Apple Risk Explodes: China's Corruption Surfaces

Apple Inc. (NASDAQ:AAPL) Faces China's Corruption

HISTORY: 2002 iPHONE

In 2002 Apple applied for a trademark in the electronic goods category in China. This was nearly five years before the launch of the iPhone itself. The trademark was not granted. However in 2007, once the iPhone was a known product, a Chinese company called Xintong Tiandi Technology (XTT) then applied for the iPhone trademark in leather goods in 2007, and it was granted in 2010.

Nobody was overly worried about this because first, the trademark went to a non-competitive industry. Then, in the years to come, the iPhone trademark has had trouble worldwide. Apple lost the right for local carriers to use the iPhone name in Mexico back in 2014 because a local company had trademarked iFone in 2003. It also faced a trademark battle in India the same year, where a local company claimed confusion with its own brand, iFon (9TO5Mac).

HISTORY: 2016 iTunes

On April 22nd of 2016, China shut down Apple's online book and movie services in the country, suggesting an intensifying campaign to bring Web content in line with Beijing's stringent guidelines for traditional media (WSJ).

This came as a much bigger surprise because Apple had done so much work in China to garner goodwill from the ruling Communist government. The ruling did not seem Apple specific, again, because the totalitarian government in China had done the same type of content censorship with Google, Facebook and Twitter. This seemed to be more of a case where Apple stepped into a red zone, outside of hardware, and China doesn't let anyone in to that zone.

Here's a take from Forbes surrounding that event:

"

[T]he ruling Chinese Communist Party (CCP) does not seem to value such demonstrations of goodwill. The CCP seldom allows sentimentality to get in the way when a foreign company - even an old "friend of China" such as Apple-does something that arouses the party's paranoia.

In this particular case, the digital books and movies offered by Apple are considered a potential threat to the Chinese government's ongoing campaign of keeping out Western liberal ideas. In addition, the notion that Apple could dominate China's digital content market must also have offended Beijing's protectionist instincts.

[T]he ruling Chinese Communist Party (CCP) does not seem to value such demonstrations of goodwill. The CCP seldom allows sentimentality to get in the way when a foreign company - even an old "friend of China" such as Apple-does something that arouses the party's paranoia.

In this particular case, the digital books and movies offered by Apple are considered a potential threat to the Chinese government's ongoing campaign of keeping out Western liberal ideas. In addition, the notion that Apple could dominate China's digital content market must also have offended Beijing's protectionist instincts.

"

Source: Forbes

The Forbes article goes on to read "On a fundamental level, Beijing wants to keep foreign firms from dominating China's information sector and from posing an existential threat to the CCP's monopoly of power. China may have to pay a high price for such resistance. They may have to use inferior technology, products, and services. But such costs are considered affordable to the regime because they are borne almost exclusively by ordinary Chinese people."

At this point, multi-billionaire Carl Icahn sold his stake in Apple.

"

"We no longer have a position in Apple." Apple is a "great company" and CEO Tim Cook is "doing a great job."

Icahn said China's attitude toward Apple largely drove him to exit his position.

"You worry a little bit - and maybe more than a little - about China's attitude," Icahn said, later adding that China's government could "come in and make it very difficult for Apple to sell there ... you can do pretty much what you want there."

"We no longer have a position in Apple." Apple is a "great company" and CEO Tim Cook is "doing a great job."

Icahn said China's attitude toward Apple largely drove him to exit his position.

"You worry a little bit - and maybe more than a little - about China's attitude," Icahn said, later adding that China's government could "come in and make it very difficult for Apple to sell there ... you can do pretty much what you want there."

"

Source: CNBC

What the press did not do a great job of covering was the last part of Icahn's statement, which reads: "[If China] was basically steadied," he would buy back into Apple.

Apple's CFO and CEO did comment on the sale. CFO Luca Maestri said: "We remain very optimistic about the China market over the long term, and we are committed to investing there for the long run.

RIGHT NOW: 2016 APPLE IPHONE

But the most disturbing news came out last week. Here it is:

"

Intellectual property regulators in Beijing barred Apple from selling models of the iPhone 6 and 6 Plus in the city, citing strong similarity to an existing Chinese phone.

The regulator said iPhone models infringed on the patents of 100C mobile phones.

