The Largest and Most Absurd Stock Buybacks

PREFACE

Investor's Business Daily just reported that "[c]ompanies in the S&P 500 spent a total of $161.4 billion in stock buybacks in Q1, up 12% from Q1 2015. It was the second-largest expenditure on record, following the $172 billion spent in Q3 2007, as reported by the S&P Dow Jones Indices."

But diving deeper reveals some borderline absurd numbers. In the latest quarter, Gilead Sciences Inc. (NASDAQ:GILD) and Apple Inc. (NASDAQ:AAPL) spent the most on stock buybacks. Both companies have seen share prices hit bear market levels, well below 20% from highs and both companies have large stock piles of cash.

While both firms have increased spending on research and development, the real money is going into stock buybacks.

STORY

There is an ever heated conversation that surrounds the value of stock buybacks. At the extremes it can be considered an accounting game that simply raises earnings per share by reducing share count without doing anything to affect earnings. At the other extreme you'll find investors that believe it's a signal from firms that they see brighter times ahead are using their cash to make the best investment possible -- buy their own stock at a discount.

Let's examine the companies that have the largest stock buybacks in the most recent quarter:

Atop the list is Gilead Sciences with an enormous $8 billion in stock buybacks. The most recent data from the company's balance sheet shows $8.3 billion in cash and short-term investments, down from just under $15 billion in the quarter before.

We break news every day. Discover the Undiscovered.

Get Our (Free) News Alerts Once a Day.

Apple Inc. comes in at number two with just under $7 billion in stock buybacks, but Apple has a stock pile of cash eclipsing $200 billion, and over $150 billion after debt is taken out. The Gilead Sciences buyback is extraordinary relative to Apple. But, in greater context, Apple has approved a $250 billion stock buyback plan, a staggering number which in and of itself is larger than all but eight companies in the S&P 500.

If we extend this analysis and look at all stock buybacks over the trailing twelve months, we can get a better feeling for the enormity of Apple's buybacks.

We can see Apple at the top again, with Gilead Sciences coming in at number three. Microsoft Corporation (NASDAQ:MSFT) comes in at number two. Putting more context around Gilead Science's buyback plan, Microsoft has more than $100 billion in cash and equivalents with a $17 billion buyback in the last year. While analysts and investors alike may be pounding the table in anger at Apple and Microsoft, again, Gilead Sciences buyback seems absurd.

We also note that both Apple and Microsoft have growing cash balances even in the face of the stock repurchases, whereas Gilead has spent half its corporate cash in the last three-months.

WHY THIS MATTERS

At Capital Market Labs we identify transformations and the companies that will benefit most from them to find the "next Apple" or the "next Google." Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution. Our purpose is to break the information monopoly held by the top .1%.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, Internet of Things, drones, biotech and more. In fact, here is just one of the trends that will radically affect the future that we are ahead of:

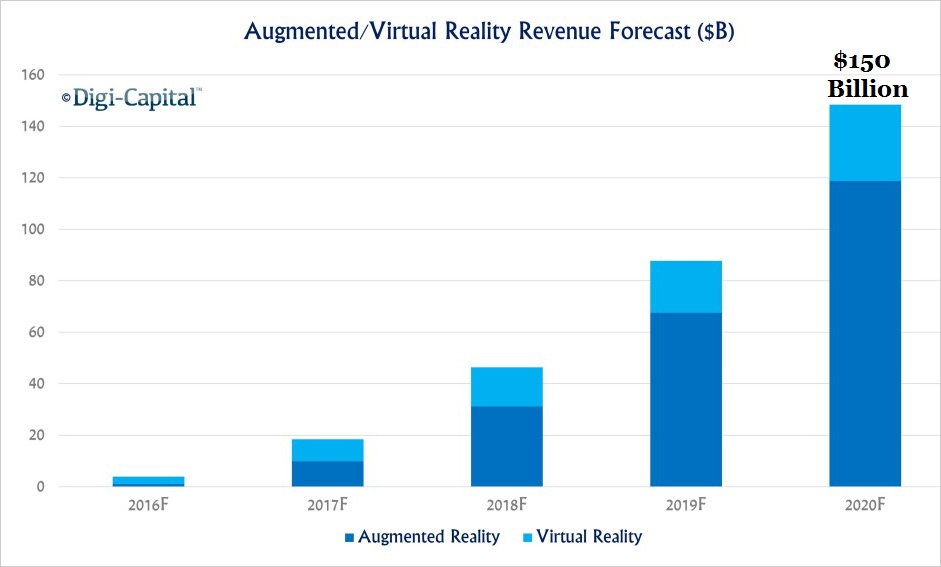

Virtual reality is one of the fundamental shifts coming in the very near future that will change how we live, work, and play. This is a technology whose consumer base looks increasingly like all of humanity. This is the opportunity so many investors say they welcome – that say they search for. The opportunity to find the "Next Apple," or the "next Google." Friends, it's coming right now, and it lies in the depths of technology's core. It's not artificial intelligence, it's artificial super intelligence and there is one company that will rule all of it.

This just one of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.