Apple, AAPL, MSFT, GOOGL, GOOG, AMZN, revenue, company, stock, iphone, year, time, watch

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 5-3-2018.

Hello, all. This is Ophir writing. This is a semi-lengthy dossier, but if you want to understand Apple, and really understand what it holds for the future and why this last earnings release was so different -- and potentially monumental, then sit back, grab a cup of Joe, and go on a journey with me. It will be worth it.

LEDE

Apple announced a beat of EPS in the latest quarter and the stock jumped higher adding nearly $80 billion to its market cap over two days.

But, three things happened that have never happened before at the same time -- which is to say, each has happened by itself, but the coincidence of all three may be the first time that Apple bulls can finally take a breath -- they were right, we were right. The doubters, at least for one quarter, were wrong.

STORY

While the headlines will have us look at the revenue and EPS beat (we discuss below), and the focus on Apple Services (which we also discuss below), the coincidence of these three things, as far as we know, have never happened:

* iPhone units missed estimates (52.5 million vs 53 million).

* EPS beat estimates ($2.73 vs $2.69) but revenue missed estimates ($61.1 billion vs $61.15 billion).

* The stock rose anyway.

Yes, for the first time since the iPhone became the dominant product for Apple, an unit miss and a revenue miss was applauded by Wall Street, and while a massive new stock buyback program was announced, that was not the reason for the rally, in our opinion.

WHY THE RALLY

Apple bulls have, now for more than two-years, insisted that Apple is not just a phone company. As long as it was seen as such, every statistic about the iPhone, every nook and cranny by geography, drove the stock price.

Even further, the multiple the company received on its earnings (the Price to Earnings multiple) has been far lower than other mega tech peers, because hardware sales (read iPhone sales) are not recurring revenue, like, say, Amazon Prime memberships, or Microsoft word subscriptions.

But, this time around, Wall Street heard it loud and clear, Apple is not just a phone company. And while Tim Cook has been jumping up and down with this narrative for years, somehow, this quarter, Wall Street listened to the facts, and they were astounding.

BEYOND iPHONE

There are two massive trends that Apple is pushing forward outside of the iPhone. The first is Apple Services (App Store, Apple Music, iCloud and Apple Pay).

Apple says it now has 270 million paid subscriptions (subscriptions are recurring revenue), which is up 100 million on a year-over-year basis.

Apple Services delivered $9.2 billion in revenue in the last 3-months, which was up 30% on a year-over-year basis. And, according to Cook, the services growth was global. He says the "minimum" growth for services was 25% in each geography.

Not only are Services revenue booming, and not only is that revenue recurring, but it also carries with it a high margin. Apple doesn't divulge the numbers, but the gross margin on an Apple Music subscription or an iCloud subscription is massively higher than on a piece of hardware.

But, given all of that, we still don't feel like that, alone, would have moved Apple stock higher given the iPhone unit miss. Apple needed a second piece, and it got it, of course, from wearables.

We have written so many times about the Apple Watch that if you look at the original Top Pick dossier and scroll through the updates, it looks like we only update about the Watch (and China). But, yet again, here's why it matters.

WEARABLES AND THE WATCH

We just published, on 4-9-2018, Apple Watch is Turning into a Huge Winner.

In that dossier we note that Apple is utterly dominating the wearable market, and in particular the smart watch market. Here's an image from that dossier:

While Apple is growing at 55% year-over-year, it's next two closet rivals are shrinking. But, here's why that matters -- from the earnings call:

Tim Cook said Apple's "wearables" business was up 50% and is now the size of a "Fortune 300" company. That implies its wearables - which include the Apple Watch, AirPods and Beats - is a $9 billion annual business, which is growing at a 50% rate. Cook said the Apple Watch grew at a "strong" double-digit rate and had its best ever March quarter performance.

As we continue to see Apple's results, and then research from IDC (and others), it looks like Apple is not only dominating this market, it looks like its growth is accelerating.

The Apple Watch appears well on its way to being a 25 million unit seller for the full year, and that, finally, is the scale of Apple.

Suddenly Apple's incredible ability to sell hardware that people want, and will pay up for, does have a second home -- it's the wearable category, from Air Pods to watches. And the watch is turning into a serious driver for the company.

