Apple: Five Horrifying Charts and Incredible Potential Turnaround

Fundamentals

Our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%. Thanks for standing with us.

PREFACE

Apple saw its first annual decline in revenue in 13-years and guided lower for next quarter as well. The stock has tumbled to 40% off of its all-time highs. It's gone from Wall Street darling to punching bag. We'll look at five charts that demonstrate vividly the cause for concern and, the cause for a bullish thesis.

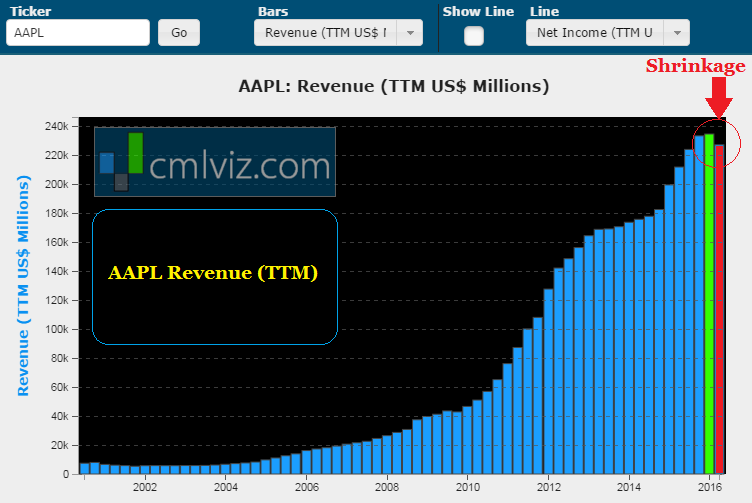

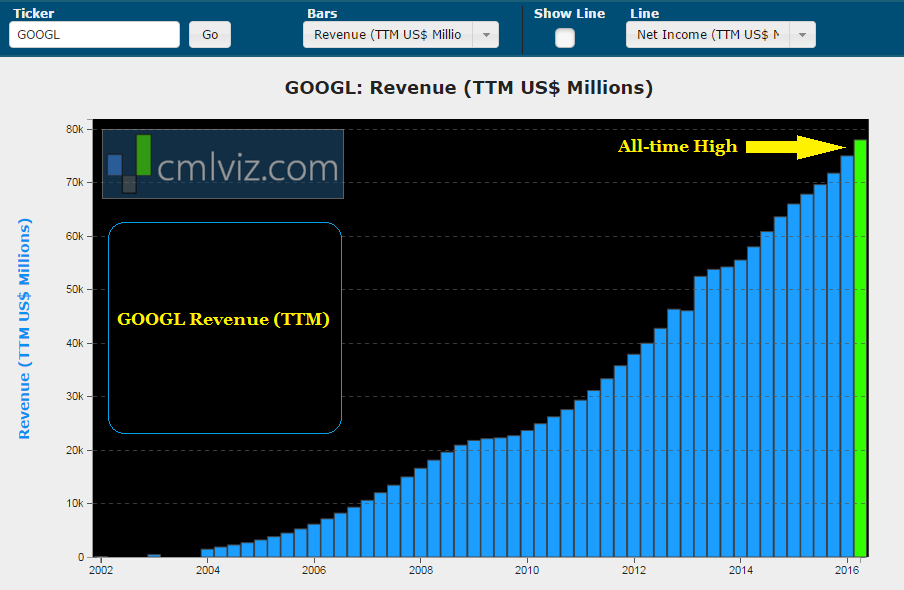

REVENUE

We led with it, so let's look at it. This is what has happened to Apple's revenue:

APPLE REVENUE (TTM)

