Apple Gets Unbelievably Good and Catastrophic News on iPhone

Preface

Apple Inc. (NASDAQ:AAPL) has been hounded by bears as its stock had dropped nearly 40% at its lows. The stock has seen a nice bounce back when the market reacted to news via Apple Inc. suppliers that iPhone 7 demand was going to be substantially stronger than previously accounted for. Here's a snippet of that before we get into the news today.

SURPRISE

It turns out the Apple iPhone is not only doing better than expected, it's doing better than almost everyone else. In what has been a whirlwind of a month we have learned that iPhone 7 suppliers reported substantially higher demand production required from Apple Inc. which were well above forecasts.

“

iPhone 7 suppliers to produce 72 million to 78 million units this year, many more than the 65 million units Wall Street has projected. That production target is also the highest in about two years.

Source: Investors Business Daily

iPhone 7 suppliers to produce 72 million to 78 million units this year, many more than the 65 million units Wall Street has projected. That production target is also the highest in about two years.

”

Source: Investors Business Daily

Then on CNBC's "Squawk on the Street," Jim Cramer said:

Forecasts had called for 65 million iPhone 7s to be produced by the end of 2016, so this 72 million to 78 million range is in fact a smashing of forecasts.

While that news was market moving, and added about $50 billion in market cap to Apple Inc. market cap, we just caught wind of two other pieces of news: one is great news, the other could be catastrophic.

GREAT NEWS

Apple Inc. (NASDAQ:AAPL) is going after India, the country that represents the second largest smartphone market in the world, behind China. We have written about it ad nauseum, but the major point here is that Apple has essentially no footprint in the country, taking home as little as 1% of the smartphone market share, and all of a sudden, everything changed.

If you recall that that 1%-2% market share we looked at in India as of mid-2015, news from Quartz broke in March that the tide is shifting, and it's building into a tsunami:

“

iPhone sales made up 4.6% of the overall smartphones sold in India's top 30 cities between October and December 2015.

iPhone sales made up 4.6% of the overall smartphones sold in India's top 30 cities between October and December 2015.

”

That number has spiked to 5.8% in tier-I Indian cities.

The key for Apple Inc. was to get around India's law that requires 30% domestic sourcing of products sold in India. First, it looked like Apple had a huge win by side stepping the requirement. A tectonic shift began last year with a visit by Apple's CEO Tim Cook and a private meeting with India's Prime Minister. While the meeting was rather private, the results were not:

Shortly after the meeting we got this news: India has singled out "cutting-edge technology" as a segment that can side-step the 30% local producer rule and Apple has been singled out as "cutting-edge technology." What a coincidence.

We break news every day. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

Then Tim Cook went to India just a few weeks ago things went spectacularly well, with news of Apple Inc. (NASDAQ:AAPL) stores coming to the country, an R&D facility, and just a lot of smiles. But, as Prime Minister Modi shook Tim Cook's hand, the country's finance minister kicked him in the shins, reportedly denying a waiver of that 30% sourcing rule. That news was stunning.

Alas, the good news came right back, with this:

“

Talks between India's Finance Ministry and the Department of Industrial Policy and Promotion (DIPP) have begun and the option of letting Apple open stores without sourcing requirements in the initial years has been floated.

The Indian government is expected to allow the tech giant to open its own retail stores in the country without any sourcing requirement for two to three years, according to the Times of India.

Source: TheStreet

Talks between India's Finance Ministry and the Department of Industrial Policy and Promotion (DIPP) have begun and the option of letting Apple open stores without sourcing requirements in the initial years has been floated.

The Indian government is expected to allow the tech giant to open its own retail stores in the country without any sourcing requirement for two to three years, according to the Times of India.

”

Source: TheStreet

That's the great news. But, Apple Inc. also just received catastrophic news too, from a totally different place.

CATASTROPHIC NEWS

China makes up more than 50% of Apple Inc. (NASDAQ:AAPL) operating income, but the company has met fierce new competition. Tim Cook has calmed fears of that competition, noting several facts about Apple's brand acceptance in China. But what nobody expected was for China's homegrown smartphone companies to come to the United States. And friends, that is going to happen.

“

[A] new patent cross-licensing agreement with Microsoft now gives Xiaomi access to about 1,500 of Microsoft's patents for voice communications, multimedia and cloud computing. In exchange, Xiaomi has agreed in exchange to install Microsoft's Office and Skype software on all the smartphones and tablets it sells.

About 90 percent of the 70 million smartphones that Xiaomi built last year were sold in China. UK-based analyst Sameer Singh told Reuters, "This deal might just give them enough of a patent trove to move to Western markets."

