Startling Disclosure in Relypsa's Filings Reveal a Possible Sanofi Takeover

RELYPSA

A lot of the information we're about to cover might feel like a surprise. In many ways it is. That's because our purpose is to provide institutional research to all investors and break the information monopoly held by the top .1%.FIRST

Before we get into earnings, here's a quick review of the event that crushed the stock the day earlier.

Relypsa announced that it secured $150 million in debt financing (a loan). Here is a snippet from the 8-K:

“

On April 27, 2016, Relypsa, Inc. entered into a Credit Agreement[] consisting of a six-year term loan facility for an aggregate principal amount of $150.0 million. The Borrowings [] bear interest through maturity at 11.5% per annum.

Source: GlobeNewswire

On April 27, 2016, Relypsa, Inc. entered into a Credit Agreement[] consisting of a six-year term loan facility for an aggregate principal amount of $150.0 million. The Borrowings [] bear interest through maturity at 11.5% per annum.

Source: GlobeNewswire

”

Relypsa intends to use approximately $17 million of the net proceeds to repay all outstanding obligations under its loan and security agreement.

Let's move forward into the earnings release and then an investigative piece that reveals perhaps nothing -- or reveals a takeover deal in the works between Relypsa and its partner Sanofi that requires a reading of page 38 of the firm's 10 Q/A from this year and a look back at its 10Q from 2014.

Here's a hint: it's only a secret if you don't look -- lawyers matter, especially these two.

EARNINGS

Relypsa beat revenue estimates rather substantially, reporting total revenues for the first quarter of $12.4 million. $600,000 came from net product revenues of Veltassa (patiromer) and collaboration and license revenue of $11.8 million.

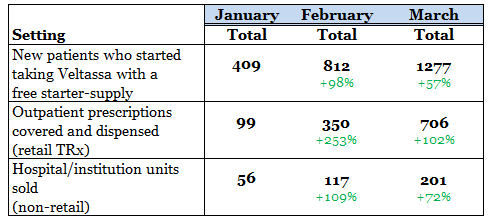

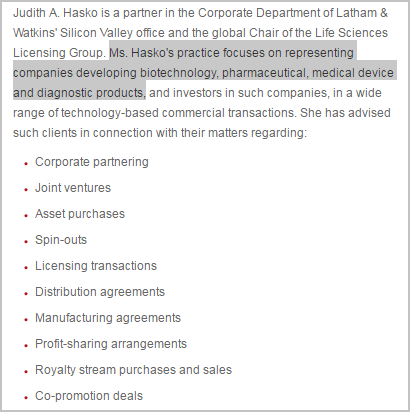

Expected revenue was just $200,000 from drug sales and overall consensus sales estimates came in at ~$7 million. The company simply repeated the numbers it had already provided for drug sales, here is a table:

We note that it's generally in the third and fourth quarters of a drugs release that a sort of hockey stick growth takes place. Estimates call for over $30 million in drug sales by the end of 2016.

OK, let's get into the call, which was the real news.

CONFERENCE CALL: BORING STUFF

Getting the drug covered by insurance is mission critical and Relypsa is doing well in that regard.

“

Across all payer plans, Veltassa has broad coverage with more than 80 percent of all plans covering to date.

Approximately half of the Company's target national and regional payers have made coverage decisions for Veltassa and, of these, 75 percent have decided to cover Veltassa in a Tier 3 or better position.

Across all payer plans, Veltassa has broad coverage with more than 80 percent of all plans covering to date.

Approximately half of the Company's target national and regional payers have made coverage decisions for Veltassa and, of these, 75 percent have decided to cover Veltassa in a Tier 3 or better position.

”

On April 28, 2016, the company filed with its partner to the European Medicines Agency (EMA) requesting European approval of Veltassa for the treatment of hyperkalemia. Note that Relypsa's partnership allows it some milestone payments but in finality, a 22% royalty from sales.