All of a sudden, a slight miss on iPhone units isn't that big of a deal -- not when a Services Segment is now about the size of Facebook on its own, growing at a remarkable pace, and a second wave of hardware appears to bubbling to the surface with the wearables.

Add to that our recent dossier on 3-5-2018, Apple, Finally, Makes a Serious Move into Video, and we see a company that is using its more than one billion person user base into more businesses -- away from just the iPhone, and even away from just hardware.

All the way back in 2015, our first dossier on Apple was Apple's Growth Will Humiliate the Skeptics. We believe it will -- and the stock reaction this quarter to a miss on iPhone units and basically a miss on revenue is our circumstantial evidence.

A REMINDER ABOUT RECURRING REVENUE

We've done this exercise before, but just as a reminder of how important it is to have recurring revenue, not just hardware sales, here are some stunning facts about Microsoft when it changed its business from selling office as an one-time sale, to turning it into a subscription (read: recurring) revenue model.

We detail this in our dossier from 01-19-2016, Apple's Seismic Shift Could Double the Stock. This is intentionally old data, to see how a shift in revenue type overcomes even a revenue short fall.

This is from January 2016:

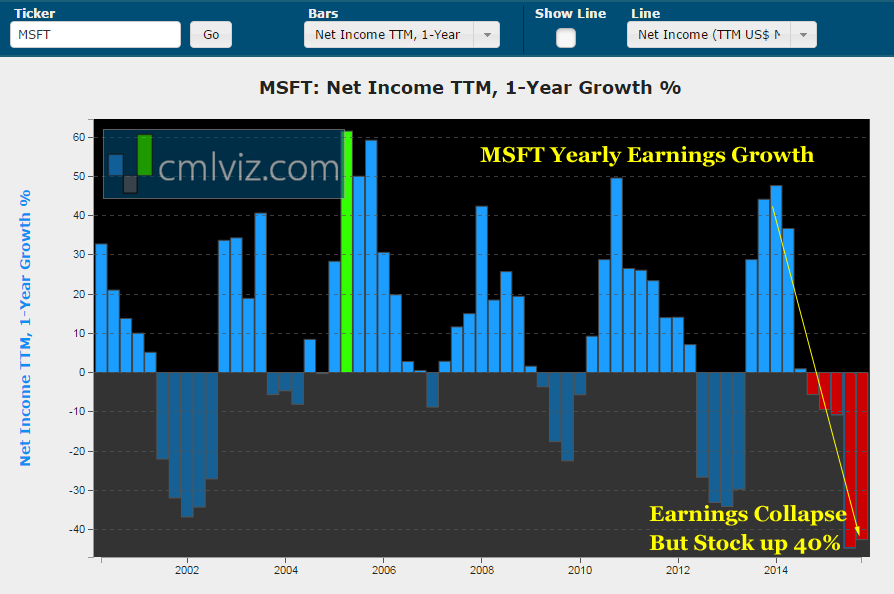

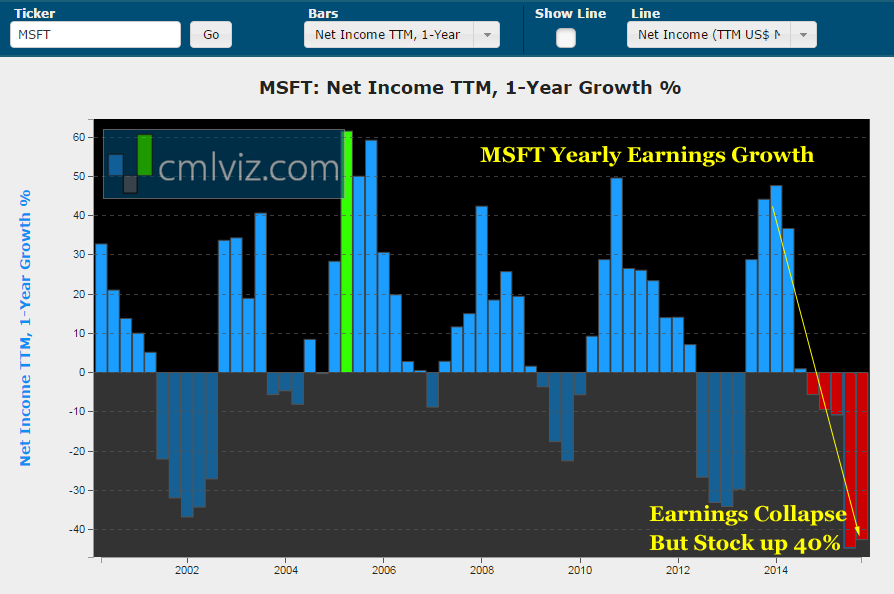

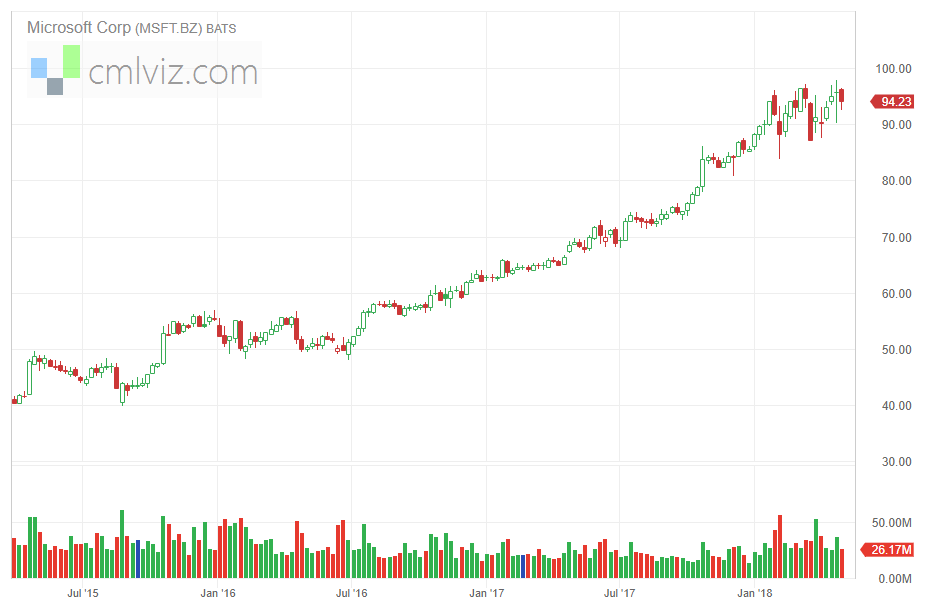

While Microsoft's stock price is up 40% in the last two-years, it's earnings growth has turned negative as it has switched from an one-time sale to recurring revenue model. Here is the net income 1-year growth chart through time.

Yes, this is how important the revenue model is. MSFT is in an unabashed earnings recession while the stock is crushing it.

