How to Trade Options Before Earnings in Fabrinet (NYSE:FN)

How to Trade Options Before Earnings in Fabrinet (NYSE:FN)

Date Published: 2017-06-28This article can be seen in a video or as a full written article below the video.

Preface

Trading options in Fabrinet (NYSE:FN) using a short window before earnings are released has been a staggering winner over the last several years.

This is it -- this is how people profit from the option market. Identifying strategies that are tightly risk controlled, take no stock direction risk and no earnings risk. Strategies that are immune from a bull or bear market.

STORY

Everyone knows that the day of an earnings announcement is a risky event for a stock. But the question every option trader, whether professional or amateur, has long asked is if there is a way to profit from this known implied volatility rise. It turns out, that over the long-run, for stocks with certain tendencies, the answer is actually, yes.

Yes, there is a systematic way to trade this repeating phenomenon, without making a bet on earnings or stock direction.

THE SET UP

What a trader wants to do is to see the results of buying an at the money straddle a couple of weeks before earnings, and then sell that straddle just before earnings. Here is the setup:

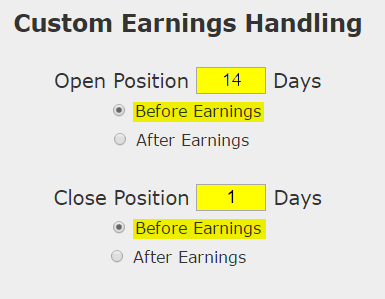

We are testing opening the position 14 days before earnings and then closing the position 1 day before earnings. This is not making any earnings bet. This is not making any stock direction bet.

Once we apply that simple rule to our back-test, we run it on an at-the-money straddle:

RETURNS

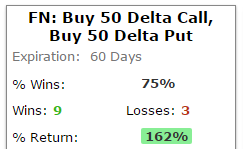

If we did this long at-the-money straddle in Fabrinet (NYSE:FN) over the last three-years but only held it before earnings we get these results:

That's a 162% return over the last three-years, with 9 winning trades and 3 losing trades. But, let's take a step toward risk reduction before we move forward.

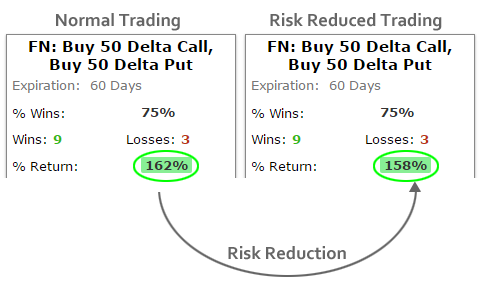

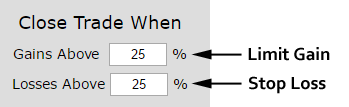

While we are looking at this same trade, let's also set a rule that if at any point in the two-week period the straddle loses 25% of its value, we just close it and wait for the next pre-earnings cycle. While we're at it, we will do the same with the upside -- that is, if at any time during the two-weeks the straddle goes up 25%, we take the profits and close the trade.

For clarity, this is what we test:

And now we can see the results over the same three-year period:

While we are taking 75% less risk, we are seeing about the same results -- we will continue down this risk adjusted path for the rest of this dossier.

Digging Deeper

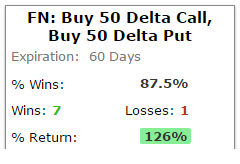

Now we can see the results over the last two-years:

That's a 126% return and 7 winning trades with 1 losing trade. Remember, this trade takes no stock direction risk and no earnings risk -- this is completely agnostic to a bull or bear market.

Even further, that 126% actually came on just 16 weeks of trading (2-weeks per earnings cycle, 8 earnings cycles), which is over 400% annualized returns.

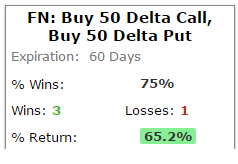

Now we look at the last year:

We see a 65.2% percent return on 3 winning trade and 1 losing trade.

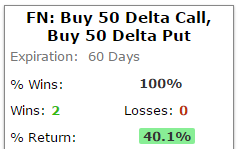

Finally, we can look at the last six-months:

That's 40.1%, winning both of the last two pre-earnings trades.

WHAT HAPPENED

This is it -- this is how people profit from the option market. Identifying strategies that are tightly risk controlled, take no stock direction bets or earnings risk. It's preparation, not luck.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.