The Single Metric To Find Tech Super Star Stocks

Stock Buy Backs

PREFACEA hot topic of late has been stock buybacks. Is it a worthy investment of money or a borderline accounting shenanigan to boost earnings per share (EPS)?

We'll review this with beautiful visuals, and then we'll talk about the single most powerful metric that the top .1% are using and beating the market because of it.

STOCK BUYBACKS

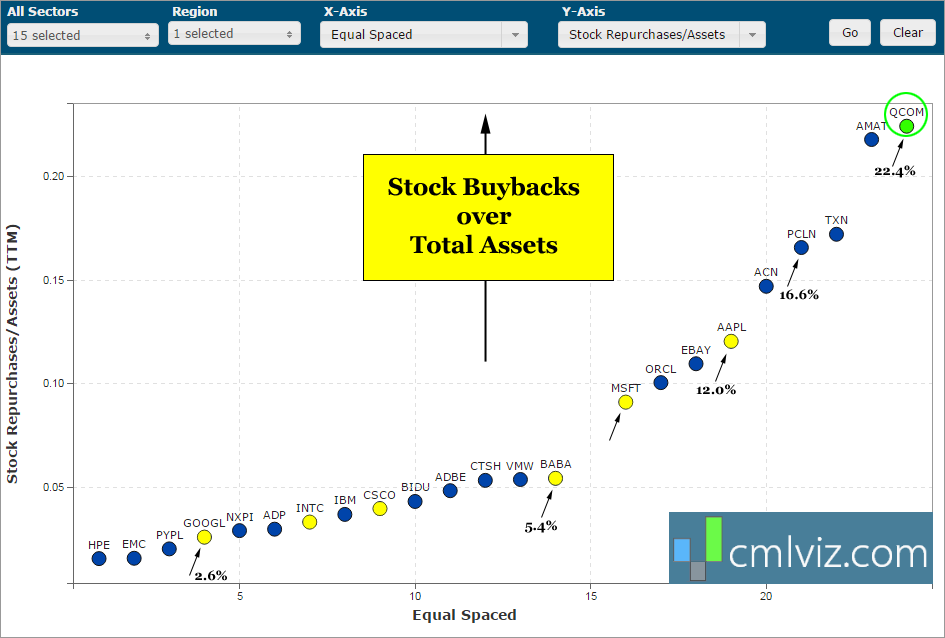

Let's chart technology companies with market caps greater than $25 billion by the amount spent on stock buy backs as a percent of total assets.

STOCK REPURCHASES AS % OF ASSETS

We note that on this chart, Apple and Microsoft hardly look like outliers even though their gross repurchases are absolutely enormous. Further, no matter how you slice it, Qualcomm's woes in revenue growth have turned the company to buybacks, not investment and that's at the very least eyebrow raising if not downright absurdity.

THE NEXT HUGE WINNERS

How a company spends its cash is critical to its life blood. Buybacks are good to a point, but investment in R&D is better as long as revenue growth continues. It turns out there is one single measure that if you take the top five companies in the entire large cap market over the last two-years or one-year they have dominated the broader market.

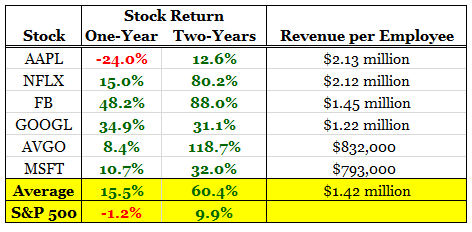

We won't hide it from you – this isn't a teaser – here it is: revenue per employee:

No matter how you look at it -- the top 3, 4, 5, 6 companies over one or two years, this metric has been a symptom of a portfolio that substantially outperforms the market.

WHY THIS MATTERS

This is how the greatest transfer in wealth we have ever experienced has moved to the top 0.1% from everybody else. It's just access to information. True margins, revenue and profits, the kind that turn companies from small caps into mega caps, the kind that see stocks double, triple or even quadruple, that only occurs when two critical phenomena collide:

To find the "next Apple" or "next Google" we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our Top Picks is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, the cloud, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

That chart plots the growth in 4G usage worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends. The author is long Apple shares in his personal account.