Apple Could Rally Ahead of Earnings -- Here's the Custom Pattern That Has Held for 3 Straight Years

Apple Could Rally Ahead of Earnings -- Here's the Custom Pattern That Has Held for 3 Straight Years

Date Published: 2018-10-11

Disclaimer

The results here are provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation.Preface

There is a bullish momentum pattern in Apple (NASDAQ:AAPL) that has persisted for 3-straight years, but it requires a condition to be met first. That condition has been met -- and that means the trigger is set.Apple has earnings due out on 11-1-2018, according to our data provide Wall Street Horizon. Ten calendar days before then would be October 22nd, near the market close.

The Bullish Option Trade Before Earnings in Apple Inc

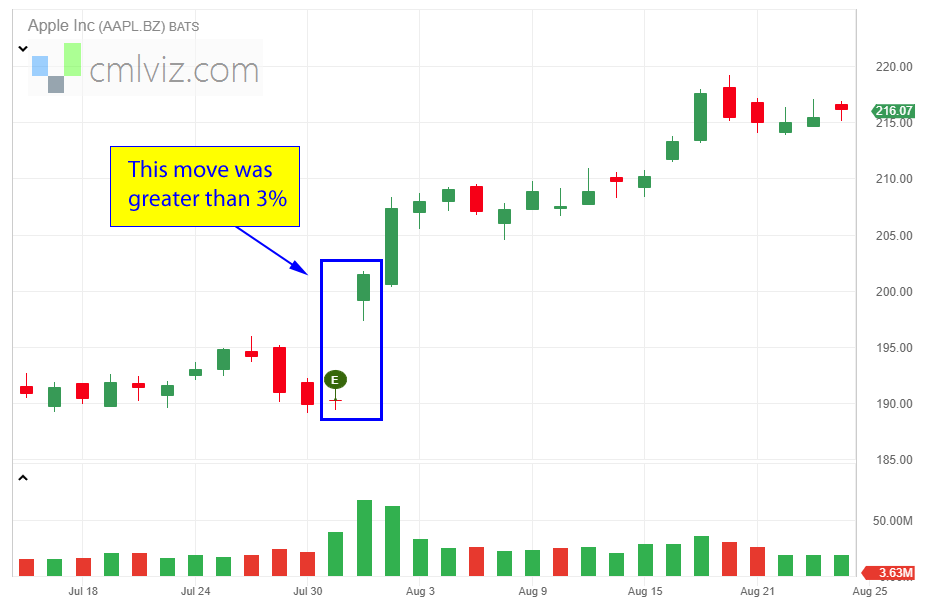

We will examine the outcome of getting long a two-week out of the money (30 delta) call option in Apple 10-days before earnings (using calendar days) and selling the call before the earnings announcement.But, we will restrict the entry to times when the prior earnings move was 3% or larger. Here it is, in a chart from the earnings release on July 31, 2018, and then the follow up stock reaction on August 1, 2018 (the one day move):

So, to set this up in Trade Machine, it's this simple:

Again, note that the trade closes before earnings since Apple reports after the market closes, so this trade does not make a bet on the earnings result.

RISK MANAGEMENT

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Here are the results over the last three-years in Apple Inc:| AAPL: Long 30 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 5 | Losses: 0 | ||

| % Return: | 462% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® Stock Option Backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Track this trade idea. Get alerted for ticker `AAPL` 10 days before earnings

Setting Expectations

While this strategy had an overall return of 462%, the trade details keep us in bounds with expectations:➡ The average percent return per trade was 88.9%.

WHAT HAPPENED

This is how people profit from the option market. Take a reasonable idea or hypothesis, test it, and apply lessons learned.Tap Here, See for Yourself

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.