Breaking: Relypsa By the Numbers

Relypsa, Inc.

PREFACE

Relypsa (RLYP) is a small-cap clinical stage biopharmaceutical company with a market cap of ~$700 million. The company has a single drug named Veltassa that treats hyperkalemia, which is a condition of fatal levels of potassium in patients with chronic kidney disease or heart problems.

Sales of Veltassa officially started in January of this year and in total it is expected to have an addressable market of 2.4 million to 3 million people and to reach peak sales of $1 billion within several years.

BREAKING

Relypsa just released its first ever sales update. I was on the conference call and Periscoped it here: Relypsa Conference Call. Here's what we know:

Initial demand for Veltassa has been encouraging.

Since Veltassa became available on December 21, 2015 through February 12, 2016, 1,229 new outpatient prescriptions were written for Veltassa.

Source: GlobeNewswire

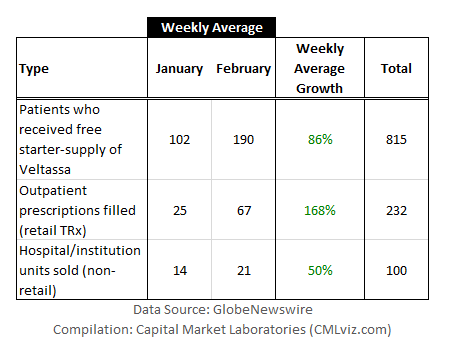

The number of patients who received a free starter-supply of Veltassa, outpatient prescriptions filled and hospital units sold since the launch on December 21, 2015 through February 12, 2016 are detailed below.

Since Veltassa became available on December 21, 2015 through February 12, 2016, 1,229 new outpatient prescriptions were written for Veltassa.

Source: GlobeNewswire

The weekly average number for all three groups increased 86%, 168% and 50%, respectively for free starter-supply, outpatient prescriptions and hospital units.

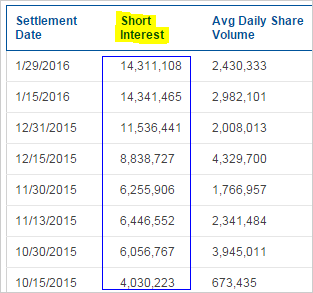

The stock has enormous short interest. Here's the the accumulation:

The drug is doing quite well, awareness is high, demand is high and the drug is welcomed as a much needed alternative. The immense short interest makes for a rather uncomfortable disconnect between the business and the stock.

Every time we get more data on the company, it reads positive. The 409 scripts in Janaury is larger than all seven other drugs the company considers within a comparable specialty. In fact, the largest was 300, the rest were near 100. In other words, Relypsa views the first month as essentially better than anyone has ever done before in this field. But, the stock market disagrees.

STOCK

The stock is tumbling after hours, trading as low as $14.32 after closing at $16.78. The stock's 52 week high, which came before its drug was approved by the FDA, was $42.26.

At the same time the short interest has accumulated, the closing stock price of $16.78 compares to the median price target from all 10 Thomson/First Call analysts is $45, which is a staggering 160% higher than the current price.

Further, Wedbush has a price target of $86, H.C. Wainwright has a price target of $63 and Oppenheimer has a price target of $55. Morgan Stanley stands famously as the only firm with a sell rating on the stock.

MORE RESULTS

Agreements have been signed with Express Scripts and CVS Caremark, the two largest pharmacy benefit managers in the United States.

Centers for Medicare & Medicaid Service (CMS) have added Veltassa to its calendar year 2016 Formulary Reference File on Thursday for all three dosage strengths of Veltassa listed on the label. The decision by CMS is both positive and early, with initial expectations calling for a March decision.

This affects about 1.8 million of the 3 million-plus Veltassa-eligable patient population being covered by Medicare (Street Insider).

WHAT'S GOING ON

The Relypsa story is one that seems so bullish and at the same time so steeped in fact that it will feel almost impossible. At the same time, the stock market is never 'wrong,' and the price is tumbling.

THE FUTRE VALUE

Analysts predict that Relypsa's drug will reach peak sales in the United States alone of $1 billion. That's not to speak of Japan, and Europe. As of the close of trading today, Relypsa is trading at a confounding 0.4 price to future sales. The IBB biotech index has an average price to sales of 6 to 1. The stodgy S&P 500 has a price to sales of 2 to 1.

Now, large cap pharma AstraZeneca paid $2.7 billion to takeover ZS Pharma for its hyperkalemia drug candidate. Yes, while we can play the "price-to-sales" game all we want, a major pharma company has said outloud with its pocket book that just the chance of a drug approved in a year to treat hyperkalemia is worth more than $2.7 billion.

Further, a Citigroup analyst said (emphasis added):

"The valuation gap between ZSPH ($2.7B) and RLYP (~$800M) now stands at ~$1.9B, which is embarrassing from a market efficiency perspective for several reasons."

Source: Street Insider

Source: Street Insider

BLACK BOX

It turns out that on news of the drug approval, Relypsa stock actually dropped nearly 40% in one day because the approval was met with a black box label -- the FDAs strictest warning.

On the conference call, Relypsa announced it would submit its drug-to-drug (DDI) interaction results,which were quite strong, to the FDA by mid-year and they expect the FDA to respond by year end.

Relypsa aims to have the six hour window cut down to three, to have the data from the DDI study included in the packaging, and to have the black box warning removed, and turned into a more general safety indication.

CONCLUSION

At a $550 million market cap as of the after hour's trade, the argument made by the vast majority of Wall Street analysts appear to be falling on deaf ears. The stock price is now controlled by the massive short interest.

But, at CML, we still hold this company as one of the few gems in small cap biotech with an approved drug, accelerating sales and a large addressable market. It had the best first month ever for a drug in its category, the company refuted accusations that it would go to the equity market to raise money, and the weekly sales gains are tremendous.

WHY THIS MATTERS

Relypsa is still a CML Pro 'Top Pick.' Patience is the better of valor -- this company has an organic growth trajectory that appears to be quite steady.

As we said at the top -- if any of the information we just covered feels like a surprise, in many ways it is. But while CML Pro research sits side side-by-side with research from Goldman Sachs, Morgan Stanley, and the rest, we are the anti-institution, and make this type of research available to our retail family for just $10 a month.

Relypsa is one of just a precious few 'Top Picks' from CML Pro. Each company identified as the single winner in an exploding thematic change like artificial intelligence, Internet of Things, drones, mobile pay and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Here's cybersecurity:

There's just no stopping the growth in the need for cyber security and we are right at the beginning. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

The author is net long Relypsa.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn't do it even if we were. We’re sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.