Apple Inc, AAPL, earnings, stock, put spread, options, days, results

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

LEDE

This is a simple option trade that starts three calendar days after Apple (NASDAQ:AAPL) earnings and lasts for the one month to follow, that has been a winner for 8 consecutive quarters.

Since Apple reported earnings on Thursday 2-1-2018, three calendar days later would be 2-4-2018, which is a Sunday, so this back-test set-up would be repeated by opening the trade on Monday 2-5-2018 near the market close, not at the open.

Apple (NASDAQ:AAPL) Earnings

While the mainstream media likes to focus on the actual earnings move for a stock, that's the distraction when it comes to the option market. Analysts disagreed about Apple's earnings results before they were released, and now they mostly fall in the "no big deal either way" camp after the release. That's good news.

For Apple Inc, irrespective of whether the earnings move was up or down, if we waited three calendar days after the stock move, and then sold an one-month out of the money put spread, the results were simply staggering. We use three-days to allow the stock to fully reach equilibrium post earnings.

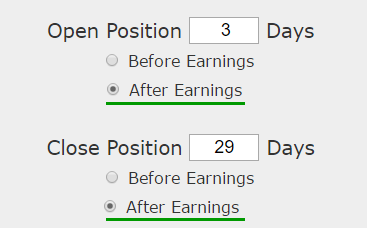

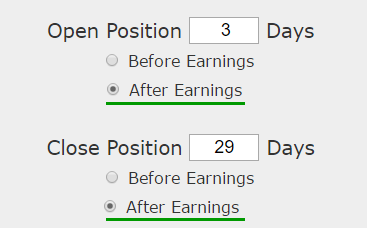

We can examine this intelligent approach, objectively, with a custom option back-test. Here is our earnings set-up:

Rules

* Open short put spread 3-days after earnings

* Close short put spread 29 days later

* Use the 30-day options

RETURNS

If we sold this 30/15 delta out-of-the-money put spread in Apple (NASDAQ:AAPL) over the last two-years but only held it after earnings we get these results:

Tap Here to See the Back-test

We see a 129% return, testing this over the last 8 earnings dates in Apple Inc.

Setting Expectations

While this strategy had an overall return of 129%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 16.7% in just 27-calendar days.

MORE TO IT THAN MEETS THE EYE

While a short put spread is a strategy that gains profits if the underlying stock "doesn't go down a lot," there is more to this with Apple Inc.

What we're after with this approach is identifying companies that make their large stock move the day after earnings -- whether that's up or down -- and after that, find a sense of equilibrium in the stock price for the next month. This is what we find in Apple (NASDAQ:AAPL) .

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

Right After Earnings, The Intelligent Options Trade in Apple Inc

Apple (NASDAQ:AAPL) : Right After Earnings, The Intelligent Options Trade

Date Published: 2018-02-2Author: Ophir Gottlieb

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.

LEDE

This is a simple option trade that starts three calendar days after Apple (NASDAQ:AAPL) earnings and lasts for the one month to follow, that has been a winner for 8 consecutive quarters.

Since Apple reported earnings on Thursday 2-1-2018, three calendar days later would be 2-4-2018, which is a Sunday, so this back-test set-up would be repeated by opening the trade on Monday 2-5-2018 near the market close, not at the open.

Apple (NASDAQ:AAPL) Earnings

While the mainstream media likes to focus on the actual earnings move for a stock, that's the distraction when it comes to the option market. Analysts disagreed about Apple's earnings results before they were released, and now they mostly fall in the "no big deal either way" camp after the release. That's good news.

For Apple Inc, irrespective of whether the earnings move was up or down, if we waited three calendar days after the stock move, and then sold an one-month out of the money put spread, the results were simply staggering. We use three-days to allow the stock to fully reach equilibrium post earnings.

We can examine this intelligent approach, objectively, with a custom option back-test. Here is our earnings set-up:

Rules

* Open short put spread 3-days after earnings

* Close short put spread 29 days later

* Use the 30-day options

RETURNS

If we sold this 30/15 delta out-of-the-money put spread in Apple (NASDAQ:AAPL) over the last two-years but only held it after earnings we get these results:

| AAPL: Short 30 Delta / 15 Delta Put Spread |

|||

| % Wins: | 100% | ||

| Wins: 8 | Losses: 0 | ||

| % Return: | 129% | ||

Tap Here to See the Back-test

We see a 129% return, testing this over the last 8 earnings dates in Apple Inc.

Setting Expectations

While this strategy had an overall return of 129%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 16.7% in just 27-calendar days.

MORE TO IT THAN MEETS THE EYE

While a short put spread is a strategy that gains profits if the underlying stock "doesn't go down a lot," there is more to this with Apple Inc.

What we're after with this approach is identifying companies that make their large stock move the day after earnings -- whether that's up or down -- and after that, find a sense of equilibrium in the stock price for the next month. This is what we find in Apple (NASDAQ:AAPL) .

WHAT HAPPENED

Traders that have a plan guess less. This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.