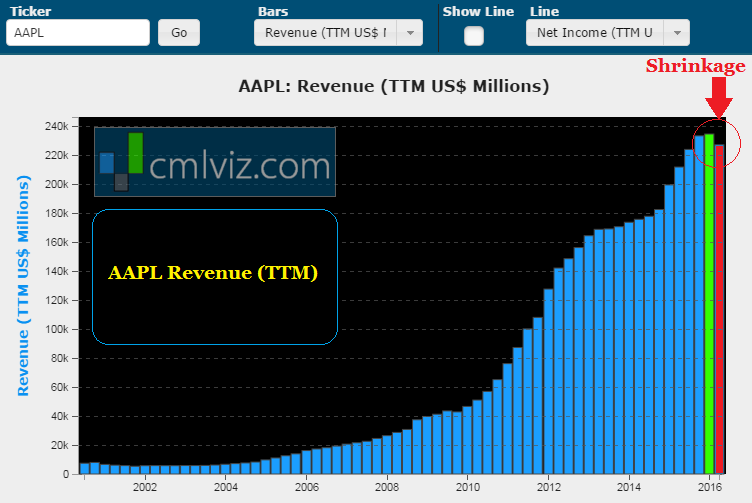

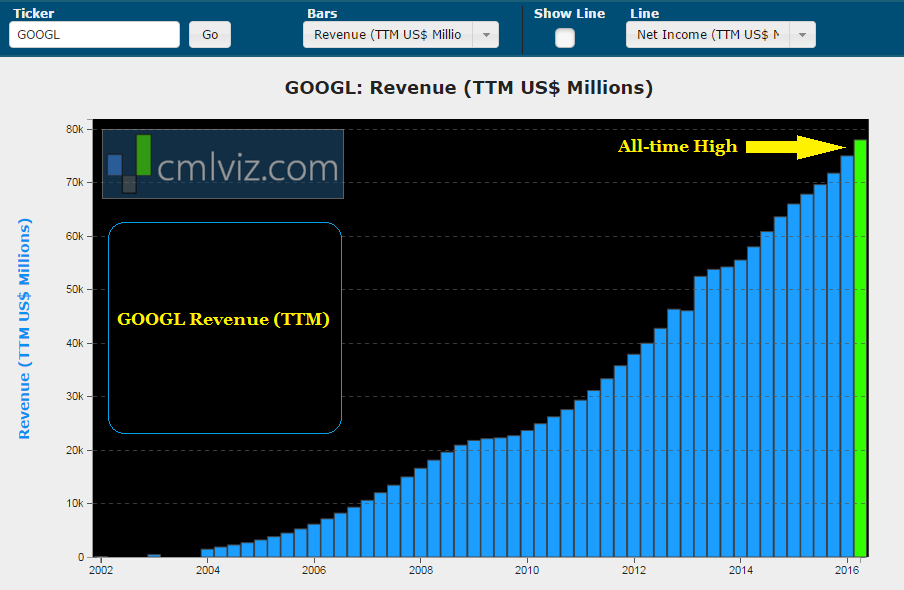

There it is, in plain sight. Apple's revenue has dropped. For context, here is that Google, Amazon and Facebook look like in their revenue charts:

GOOGL REVENUE (TTM)

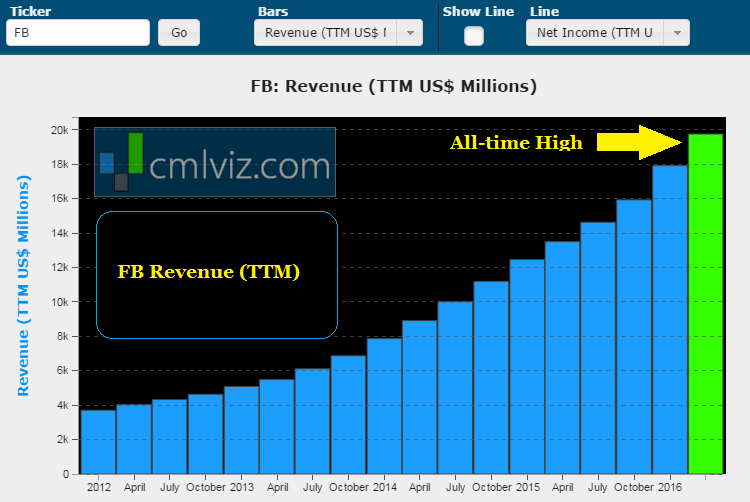

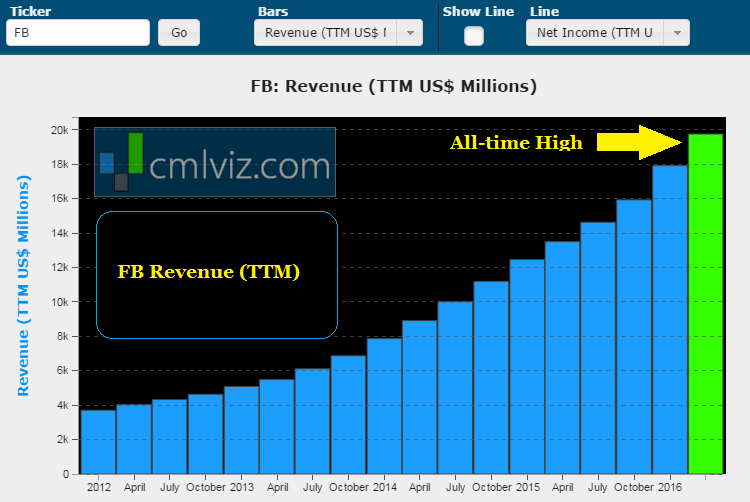

FB REVENUE (TTM)