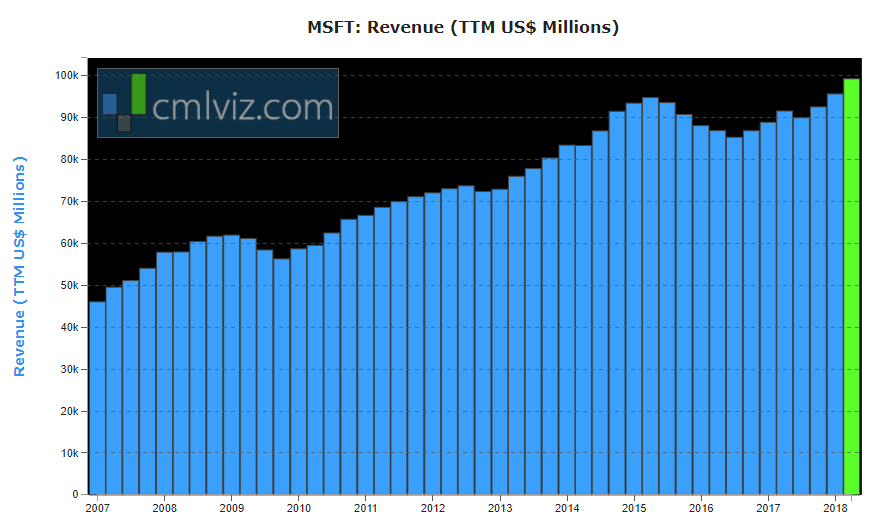

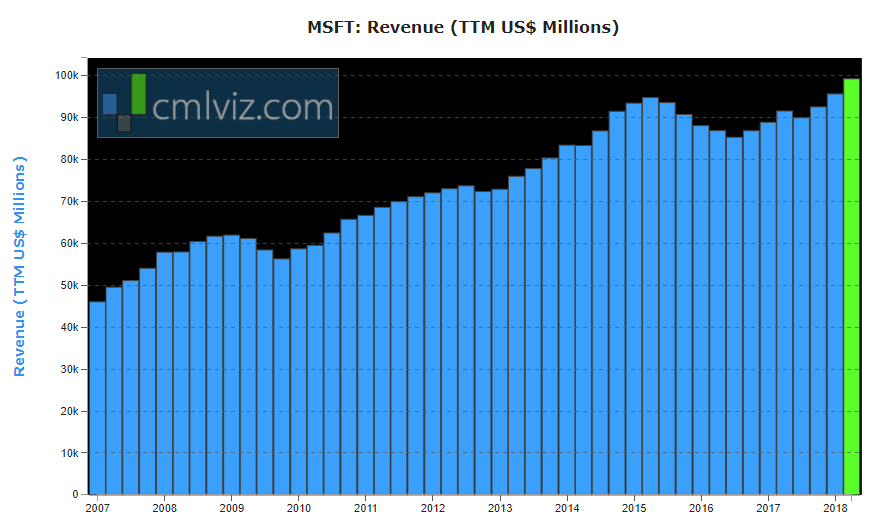

Now, let's fast forward to today. Here is a chart of Microsoft's revenue.

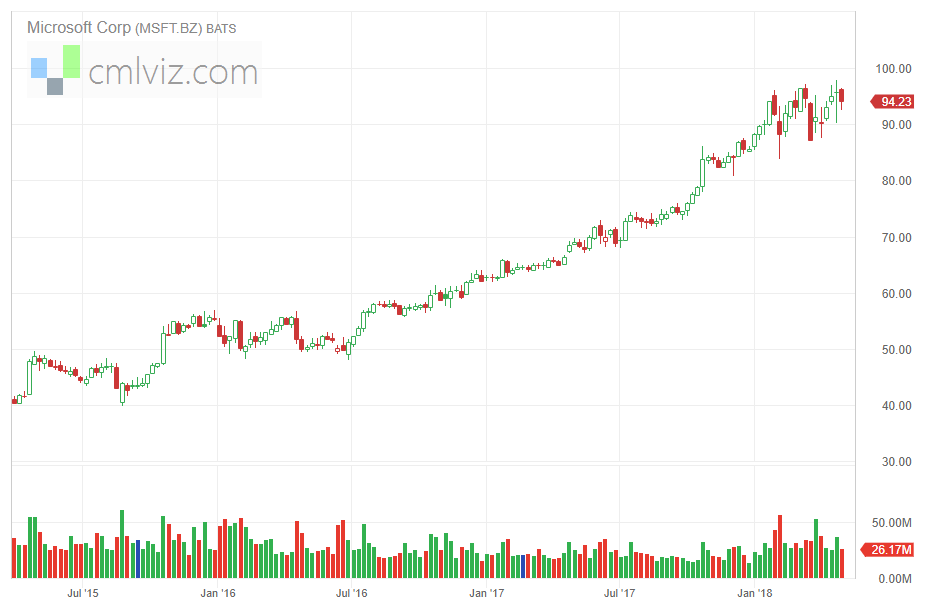

Since April of 2015, Microsoft has seen revenue "grow" by 5%. Yes, 5%. In those same three (ish) years the stock is up 126% while the S&P 500 is up just 26%.

It's not that Wall Street has lost its mind. Quite the opposite. Microsoft has changed itself from a company selling software one at a time, to a company that has a massive subscription service, most of which is powering its cloud revenue.

