Apple Inc, AAPL, earnings, option, optimism

Preface

There is a powerful pattern of optimism and momentum in Apple (NASDAQ:AAPL) stock right before of earnings, and we can capture that pattern by looking at returns in the option market. The strategy won't work forever, but for now it is a momentum play that has not only returned 185% annualized returns, but has also shown a high win-rate of 67%.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the two-weeks before an earnings announcement.

That is, totally irrespective of whether the stocks have a history of beating earnings, in the two-weeks before of earnings, several of them tend to rally abruptly into the event. There has been a way to profit from this pattern without taking any actual earnings risk -- and it is very powerful in Apple Inc.

Option trading isn't about luck -- this four minute video will change your trading life forever: Option Trading and Truth

The Options Optimism Trade Before Earnings in Apple Inc

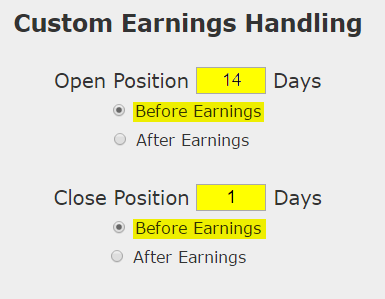

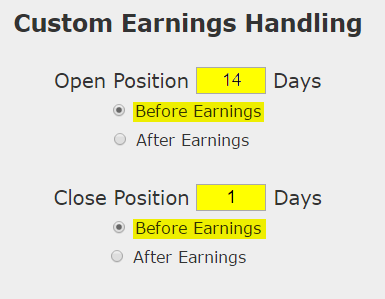

Let's look at the results of buying a monthly call option in Apple Inc two-weeks before earnings and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are mind bending.

Here are the results over the last three-years in Apple Inc:

We see a 85.1% return, testing this over the last 12 earnings dates in Apple Inc. That's a total of just 168 days (14 days for each earnings date, over 12 earnings dates). That's a annualized rate of 185%. That's the power of following the trend of optimism into earnings -- and never even worrying about the actual earnings result.

We can also see that this strategy hasn't been a winner all the time, rather it has won 8 times and lost 4 times, for a 67% win-rate and again, that 85.1% return in less than six-full months of trading.

Checking More Time Periods in Apple Inc

Now we can look at just the last year as well:

We're now looking at 26.7% returns, on 3 winning trades and 1 losing trades. It's worth noting again that we are only talking about two-weeks of trading for each earnings release, so this is 26.7% in just 8-weeks of total trading which annualizes to 174%.

WHAT HAPPENED

For the expert option trader, or the option trader that wants to take the next step in the evolution of trading, this is it. This is how people profit from the option market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Trading Earnings Optimism With Options in Apple Inc

Apple (NASDAQ:AAPL) : Trading Earnings Optimism With Options

Date Published: 2017-07-1Author: Ophir Gottlieb

Preface

There is a powerful pattern of optimism and momentum in Apple (NASDAQ:AAPL) stock right before of earnings, and we can capture that pattern by looking at returns in the option market. The strategy won't work forever, but for now it is a momentum play that has not only returned 185% annualized returns, but has also shown a high win-rate of 67%.

PREMISE

The premise is simple -- one of the least recognized but most important phenomena surrounding this bull market is the amount of optimism, or upward momentum, that sets in the two-weeks before an earnings announcement.

That is, totally irrespective of whether the stocks have a history of beating earnings, in the two-weeks before of earnings, several of them tend to rally abruptly into the event. There has been a way to profit from this pattern without taking any actual earnings risk -- and it is very powerful in Apple Inc.

Option trading isn't about luck -- this four minute video will change your trading life forever: Option Trading and Truth

The Options Optimism Trade Before Earnings in Apple Inc

Let's look at the results of buying a monthly call option in Apple Inc two-weeks before earnings and selling the call before the earnings announcement.

Here's the set-up in great clarity; again, note that the trade closes before earnings, so this trade does not make a bet on the earnings result.

Now, unlike many of our other set-ups, this is in fact a straight down the middle bullish bet -- this absolutely takes on directional stock risk, so let's be conscious of that before we see the results, because they are mind bending.

Here are the results over the last three-years in Apple Inc:

| Long a Call Option | |||

| * Monthly Options | |||

| * Back-test length: three-years | |||

| * Open 14-days Before Earnings | |||

| * Close 1-day Before Earnings | |||

| * Holding Period: 14-Days per Earnings | |||

| Winning Trades: | 8 | ||

| Losing Trades: | 4 | ||

| Pre-Earnings Call Return: | 85.1% | ||

| Annualized Return: | 185% | ||

We see a 85.1% return, testing this over the last 12 earnings dates in Apple Inc. That's a total of just 168 days (14 days for each earnings date, over 12 earnings dates). That's a annualized rate of 185%. That's the power of following the trend of optimism into earnings -- and never even worrying about the actual earnings result.

We can also see that this strategy hasn't been a winner all the time, rather it has won 8 times and lost 4 times, for a 67% win-rate and again, that 85.1% return in less than six-full months of trading.

Checking More Time Periods in Apple Inc

Now we can look at just the last year as well:

| Long a Call Option | |||

| * Monthly Options | |||

| * Back-test length: One-Year | |||

| * Open 14-days Before Earnings | |||

| * Close 1-day Before Earnings | |||

| * Holding Period: 14-Days per Earnings | |||

| Winning Trades: | 3 | ||

| Losing Trades: | 1 | ||

| Pre-Earnings Call Return: | 26.7% | ||

| Annualized Return: | 174% | ||

We're now looking at 26.7% returns, on 3 winning trades and 1 losing trades. It's worth noting again that we are only talking about two-weeks of trading for each earnings release, so this is 26.7% in just 8-weeks of total trading which annualizes to 174%.

WHAT HAPPENED

For the expert option trader, or the option trader that wants to take the next step in the evolution of trading, this is it. This is how people profit from the option market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.