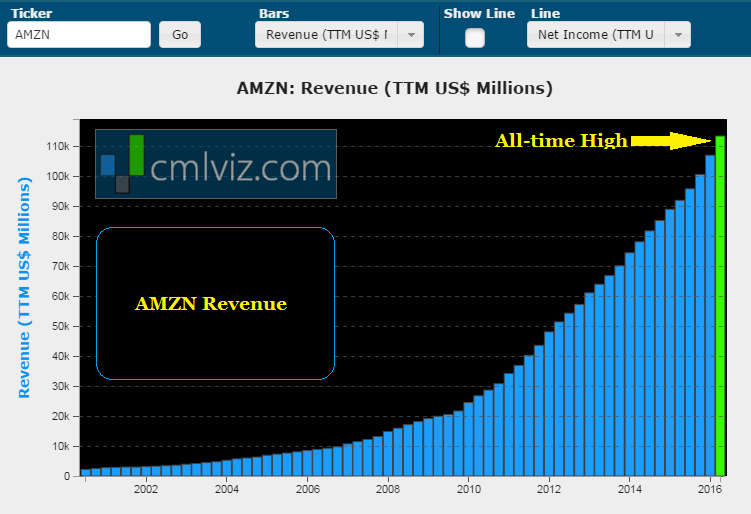

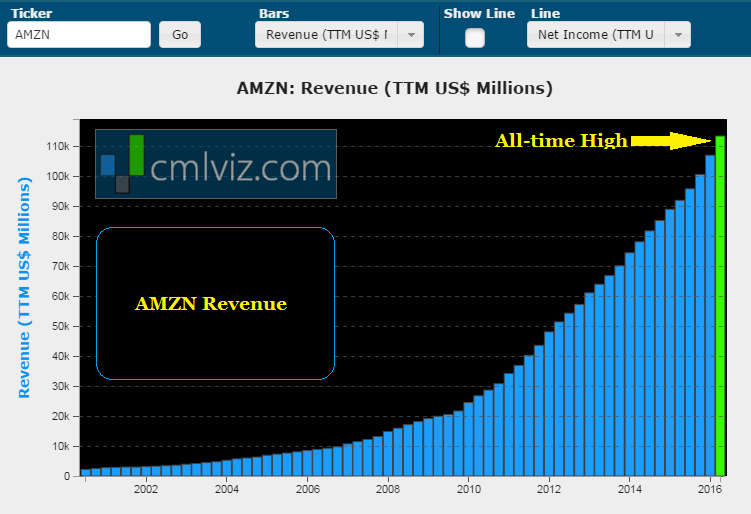

AMZN REVENUE (TTM)