This is what Apple is trying to do, but in the meantime, revenue is growing and so are earnings.

It's this goal that we see Apple pursuing -- it's this phenomenon that could make this company's stock soar. And for the record, when we wrote that this could "double the stock," -- well, we're already half way there, with a 50% rise.

CONCLUSION The impossible happened -- Apple missed on iPhone units and was at best at analyst expectations of revenue, but Wall Street (maybe) finally gets it. This company is changing -- it will always be hardware heavy, but it will diversify that hardware into wearables, and it will (and has) create a massive recurring revenue business called Apple Services.

This is the bullish thesis for Apple. This is why its a Top Pick. And this is why we still see upside for the company.

SEEING THE FUTURE

It's understanding technology that gets us an edge. This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Apple at the time of writing and publication. Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Apple Stunned Everyone -- Did Something it Has Never Done Before

Apple Stunned Everyone -- Did Something it Has Never Done Before

Date Published: 2018-05-27Author: Ophir Gottlieb

Written by: Ophir Gottlieb

This is a snippet from the original CML Pro dossier published on 5-3-2018.

Hello, all. This is Ophir writing. This is a semi-lengthy dossier, but if you want to understand Apple, and really understand what it holds for the future and why this last earnings release was so different -- and potentially monumental, then sit back, grab a cup of Joe, and go on a journey with me. It will be worth it.

LEDE

Apple announced a beat of EPS in the latest quarter and the stock jumped higher adding nearly $80 billion to its market cap over two days.

But, three things happened that have never happened before at the same time -- which is to say, each has happened by itself, but the coincidence of all three may be the first time that Apple bulls can finally take a breath -- they were right, we were right. The doubters, at least for one quarter, were wrong.

STORY

While the headlines will have us look at the revenue and EPS beat (we discuss below), and the focus on Apple Services (which we also discuss below), the coincidence of these three things, as far as we know, have never happened:

* iPhone units missed estimates (52.5 million vs 53 million).

* EPS beat estimates ($2.73 vs $2.69) but revenue missed estimates ($61.1 billion vs $61.15 billion).

* The stock rose anyway.

Yes, for the first time since the iPhone became the dominant product for Apple, an unit miss and a revenue miss was applauded by Wall Street, and while a massive new stock buyback program was announced, that was not the reason for the rally, in our opinion.

WHY THE RALLY

Apple bulls have, now for more than two-years, insisted that Apple is not just a phone company. As long as it was seen as such, every statistic about the iPhone, every nook and cranny by geography, drove the stock price.

Even further, the multiple the company received on its earnings (the Price to Earnings multiple) has been far lower than other mega tech peers, because hardware sales (read iPhone sales) are not recurring revenue, like, say, Amazon Prime memberships, or Microsoft word subscriptions.

But, this time around, Wall Street heard it loud and clear, Apple is not just a phone company. And while Tim Cook has been jumping up and down with this narrative for years, somehow, this quarter, Wall Street listened to the facts, and they were astounding.

BEYOND iPHONE

There are two massive trends that Apple is pushing forward outside of the iPhone. The first is Apple Services (App Store, Apple Music, iCloud and Apple Pay).

Apple says it now has 270 million paid subscriptions (subscriptions are recurring revenue), which is up 100 million on a year-over-year basis.

Apple Services delivered $9.2 billion in revenue in the last 3-months, which was up 30% on a year-over-year basis. And, according to Cook, the services growth was global. He says the "minimum" growth for services was 25% in each geography.

Not only are Services revenue booming, and not only is that revenue recurring, but it also carries with it a high margin. Apple doesn't divulge the numbers, but the gross margin on an Apple Music subscription or an iCloud subscription is massively higher than on a piece of hardware.

But, given all of that, we still don't feel like that, alone, would have moved Apple stock higher given the iPhone unit miss. Apple needed a second piece, and it got it, of course, from wearables.

We have written so many times about the Apple Watch that if you look at the original Top Pick dossier and scroll through the updates, it looks like we only update about the Watch (and China). But, yet again, here's why it matters.

WEARABLES AND THE WATCH

We just published, on 4-9-2018, Apple Watch is Turning into a Huge Winner.