“

Veltassa has intellectual property protection until 2030 in the United States and 2029 in the European Union.

Veltassa has intellectual property protection until 2030 in the United States and 2029 in the European Union.

”

By mid-2016, the company plans to submit a supplemental New Drug Application (sNDA) to the U.S. Food and Drug Administration (FDA) requesting a label change for Veltassa based on the results of the drug-drug interaction studies. For those that follow the firm closely, this is the DDI study that showed perhaps that black box warning label could be dropped or at least lessened.

Cash: One thing the company can do very well is spend cash at amazingly high rates for such a small firm. The firm's cash position went from $241 million in the prior quarter to $205.3 million -- and that of course, includes incoming revenue. After the debt injection, cash now was reported as $336.3 million as of March 31, 2016.

The company spent $50.6 million in SG&A (selling general and administrative) expense -- which is high. Add $16.3 million in research and development (R&D) surrounding clinical studies of Veltassa, including the drug-drug interaction studies and initiation of the TOURMALINE study. That's a lot of kesef for a tiny outfit.

And now the real analysis

CONFERENCE CALL: THE REAL ANALYSIS

The question and answer period was more strained that prior sessions in my opinion, with fewer analysts congratulating the firm and questions more pointed toward understanding the future. Relypsa does not make forward looking projections for revenue, which is not uncommon for the first year of a drug's release but is troubling in this case for two reasons:

First: CEO John Orwin has forecast 2016 total operating expense of $275 million - $300 million, of which about $250 million will be cash expense. That is an absurdly higher number for a drug with peak sales pegged at $1 billion and a company with $240 million in cash at the beginning of the quarter.

If Orwin is so clear on the expense side, he obviously has estimates, even if rough, of revenue and it's simply an obfuscation to not report those. It's not necessarily a dereliction of duty, "competitive reasons" are often sighted for hiding mission critical data, so this can fall under that category. But, again, given the clarity in operating expense at such a high level -- there's at least reason to argue that Orwin could have given the street (and shareholders) some guidance for operating revenue.

Second: The firm raised $150 million in debt at a poor junk interest rate, which is fine, but the firm did note on the call that the debt financing was at least in part due to the low stock price. Moving the numbers and words around we can read that this $150 million semi-bridge loan is likely the last chance Relypsa has to raise debt financing.

That means the cash in hand is supposed to be the last capital raise the firm requires moving forward. Again, $150 million is a pretty specific number, which means Orwin must have a clear path to positive cash flow by the time that total $336 million remaining cash runs out. A revenue forecast would have been appreciated.

CONFERENCE CALL:DIGGING DEEPER

I don't like calling out what I find to be poor analysis if it isn't from a big bank since that's their job, but some of the information reported on Seeking Alpha is in correct. There was an article (which I am intentionally am not linking too) that makes a pretty bold case that short-sellers should be less interested in the stock because a major dilutive event has been taken off the table.

So, this is where I would stick with financial professionals rather than bloggers. Whatever probability was assigned to a takeover has been lessened because the firm raised debt and appears to be going it alone. That means shorts face a lower probability of a black swan event (a takeover) and can sit more comfortably in their positions.

Secondly, the debt amount (which was small) and interest rate leave Relypsa in dire straits if the company cannot turn cash positive in pretty short order. In any case, any sort of sweeping conclusion on the short positions based on the debt financing is wrong. Yes, short interest has peaked and fallen, but that doesn't signal anything about the future. Relypsa faces existential risk with its absurdly high operating expenses and now semi-finite cash position. No short reads this financing as a reason to cover.

CONFERENCE CALL: MORE DIGGING DEEPER

Relypsa still has a bullish thesis. In fact, in many ways it has addressed the three short theses that were weighing on the stock.

I. The company said it would spend ~$250 million in cash for 2016 but that's the company's entire cash balance before the debt financing. The risk of "running out of money" is now over in the immediate-term. It may rear its ugly head again in a year, but for now, that conversion is moot.

