing market share, I'm afraid that's wrong. In fact, why don't we take two sources to disprove that. First, Apple's CEO Tim Cook said, and we quote (emphasis added):

"We recorded the highest rate on record for Android switchers last quarter at 30 percent."

And if we don't like the actual CEO of Apple as our course, how about Goldman Sachs when the firm just completed a survey of smartphone buyers:

The survey also indicates a decent chunk of iPhone 7 sales, near 25%, coming from people switching from other platforms, like Android, suggesting that Apple will continue to gain market share.

FACT #3: IPHONE DEMAND IS BOOMING

Yet again, the headlines would have you believe that iPhone demand is waning. But if we decide that giving news organizations advertising dollars because of click bait might not be our best source of information, we get these three facts:

First, from RBC:

Since it launched just over a week ago, the iPhone SE has seen demand outstrip supply.

And then there's Apple Insider, which reported on the iPhone SE:

Virtually all models with all carriers [are] out of stock at Apple's retail stores.

Demand is also exceeding supply internationally.

Demand is also exceeding supply internationally.

And when we're told that it's all about the new "mini iPhone," well that's just not true either. This is from Goldman Sachs

Most importantly, our survey points to extremely strong pent-up demand for the iPhone 7 with 44% of respondents indicating that that they plan to buy the iPhone 7 in the fall.

But why depend on RBC, Goldman Sachs and Apple Insider? How about Apple suppliers: Drexel Hamilton is famously known for monitoring nine "important" publicly-traded Apple suppliers based in Taiwan. Brian White of Drexel Hamilton revealed this (emphasis added):

[The company's "Apple Monitor" supplier group] posted its strongest January since 2008.

FACT #4: IPHONE IS MORE RELEVANT THAN EVER

Sticking with headlines, we'll read that Apple is getting old -- less relevant to the younger generation and open to a new wave of competition. Well, that turns out to be a false narrative as well. Business Insider tells us that "teenagers are heavy smartphone users — many spend six hours a day on their phones — and Apple's iPhone remains their brand of choice." And then they wrote this:

Nearly 7 out of 10 teens surveyed by Piper Jaffray own an iPhone, and 75% percent said they intend to buy an iPhone as their next smartphone.

69% of teenagers surveyed are currently iPhone users. That's the highest interest in the iPhone among teenagers since at least 2013.

69% of teenagers surveyed are currently iPhone users. That's the highest interest in the iPhone among teenagers since at least 2013.

Combine those staggering numbers with "the highest rate on record for Android switchers last quarter," and I think we can safely say the iPhone has never been more relevant.

FACT #5: APPLE PAY IS EXPLODING

As far as Apple being "just a phone company," how about this fact. Whether mobile payments sound exciting or not, the projection from Bank of America is that total transaction volume will reach $3 trillion by 2022. Between the iPhone and the iPad, Apple controls 65% market share and even better, straight from Apple's last earnings report:

In the second half of 2015, we saw significant acceleration in usage, with a growth rate ten times higher than in the first half of the year.

Yes, he said ten times higher growth in six-months.

INFORMATION MONOPOLY

Our purpose is to break the information monopoly held by the top .1%. We just shared five facts, but there's so much going on with Apple it actually spans eight different thematic transformations. The reasons behind the company sitting as one of our precious few "Top Picks" for CML Pro are yet more breathtaking than those tidbits we covered above. But to find the 'next Apple' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.