In that dossier we note that Apple is utterly dominating the wearable market, and in particular the smart watch market. Here's an image from that dossier:

Top 5 Wearable Companies by Shipment Volume, Market Share, and Year-Over-Year Growth, Calendar Year 2017 (shipments in millions)

Source: IDC

Source: IDC

While Apple is growing at 55% year-over-year, it's next two closet rivals are shrinking. But, here's why that matters -- from the earnings call:

Tim Cook said Apple's "wearables" business was up 50% and is now the size of a "Fortune 300" company. That implies its wearables - which include the Apple Watch, AirPods and Beats - is a $9 billion annual business, which is growing at a 50% rate. Cook said the Apple Watch grew at a "strong" double-digit rate and had its best ever March quarter performance.

As we continue to see Apple's results, and then research from IDC (and others), it looks like Apple is not only dominating this market, it looks like its growth is accelerating.

The Apple Watch appears well on its way to being a 25 million unit seller for the full year, and that, finally, is the scale of Apple.

Suddenly Apple's incredible ability to sell hardware that people want, and will pay up for, does have a second home -- it's the wearable category, from Air Pods to watches. And the watch is turning into a serious driver for the company.

All of a sudden, a slight miss on iPhone units isn't that big of a deal -- not when a Services Segment is now about the size of Facebook on its own, growing at a remarkable pace, and a second wave of hardware appears to bubbling to the surface with the wearables.

Add to that our recent dossier on 3-5-2018, Apple, Finally, Makes a Serious Move into Video, and we see a company that is using its more than one billion person user base into more businesses -- away from just the iPhone, and even away from just hardware.

All the way back in 2015, our first dossier on Apple was Apple's Growth Will Humiliate the Skeptics. We believe it will -- and the stock reaction this quarter to a miss on iPhone units and basically a miss on revenue is our circumstantial evidence.

A REMINDER ABOUT RECURRING REVENUE

We've done this exercise before, but just as a reminder of how important it is to have recurring revenue, not just hardware sales, here are some stunning facts about Microsoft when it changed its business from selling office as an one-time sale, to turning it into a subscription (read: recurring) revenue model.

We detail this in our dossier from 01-19-2016, Apple's Seismic Shift Could Double the Stock. This is intentionally old data, to see how a shift in revenue type overcomes even a revenue short fall.

This is from January 2016:

While Microsoft's stock price is up 40% in the last two-years, it's earnings growth has turned negative as it has switched from an one-time sale to recurring revenue model. Here is the net income 1-year growth chart through time.

Yes, this is how important the revenue model is. MSFT is in an unabashed earnings recession while the stock is crushing it.

Now, let's fast forward to today. Here is a chart of Microsoft's revenue.

Since April of 2015, Microsoft has seen revenue "grow" by 5%. Yes, 5%. In those same three (ish) years the stock is up 126% while the S&P 500 is up just 26%.

It's not that Wall Street has lost its mind. Quite the opposite. Microsoft has changed itself from a company selling software one at a time, to a company that has a massive subscription service, most of which is powering its cloud revenue.

This is what Apple is trying to do, but in the meantime, revenue is growing and so are earnings.

It's this goal that we see Apple pursuing -- it's this phenomenon that could make this company's stock soar. And for the record, when we wrote that this could "double the stock," -- well, we're already half way there, with a 50% rise.

CONCLUSION The impossible happened -- Apple missed on iPhone units and was at best at analyst expectations of revenue, but Wall Street (maybe) finally gets it. This company is changing -- it will always be hardware heavy, but it will diversify that hardware into wearables, and it will (and has) create a massive recurring revenue business called Apple Services.

This is the bullish thesis for Apple. This is why its a Top Pick. And this is why we still see upside for the company.

SEEING THE FUTURE

It's understanding technology that gets us an edge. This is what CML Pro does. We are members of Thomson First Call -- our research sits side by side with Goldman Sachs, Morgan Stanley and the rest, but we are the anti-institution and break the information asymmetry.

The precious few thematic top picks for 2018, research dossiers, and alerts are available for a limited time at a 80% discount for $29/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Apple at the time of writing and publication. Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.