Intellectual property regulators in Beijing barred Apple from selling models of the iPhone 6 and 6 Plus in the city, citing strong similarity to an existing Chinese phone.

The regulator said iPhone models infringed on the patents of 100C mobile phones.

"

Source: CNBC

Even though Apple noted, correctly, that "iPhone 6 and iPhone 6 Plus as well as iPhone 6s, iPhone 6s Plus and iPhone SE models are all available for sale today in China," there's no way to read this move from China other than all out totalitarian, nationalistic and brutal.

The Wall Street Journal reported earlier Friday that some stores stopped selling the phones months ago and are switching to newer models. Apple will soon end production of the banned iPhone 6 models, a person familiar with the production plans told the Journal.

WHAT'S REALLY HAPPENING

After reading everything above, it can seem as though China is slowly dropping the hammer on Apple, as home grown companies are delivering smartphones that are "good enough" if not better than Apple. The populace at large, it could be argued, will not be harmed.

What was not properly reported other than by CNBC was that "this is a patent filed in a Beijing court for Beijing only, and it's about the outside look of the phone. It has nothing to do with the technology of the thing" (John Rutledge, Chief Investment Strategist at SAFANAD).

Some comfort can be had with reality that the iPhone ban was isolated to an older iPhone model, a single city (Beijing) patent law, and the fact that it has only to do with the outside of the phone rather than the technology inside. Further comfort can be found with the reality that this single ban, in isolation, will have no material impact on Apple's revenue or profits.

WHAT'S GOING TO HAPPEN China depends on Apple just as Apple depends on China.

If the country truly turns Apple out, it would be a disaster for the country's growing move to attract foreign companies to build research and development centers in the country -- to go beyond manufacturing facilities that make use simply of inexpensive labor. As China's labor force becomes more expensive, foreign companies are already hopping out of town to go to other lesser developed countries for labor. Further, Foxconn, the massive Apple and Samsung supplier, has replaced sixty thousand Chinese workers with robots.

Marketwatch reported that the "Apple supplier says automation has freed up its employees for higher value-added roles, such as in R&D." That's exactly what China wanted to hear.

Nipping at the heels of Apple simply reminds the Chinese populace that the government is in charge, but that other than posturing, this isn't (yet?) the disaster that the man stream media will have us believe. But this is getting dangerously close to playing politics rather than doing research for investments.

WHY THIS MATTERS

CML Pro identifies the most powerful thematic transformations that are coming and then identifies the companies best positioned to win. You see, to find the 'next Apple' or 'next Google,' we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

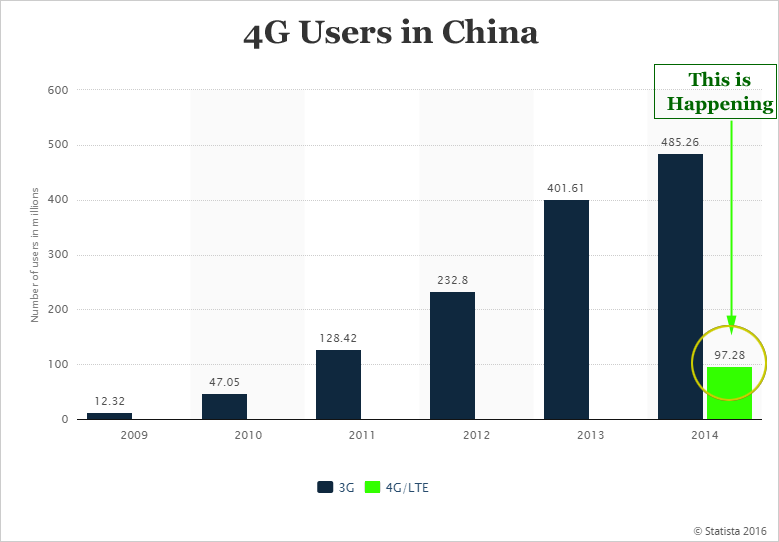

That light green colored bar (4G) is soon going to be larger than the dark colored bar (3G). 4G usage will grow from 330 million people today to nearly 2 billion in five years. CML Pro has named the single winner that will power this transformation. Then there's cyber security:

Market correction or not, recession or not, the growth in this area is a near certainty, even if projections come down, this is happening. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

Thanks for reading, friends. The author owns Apple shares.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn't do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.