II. Based on #1 above, some bearish sell siders noted that the company had no choice but to sell stock to fund operations. With the stock at $17, the company would have had to sell 9 million shares to secure the $150 million it received from the debt.

With only 43 million shares outstanding, that sale of stock would have turned into a death spiral of the firm selling stock in its own face, pushing the price lower, causing the need to sell yet more shares to secure financing. That was a bearish scenario, but that risk is now off the table in the immediate-term as well.

III. The final bearish thesis surrounded the drug itself -- that it simply wouldn't sell. No one can see the future, but we do finally have three months of sales data. Here it is:

Will this turn into a billion dollar blockbuster drug? Nobody knows, but with three months of data, we can certainly say it's selling.

SALES

With the company pouring so much into SG&A and operating expenses, the drug has to sell and it has to sell fast -- that's it. There are some milestone payments to be had, but in general the company will need to generate upwards of $100 million in sales by 2017 to be anywhere out of "disaster" status. Having said that, that very well may be the case.

ZS-9

AstraZeneca's ZS-9 hyperkalemia drug will face its PDUFA date on May 26th. The drug is faster acting than Veltassa, but does have some issues with creating sodium as a side-effect and that very well could mean a stringent black box warning.

In fact, black box warnings generally refer to known severe adverse events, which is why the Relypsa "theoretical" black box was weird, to say the least. A black box surrounding sodium could even push ZS-9 out of the large and lucrative chronic market and force it into the very small emergency market.

Any sort of wording like that would make Relypsa's Veltassa and the firm in totality worth about twice as much as it is today. It would leave the firm with an open field to the 2-3 million chronic hyperkalemia patients in the U.S. and no competition.

Now that's the "rose colored glasses" view. Alternatively, ZS-9 could get approved with no labels, and then the competition is huge.

FIRST MOVER IS NOT AN ADVANTAGE

It's actually pretty rare that a first mover advantage is that big of a deal, if an advantage at all. Facebook found success quickly because Myspace and Friendster paved the way for social interactions. Google was the 20th search engine and benefitted from the fact that the populace had become familiarized with using a search engine. The iPhone was in part such a smash hit because Research in Motion (Blackberry) had opened the eyes to total fanaticism and compulsions using our phones as email machines.

Relypsa's six to twelve month start is not a major advantage. In fact, when ZS-9 enters the market, it could actually help Relypsa. At this point, Relypsa is bearing the entire cost of educating the medical world about a new drug for the hyperkalemia ailment -- the first in 50 years. That's really expensive.

When ZS-9 gets into the fray, that's a power house with AstraZeneca behind it and I believe will help Relypsa make sales with much lower expenses. Yes, I believe competition helps, and it helps so much it is a part of the bullish thesis for Relypsa.

WHAT NOW

Alright, now, try not to make this a reason to get involved with the stock but there is reason to support an underlying takeout thesis. I saved this for the end because I get the feeling if it was first, the guts behind this company would have been ignored. So, buckle up, this is going to get your takeover juices flowing, and rather rapidly.

IT'S ONLY A SECRET IF YOU DON'T LOOK

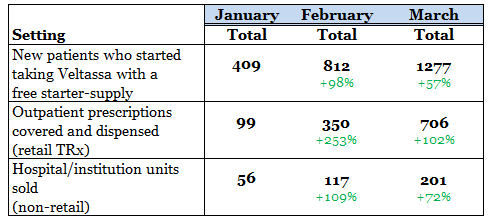

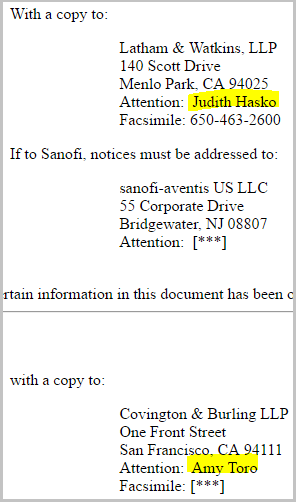

On the January 5th Amended Quarterly Results 10Q/A, on page 38 we see this:

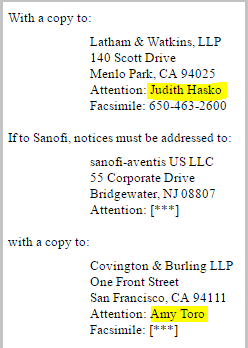

You'll note that Judith Hasko and Amy Toro are named -- copies going between Relypsa and Sanofi. And who are these people? Here you go:

Judith Hasko is a transaction attorney for biotech. And Amy Toro:

Amy Toro is also a transaction attorney.

But it goes further. It turns out that in 2012, there was a 90 minute webinar entitled: "Collaborative Agreements in Life Sciences: Key Considerations." The only people listed in this panel were, you guessed it, Judith A. Hasko and Amy L. Toro.

But there's more. In 2010, Sanofi bought out TargeGen for $560 million, and what do you know, at the end of the press release we see this (emphasis added):

“

Latham & Watkins LLP served as special counsel to the TargeGen board, including partners Alan Mendelson and Judith Hasko and associate Jamie Leigh.

Latham & Watkins LLP served as special counsel to the TargeGen board, including partners Alan Mendelson and Judith Hasko and associate Jamie Leigh.

”

As for Amy Toro, she and her firm have been involved in numerous M&A activities in the field of Life Sciences -- all it take is Google to find them. Recall, the firm she works for is called "Covington."

But the rabbit hole goes yet deeper. If you look through Relypsa's 10-Q filed in November of 2014, there is no mention of either Hasko or Toro.

But, if you pull up the 10-Q from November of 2015, all of a sudden both lawyers are explicitly mentioned.

For the record, the Sanofi and Relypsa marketing agreement was announced on Aug 10th, 2015. So, it is also reasonable that the partnerships is simply the full spectrum of the agreement and these lawyers are just the go to ladies when it comes to this stuff.

Read that last sentence again -- it takes the "conspiracy" out of the theory. This may just be standard operating procedure.

I leave the analysis (and wild speculation) to the reader. The facts, they have been presented.

WHY THIS MATTERS

If you want research - the kind that goes beyond headlines, the kind that reads page 38 of a 10 Q/A and looks for lawyer names, then you need institutional research. While JPMorgan requires a $9 million account to access their institutional research, at CML Pro we are here to smash the information monopoly that the top 0.1% have. But while CML Pro research sits side side-by-side with research from Goldman Sachs, Morgan Stanley, and the rest, we are the anti-institution, and make this type of research available to our retail family.

Relypsa is one of just a precious few 'Top Picks' from CML Pro. Each company identified as the single winner in an exploding thematic change like artificial intelligence, Internet of Things, drones, mobile pay and more. In fact, here are just two of the trends that will radically affect the future that we are ahead of:

The Internet of Things (IoT) market will be measured in trillions of dollars as of next year. CML Pro has named the top two companies that will benefit. Here's cybersecurity:

There's just no stopping the growth in the need for cyber security and we are right at the beginning. CML Pro has named the single best cyber security stock to benefit from this theme.

These are just two of the themes we have identified and this is just one of the fantastic reports CML Pro members get along with all the visual tools, the precious few thematic top picks for 2016, research dossiers and alerts. For a limited time we are offering CML Pro at a 90% discount for $10/mo. with a lifetime guaranteed rate. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 1%.

The author is net long Relypsa.

Thanks for reading, friends.

Please read the legal disclaimers below and as always, remember, we are not making a recommendation or soliciting a sale or purchase of any security ever. We are not licensed to do so, and we wouldn't do it even if we were. We're sharing my opinions, and provide you the power to be knowledgeable to make your own decisions.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.