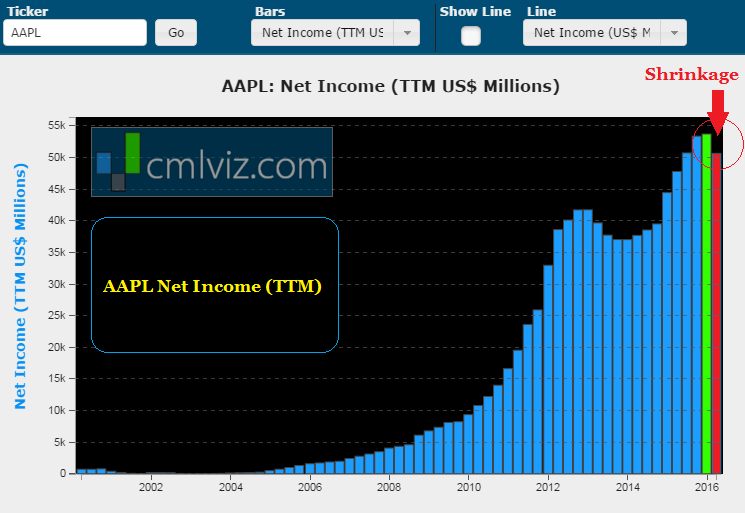

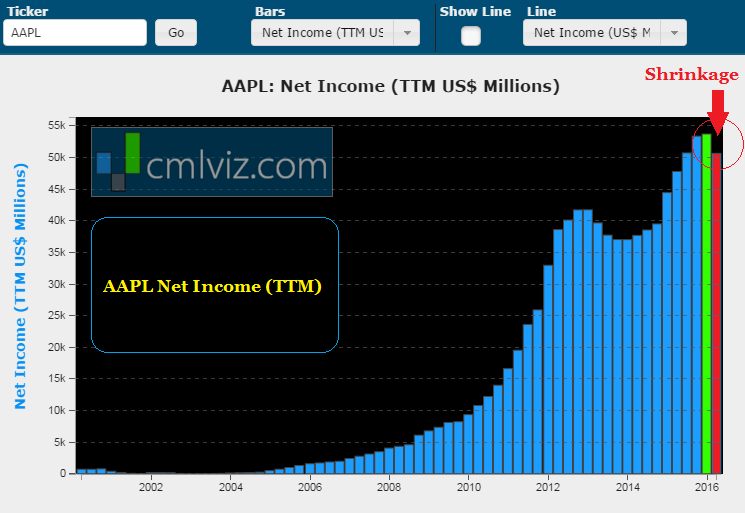

NET INCOME

Apple's earnings have also taken a fall. Here is the 16-year net income chart:

AAPL NET INCOME (TTM)

No great surprise here. iPhone unit sales dipped, and while other business segments, like Apple Services, grew quite nicely, they aren't yet large enough to make up for an iPhone dip.

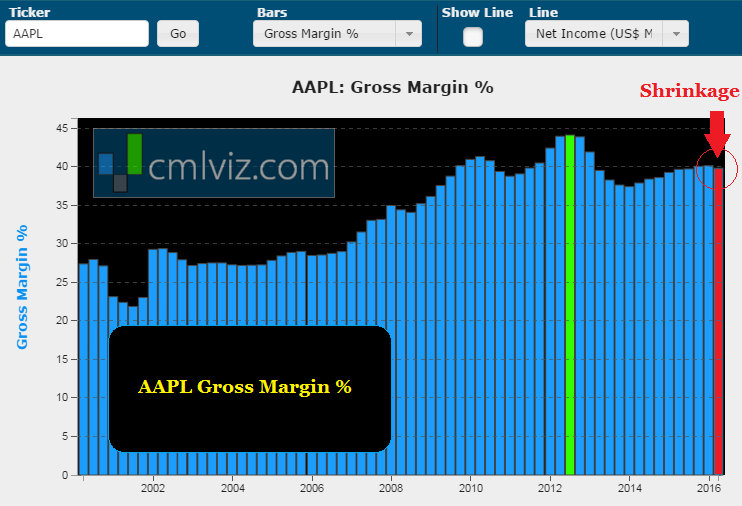

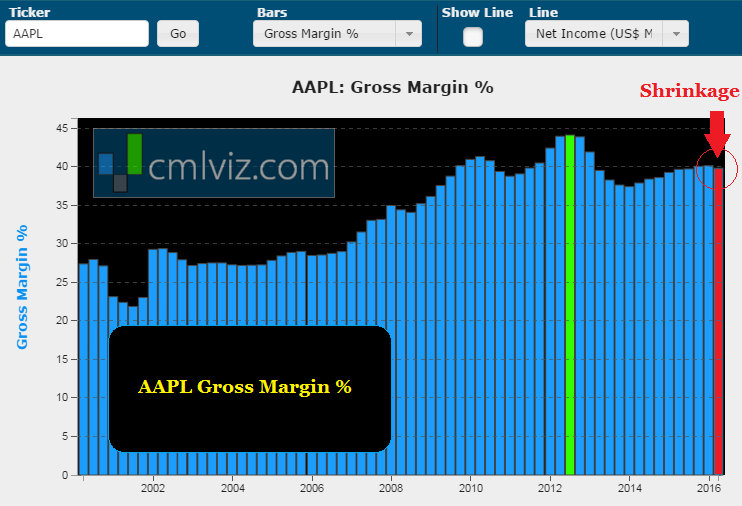

GROSS MARGIN %

As Apple has turned to India as a growth driver (which it will be), it has also turned to a slightly lower average selling price (ASP) for the iPhone. The net result, gross margins have decreased.

AAPL GROSS MARGIN %

So is all hope lost? Actually, no, it isn't.

