The Stunning Reality of Apple, Amazon, and Facebook in 3 Charts

MEGA TECH DIFERENCES

PREFACE

We have quickly come to a place where there are five mega tech companies that are ruling the world: Facebook Inc. (NASDAQ:FB), Alphabet Inc. (NASDAQ:GOOGL), Microsoft Corporation (NASDAQ:MSFT), Apple Inc. (NASDAQ:AAPL) and Amazon.com Inc. (NASDAQ:AMZN).

Each of these companies is stepping on each others' turf, each competing directly, indirectly and everything in between. The business lines have become so overlapped, the audiences they are pursuing are so oversaturated that we start to lose sight of the fact that these five mega tech companies are quite different in their operations and approach. Let's look at a few charts that are fascinating and draw out the vast differences between these firms.

MEGA TECH STOCK RETURNS

We'll start simple -- here are the five mega tech stocks ranked by stock return over the last year.

Amazon.com Inc. (NASDAQ:AMZN) has blown past the market and its mega tech peers with a 68% return in the last year. Facebook Inc. (NASDAQ:FB) has also loudly beat earnings expectations and seen its stock jump nearly 50%. But rather quietly, Alphabet Inc. (NASDAQ:GOOGL) has become the largest company in the world with a 34% rise in stock price over the last year. Interestingly, the bottom two performers are the oldest companies: Apple Inc. (NASDAQ:AAPL) and Microsoft Corporation (NASDAQ:MSFT).

Now let's look at the charts that show how differently these firms operate.

MEGA TECH R&D

Next we will rank these five companies by the amount they spend on research and development per $1 of operating expense.

Two points are astonishing, here. First, Facebook Inc. spends almost $0.40 of every dollar in operating expense on R&D. Now, we need to be aware that stock based compensation finds its way into the R&D line on the income statement, which is odd, but is reality.

While Facebook, Inc. spends a ton here, it also has the smallest operating expense in general, so the comparison isn’t really apples to apples. But Alphabet Inc. is enormous, and the firm pays $0.17 in research and development for every $1 in operating expense -- that's huge.

We can see that Amazon.com Inc. actually spends the least per dollar of operating expense, but, Amazon.com spends the most on R&D than any other company in the world. Apple Inc.is actually the outlier here, spending much less than Alphabet Inc., Amazon.com Inc. and Microsoft Corporation on R&D.

MEGA TECH STOCK BASED COMPENSATION

Finally, we can rank the companies on the amount the payout in stock based compensation for every dollar of operating expense.

We can see again that Facebook Inc. spends the most on stock based compensation relative4 to operating expense than any of the other mega tech peers and that is in part driving the R&D expense. Yet again, we see that Alphabet Inc. spends a huge amount for a company as large as it is. Apple Inc. (NASDAQ:AAPL) and Amazon.com Inc. are outliers again.

WHY THIS MATTERS

R&D and expense recognition trends alone can never capture the force that truly drives growth for a company. The kind of growth that creates companies like Apple, and Facebook, comes from fundamental changes in technology and the economy. At Capital Market Labs, we identify these transformations, and the companies that will benefit most from them to find the "next Apple" or the "next Google." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

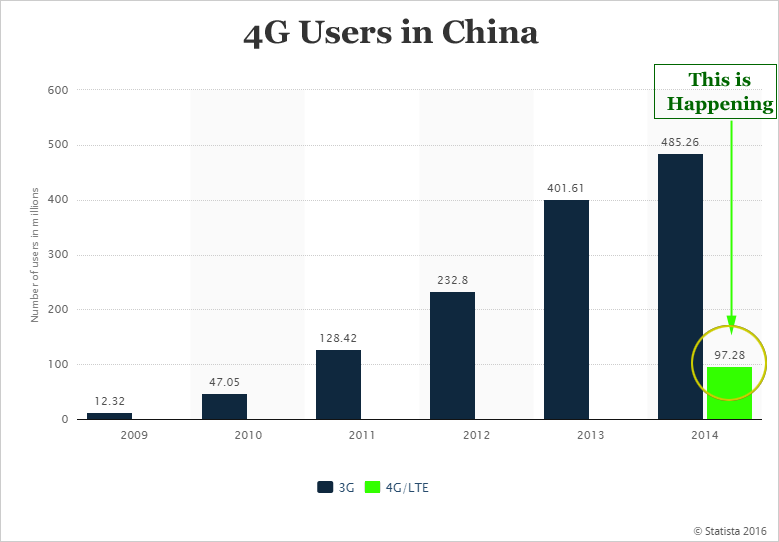

That light green colored bar (4G) is soon going to be larger than the dark colored bar (3G). 4G usage will grow from 330 million people today to nearly 2 billion in five years. CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.