Source: Breitbart

[A] new patent cross-licensing agreement with Microsoft now gives Xiaomi access to about 1,500 of Microsoft's patents for voice communications, multimedia and cloud computing. In exchange, Xiaomi has agreed in exchange to install Microsoft's Office and Skype software on all the smartphones and tablets it sells.

About 90 percent of the 70 million smartphones that Xiaomi built last year were sold in China. UK-based analyst Sameer Singh told Reuters, "This deal might just give them enough of a patent trove to move to Western markets."

”

Source: Breitbart

So Microsoft Corporation (NASDAQ:MSFT) has made a brilliant move to strengthen its footprint in China, while simultaneously allowing Xiaomi to take aim at Apple in the United States.

People have called the new launch of the Xiaomi Mi 5, a $400 phone, "the iPhone killer" in China with twice the battery, 10 percent less weight, a more powerful processor than the Apple's A9, and standard low-light with advanced optical stabilization camera. Most analysts report that in comparison, Chinese users tend to report that the Mi 5 has a better feel than the iPhone 6S (Breitbart).

Xiaomi's cheaper phone wasn't a global iPhone killer because the domestic Chinese have never had the patent rights to begin forming alliances with telecommunications firms in the U.S. and Europe. That barrier has been smashed down and that's catastrophic news for Apple. Or is it?

GOOD NEWS VERSUS BAD NEWS

While the bearish view of this outcome is pretty obvious, it turns out this could be a non-issue. No matter how we slice it, "Sino phobia" (a sentiment against China, or Chinese culture) is as real as ever. The public Chinese companies that trade on U.S. exchanges have been hounded by fraud allegations from the smallest companies all the way to the largest of them all, Alibaba (NASDAQ:BABA).

The U.S. consumer is no different and there is very little evidence that even if Xiomi makes it to the U.S. that anyone will be interested.

On the other hand, the news in India is tremendously good. Bears will argue that India's consumer can't afford an iPhone, which is true for the most part, but Apple isn't after "the most part," it's after 20% of the market, like it has in China. Is there more to this story? Yes, there's a lot.

WHY THIS MATTERS

There's so much going on with Apple it's impossible to cover in one report. But, to find the 'next Apple,' 'next Google,' or 'next FANG stock,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

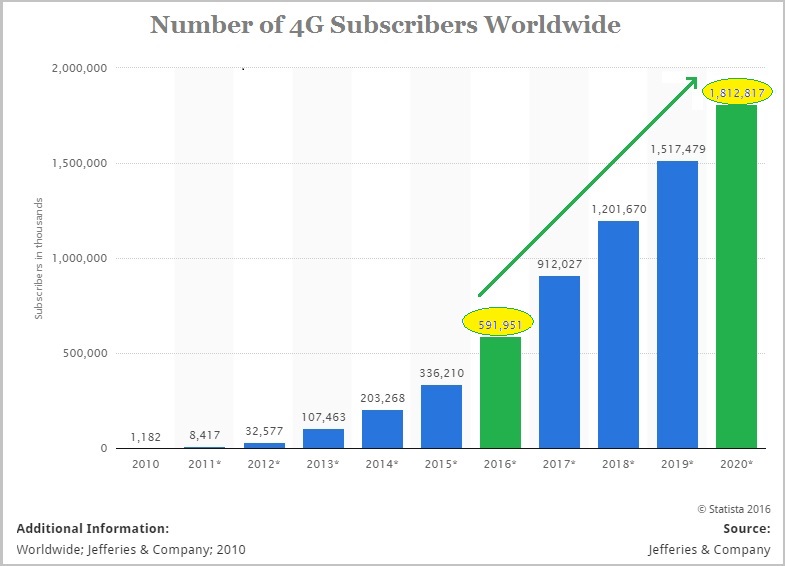

That chart plots the growth in 4G usage worldwide and how it will grow from 330 million people today to nearly 2 billion in five years. This is the lifeblood fueling every IoT and mobile device on the planet and CML Pro has named the single winner that will power this transformation. Then there's cyber security:

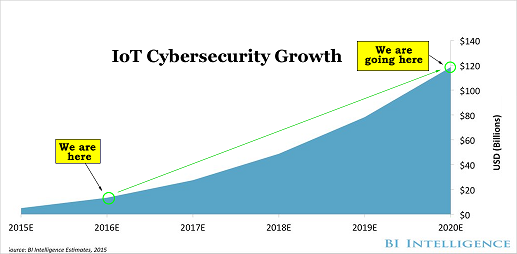

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends. The author is long Apple shares in his personal account.