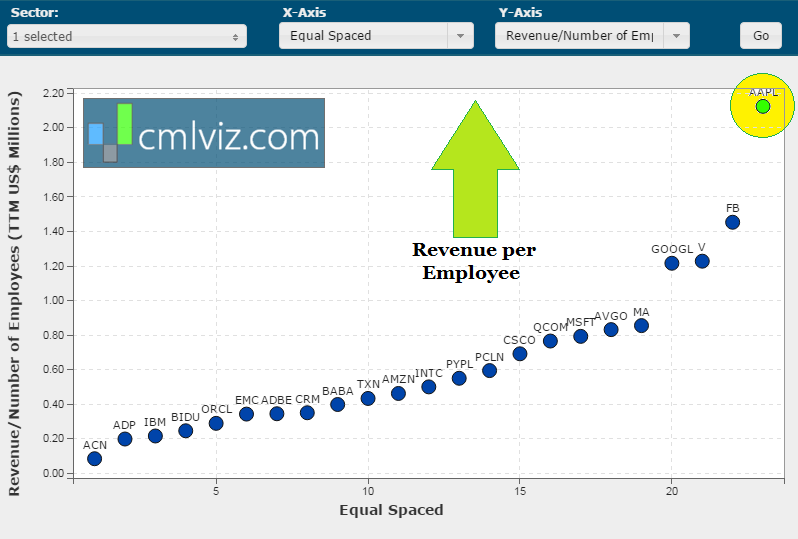

REVENUE PER EMPLOYEE

If we take all mega cap technology stocks and plot the revenue per employee ($ million) on the y-axis while ranking them on the x-axis, we get this:

No matter how you slice it, there simply is no other company generating as much revenue per employee as Apple in the mega cap tech space. And for the record, Apple has over 110,000 employees, compared to ~61,000 for Google and ~ 13,000 for Facebook.

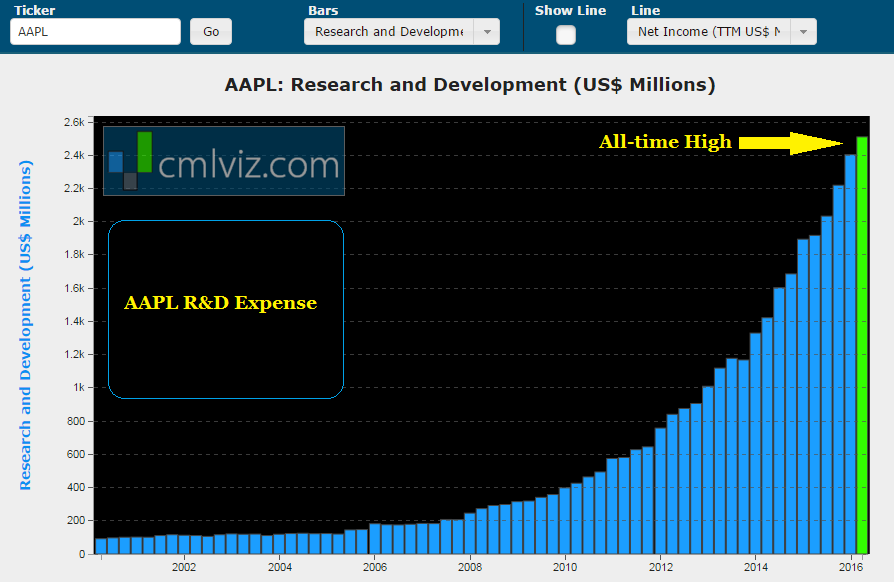

RESEARCH AND DEVELOPMENT

For a long time it was a widely held belief by bears that Apple was under investing in research and development (R&D). The bulls argued that it wasn't necessary, Apple was just better at it, so it could spend less than peers. Well, the two can come together now -- Apple has exploded its investment in R&D over the last two-years. Here is the 16-year chart:

AAPL R&D

Apple has increased R&D spending by 80% over the last two-years and it has also increased R&D per $1 of revenue from $0.03 to $0.05 -- another staggering increase.

NOW WHAT

The bearish argument is that Apple is an iPhone company and the product is in a mature market with heightening competition. The bulls argue that by 2020, 6 billion people will own a smartphone. Today, there are just 2.6 billion.

Bears will argue that a 'phone company' has no innovation. Bulls argue that Apple's radical disruption in mobile pay, it's move to own Cable TV through Apple TV, and its booming Services segment even excluding new iPhone sales are proof that innovation is taking hold.

Bears will argue that China has turned from a growth engine to shrinkage. Bulls will argue that China's middle class will grow from 50 million people in 2010 to 500 million people by 2020.

Bulls will also counter with Apple's entrance into India, the second largest smartphone market in the world, is proof of yet another huge opportunity. Bears will argue that the Indian consumer is much less well-off and very few people can afford anywhere near $400 for a phone.

WHY THIS MATTERS

There's so much more going on with Apple it actually spans eight different thematic transformations and we can't fit it into one dossier. It's OK to be bullish or bearish on Apple, but the headlines won't give us the knowledge we need to make the kind of decision we expect of ourselves. Even further, to find the 'next Apple' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks’ is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit.

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends.